The value of Yemeni rials increased dramatically today, April 7, following the announcement of US$3 billion in new Saudi and Emirati support for the internationally recognized Yemeni government. However, there are strong signs already from the money market that the rebound will be temporary.

Consultations in Riyadh between Yemeni parties to the anti-Houthi coalition and Gulf Cooperation Council states yielded major results in the past 24 hours, with Yemeni President Abdo Rabbu Mansour Hadi replaced by a presidential council and Vice President Ali Mohsen al-Ahmar sacked. Both Saudi Arabia and the United Arab Emirates committed US$1 billion each in new support to the government-controlled Central Bank of Yemen (CBY) in Aden, while Saudi Arabia committed a further US$1 billion in support for oil derivative purchases and development projects.

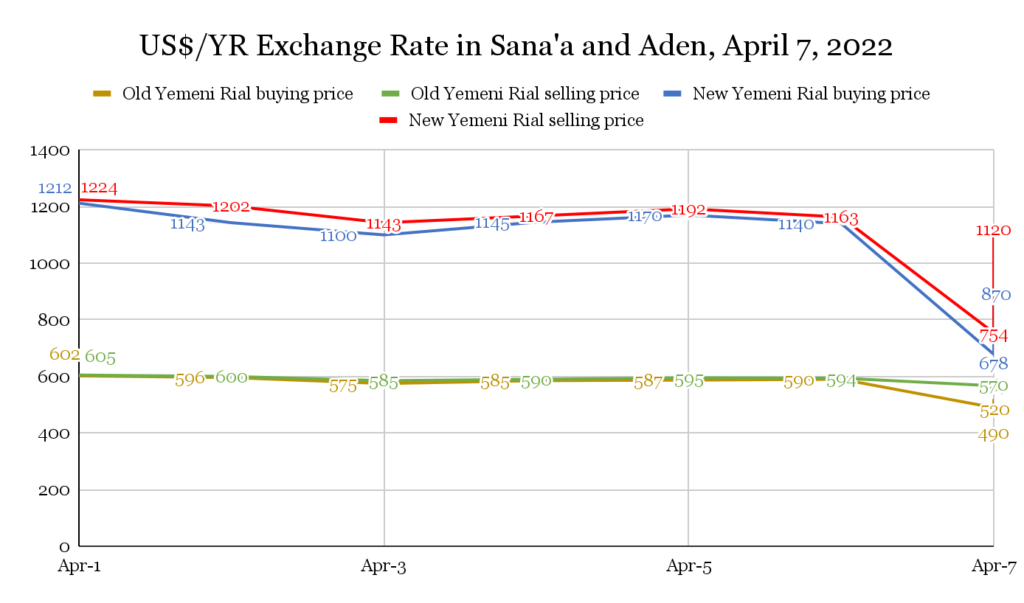

The rapid appreciation in the value of the rial can be attributed to positive market sentiment following the overnight political shake up at the top of the Yemeni government and newly announced Saudi and Emirati financial support. Around mid-day, new rials were trading at roughly 40 percent higher relative to the United States dollar (US$), and old rials roughly 16 percent higher. By evening, the rates had fallen, with new rials still up 23 percent, and old rials 11 percent.

The onset of the holy month of Ramadan routinely puts upward pressure on the value of the Yemeni rial. During Ramadan, hundreds of thousands of Yemenis working abroad increase the remittances they send home to their families, who must then exchange the foreign currency for rials to spend in Yemen, increasing demand for the rial and putting upward pressure on its value. This support is temporary, however, typically ending with Ramadan when remittances return to normal levels.

Prior to the ongoing conflict, the CBY was able to restrict speculation and regulate the relative supply of foreign and domestic currency in the money market, thereby keeping the exchange rate stable. Both of these capacities have been severely undermined since the central bank’s fragmentation in 2016, allowing currency traders far more leeway to manipulate the market and profit from large swings in currency value. Since January 2020, the country has effectively had two domestic currencies with differing exchange rates: ‘new rials’, issued by the CBY-Aden since 2017, which circulate in government-controlled areas; and ‘old rials’, issued prior to 2017, which circulate in the Houthi-controlled north.

Today’s announcement of new financial support has essentially super-charged the fluctuations in exchange rate pressures normally expected during Ramadan. While new injections of foreign currency (FX) will help push the value of the rial, particularly the new rial, above valuations seen in the past year, much of today’s gains will almost certainly be fleeting.

Tellingly, there was a wide disparity in the ‘buy’ and ‘sell’ prices money exchangers were offering. During the day, Sana’a exchangers offered to buy dollars at YR490 and sell at YR567; in Aden, exchanges were buying dollars for YR678 in new rial notes, and selling at YR754. By the evening, Sana’a exchangers were offering to buy dollars at YR520 and sell at YR570; in Aden, exchanges were buying dollars for YR870 in new rial notes, and selling at YR1120, indicating high volatility in the value of new rials.

Notably, these rates were in some cases hypothetical: upon visiting money exchangers in Sana’a, the Sana’a Center Economic Unit was told that while rials were for sale, US dollars and Saudi riyals were not. This suggests money exchangers are attempting to hoard foreign currency in expectation of the Yemeni rial depreciating in value again, when they can profit from currency arbitrage.

Also notable from today’s exchange rate fluctuations are the outsized gains that new rials made relative to old rials, significantly narrowing the exchange rate disparity between the two. This disparity has been a boon to the credibility of the Houthi authorities, who have used it as evidence of their superior economic and monetary management relative to the Yemeni government. As a result, Houthi authorities will almost certainly feel pressured to revalue old rials in areas they control to re-establish the exchange rate disparity.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية