By: Mansoor al-Bashiri

Executive Summary

The telecommunications and information technology sector in Yemen is a vital component of the country’s infrastructure and plays a critical role in economic growth. It is the second largest source of public revenue after the petroleum sector, and contributes important work opportunities, whether directly or indirectly, through its connections to other sectors of the national economy.

From 2015 to 2019, the sector’s performance has varied due to the extraordinary circumstances Yemen has been going through. It is estimated that the conflict has caused about $4.1 billion in direct financial losses for the telecommunications sector due to electricity outages (at times caused by a lack of fuel), institutional fragmentation, and competing policies and financial demands by the authorities in Sana’a and Aden, as well as confiscation of assets and extortion. The sector has also lost a number of opportunities that may have otherwise been available if it were not for the outbreak of the conflict, like the development of licensing agreements and the progression to 4G technology. Investors in the telecommunications sector have been deterred from the Yemeni market despite its large size and the fact that many services are not currently being provided by the companies operating in the sector.

The sector faces a large number of challenges, the most serious of which are: the unsuitability of the legal and institutional regulatory environments; fragmentation of public entities in the sector; unproductive accusations made by the parties to the conflict; the lack of separation between political, regulatory and operational roles within the sector; and the reliance on a weak and fragile infrastructure to provide these services. Other challenges include the restrictions imposed on importing equipment, difficulty accessing a number of districts and entire governorates to carry out necessary repairs, declining revenues for the companies, and the increase of fees being levied by both the authorities in Sana’a and in Aden, compounded by the population’s general impoverishment and limited purchasing power.

To strengthen the role of Yemen’s telecommunications, there must be efforts in the short term to depoliticize the sector during the conflict, repair operator networks, introduce new services (such as video conferencing and digital financial services), and work to lower internet tariffs—this paper does not provide an analysis of how to achieve a viable mix of upgraded services and affordable prices while still maintaining the feasibility of new investments. In the medium and long term, efforts to draft new telecommunications laws must continue, in addition to separating regulatory and operational roles, developing the regulatory and institutional environment, encouraging private investment, and updating educational programs and university curricula to ensure that they are up-to-date with ongoing developments in the field of telecommunications and information technology. These curricula and programs must meet the local market’s needs for specialized labor.

General Background

The telecommunications and information technology sector in Yemen is a vital component of the country’s infrastructure, and it plays an important role in economic growth. Starting in 2001 and accelerating from 2013 to 2014, the sector witnessed large-scale investments by the private sector as well as the government. Telecommunications towers and infrastructure were installed across much of the country, allowing access to telecommunications services in most Yemeni cities and villages, and there was rapid diffusion of mobile phones and internet services. Prior to 2001, cellular services were provided through the analogue network of a publicly-owned sole mobile operator, TeleYemen.

The sector is of great importance in terms of economic development, social development, and human capital, helping link people, communities, and businesses through the exchange of information in an increasingly connected global economy. It is also one of the most important sources of revenue for the state, especially in acquiring hard currency. Before the conflict, the sector was second only to the oil and gas sector in generating public financial revenues and foreign currency.[1] Mobile operators pay a once-off license fee to the government. During the war, some paid a fee for a temporary license extension until a new full license can be renegotiated. For instance, in 2016, MTN Yemen paid $36.4 million for a 29-month extension to their original 15-year license that was granted in July 2000, thereby extending their operating license to December 2017. In addition, the government collects annual regulatory fees. Generally speaking, governments collect regulatory fees from telecom operators to recover the regulatory costs associated with enforcement, policy and rulemaking, user information, and international activities. For example, MTN Yemen, which held a market share of 42.8% as of 2016 according to their estimates, presumably paid—according to the terms of their license agreement—what would have amounted to YER 1.7 billion annually for the duration of their 15-year license that became effective in July 2000.

Between 2015 and 2018, the telecommunications and information technology sector contributed around 7% to Yemen’s real gross domestic product (GDP).[2] The sector provides employment opportunities directly and indirectly through linkages with other parts of the economy that depend on it.

In addition to the economic and social value of the telecommunications sector, its political, security, and strategic importance cannot be overlooked, whether during wartime or transitional and reconstruction stages. For this reason, the sector has been weaponized by the warring parties. Telecommunications infrastructure has been directly targeted and destroyed by virtually all of the parties to the conflict, while political divisions have deepened institutional fragmentation in the sector, hindering efforts aimed at maintaining or improving its services.

Expanding the telecommunications and information technology sector, realizing its full contribution to economic and social development, and enhancing its competitiveness are areas that hold a lot of potential given Yemen’s relatively large population, high population growth rate, subscriber penetration rates that remain well below 50%, and modest level of services that are currently available. This paper provides a brief presentation and analysis of the mobile telecommunication and internet services that are currently provided, the challenges that the providers of these services face, and the impact of the conflict on the services. The paper then presents several recommendations to enhance and develop the country’s mobile telecommunication and internet services in the short, medium, and long term.

Organizational and Institutional Structure of the Sector

The Ministry of Telecommunications and Information Technology is the government entity mandated with enforcing the laws enacted by the state to regulate the various parts of the sector (i.e., landline telephones, mobile phones, internet, and post). It is also tasked with approving appropriate new bylaws, formulating policies and plans for the sector, managing the frequency spectrum for the mobile broadband services, granting licenses for the establishment and operation of private or public networks, maintaining the national numbering plan, and approving pricing policies for telecommunications services.

Telecommunications Law No. 38 of 1991 Pertaining to Wired and Wireless Telecommunications, as amended in Law No. 33 of 1996, is the sole legislation regulating the telecommunications sector.[3] However, it is not the legal reference point for mobile telecommunications and internet companies and their services in Yemen. Instead, these companies, which started operating several years after technology-specific laws were passed (internet service providers started in 1996 and mobile phone operators started in 2001), are regulated by the licensing agreements that were reached between the government and each network operator.[4] At issue is not so much whether these individual license agreements are standardized in terms of their terms, cost, and procurement procedures, but rather that having an outdated law in place and resorting to piecemeal regulation weakens the legal framework governing the sector and hinders private investment.

The Public Telecom Corporation of the Ministry of Telecommunications and Internet Technology is the only operator for landline services and one of the most important internet providers alongside the Yemen International Telecommunications Company (TeleYemen), which also provides international calling and mobile satellite services.

To help bear the high investment and operational costs of mobile phone companies, and to strengthen the role of the private sector in the economy, the government has incentivized private investment in the telecommunications sector by adopting a wide range of structural reforms. For instance, in 1997, Yemen’s government adopted a program for economic reforms in partnership with the World Bank and the International Monetary Fund (IMF). This program sought to decrease the role of the state in economic life and increase the role of the private sector. As another example of some of the incentives offered by the government, some operators entered into an exclusivity agreement with the government for periods up to four years.[5] As a result, since 2001, the private sector has had an active role in the field of telecommunications. To date, the government has granted three operating licenses to three private companies to operate Global System for Mobile Communications (GSM) networks, namely, Sabafon, MTN Yemen Limited (MTN Yemen) (previously known as Spacetel Yemen), and HiTS Unitel, known by its trading name of Y Telecom. In addition, the government, represented by the Public Telecom Corporation, established a fourth company, Yemen Mobile, which operates a Code Division Multiple Access (CDMA) network.[6]

Table 1: Institutional structure of the telecommunications sector in Yemen

|

# |

Company |

Ownership |

Activity |

|

1 |

Public Telecom Corporation |

Government |

Oversees landline telecommunication network, provides services throughout Yemen, including phone, internet and data transmission. |

|

2 |

TeleYemen |

Government |

Provides international telecommunications services, analogue mobile phones, and internet. |

|

3 |

Sabafon |

Private Sector |

Provides GSM services. |

|

4 |

MTN Yemen |

Private Sector |

Provides GSM services. |

|

5 |

Yemen Mobile |

Government |

Provides CDMA services. |

|

6 |

Y Telecom |

Private Sector |

Provides GSM services. |

|

Source: National Information Center, https://yemen-nic.info/sectors/information/ (accessed August 28, 2020). |

|||

Infrastructure and Performance Levels

As noted, there are two wireless transmission technologies in Yemen used by local mobile telephone networks. Yemen Mobile, which is majority-owned by the state, provides its services through the CDMA system, while the rest of the carriers use GSM, which was launched for the first time in February 2001. The services provided by these companies are available throughout the Republic of Yemen, although coverage is patchy.

Table 2: Mobile phone services market in Yemen (2019)

|

Company |

Subscribers in Millions |

Market Share |

Technology |

Ownership |

|

Yemen Mobile |

7.5 |

40% |

CDMA – CDMA2000 1x – CDMA2000 (2.5G) – 1xEV-DO (3G) |

Public Telecom Corporation: 59.37% Other government entities: 17.3% Private and individual owners: 23.5% |

|

Sabafon |

5.2 |

28% |

GSM (2G, 2.5G) |

Al-Ahmar Group: 60% Batelco (Bahrain): 26.9% Other investors, including the Iran Foreign Investment Company. |

|

MTN Yemen |

5 |

27% |

GSM (2G, 2.5G) |

MTN Group in South Africa: 83% |

|

Y |

0.9 |

5% |

GSM (2G) |

Formerly owned by Kuwaiti and Saudi investment companies and investors from the private sector in Yemen, the United Arab Emirates, and Syria, the company was purchased earlier in 2020 by al-Essi Group and other Yemeni businessmen close to President Abdrabbuh Mansour Hadi following its bankruptcy declaration in the Commercial Court in Sana’a in March 2020. |

|

Source: Public Telecom Corporation, 2019 Report, World Bank, Policy Memo, February 2017. |

||||

From 2015 to 2019, mobile phone services had mixed performance despite the fact that the general trend in this sector has shown positive growth. The overall number of mobile phone connections rose from 15.7 million in 2014 to 18.6 million lines at the end of 2019.[7] Furthermore, by the end of 2018, the unique mobile subscriber penetration rate in Yemen was estimated at 42–43%, compared to a Middle East and North Africa average of 64% and a global average of 66%.[8] The unique subscriber base in Yemen by the end of 2014 was estimated at 46%.[9]

It should be noted that TeleYemen provides mobile-satellite services through its mobile satellite communications service called Thuraya, which enables its customers to use Thuraya phones for voice calls, fax services, and internet connections even when other land-based internet and mobile phone services are not operating. In particular, Thuraya provides essential communication services to oil companies, maritime operations, and development activities in remote areas.

Internet services were introduced to Yemen in 1996 by a single provider, TeleYemen.[10] It owns the country’s International and Internet Gateways (i.e., access to international connectivity via terrestrial and submarine cables). Yemen’s internet is linked to the broader region and the rest of the world through four land and three sea cables. Due to the current conflict, Yemen relies on three working links: (1) The al-Wadiyah land port in Hadramawt governorate, which is a border crossing with the Kingdom of Saudi Arabia, (2) the al-Ghaydhah sea port in al-Mahra governorate, linked to an international submarine cable, the Fibre-optic Link Around the Globe (FLAG) Alcatel-Lucent Optical Network (FALCON) cable, which provides Yemen with the majority of its international links to the internet, and (3) the Aden Port, which is a sea port that is linked to two fiber optic cables, one of which is the Aden–Djibouti submarine cable that has been active since 1994 and was upgraded in 2014. The rest of Yemen’s internet links are not functioning either because of their destruction during the war, as in the cases of the Haradh and Alab land ports along Yemen’s north western border with Saudi Arabia, or because of damage from tropical cyclone Laban, as in the case of the Shihin land port along Yemen’s eastern border with Oman. The fragmentation of policies and institutions among the parties to the conflict has also led to the non-usage of internet links, as in the case of the Asia-Africa-Europe 1 (AAE-1) submarine cable in Aden, in which Yemen invested about $40 million. This link was launched for commercial services in mid-2017. Another example is the FLAG FALCON submarine cable in Hudaydah governorate, in which Yemen invested about $30 million. Once again, Yemen has been unable to use this service since 2017 because of the difficulties encountered in completing the connection through Yemen as a result of the ongoing war.[11]

TeleYemen provides a number of other internet-related services, like web hosting, data transmission, domain name services, and IP address services. Over the past few years, there has been noticeable growth in the number of internet users in Yemen, reaching 7.2 million at the end of 2019, compared to 3.2 million users in 2014. The number of broadband internet (ADSL) subscribers reached 355,058 in 2019 according to the Ministry of Telecommunications and Information Technology (Sana’a), up from an estimated 340,000 in 2014 as estimated by a non-official source.[12] However, when the ministry’s 2019 figure is cross-referenced with available official estimates for the preceding years, we see that the number of subscribers has significantly dropped from 427,699 in 2017 and 385,251 in 2016.[13]

Table 3: Highlights of the makeup of Yemen’s telecommunications market by segment

|

|

2014 |

2019 |

Change |

|

Population[14] |

25,956,000 |

29,665,000 |

14% (+) |

|

Unique mobile subscriber penetration rate[15] |

46% |

~42–43% |

4–3 % points (−) |

|

Mobile phone connections[16] |

15,708,035 |

18,597,333 |

18% (+) |

|

Internet users[17] |

3,236,679 |

7,190,000 |

122% (+) |

|

Operated landlines[18] |

1,123,318 |

1,189,397 |

6% (+) |

|

Broadband internet subscribers[19] |

340,000 |

355,058 |

4% (+) |

|

Sources: CSO, MTIT (Sana’a), GSMA, and ITU. |

|||

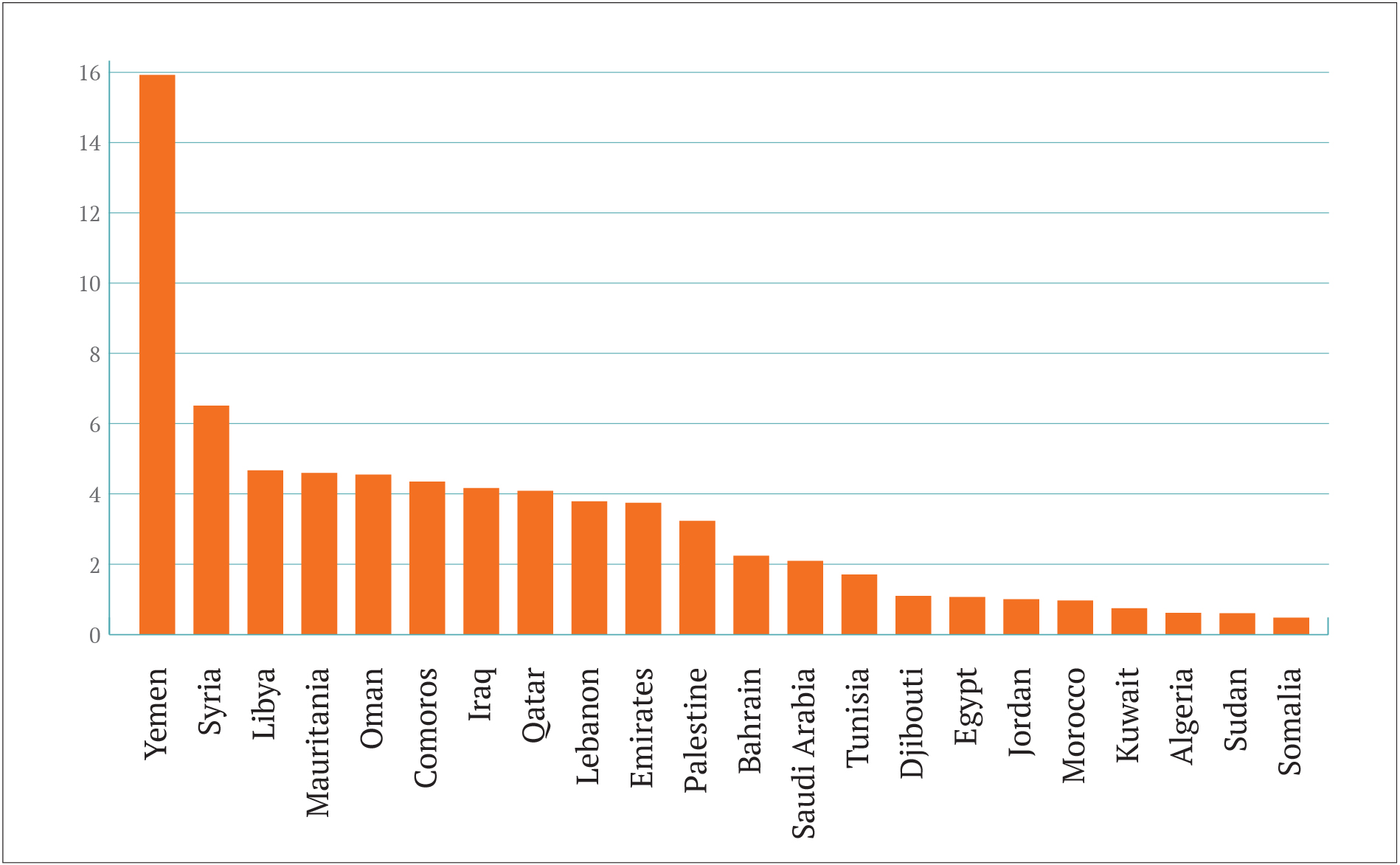

The prices of these services are one of the main factors in their spread or lack thereof throughout society, taking into account per capita income and educational levels. In this regard, recent studies show that the price of mobile phone services in Yemen is lower than the average price in the Arab world, with Yemen having the 7th lowest price point out of 22 countries in 2017, an improvement of its rank by three positions compared to 2015 and 2016. The price of a bundle of 300 calls was around $56.90 (considering purchasing power parity and value-added tax), compared to an average of around $69.40 in the Arab world.[20]

However, when it comes to mobile data, Yemen is one of the most expensive countries in the world, and the most expensive country in the Arab world, according to Cable.[21] This study compared mobile data prices around the world in 2020, with Yemen ranking last among Arab countries with a single gigabyte costing around $15.98. Somalia provided mobile data for the lowest cost among the Arab states, at an average price of around $0.50 per gigabyte.

Figure (1): The cost of 1GB of mobile data in the Arab world ($/GB

Source: Cable.co.uk, 2020.

Impacts of the Conflict

According to an estimate by the Ministry of Telecommunications and Information Technology in Sana’a, which is under the control of Ansar Allah authorities, the total wartime losses of the telecommunications sector as of March 2020 are estimated at $4.1 billion due to the damage or destruction of infrastructure, including facilities, telecommunications towers and stations, telephone centrals; confiscation of equipment arriving at Yemen’s ports; and the inability to utilize some of the international internet cables due to the ongoing conflict as earlier noted.[22] Other sources estimate that around 200 out of Yemen Mobile’s 850 transmission stations were not operating as of March 2019 due to the conflict.[23]

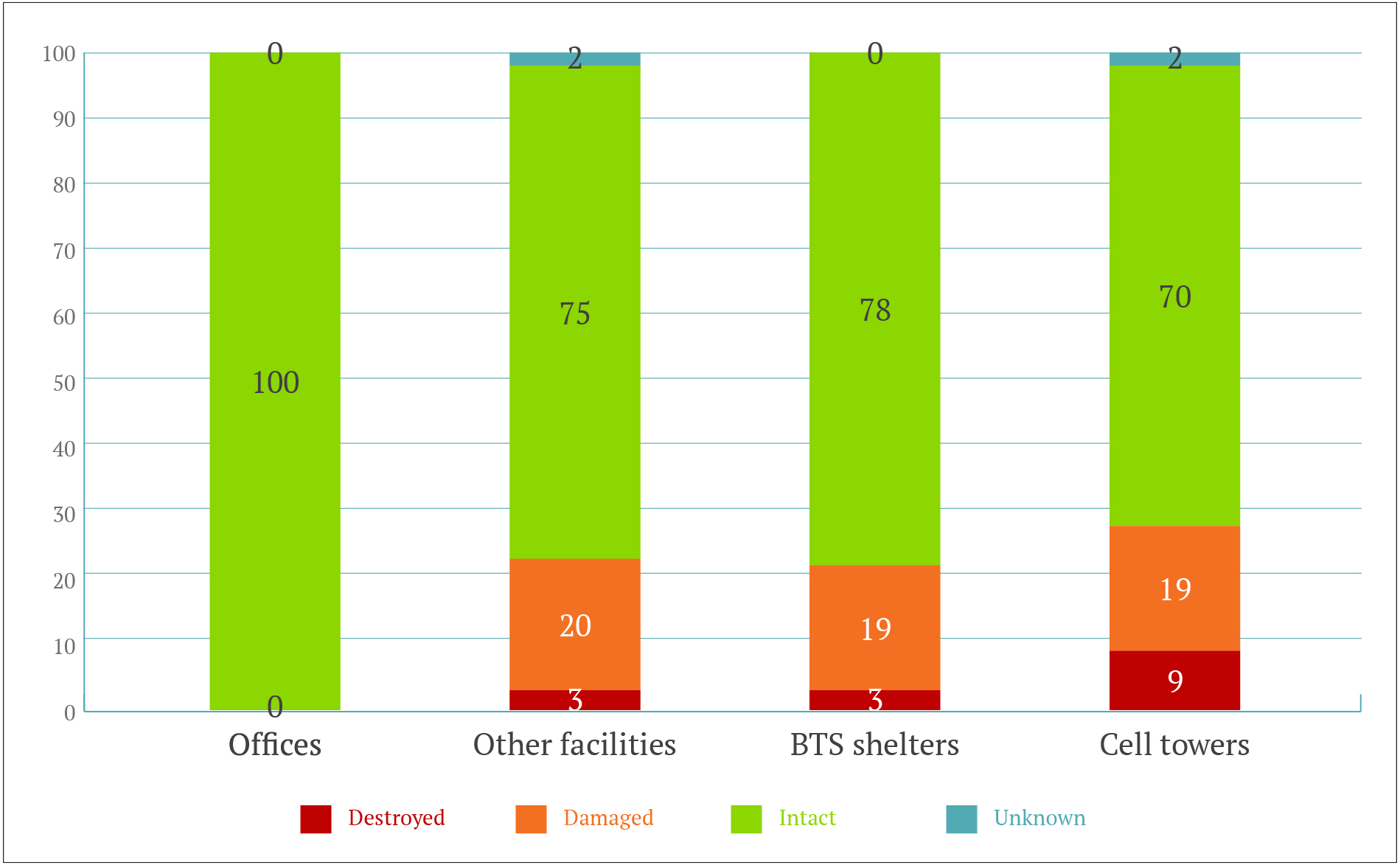

In this regard, the third phase of the World Bank’s Dynamic Damage and Needs Assessment (DNA) estimates that 25% of the telecommunication sector’s assets were either damaged or destroyed since the onset of the war. These estimates are based on satellite imagery, and thus they likely do not capture the full scale of the inflicted damages, particularly because some ICT towers or other facilities such as hangars for telecommunications equipment may not have been visible during the survey. For example, some of the on-ground assessments conducted in the city of Ta’iz suggest that the actual damages largely exceed what was estimated via the satellite survey. Furthermore, the survey does not take into account the ongoing maintenance and re-construction carried out by the different network operators when they have the opportunity to access affected areas. Finally, it is noteworthy that Hudaydah and Sa’ada were the hardest hit governorates in terms of mobile network asset losses, where it is estimated that 75% of the assets in those two areas have been damaged or lost.[24]

Figure (2): Physical damages to the telecommunications sector in Yemen by asset type[25]

Source: World Bank, DNA – Phase 3, 2020.

In addition to the above-mentioned losses, telecommunications companies, especially mobile service providers in the private sector, have experienced losses due to fuel shortages. Companies need fuel to power the generators that provide electricity to their offices, servers, and transmission stations in various parts of the country. Cyclones that have affected some southern governorates have also damaged telecommunications towers and network infrastructure in those areas. All of these factors have reportedly led to a reduction of coverage by around 40%.[26]

Companies have also suffered large financial losses due to institutional and policy divisions and financial demands by the authorities in Sana’a and Aden, as well as the confiscation of assets and extortion by some security agencies and militias. One company, Y Telecom, had to declare bankruptcy in March 2020, leaving behind its equipment and offices in Sana’a and arranging to restart its operations in Aden using 4G technology.

From January to March 2020, there was a wide scale internet outage in Yemen due to damage to the FALCON cable near the Suez Canal. The internet outage disrupted commercial business activity, internal and external financial transfers, as well as other official and private communications throughout Yemen.

Another result of the war has been the loss of opportunities to develop and modernize Yemen’s telecommunications technologies. Many of the licensing agreements with companies operating in the sector were nearing expiry just before the war started in 2015. Renegotiated licenses would have enabled these companies to provide next-generation mobile internet services.[27] Only the state-owned mobile phone company Yemen Mobile has been granted permission to provide mobile internet services using 3G technology.[28] The rest of the mobile telecommunications operators have only been granted licenses by the Ministry of Telecommunications and Information Technology to provide 2G or 2.5G mobile internet services, which have a limited capacity.[29] Restrictions preventing these companies from developing their technology and services result in indirect losses to the companies, the telecommunications sector in general, and consumers.[30] Another source of indirect losses is the fragile, complicated, and high-risk investment environment, which has discouraged investors from entering the Yemeni market, despite its large size and the plethora of services that are not being provided by companies currently operating in the sector.

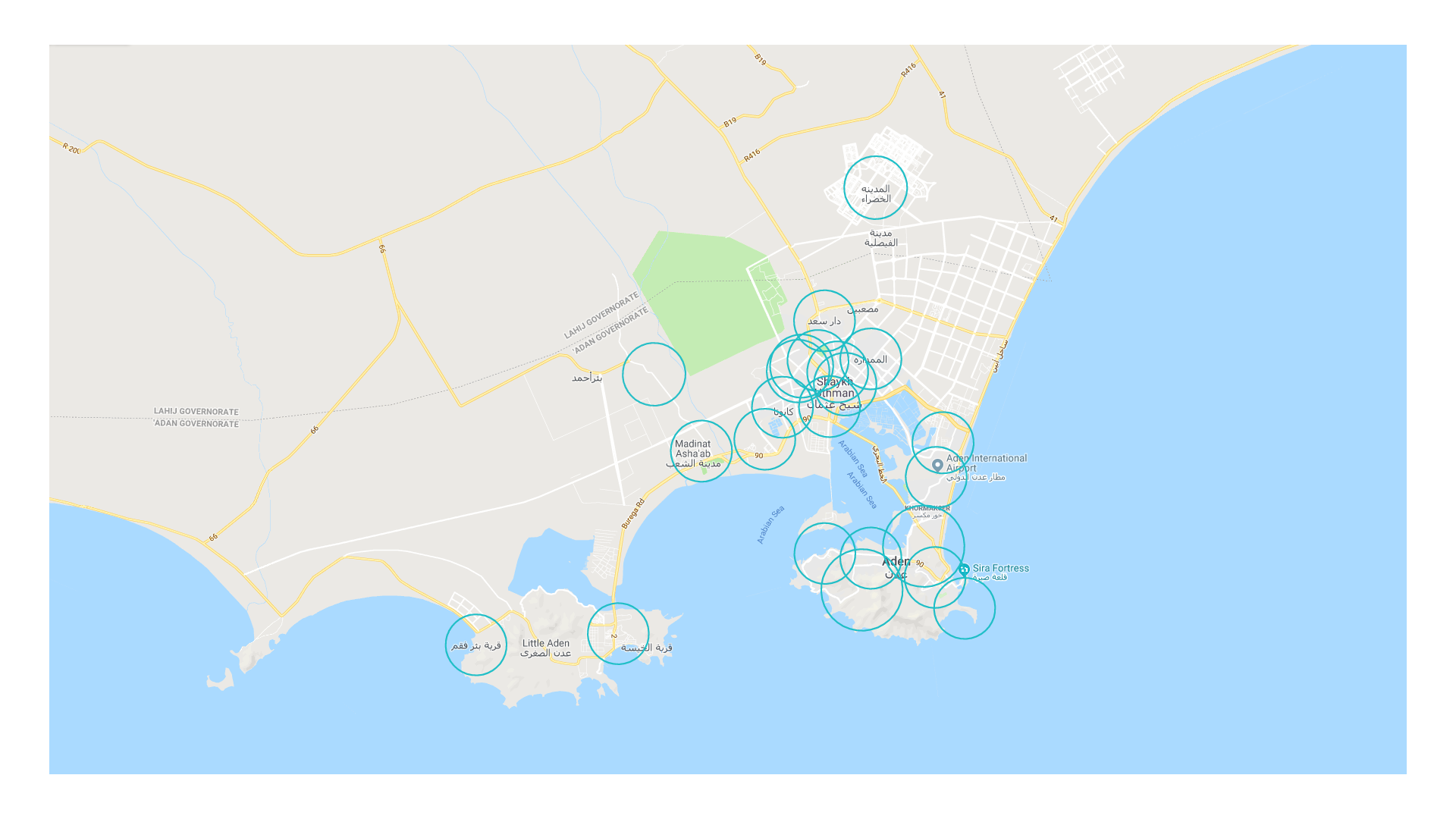

The continuing conflict risks deepening the institutional divides in the various vital economic sectors, including telecommunications. For example, the internationally recognized government has opened a new portal for the provision of internet services called Aden Net, using 4G technology.[31] Both Sabafon and Y Telecom have been preparing to shift to 4G through this new portal.[32]

Figure (3): Aden Net coverage[33]

Despite the conflict’s destruction and the challenges, it has created for the operating environment, the new political, economic, and social reality it has imposed has also created new opportunities in the telecommunications and information technology sector. For example, there has been an increase in demand for internet services, especially due to the electricity outages whereby many consumers have become reliant on access to the internet to follow news and developments affecting their daily lives. The increased demand for these services has led to:

- The spread of limited, small-scale local networks in the neighborhoods of major cities, towns, and even villages; these networks are operated by large numbers of youth and people who have lost their other jobs due to the war.[34] The Ansar Allah authorities temporarily outlawed these local networks in late 2019.[35] Under pressure from the owners of these networks, they have now been permitted to resume their business.

- Increased use of technology and social media platforms for financial transactions, especially WhatsApp, by money exchange companies, and the use of these applications by some small and micro-finance institutions, like the National Microfinance Foundation.[36]

- An increase in commercial activities and services that are linked to the internet, mobile services, and secondary sectors, like mobile accessories, maintenance, and programming services. The 2019 Rapid Business Survey showed that 26.4% of the total number of enterprises operating in Yemen’s telecommunications, information, and related services are new and were established during the period from 2015 to 2019.[37]

Challenges

Organizational Challenges

- The legal and institutional environment regulating the telecommunications sector is inadequate. Having remained unchanged since 1996, it has not kept up with the rapid and successive developments in this sector and has thus weakened the quality of services and limited revenues.

- The institutional divide and politicization of the telecommunications sector is another challenge. These developments have further complicated the situation and have led to conflicting policies, which have baffled service-providers, affecting the quality of services provided to users, as follows:

- Operators are now required to pay licensing fees and taxes to both the internationally recognized government and the de facto Ansar Allah authorities, as each party perceives itself as the legitimate authority.

- Operators are perceived by the internationally recognized government and Ansar Allah authorities as complicit in helping one party to spy on the other.

- The political, regulatory, and operational roles within the sector have not been properly separated, especially with regard to the provision of internet services solely through government corporations. There is a monopoly in the internet market, which has led to the deterioration of services and excessively high prices compared to other countries in the region and around the world.

Operational Challenges

- The reliance on a weak and fragile infrastructure to provide ADSL (land-based) internet services has limited bandwidth and internet speeds in Yemen.[38] Copper wires, installed for the purpose of landline phone communication, were used to add ADSL services instead of far superior fiber optic cable.[39]

- The importation of the equipment and tools necessary to replace what was destroyed during the war, as well as to modernize the networks to use 4G technology, is prohibited by the coalition.

- Ongoing clashes in a number of governorates prevent access to carry out necessary repairs to internet cables, communication towers and networks.

- Recurring electricity outages and fuel crises have led to a reduction in the number of operational stations for mobile telecommunications companies. This has weakened or eliminated coverage in some parts of the country.

Financial Challenges

- Despite the aforementioned growth in the number of mobile phone users during 2014–19, the number of users dropped significantly between 2015–17.[40] This was due to damages to a number of coverage stations for telecommunications networks in areas with armed clashes, airstrikes, and natural disasters. As a consequence, the revenues of mobile network operators decreased during that period but some recent reports show that some of these losses have now been recouped.[41]

- The rise of operational costs due to increased payment demands and fee types, as well as duplicate fees, being paid to the authorities in Sana’a and in Aden. These fees include license renewal fees, taxes, and zakat fees. Some of the companies have also been subject to financial extortion by militias with the justification that they are protecting their cell towers, among other excuses. Ansar Allah authorities have also confiscated the funds and assets of private telecommunications companies in Yemen.[42]

Priority Policies and Programs

Urgent Policies and Programs

- The telecommunications and information technology sector needs to be depoliticized to provide services efficiently and effectively across Yemen. Double taxation needs to be curbed and clear mechanisms should be found to distribute the fees imposed on the sector based on the services provided in various areas.

- The network needs to be upgraded by all operators to at least 4G technology to improve the companies’ ability to diversify their offers, increase their revenues, and provide better-quality services at reasonable prices. To enable this, the government needs to grant 4G licenses to private operators.

- The increasing demand by various economic sectors and individual consumers for telecommunications and internet services needs to be addressed, and emerging services based on rapid technological development need to be introduced, like video conferencing services. Simultaneously, the government needs to level the playing field to ensure that prices remain at fair price levels. There should also be efforts to implement digital financial services in a way that decreases the growing liquidity crisis in the Yemeni economy. These services also provide a suitable platform for social transfers that can help aid reach deserving beneficiaries without the assistance provided by humanitarian organizations being subject to corruption and looting, while at the same time providing increased transparency and accountability.

Medium- and Long-Term (i.e., Post Peace Agreement) Policies and Programs

- Efforts to prepare a new telecommunications law should be resumed in a way that meets the needs of the telecommunications market and enhances the role and partnership of the private sector.

- The regulatory and institutional makeup of the telecommunications and information technology sector needs to be restructured and further developed to keep up with modern advancements and encourage competition. A priority reform should be to separate the regulating body from the operating body. Currently, the Ministry and the PTC play a dual role of regulation and operation and thus competing with other private players. One of the key components of the new draft law referred to in the previous recommendation is to create an independent regulator.

- Suspended internet international links need to be restored and infrastructure improvement projects need to be resumed.

- The door needs to be opened for private internet service providers—recall that currently internet services are primarily provided through the government (i.e., fixed line internet through TeleYemen, YemenNet, and Aden Net, and cell phone data through Yemen Mobile); MTN Yemen and Sabafon provide 2G internet but 2G internet is very limited in bandwidth and not practically useful.

- A cohesive, comprehensive national digital strategy for inclusive economic growth needs to be designed in close consultation with the private sector and civil society.[43]

- University education curricula and other educational institutions should keep up with ongoing developments in the field of telecommunications and information technology in order to meet labor market needs for specialized professionals.

- Telecommunications and information technology should be leveraged by, for example, using it to decrease the risks from natural disasters that have affected Yemen in recent years. This includes addressing the need for an early-warning system for disasters, using modern technology to survey the affected areas, gathering data, and supporting search-and-rescue operations. Other opportunities that an improved sector could provide include remote education, FinTech, welfare cash transfers, and remote work.

This policy brief was prepared for the Rethinking Yemen’s Economy project by DeepRoot Consulting, in coordination with project partners Sana’a Center for Strategic Studies and CARPO – Center for Applied Research in Partnership with the Orient

Endnots

[1] (i) Naoko Kojo and Amir Althibah, Yemen Monthly Economic Update, January 2020 issue, World Bank Group, January 2020, p. 6: “the [telecom sector] was second to the oil and gas sector in terms of bringing in foreign currency and as a source of fiscal revenues,” http://pubdocs.worldbank.org/en/901061582293682832/Yemen-Economic-Update-January-EN.pdf (accessed August 28, 2020). (ii) Naomi J. Halewood and Xavier Stephane Decoster, “Input to The Yemen Policy Note no. 4. on Inclusive Services Delivery: Yemen Information & Communication Technology (ICT),” Washington, D.C.: World Bank Group, February 13, 2017, p. 4: “Prior to 2015, government revenue from the telecommunications industry was said to be second largest after hydrocarbons. Moreover, telecommunications services brought in hard currencies into the economy, previously reported in the order of about USD300 million, annually,” http://documents.worldbank.org/curated/en/337651508409897554/Yemen-information-and-communication-technology-ICT (accessed August 28, 2020).

[2] Central Statistical Organisation (CSO), “Statistical Year Book for 2017 – Chapter 25: National Accounts,” Table 10 (“The Structure of GDP at Producers Prices by Economic Activity at Constant Prices for 2004–2017 (%) 2000=100”) in Excel sheet labelled “10,” http://www.cso-yemen.com/publiction/yearbook2017/National_Account.xls (accessed August 28, 2020). According to the cited table, the ICT sector’s share (including both the public and private sectors) of national real GDP in 2015, 2016, and 2017 is 6.69%, 6.96%, and 6.88% respectively.

[3] Law No. 38 of 1991 Pertaining to Wired and Wireless Telecommunications as Amended in Law No. 33 of 1996, https://www.wto.org/english/thewto_e/acc_e/yem_e/WTACCYEM4A1_LEG_16.pdf (accessed October 13, 2020).

[4] Ibid. See Paragraph K of Article 3 for reference to licensing agreements.

[5] MTN, “MTN Investors Group Note 35: License Agreements,” MTN Yemen license agreement: “The licence agreement is effective from July 2000 and is applicable for 15 years, renewable thereafter. There is a four year exclusivity clause after which licence parity will apply,” http://www.mtn-investor.com/mtn_ar08/book2/fin_gr_notes35.html (accessed November 17, 2020).

[6] GSM is a 1990s standard developed to describe the protocols for second-generation (2G) digital cellular networks used by mobile devices such as mobile phones and tablets. By the mid-2010s, it became a global standard for mobile communications, achieving over 90% market share, making GSM the most ubiquitous of the many standards for cellular networks, including the CDMA standard of the same era. For more technical details about the different generations of cellular standards, see: Kgs Venkatesan, “Comparison of CDMA and GSM mobile technology,” Middle East Journal of Scientific Research 13(12):1590-1594, January 2013, https://www.researchgate.net/publication/273452419_Comparison_of_CDMA_and_GSM_mobile_technology (accessed October 16, 2020).

[7] (i) For the 2014 figure, see: Central Statistical Organisation (CSO), “Statistical Year Book for 2016 – Chapter 13: Communications & Information Technology,” Summary table (“Main Statistical Indicators of Communications and Information Technology”) in Excel sheet labelled “Indicators [AR],” http://www.cso-yemen.com/publiction/yearbook2016/Communication_Information_Technology.xls (accessed August 28, 2020). (Original source: Annual Statistical Bulletin of Public Corporation for Wired and Wireless Telecommunications of 2016.) (ii) For the 2019 figure, see: Ministry of Telecommunications and Information Technology (MTIT) (Sana’a), an infographic on the homepage entitled “Telecommunication and Information Technology Infrastructure Indicators 2019 [AR],” http://www.yemen.gov.ye/portal/portals/4/upload/%D8%A7%D9%86%D9%81%D9%88%D8%AC%D8%B1%D8%A7%D9%81%D9%8A%D9%83/1.jpg (accessed August 28, 2020).

[8] GSM Association (GSMA), “The Mobile Economy: Middle East & North Africa 2019,” 2019, pp. 2: “For context, the global average at the end of the same period was 66%,” 4, and 9 (Figure 2: The GCC Arab States lead the region in terms of subscriber penetration (Q2 2019)), https://www.gsma.com/mobileeconomy/wp-content/uploads/2020/03/GSMA_MobileEconomy2020_MENA_Eng.pdf (accessed August 28, 2020). Note that unique subscriptions differ from mobile connections—a single subscriber can have multiple connections (i.e., active mobile phone numbers/SIM cards). However, the details of GSMA’s methodology for calculating unique penetration rates are unknown.

[9] GSM Association (GSMA), “The Mobile Economy: Arab States 2015,” 2015, p. 8 (Figure captioned “Arab States penetration by country (Q2 2015)”), https://data.gsmaintelligence.com/research/research/research-2015/the-mobile-economy-arab-states-2015 or https://data.gsmaintelligence.com/api-web/v2/research-file-download?id=18809327&file=the-mobile-economy-arab-states-2015-1482139932360.pdf (accessed August 28, 2020).

[10] TeleYemen has been the sole licensed provider of the international telecommunication services in Yemen since 1972. It was established as a subsidiary company of the British company “Cable & Wireless plc” C&W, until 1990 when the Yemen Public Telecom Corporation (PTC) became a partner with C&W with a 49% of the total shares and then the company’s name changed to TeleYemen. In 2004, TeleYemen became a 100% state-owned entity with 75% of shares owned by PTC and 25% owned by the Yemen Post & Postal Savings Corporation.

[11] “An Economic Expert Interviews the Minister of Telecommunications on the Future of Telecom Companies’ Business Activity and Whether or Not They Are Being Targeted [AR],” Aden Time, February 17, 2020, http://aden-tm.net/NDetails.aspx?contid=117958 (accessed August 28, 2020).

[12] See Table 3 for detailed citations of all these 2014 and 2019 figures and others.

[13] Central Statistical Organisation (CSO), “Statistical Year Book for 2017 – Chapter 13: Communications & Information Technology,” Summary table (“Main Statistical Indicators of Communications and Information Technology”) in Excel sheet labelled “Indicators [AR],” http://www.cso-yemen.com/publiction/yearbook2017/Communication_Information_Technology.xls (accessed August 28, 2020). (Original source: Annual Statistical Bulletin of Public Corporation for Wired and Wireless Telecommunications of 2016.)

[14] Central Statistical Organization (CSO), “Projections for 2005-2025,” June 2010.

[15] (i) For 2014 data, see: GSMA, “The Mobile Economy: Arab States 2015,” op. cit. (ii) For 2019 data, see: GSMA, “The Mobile Economy: Middle East & North Africa 2019,” op. cit. Recall that unique subscriptions differ from mobile connections

[16] (i) For 2014 data, see: CSO, “Statistical Year Book for 2016 – Chapter 13: Communications & Information Technology,” op. cit. (ii) For 2019 data, see: MTIT (Sana’a), “Telecommunication and Information Technology Infrastructure Indicators 2019 [AR],” op. cit.

[17] Ibid.

[18] Ibid.

[19] (i) For 2014 data, see: International Telecommunication Union (ITU), ICT-Eye (online database), https://www.itu.int/net4/ITU-D/icteye/#/query (accessed August 28, 2020). Official data not available for this year because until 2014, available official statistics by TeleYemen and the Public Telecom Corporation used to combine ADSL and dial-up internet subscriptions (See: CSO, “Statistical Year Book for 2016 – Chapter 13: Communications & Information Technology,” op. cit.). (ii) For 2019 data, see: MTIT (Sana’a), “Telecommunication and Information Technology Infrastructure Indicators 2019 [AR],” op. cit.

[20] Nasser Al-Fadhel, “Comparative Study of Communication Prices in Arab Countries,” 16th Annual Arab Regulators Network (AREGNET) Meeting, Manama, October 2018.

[21] Cable.co.uk, “Worldwide mobile data pricing: The cost of 1GB of mobile data in 228 countries,” https://www.cable.co.uk/mobiles/worldwide-data-pricing/#regions (accessed August 29, 2020). According to the source, data from 5,554 mobile data plans in 228 countries were gathered and analyzed between February 3–25, 2020. The average cost of one gigabyte (1GB) was then calculated and compared to form a worldwide mobile data pricing league table.

[22] Ministry of Telecommunications and Information Technology (MTIT) (Sana’a), an infographic on the infographics web page, http://www.yemen.gov.ye/portal/Portals/4/upload/%D8%A7%D9%86%D9%81%D9%88%D8%AC%D8%B1%D8%A7%D9%81%D9%8A%D9%83/%D8%AC%D8%B1%D8%A7%D8%A6%D9%85%20%D8%A7%D9%84%D8%B9%D8%AF%D9%88%D8%A7%D9%86.jpg (accessed August 28, 2020).

[23] “Between Houthi Extortion and Government Failure.. Yemen Telecommunications Fight to Survive [AR],” al-Khaleej Online, March 22, 2019, http://khaleej.online/64z4Ba (accessed August 28, 2020).

[24] World Bank, Dynamic Damage and Needs Assessment (DNA) – Phase 3, 2020, pp. 91–100.

[25] BTS shelters are small shelters at the base of towers that house a device called the base transceiver station (BTS), a piece of equipment that facilitates wireless communication between user equipment and a network.

[26] Al-Khaleej Online, op. cit.

[27] The licenses granted to the two largest operators in the private sector (MTN Yemen and Sabafon) expired in 2015, and there have been negotiations since that time to extend them temporarily until new licenses can be negotiated. For instance, MTN’s most recent financial reports indicate that MTN Yemen was granted a new short-term extension on January 1, 2020, for 900MHz and 1800MHz licenses for two years (see: MTN Group Limited, “Annual financial statements for the year ended 31 December 2019,” March 11, 2020, p. 72, https://www.mtn.com/wp-content/uploads/2020/04/MTN-Annual-financial-statements.pdf (accessed December 2, 2020)).

[28] As noted, the Ministry of Telecommunications and Information Technology is responsible of issuing licenses. In 2004, Yemen Mobile took over TeleYemen cellular network and replaced its analogue services with CDMA services and was granted a 3G license by the ministry.

[29] As noted, licenses are granted to mobile operators by the Ministry of Telecommunications and Information Technology (MTIT). Before 2015, there were negotiations between the ministry and mobile operators like MTN Yemen and Sabafon for the renewal of their licenses and migration of their networks to 4G. At that time, the operators’ point of view was that they were already licensed to operate and they should only have to pay fees for the new 4G services, whereas the ministry’s point of view was that 4G was an entirely new offering that requires a different kind of equipment and infrastructure. Thus, according to the ministry, a new license is needed, not just new fees. At any rate, all discussions regarding migration to 4G came to a halt post-2015 due to the wartime blockade that has prevented any new telecom equipment from entering the country.

[30] Halewood and Decoster, op. cit., p. 2: “Only the state-owned mobile operator, Yemen Mobile was provided permission to provide 3G services. The others only had licenses to offer 2G or 2.5G services, with 2.5G allowing for very limited data capacity.”

[31] The performance of Aden Net is still lagging behind, and its coverage is limited to some districts in the governorate of Aden only. Furthermore, it conducts its business in a monopolistic manner. For instance, Aden Net is the only seller of Aden Net internet modems. Furthermore, because of its limited financial resources, it is unable to supply them in sufficient quantities. This has resulted in very high internet prices that are beyond reach for most people, in addition to creating a new black market for selling these modems.

[32] In September 2020, Sabafon announced launching its operations from Aden to offer its services to areas under the internationally recognized government’s control via a network that is technically and administratively independent from Sana’a.

[33] Aden Net, “Coverage Map [AR],” https://www.adennet4g.net/index.php/ar/2018-07-17-07-54-46 (accessed October 16, 2020).

[34] The local networks are established in neighborhoods, cities, towns, and rural areas. They are wi-fi networks whose operators subscribe to the Super Net service from Yemen Net, the dominant Internet Service Provider, and then provide internet services through prepaid cards.

[35] Casey Coombs, “In Yemen, the internet is a key front in the conflict,” Coda, March 10, 2020, “Houthi government in Sanaa announced that it would no longer issue business permits to the community networks”, https://www.codastory.com/authoritarian-tech/yemen-internet-conflict/ (accessed August 28, 2020).

[36] Sharaf al-Kibsi and Mustafa Hantoush, “WhatsApp in War-Torn Yemen Opens Opportunities to Improve Resilience, Livelihood, and Prosperity Through Microfinance Communication Innovation,” National Microfinance Foundation, March 2018, https://www.findevgateway.org/sites/default/files/publications/files/whatsapp_in_yemen_microfinance_v2_0.pdf (accessed August 28, 2020).

[37] Small & Micro Enterprise Promotion Service (SMEPS), “Yemen Rapid Business Survey 2019” (unpublished).

[38] As already noted, until 2014, available official statistics by TeleYemen and the Public Telecom Corporation used to combine ADSL and dial-up internet subscriptions—not users, because statistics differentiate between internet users in Yemen and subscribers to the different internet services available in the country, namely, ADSL and dial-up—putting the combined total for 2014 at 998,856 (See: CSO, “Statistical Year Book for 2016 – Chapter 13: Communications & Information Technology,” op. cit.). However, by subtracting the ADSL-only subscriptions estimated in Table 3 at 340,000 in 2014 from this total figure of 998,856, we estimate that the total dial-up subscriptions in 2014 would have amounted to 658,856 subscribers.

[39] Abdulqadir Othman, “Internet in Yemen: The Nightmare of War and the Curse of Monopoly [AR],” The New Arab, December 15, 2019, https://www.alaraby.co.uk/medianews/d7a9b457-9681-47b4-abcc-249fca044438 (accessed August 28, 2020).

[40] Halewood and Decoster, op. cit., p. 3: “In December 2015, there were an estimated 16.88 million mobile customers in Yemen, down 4.2% from 17.62 million a year earlier and a recent peak of 18.36 million at the beginning of 2015 […] the impact of conflict on mobile penetration rates is almost immediate.”

[41] MTN Group Limited, “Results overview for the year ended 31 December 2019,” March 11, 2020, p. 28: “MTN Yemen also contributed positively to the MENA portfolio, growing service revenue by 14,2%* on the back of a 28,8%* increase in data revenue against a challenging macroeconomic backdrop and political instability,” https://www.mtn.com/wp-content/uploads/2020/03/MTN-Group-2019-annual-results.pdf (accessed December 2, 2020).

[42] The Emirati Al-Bayan newspaper wrote on October 8, 2019, that in 2018 the Ansarullah authorities confiscated YER 51 billion from Yemeni telecom operators distributed as follows: YER 27 billion from Sabafon, YER 17 billion from Y, YER 7 billion from MTN Yemen. See: https://www.albayan.ae/one-world/arabs/2019-10-08-1.3668294 (accessed October 14, 2020).

[43] See also: https://pathwayscommission.bsg.ox.ac.uk/digital-roadmap.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية