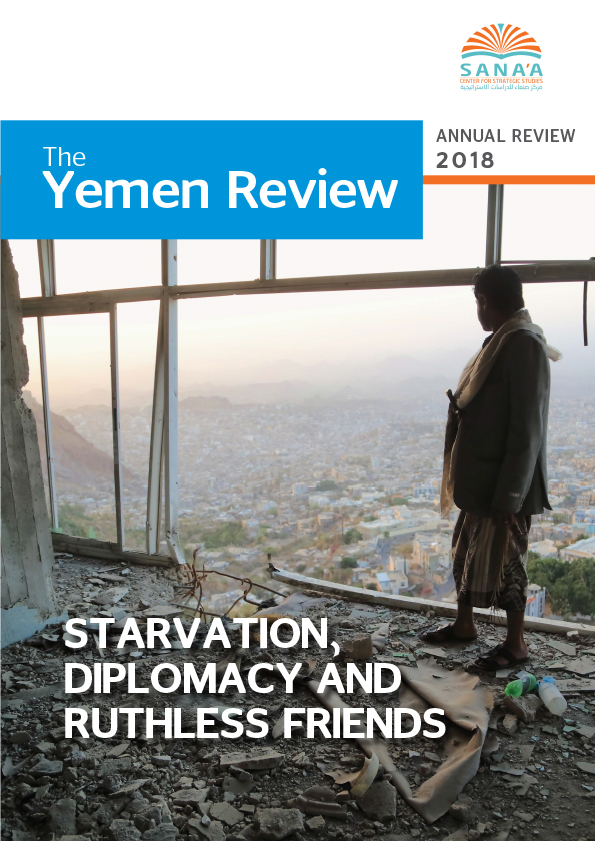

Hani al-Moalem overlooks Taiz from the wreckage of his café. He used to own six such businesses in the city, all of which the war has left either fully or partially destroyed // Photo Credit: Anas al-Hajj

The Sana’a Center Editorial:

Beyond the Brink

Beyond the Brink

Yemen is no longer “on the brink” of catastrophe. Rather, it has already been pushed into the abyss and therein continues to fall. After four years of war, Yemen has suffered the destruction of its infrastructure, economy, social fabric, and much more. Yemenis are a nation traumatized by human loss and starvation. In the past year, photos of malnourished children have become synonymous with Yemen worldwide. Yet, as much as it deserved the media attention, the story of the world’s worst humanitarian crisis at times concealed the fact that this is not a natural disaster that has befallen Yemen. It is an accumulation of political conflicts within the country, exacerbated by reckless regional interference backed by the world’s Western powers.

Aid organizations are now preparing for another year of humanitarian suffering. The United Nations has announced plans to raise funds amounting to $US4 billion – a third more than last year’s appeal for roughly US$3 billion – with Saudi Arabia and the United Arab Emirates funding about a third of the appeal. However, humanitarian organizations are reaching their capacity limits, while the immense looting and confiscation of humanitarian supplies in which belligerent parties are engaged – the Houthi forces far more than any – means aid itself is at times helping to finance the war instead of reaching those in need. Neither the coalition powers nor the Western countries backing them should therefore content themselves with pouring aid into Yemen. Yemen desperately needs political decisions to be made.

At a closer look, developments last year demonstrated clearly that the crisis in Yemen is political at its core, and that’s how it needs to be addressed. It was new geopolitical dynamics that encouraged decisions to contain Yemen’s downward spiral toward the end of 2018 – even if decisions came late, unexpectedly, and at times resulted from events that on face value had little relation to the Yemen conflict.

At the epicenter of the conflict and its shifting dynamics were the city of Hudaydah and the nearby ports – the last access Houthi forces have left to the Red Sea. These ports are also the entry point for most of the basic commodities feeding a nation descending into mass famine. For some two years the Saudi-led military coalition has been pushing for a military campaign to take Hudaydah. However, international concern – that cargo shipments would be interrupted and trigger a humanitarian catastrophe – has been intense, and the coalition was waiting for a green light from its main backers, the United States and the United Kingdom, to pursue the offensive. Near the midpoint of 2018, Washington gave what amounted to a “yellow light”, according to a US government official who spoke with the Sana’a Center at the time.

The strategic and military preparations for the campaign changed the calculations of various groups in the anti-Houthi coalition. For instance, the UAE had for the past several years built proxy militias in areas the Yemeni government is meant to control, with these militias often challenging the government’s authority and some seeking to partition the country. In 2018, however, unity among anti-Houthi ground forces was seen as paramount for the battle for Hudaydah. With UAE prompting, these disparate groups closed ranks and put differences aside for the military campaign. Symbolic of this were the visits to Abu Dhabi by Yemeni President Abdo Rabbu Mansour Hadi and Islah party leaders in 2018.

Through the latter half of 2018, the coalition’s efforts to drive the Houthis from Hudaydah progressed slowly and effectively stalled at the southern edge of the city, threatening to become a battle of attrition. Simultaneously, international pressure was building on Saudi Arabia – pressure that was then key to facilitating the UN-led peace consultations in Sweden and the Stockholm Agreement that halted the battle for Hudaydah. It was, however, not the possible starvation of millions of Yemenis that created the international momentum for peace consultations and a ceasefire. Rather, it was the media spectacle around the murder of one man, Saudi journalist Jamal Khashoggi, at his country’s consulate in Istanbul that provoked international outcry and prompted Washington and London to force Riyadh’s hand. Many Western leaders had been growing increasingly uncomfortable over reckless Saudi foreign policy and were embarrassed by reports of war crimes in Yemen committed by their ally, including bombing buses full of school children and siege tactics that have helped push the country toward mass starvation. However, while Western countries, above all the US and the UK, had enabled the Saudi-led military intervention in Yemen, they had no hand in Khashoggi’s murder, which allowed for an opportunity to criticize Riyadh while claiming the moral high ground.

The Stockholm Agreement, endorsed by the UN Security Council, came about thanks to international pressure, Saudi influence over the Yemeni government and the belligerent parties each wanting to avoid blame for the peace process’ failure. At the same time both sides were hoping to gain an advantage. The UN Special Envoy for Yemen Martin Griffiths secured the warring parties’ commitments not through compromise, but by watering down the language in the deal to the point that what the parties actually committed to is widely up to their own discretion. In the short time it has been since the talks, it is apparent the parties are interpreting their commitments quite differently. Neither regarded the talks as a stepping stone to a greater accord, but rather a localized accommodation.

President Hadi – technically still a ‘transitional president’ who was meant to leave office in 2014 – also knows his exit from power is almost assured if and when a peace deal is signed. Hadi’s choice to send a delegation to Sweden was, however, not his to make, given that he is beholden to his Saudi patrons. Indeed, Hadi has attempted to govern his country from Riyadh since 2015. The armed Houthi movement likewise attended the talks under duress. Their leadership is keenly aware that the greatest “victory” they could possibly achieve at this point is to survive. The pummeling Houthi forces have been sustaining on the battlefield has left them smarting and looking for a way to ease the pressure.

There is, however, little to no chance that the Houthis will cede a military defeat to their opponents. And while they have been militarily pressured, in the territories they control they have acted increasingly paranoid and continued to craft their own police state: persecuting minorities, staging show trials and executions, banning civil society groups and launching arrest campaigns to purge undesirables – such as free-thinking journalists, human rights advocates and others – institutionalizing the extortion of businesses, workers and aid organizations, conscripting children into combat roles, and propagating religious zealotry upon the masses. Before the Houthis took over, there was more than 20 daily and weekly independent newspapers publishing from Sana’a. Today, there are only Houthi publications. Meanwhile, the ongoing war also pushed them closer to Tehran, which is ironic given that Saudi Arabia and the UAE launched their military intervention in Yemen to prevent what they saw as Iranian encroachment in their backyard.

Thus, the war has become increasingly complex as it has proceeded, entrenching the clout of warlords and armed groups as it goes and advancing the country’s fragmentation. This trend is likely to continue in the absence of a broader settlement to end the conflict. The details of what a political settlement would look like remain elusive, but some of the parameters are clear.

That the UN-led consultations began only after the US and UK – Saudi Arabia’s primary military and political backers – made it incumbent on Riyadh to facilitate them is telling: a final peace agreement will almost certainly require continued US, UK and wider international pressure to keep Riyadh and other foreigner actors on course.

Economic recovery and price stabilization – such that the population can afford to feed itself – would be foundational for political and social stability. The rapid reunification of the Central Bank of Yemen – currently divided between competing headquarters on either side of the frontlines – would be the first step to contain the economic deterioration and bring back basic public services across the country. Saudi Arabia must also stop the mass expulsion of Yemeni expat workers it is currently undertaking, given that their remittances help support millions of family members in Yemen.

Political and social stability would be fleeting while myriad armed actors continued to challenge the government’s authority, and thus reining them in would be a prerequisite for peace. In this respect, local instruments of mediation and negotiation should be favoured over UN textbook procedures. In practical terms, the UAE will need to desist from empowering secessionist groups in southern governorates and begin to decommission their armed wings. In the north it would require that Houthi forces withdraw from cities and hand over their heavy weapons to a third party. Indeed, all non-state actors in the country would need cede their military leverage, as the Yemeni state – whatever shape it eventually may take – must have a monopoly on the use of force.

None of these groups will agree to disarm unless they are reasonably assured that their long-standing grievances, which predate the war, would be addressed in the country’s post-conflict political arrangement. The planning of how the state is reconstructed will thus have to be an inclusive affair, though one that learns from the failures of the country’s 2013-2014 National Dialogue Conference (NDC) that precipitated the current conflict.

Among these lessons: agreed-upon trust-building measures must be fully implemented prior to the talks. While international pressure must be brought to bear on all parties to reach an agreement and to limit spoilers, reaching this agreement must involve genuine compromises regarding points of contention. Diluting the commitments until the belligerents find them acceptably vague is the road back to war. Unconditional amnesty from prosecution for war crimes for any party is also a nonstarter. Rather, any transitional justice process must be conditional relative to the parties adhering to their commitments.

Most parties to the original NDC saw some form of federalization as necessary to address regional grievances – whatever final form this takes must be mutually agreed through negotiation. It will necessarily require revenue sharing arrangements between the various regions to allow basic public services to be delivered nationwide.

The success of any political arrangement will depend on external factors as well. Yemen’s poverty is unfortunately likely to continue in the medium term, as will long-standing political rivalries between the various local stakeholders. These factors will leave Yemen susceptible to foreign influence and fertile ground for proxy confrontations between the region’s polarized power centers, particularly Saudi Arabia and Iran. Thus, similar to other countries around the Middle East and North Africa enduring civil strife, while relative peace and stability can be achieved in Yemen, it will remain under constant threat from outside factors in the absence of regional de-escalation. International stakeholders should recognize this, and see the opportunity that ending the Yemen conflict presents in this regard: an achievable localized outcome that has the potential to unlock far broader geopolitical shifts across the region.

Editor’s note: The Yemen Annual Review 2018 offers readers a comprehensive document regarding the most important Yemen-related events and developments between January 1 and December 31. Taken altogether the size of the text may be unwieldy for some readers, while others may have specific topic areas upon which they would like to focus. To address these issues and increase the accessibility of this document, we have provided:

- a hyperlinked table of contents listing the various sections and subsections in the text, allowing the reader to easily navigate to their topics of interest. (To navigate back to the contents listing, simply press the ‘Back’ button on your browser.)

- an overview at the beginning of each section outlining the most important developments discussed therein.

Contents

Diplomacy Gains Momentum

- Overview: The Road to the Sweden Talks

- The Stockholm Agreement

- UN Security Council Ends Impasse on Yemen

- The New UN Special Envoy

Hudaydah, the Heart of the Crisis

- Overview: The Significance of Hudaydah

- Preparing for the Offensive

- The Battle For Hudaydah

- Humanitarian and Economic Fallout

Economic Developments

- Overview: The Struggle for Financial and Monetary Control

- The Currency Crisis and the Threat of Famine

- Factors Destabilizing the Yemeni Rial

- Stabilizing Influences on the Yemeni Currency and Economy

- Competing Monetary Policies: A Tale of Two Central Banks

- War Economy Sees Cooperation Between Battlefield Adversaries

- Macroeconomic Overview

Political Developments

- Overview: Fragmentation in South, Hardliners Ascend in North

-

Cracks Within the Anti-Houthi Alliance

- Aden: Hadi, Islah vs. UAE-backed Secessionists, Salafis

- Hadramawt: Ali Mohsen, Islah vs. UAE-backed Local Forces

- Marib: Islah, Tribes and the Saudis United in Federalism

- Taiz: Islah Forces Oust Rivals

- Red Sea Coast: Tariq Saleh Switches Sides

- Socotra: The Government vs. the UAE

- Mahra: Saudi Arabia Attempting to Limit Omani Clout

- A New Prime Minister, a President in Bad Health

- Houthi Hardliners On The Rise

- The GPC in Crisis

Frontline Developments

- Overview: The Armed Houthi Movement Cornered But Uncowed

- Most Important Anti-Houthi Ground Forces

- The Northern Front

- Houthi Missiles and Drones

- A Weakened AQAP

Humanitarian Developments

- Overview: A Deepening Food Security Crisis

- Obstacles to Aid Delivery

- Impacts of State Collapse on Education and Health Services

- Humanitarian Response Stepped Up

- Cyclones Hit Socotra and Mahra

Human Rights and War Crimes

- Overview: More Investigations, More Impunity

- Human Rights Reports Published in 2018

- Overview of Violations

Yemen and the World

- Overview: Increased Global Engagement

- Yemen and the Region

- Allies of the Coalition: US and UK Policy Toward Yemen

- Other World Powers: Between Peace Brokers and Arms Dealers

List of Acronyms

Acknowledgements

Mukalla in September: Protesters block streets and burn tires in one of many demonstrations across the country as the collapsing currency sends food and fuel prices soaring // Photo Credit: Suliman al-Nowab

Diplomacy Gains Momentum

Overview: The Road to the Sweden Talks

In early December UN-led peace consultations regarding the Yemen conflict were held for the first time in more than two years. Representatives from Yemen’s main warring parties – the armed Houthi movement and the internationally recognized Yemeni government – met in the Swedish town of Rimbo, north of Stockholm. The consultations ended with the Stockholm Agreement, in which the belligerents committed to a prisoner exchange, a ceasefire agreement around the port city of Hudaydah with UN monitoring, and a statement of understanding to form a joint committee, with UN participation, regarding the situation in Taiz City (see below ‘The Stockholm Agreement’ for details).

Momentum toward the talks in Sweden increased as 2018 progressed. Through the first half of the year and into the summer, the UN and other humanitarian agencies issued progressively more dire warnings that the conflict was driving millions of Yemenis into famine (see ‘A Deepening Food Security Crisis’), while evidence of war crimes by all belligerent parties continued to mount (see ‘More Investigations, More Impunity’). The conduct of Saudi Arabia and the United Arab Emirates (UAE) – the largest partners in the regional coalition intervening in the conflict in support of the Yemeni government – came under increasing scrutiny in Washington and London, among other western capitals. The United States (US) and the United Kingdom (UK) have provided crucial backing to the coalition campaign since it began in 2015. However, lawmakers in both countries voiced increasing concerns through 2018 that this support was directly contributing to the humanitarian crisis and civilian casualties (see ‘US and UK Policy Toward Yemen’).

In October, the murder of Saudi journalist Jamal Khashoggi at the Saudi consulate in Istanbul triggered international outcry. In the subsequent media frenzy the Saudi-led military coalition intervention in Yemen and its humanitarian implications also came under intense international media and diplomatic scrutiny. By the end of October top US and UK officials were calling for a ceasefire and a new round of peace talks, with these calls then echoed by other western countries (see ‘The Khashoggi Effect’).

In early November, the UN Security Council (UNSC) began negotiating a new draft resolution on Yemen for the first time since adopting Resolution 2216 in April 2015, shortly after the Saudi-led military coalition intervention began. The UK, penholder of the Yemen file at the council, led the drafting of the new resolution in consultation with the US. Meanwhile, UN Secretary General António Guterres personally pushed for diplomacy on Yemen. Guterres discussed logistical issues for UN-led consultations on the sidelines of a meeting with Saudi Crown Prince Mohammed bin Salman in Argentina at the end of November, according to UN Special Envoy for Yemen Martin Griffiths.

Griffiths’ appointment as the new UN Special Envoy for Yemen in early 2018 also helped to bring new dynamics into the stalled peace process (see ‘The New UN Special Envoy’). An attempt to bring the warring parties together in September in Geneva had, however, failed due to logistical complications in transporting the Houthi delegation to the talks (see ‘Failure in Geneva, Success in Rimbo’). Sweden, whose non-permanent Security Council membership was to end on December 31, 2018, then helped lead a diplomatic push to support the Special Envoy’s efforts to bring the warring parties together before the end of the year. Sweden offered to host the meeting and was actively engaged at the ministerial level throughout the consultations.

During the week-long consultations in Sweden, from December 6-13, three confidence-building measures were on the agenda: the reopening of Sana’a International Airport for commercial flights, the enhancement of the capacity and reunification of the Central Bank of Yemen (CBY), and an exchange of prisoners. Only on the latter was an agreement reached. Griffiths also introduced de-escalation plans for the cities of Hudaydah and Taiz at the talks. In a rush to meet the consultations deadline of December 13, mediators successfully pushed for an agreement, although various clauses in the resulting document contained a degree of ambiguity. Sources familiar with the proceedings told the Sana’a Center that as the negotiations were ending Guterres spoke with Crown Prince Salman, following which the latter called Yemeni President Abdo Rabbu Mansour Hadi and instructed him to sign on to the de-escalation agreement for Hudaydah. The warring parties also agreed on a new round of UN-led consultations in January 2019, with the location yet to be confirmed as of this writing.

The Special Envoy’s office announced that the ceasefire for the Hudaydah governorate should commence on December 18, 2018. On December 21, the UN Security Council adopted Resolution 2451 endorsing the Stockholm Agreement. It authorized the UN Secretary General to deploy an advance team to monitor compliance for a 30-day period, beginning immediately. A UN team, led by retired Dutch Maj. Gen. Patrick Cammaert, arrived in Hudaydah shortly thereafter to monitor the ceasefire. Importantly, this was the first time the Security Council had authorized the deployment of UN monitors to Yemen.

The Stockholm Agreement

A UN-Monitored Ceasefire in Hudaydah

Hudaydah is home to the country’s busiest port. The port of Hudaydah and nearby Saleef and Ras Issa ports are the primary entry points for most of Yemen’s basic goods and humanitarian supplies. With Houthi forces having controlled the city and ports since 2015, the area has been the primary focus of coalition military efforts throughout the conflict. By the fall of 2018 coalition-backed troops had advanced to the city’s southern outskirts. Meanwhile, UN agencies, humanitarian organizations and others have repeatedly warned that the ports are a lifeline for millions of Yemenis on the cusp of famine, and that an interruption in cargo deliveries would have catastrophic humanitarian consequences (see ‘Hudaydah, the Heart of the Crisis’).

The de-escalation agreement on Hudaydah envisaged UN monitoring of the ceasefire and the redeployment of armed forces away from the city and the ports of Hudaydah, Saleef and Ras Issa. The UN was to take a leading role in the management of the ports, while the existing UN Verification and Inspection Mechanism (UNVIM) for monitoring the ports was to be enhanced.

The agreement was set to be implemented within 21 days, split into two phases. Houthi forces were to withdraw from the ports of Hudaydah, Saleef and Ras Issa within two weeks of the ceasefire. A “full mutual redeployment of all forces” from the city and its ports was to be completed by the end of the 21 days. Local forces – agreed upon by a Redeployment Coordination Committee (RCC) comprised of both warring parties – were to take control.

With the UNSC’s approval of Maj. Gen. Cammaert to lead the UN’s ceasefire monitoring team, he was also nominated to chair the RCC, which included three representatives each from the internationally recognized Yemeni government and the armed Houthi movement. On December 22, 2018, a day after the adoption of UNSC Resolution 2451, Cammaert arrived in Aden and met with the government’s representatives on the RCC. On December 24, he met with RCC members representing the armed Houthi movement in Sana’a, before heading to Hudaydah.

As of this writing, the implementation of the security arrangement for Hudaydah faced significant challenges, particularly in interpretation. The agreement stipulated that security in the city of Hudaydah and its ports should be “the responsibility of local security forces in accordance with Yemeni law”. Since mid to senior-level administrative and military posts in Hudaydah were, as of the end of 2018, held by Houthi appointees, one interpretation of the agreement would be that security responsibilities were to remain in the hands of these Houthi-affiliated officials – an interpretation the Houthi leadership would obviously favor. Another interpretation of the agreement would be that security personnel in charge prior to the Houthi takeover in 2014 would be reinstated, or that new forces would be recruited from Hudaydah’s local population; given that the armed Houthi movement has little local support, these latter interpretations would be preferred by the Yemeni government.

The challenges related to interpretation became apparent on December 29 when the Houthi leadership announced the withdrawal of its forces from the main port of Hudaydah. Speaking to journalists, sources close to the government accused their Houthi opponents of simply moving their fighters and loyalists into positions in port management and the coastguard. Several independent Sana’a Center sources supported this claim. These sources also described how, on December 29, Houthi officials had invited Maj. Gen. Cammaert to the port for discussions, but upon his arrival he was confronted by a staged media event in which Houthi fighters paraded out of the port and the replacement staff paraded in, with television cameras rolling to show that Cammaert was in attendance. The next day the UN announced that compliance with the Hudaydah agreement needed to be independently verified and expressed regret that the opening of a humanitarian corridor from Hudaydah to Sana’a had not taken place as agreed.

Divisions between the Yemeni government and anti-Houthi forces present in Hudaydah are also risk factors for the implementation of the Stockholm Agreement. In particular, the National Resistance Forces, led by Tariq Saleh and supported by the UAE, operate outside of Yemeni government command and control. Tariq – through ties his uncle Ali Abdullah Saleh built in Hudaydah during his three decades as Yemen’s president – has a local support base in the area. Sana’a Center analysts expect Tariq Saleh will likely attempt a power grab in Hudaydah as 2019 progresses. This would put him at odds with the Yemeni government and complicate any commitments the government attempts to make regarding Hudaydah during peace negotiations.

The Stockholm Agreement also stipulated that the revenues of Hudaydah, Saleef and Ras Issa ports were to be deposited in the local branch of the central bank and used toward the payment of civil servant salaries in Hudaydah governorate and throughout Yemen. The Yemeni government has refused to pay most government salaries in Houthi-controlled areas of the country for two years, while many of the regional branches of the CBY have stopped reporting revenues to the government-controlled CBY headquarters in Aden (see ‘Competing Monetary Policy: A Tale of Two Central Banks’). As no agreement was reached in Sweden regarding the central bank, the implementation of this part of the Stockholm Agreement regarding Hudaydah remained uncertain.

A Joint Committee for Taiz

The statement of understanding on Taiz was limited to an agreement to form a joint committee with UN participation, including representatives from Yemeni civil society. The committee was to determine its working mechanism and missions. The statement presented an opportunity to de-escalate tensions in the city and open humanitarian corridors to ease the movement of aid and people. However, the statement’s vague formulation left it open to different interpretations by the warring parties and lacked a timeframe or any clear terms of reference.

Prisoner Exchange

The first thing the parties agreed to in Rimbo was a prisoner exchange agreement. As of this writing, the exchange of thousands of prisoners was to take place as soon as mid-January 2019, but this faced potential challenges too. On December 29, Yemeni government officials said that of the 8,500 names of prisoners they had submitted to Houthi representatives, the latter had claimed almost 3,000 of them were not in Houthi custody.

UN Security Council Ends Impasse on Yemen

UNSC Deadlocked Throughout Most of 2018

Before it adopted Resolution 2451 in December, the UN Security Council had been in deadlock regarding Yemen for most of 2018. Sweden, Peru, the Netherlands and at times Poland had through the year lobbied for a new resolution and for greater accountability from all parties to the war. However, these efforts were derailed by the US, the UK and Kuwait, who during council proceedings on Yemen generally steered discussions toward Houthi ballistic missile attacks on Saudi Arabia and Iranian non-compliance with the arms embargo established by UNSC Resolution 2216. The states opposing a new Yemen resolution also succeeded in repeatedly weakening the language in council statements and blocking references to suspected coalition violations of international humanitarian and human rights law. They were supported in these efforts by, at times, intense lobbying by Saudi Arabia and the UAE, neither of which is a UNSC member.

In February, Russia used its veto power for the first time with regards to the Yemen conflict to quash a draft resolution at the Security Council. The UK, as the penholder of the Yemen file at the council, had introduced an annual routine draft resolution to renew the mandate of the Panel of Experts and the Sanctions Committee for Yemen. The UK also inserted a non-routine passage in the resolution regarding Iran’s alleged non-compliance of the arms embargo on Yemen, which the Panel of Experts had reported. Russia vetoed the British draft resolution, while China abstained. The Security Council then voted in favor of a routine resolution, drafted by Moscow, to renew the mandate of the Sanctions Committee.

In March, the Security Council adopted a Presidential Statement expressing concern over the humanitarian crisis in Yemen and calling out attacks on densely populated areas. The Netherlands and Sweden had pushed for a resolution on Yemen’s humanitarian crisis, but the UK as penholder introduced a Presidential Statement instead. Presidential Statements are considered less weighty and lack the mandatory enforcement power of a Chapter 7 resolution. In the final text, the UNSC called on all parties to abide by their obligations under international humanitarian law, though only Houthi forces were censured by name regarding attacks against civilians; Kuwait successfully lobbied to have references to Saudi-led military coalition airstrikes removed and to weaken the language regarding accountability for violations in Yemen.

In June, the Security Council held three closed consultations on Yemen in light of the Hudaydah military offensive. The outcomes were limited to short press elements, which made no reference to Hudaydah. Sana’a Center sources indicated that the statements had been watered down by the UK and Kuwait. After the launch of the battle for Hudaydah in June, Sweden recommended a call for an “immediate freeze” to the offensive to avoid an assault on the port. This failed to gain consensus support at the council. Kuwait lobbied heavily against the move, while the UK and France said a call for the immediate cessation of hostilities was not viable. Instead, the UK called for compliance with international humanitarian law and the protection of civilians by parties to the conflict. The UK’s approach to Yemen did not change until the end of 2018 when London started to push for a new resolution.

Breakthrough in December

On December 21, 2018, the Security Council finally adopted Resolution 2451 which endorsed the Stockholm Agreement. This was the first council resolution on Yemen since Resolution 2216 of April 14, 2015. The resolution was first drafted and circulated among member states in November, prior to the Sweden consultations, and focused on a cessation of hostilities and measures for humanitarian relief, including the injection of foreign currency into the economy.

According to Sana’a Center sources, Saudi Arabia exerted pressure on Security Council member states, particularly the US, and threatened that the Yemeni government and the Saudi-led military coalition would disengage with the UN Special Envoy for Yemen’s peace efforts if the new resolution was adopted. The concurrent recovery of the Yemeni rial, which had major humanitarian implications, and the slight abating of the battle for Hudaydah also relieved some of the sense of urgency regarding the resolution. The draft resolution was thus shelved.

After the Sweden consultations concluded in December, the UK reintroduced the draft resolution to the council with an updated text on the Stockholm Agreement, which it endorsed. The adopted text included points on ways to strengthen the economy and functioning of the CBY, and to carry out civil servant salary and pension payments. It called for the unhindered movement of goods and the reopening of Sana’a International Airport for commercial flights within an agreed mechanism. It also called on the parties to the conflict to comply with international law and to fulfil their obligations under international humanitarian law. The draft went through another round of tense negotiations following pressure from Saudi Arabia to exclude language related to humanitarian issues and obligations, accountability and independent investigations. The US also attempted to include a direct reference to Iran’s alleged violations of the arms embargo. After opposition from Russia and China, the US withdrew its demand for the reference to Iran in the text. The Security Council adopted Resolution 2451 on December 21, 2018.

On August 2, UN Special Envoy for Yemen Martin Griffiths briefs the UNSC about plans to bring the country’s belligerent parties together for peace consultations in Geneva the following month // Photo Credit: UN Photo/Manuel Elias

On August 2, UN Special Envoy for Yemen Martin Griffiths briefs the UNSC about plans to bring the country’s belligerent parties together for peace consultations in Geneva the following month // Photo Credit: UN Photo/Manuel Elias

The New UN Special Envoy

The appointment of a new UN Special Envoy for Yemen helped to restart UN-led peace efforts in 2018, culminating in December in the first round of consultations between Yemen’s main warring parties in more than two years. Martin Griffiths officially took over the post on March 19, replacing Ismail Ould Cheikh Ahmed. During 2017, the latter had been unable to bring the parties to the negotiating table, while three previous rounds of negotiations under his lead had failed in 2015 and 2016. After his UN posting ended, Ould Cheikh Ahmed was appointed Minister of Foreign Affairs in his home country of Mauritania.

Where his predecessor came from the humanitarian sector, Griffiths brought experience in mediation. He had previously worked as an adviser to the UN Special Envoy for Syria and as the executive director of the European Institute of Peace in Brussels, and had visited Yemen in that capacity in October 2017. While his declared goal was a negotiated settlement between the main warring parties, in the process Griffiths also consulted with a wide variety of other Yemeni actors as well as regional and international stakeholders. This entailed the new Special Envoy engaging in intense shuttle diplomacy throughout 2018.

Building Relations with Houthi Leaders and the STC

Restoring the relationship of his office with the armed Houthi movement was a priority early on for the new UN Special Envoy. During his tenure, Ismail Ould Cheikh Ahmed had engendered increasing animosity from Houthi leaders, to the point that they had asked the UN secretary general not to renew his term in 2017, claiming he lacked neutrality. In June 2017, Houthi authorities barred the former Special Envoy from entering areas under their control. Griffiths, by contrast, visited Sana’a four times in 2018, where he met with Houthi officials.

The Special Envoy was also involved in conversations between Houthi and Saudi representatives in Oman. In March, senior Houthi negotiator and spokesman Mohammed Abdel Salam confirmed to the Sana’a Center that he was engaged in such an ongoing dialogue involving Griffiths and facilitated by the UK.

Besides representatives of the main warring parties, among other stakeholders Griffiths consulted with was the secessionist Southern Transitional Council (STC). Several times in 2018, STC leaders threatened to obstruct any peace agreement if they were not included in peace talks. Griffiths’ position was that the southern issue, while important, should be addressed after a negotiated settlement had been reached to end the war. According to Sana’a Center sources, Griffiths abandoned a planned trip to Aden and Mukalla in April after President Hadi and his government demanded that the Special Envoy not meet with the STC. Shortly after the UN Special Envoy instead met with STC leaders in Abu Dhabi and later in Jordan. In August, Griffiths’ office declared that the STC had affirmed its “readiness to participate positively in the political process”. In December, during the Sweden consultations, the STC said that its exclusion from the talks would perpetuate the cycle of conflict in Yemen.

Griffiths also met with officials from the General People’s Congress (GPC), the party founded by late former President Ali Abdullah Saleh, in 2018, including those still in Sana’a. Houthi authorities had obstructed various other diplomats from meeting with GPC members in visits to Sana’a during the year. In November Griffiths then met with tribal leaders and civil society representatives from the governorates of Marib and Hadramawt, on the sidelines of a workshop co-organized by the Sana’a Center and the Oxford Research Group as part of an ongoing track II initiative.

Hudaydah Proposal

When an assault against the Houthi-held port city of Hudaydah seemed imminent in early June, Griffiths convinced the Houthi leadership to accept a plan he put forward on the status of Hudaydah port. The anti-Houthi coalition, however, rejected the proposal and continued preparations for the military assault (see ‘Preparing for the Offensive’). Griffiths’ plan was similar to the agreement that would eventually be reached in Sweden; it proposed that Houthi authorities hand over control of the port to the UN, which would transfer revenues from import tariffs to the CBY to pay public sector salaries across the country. The Houthis had previously rejected a similar plan put forward by Griffiths’ predecessor in May 2017.

Griffiths continued his shuttle diplomacy throughout July, meeting with US, Saudi and other officials as well as the Houthi leadership in Sana’a, in an attempt to halt the military assault on Hudaydah.

Economic Consultations

Griffiths publicly attached greater importance to the Yemen economy in the second half of 2018, particularly after the rapid depreciation of the Yemeni rial in August and September, given its humanitarian repercussions (see ‘The Currency Crisis and the Threat of Famine’). In July, Griffiths met with the leadership and the board of the Sana’a-based CBY to discuss the reunification of the central bank, which has been split between competing headquarters on either side of the front line since September 2016. Griffiths and his team then sought but ultimately failed to organize UN-sponsored discussions to bring together central bank officials from Sana’a and Aden in Nairobi, Kenya. Although those discussions did not take place, the acknowledgement of the importance of the Yemeni economy to the humanitarian crisis demonstrated a far greater awareness of dynamics at play in the country than his predecessor’s, Ismail Ould Cheikh Ahmed.

While prior to the Sweden talks Griffiths had again stated that the economic file was a priority of the consultations, there was no breakthrough in this regard in Rimbo. Importantly, while the Houthi side had sent the governor of the Sana’a-based CBY and his deputy to the talks, the Yemeni government sent neither the governor of the Aden-based CBY nor the head of the government’s Economic Committee (see ‘Aden’s New CBY Governor, the Economic Committee and Import Regulation’).

The UK reportedly facilitated a minor breakthrough late in 2018 to support Griffiths’ efforts on the economic front. The UK had backed the envoy’s attempts to devise a framework for closer coordination between key economic stakeholders, including the governors of the rival central banks in Aden and Sana’a. In December, as peace talks in Sweden drew to a close, Mohammed Zammam, governor of the central bank in Aden, spoke with his counterpart in Sana’a, Mohammed Sayani, via video conference at the behest of London, several well-informed sources told the Sana’a Center Economic Unit.

Negotiations Framework

On June 18, the Special Envoy shared his framework for peace negotiations in a closed-door meeting of the UN Security Council. According to sources familiar with the proceedings who spoke with the Sana’a Center, a package of security and political arrangements included the establishment of a national military council in Yemen to oversee security arrangements and the handover of medium and heavy weapons by non-state actors. This was to be followed by the formation of a transitional government, led by an “agreed upon” prime minister. The transitional government would be in charge of restoring basic services, rebuilding state institutions, addressing issues specifically related to grievances in southern Yemen, implementing the outcomes of the National Dialogue Conference (NDC), and carrying out electoral reform and national reconciliation.

Despite going beyond previous UN-led peace plans, Griffiths’ framework for negotiations in many ways resembled the failed plans of his predecessor. These previous efforts included several contentious issues, among them the references to UNSC Resolution 2216, the GCC Initiative and the NDC outcomes as principles for peace talks. Generally, the framework seemed to turn possible outcomes of peace negotiations into preconditions for talks. Previous peace proposals failed over a similar approach, such as stipulating that Houthi forces surrender weapons and withdraw from captured areas before entering negotiations. Members of the Houthi leadership, in reaction to previous peace plans, had already demonstrated their resistance to surrendering their military leverage before negotiating their place in a future political arrangement.

Failure in Geneva, Success in Rimbo

On September 6, the first UN-led peace consultations since the collapse of UN-mediated peace talks in Kuwait in 2016 were scheduled in Geneva. The day before the consultations were to begin, Houthi representatives pulled out of the talks in a dispute over their travel arrangements to Switzerland. Houthi officials demanded to travel on an Omani plane and said they planned to transport injured fighters to Muscat for treatment. Meanwhile, Saudi Arabia insisted that the Houthi delegation should travel on a UN plane via Djibouti. Saudi officials later claimed that Houthi officials had planned to transport injured Iranian and Hezbollah fighters on the flight.

Given that the Saudi-led military coalition had blocked the Houthi delegation from returning to Yemen for three months after the peace talks in 2016, Houthi officials saw a return flight to Sana’a via Muscat as the most likely way to avoid a repeat. In addition, Houthi delegates were unnerved when the UN asked them to sign a liability waiver, interpreting this as a sign the UN could not guarantee their safe return, according to a source close to the delegation who spoke with the Sana’a Center. Ultimately, Griffiths was unable to resolve the impasse and the Houthi delegation did not travel.

In the absence of the Houthi representatives, the Special Envoy held meetings in Geneva with the Yemeni government delegation. They discussed the release of prisoners, the reopening of Sana’a International Airport, humanitarian aid and economic development. The envoy also met with a technical advisory group of Yemeni women, a number of ambassadors assigned to Yemen from the so-called “Group of 19” states, and ambassadors from the five permanent member states of the UN Security Council.

In early December, the UN Special Envoy finally succeeded in bringing representatives of the warring parties together for the first time in more than two years in Sweden. This time, the Saudi-led military coalition had agreed to Griffiths’ suggested logistical arrangements and Muscat had offered to facilitate the medical evacuation of some 50 injured Houthi fighters out of Sana’a, who were eventually flown out on an Ethiopian plane to Oman. When the Houthi delegation actually did leave Sana’a on December 4 aboard a Kuwaiti airliner, Griffiths himself was also on board – as well as the Kuwaiti ambassador to Yemen and the Swedish envoy to Yemen and Libya – as a reassurance for the Houthi officials that the Saudi-led military coalition, which controls Yemeni airspace, would not intercept the flight.

Hudaydah, the Heart of the Crisis

Overview: The Significance of Hudaydah

The port city of Hudaydah was at the center of escalating clashes and the deteriorating humanitarian crisis in 2018. Yemen has historically imported as much as 90 percent of its basic foodstuffs, while Hudaydah and nearby Saleef and Ras Issa ports are the point of entry for more than 70 percent of the country’s basic commodities, including staple foods, medical supplies and fuel. They were also the only ports controlled by the armed Houthi movement in 2018. UN agencies, humanitarian groups and many Yemeni experts have long said that there is no replacement for these ports in feeding large swathes of the country. This is due to these ports’ offloading capacity, their proximity to Yemen’s largest population centers, and the absence of frontlines between these ports and roughly 70 percent of the country’s population that live in Houthi-held areas.

Hudaydah City and its surroundings hold a population of more than 600,000, making it one of the country’s most densely populated areas, while the governorate is also among the poorest areas in Yemen. UN agencies, international NGOs and others had long warned that a military campaign to capture Hudaydah would exacerbate the humanitarian crisis in Yemen, given that it would likely inhibit commercial and humanitarian imports, causing prices to spike and preventing aid from reaching beneficiaries. A high number of civilian casualties was also expected in the event that fighting reached the city’s densely populated areas.

Representatives of the Saudi-led military coalition have throughout the conflict claimed that Iran has been smuggling arms to Houthi forces through Hudaydah port. The coalition has also criticized the UNVIM, the UN inspection mechanism set up in 2016 to address such concerns, as ineffective. However, a UN Panel of Experts report in January stated that it was highly unlikely arms were being transferred through Hudaydah, given that both the UN and the coalition were inspecting ships entering the port. The report further concluded that the coalition-imposed impediments to the delivery of commercial goods and humanitarian aid to Houthi-held areas amounted to a weaponization of the threat of mass starvation, which would constitute a war crime.

The coalition and the Yemeni government argued that the capture of Hudaydah port would cut a major source of income for the armed Houthi movement, which was imposing import tariffs on goods entering through the port, and would force the Houthi leaders to the negotiating table. However, many dismissed this claim as unlikely, given that Houthi forces could extort taxes on goods entering their territory through checkpoints anywhere, even if the frontlines were pushed inland from the coast. Meanwhile, Houthi forces remained firmly in control of the capital Sana’a.

Preparing for the Offensive

Saudi and UAE-backed local forces began pushing through Taiz governorate from the south toward Hudaydah City at the beginning of January, cutting Houthi supply lines between Taiz and Hudaydah. Shortly after, the Houthi leadership threatened to block international navigation in the Red Sea if the coalition-backed offensive along Yemen’s western coast continued. Houthi forces had previously carried out several attacks against vessels transiting near the Bab al-Mandab Strait using explosive-laden remote-controlled boats and repurposed anti-tank missiles, according to the UN Panel of Experts on Yemen report. The report also noted that the group had deployed improvised sea mines off the Red Sea Coast.

Through the spring of 2018 the coalition attempted to garner international support for the offensive on Hudaydah, including lobbying and media campaigns that highlighted the threat posed by the armed Houthi movement to international oil shipments passing through the Bab al-Mandab Strait.

In June, with an offensive against Hudaydah seemingly imminent, UN Special Envoy Martin Griffiths and UN Under-Secretary-General for Humanitarian Affairs and Emergency Relief Coordinator Mark Lowcock urged the UN Security Council to support efforts to avert the military assault. Griffiths also notified the council of the Houthi leadership’s willingness to hand over the administration of Hudaydah port to UN observers.

In response, the Yemeni government, backed by the Saudi-led military coalition, took a more belligerent stance. Foreign Minister Khalid al-Yamani said that the “door of diplomacy” was closed to the armed Houthi movement, that the international community’s advocacy for peace talks would only prolong the war, and that the government refused to accept anything but the full withdrawal of Houthi forces from the entire Red Sea Coast. Following a Security Council meeting on June 11, the UAE, which took the lead in coordinating the offensive, gave the UN a 48-hour deadline to convince the Houthi leadership to withdraw its forces from Hudaydah.

The Battle For Hudaydah

On June 13, the Saudi-led military coalition launched “Operation Golden Victory”, with the goal of pushing Houthi forces out of Hudaydah City and taking control of the strategic Red Sea port. Western officials, speaking to the Sana’a Center in May, said Washington and London had given conditional approval for the coalition-backed offensive to take Hudaydah city, provided that the ports were not attacked. Previously, plans for an offensive in late 2016 and early 2017 had been derailed due to a lack of US backing and warnings from international organizations regarding the likelihood of a massive humanitarian fallout from such a campaign.

On June 13, the assault on Hudaydah began, spearheaded by the Giants Brigade, or al-Amaliqa, a 20,000-strong force of six brigades of whom the majority were tribal fighters from southern areas, along with several thousand Salafists. Fighting alongside al-Amaliqa were roughly a thousand members of the local Tihama Resistance and 4,000-6,000 troops of the National Resistance Forces, led by Tariq Saleh, the nephew of late former President Ali Abdullah Saleh (see ‘Red Sea Coast: Tariq Saleh Switches Sides’). The assault was supported by coalition aircraft and warships. Reports indicated the coalition-backed forces numbered 25,000-27,000 troops, facing between 5,000 and 8,000 Houthi fighters. Prior to the offensive, Houthi forces had brought in reinforcements from Sana’a, Dhamar and other areas of Hudaydah governorate. In an attempt to avoid being targeted by airstrikes, Houthi fighters began to use buses and taxis to travel to the city, rather than military convoys, according to Sana’a Center researchers.

On June 20, anti-Houthi troops, advancing from the city’s southern end against Houthi counterattacks, took over sections of Hudaydah airport. On July 1, the UAE declared a “pause” in the assault to give the UN Special Envoy time for negotiations. Houthi representatives decried this as a cover-up and accused the UAE of using the cessation to prepare for a new battle. Houthi forces continued to target coalition and pro-government forces using unmanned aerial vehicles and short-range missiles. Outside of Hudaydah port, the Saudi-led military coalition continued to launch airstrikes against Houthi positions.

Alongside warnings from international humanitarian organizations, an independent group of prominent Yemeni experts in various socio-economic fields issued a joint letter on July 17 warning of “catastrophic” consequences if the military conflict in Hudaydah continued to escalate. This group – known as Yemen’s Development Champions – included former ministers of transportation, oil and minerals, trade and industry, agriculture, civil service, and tourism, as well as leading economists, bankers, businessmen and academics.

By the end of July, the parties to the conflict continued to be at an impasse regarding Hudaydah. While Houthi officials had agreed in principle to turn over the port to UN administration, they insisted on maintaining control of Hudaydah City. The Saudi-led military coalition and the Yemeni government demanded that Houthi forces unconditionally hand over the port and withdraw from the city and governorate. On August 2, Griffiths said during a briefing at the UN Security Council that he was now convinced that the situation in Hudaydah governorate would have a better chance of being addressed within the context of a comprehensive political settlement.

Hostilities around the city decreased in the lead up to the planned peace consultations in Geneva at the beginning of September. After these talks failed to take place, the fighting escalated and anti-Houthi forces took control of the main roads east of the city that linked Hudaydah to Sana’a. This left the minor road north of Hudaydah to Hajjah governorate as the only open land route in and out of the city. A letter from the UAE to the UN Security Council president at the time claimed that a military victory in Hudaydah was critical to compel the Houthi leadership to re-engage in peace talks. The coalition also reported the deaths of several senior Houthi military figures in the fighting. At the end of October, after the offensive had stalled, Yemeni government military officials announced that 10,000 reinforcements were being deployed to Hudaydah.

On November 2, the coalition declared the launch of a new “large-scale offensive” in Hudaydah and fighting escalated again. Medical workers in hospitals around Hudaydah reported on November 12 that at least 150 people were killed during a 24-hour period after UAE-backed ground forces reached residential areas of the city. On November 14, the Saudi-led military coalition temporarily paused its assault. Days later, the armed Houthi movement declared that it would refrain from drone and missile attacks against coalition and Yemeni forces, though low-level fighting continued in parts of the city.

A ceasefire agreed at the Sweden talks came into effect on December 18 and remained in place as of the time of writing this report, with the demarcation line running roughly in the area of 50th Street. While each side has accused the other of ceasefire violations, these localized clashes had not derailed the Stockholm Agreement as of this writing. Sana’a Center observers witnessed minor breaches of the ceasefire in Hays, al-Tuhayta and al-Jarahi districts in Hudaydah governorate by Houthi forces using artillery fire, and shelling by coalition-backed forces on Houthi positions in al-Durayhimi district.

Source: Sana’a Center research // Graphic: Ghaidaa Alrashidy

Humanitarian and Economic Fallout

Soon after the assault on Hudaydah began, prices of basic goods and foodstuffs soared in the city, prompting panic buying. According to information gathered by Oxfam in early June, the price of a bag of rice increased by 350 percent, wheat by 50 percent and cooking oil by 40 percent. Oxfam also noted high transportation costs for those trying to flee the city.

As of June 24, the UN Office for the Coordination of Humanitarian Affairs (OCHA) reported that food had become scarce in Hudaydah City, amid soaring food prices and the closure of shops, bakeries, and restaurants. People were reported to be staying in their houses, with most lacking adequate food supplies. Electricity became unavailable in most parts of the city. Trenches dug by Houthi forces damaged the water and sewage system, which led to water shortages. The International Organization for Migration (IOM) registered over 455,000 displaced people from Hudaydah Governorate between June 1 and November 6.

Humanitarian and commercial imports continued to enter Hudaydah port but at a decreased frequency. With the ongoing hostilities, it became more difficult for civilians to flee, while access for humanitarian workers deteriorated. Among the obstacles were landmines planted by Houthi forces and roads destroyed by airstrikes or blocked by Houthi trenches and barricades. Some areas where people had been displaced or injured became inaccessible. Aid workers also faced difficulties in accessing humanitarian supplies warehoused in the city before the offensive. In November, the World Food Programme (WFP) said that Houthi forces had planted seven landmines inside its facility.

As a result of the battle in Hudaydah, the already strained health sector faced increased capacity problems. Seven health facilities in the governorate temporarily closed or suspended operations due to security concerns at the end of June, while others were forced to reduce operations after health personnel were displaced. Meanwhile, clashes and airstrikes in the vicinity of hospitals put patients and medical staff in extreme danger. Given the difficulties in accessing the area, reports of casualties were often hard to verify. (For details, see ‘Access Impediments’.)

Economic Developments

Overview: The Struggle for Financial and Monetary Control

The rapid depreciation of the Yemeni rial (YR) from July through October was the primary driver of the dramatic increase in food insecurity in the country in 2018 (see ‘The Currency Crisis and the Threat of Famine’). While various factors contributed to the currency’s collapse, chief among these was unregulated fuel importers purchasing foreign currency out of the local market to place orders abroad. Unlicensed money exchangers facilitated much of the fuel importers’ financial transactions outside the formal economy, while also playing a role themselves in destabilizing the YR. Amidst a relative spike in global oil prices through August and September, fuel importers’ market speculation helped propel the rial lower, while in September they acted as a cartel to artificially instigate a country-wide fuel shortage. This created a spike in the black market price of fuel, to which the importers sold their fuel to maximize profits (see ‘Factors Destablizing the Yemeni Rial’).

Also weighing on the value of the rial was an increased domestic money supply due to the Yemeni government printing new banknotes – rather than raising revenues – to cover the public sector wage bill, which has grown significantly in nominal terms during the conflict. Decreased remittances, due to thousands of Yemeni expat workers being expelled from Saudi Arabia or facing increased fees to stay in the kingdom, also contributed to the YR’s depreciation.

Among the factors that helped the rial recover value in November and December was the Aden-based Central Bank of Yemen’s (CBY) increased issuance of letters of credit to finance imports of basic commodities and fuel. The CBY had the foreign currency reserves to do so thanks to more than US$2 billion in deposits and grants Riyadh provided in 2018. In October, Saudi Arabia also began delivering a monthly $60 million fuel grant for power generation in Aden and surrounding governorates, helping to ease fuel importers’ demand for foreign currency. In renewed attempts to raise revenue from non-inflationary sources, the Aden-based CBY had the first successful public debt issuance since the conflict began, raising YR100 billion from Yemeni commercial and Islamic banks in November. The same month the CBY inked a US$500 million trade grant with the International Finance Corporation. During the summer the Yemeni government established an Economic Committee to advise and assist the Aden-based CBY. Through the fall the committee and the bank began taking measures to try and regulate imports and the exchange market, and to bring the money cycle back into the formal economy. (see ‘Stabilizing Influences on the Yemeni Currency and Economy’)

However, throughout the year the Sana’a-based CBY, under Houthi control, took steps to undermine the Yemeni government’s economic and monetary policy, such as banning new banknotes issued from Aden, and pressuring commercial banks not to cooperate with the Aden-based CBY. The country’s banks and businesses thus increasingly found themselves in a tug-of-war between the two sides. Houthi authorities also tightened their grip on business and financial flows in northern areas during 2018 (see ‘Competing Monetary Policies A Tale of Two Central Banks’ for more details).

Meanwhile, a year-long investigation by the Sana’a Center found that apparent adversaries on the battlefield were cooperating seamlessly on many fronts to profit from illicit oil and weapons sales in a flourishing war economy (see ‘War Economy Sees Cooperation Between Battlefield Adversaries’).

The Currency Crisis and the Threat of Famine

A major factor behind the threat of famine in 2018 was the depreciation in the value of Yemen’s domestic currency, the Yemeni rial (YR). Prior to the outbreak of the regional conflict in March 2015, Yemen imported up to 90 percent of its food supplies and had the lowest per-capita purchasing power in the Middle East. Changes in the Yemeni rial exchange rate thus have had profound implications for food security in the country.

In March 2015, when the Saudi-led military coalition began its intervention, the rial was trading at an official exchange rate of YR215 per US$1. Since then the rial’s decline has been largely characterized by long periods of stability or gradual decline, interspersed with sudden, brief periods of wild instability and rapid decline.

In the fourth quarter of 2017, the Yemeni rial began its first prolonged rapid depreciation of the conflict, dropping from a monthly average in October 2017 of YR392 per US$1 to as low as YR525 per US$1 in mid-January 2018. The announcement of a US$2 billion Saudi deposit at the Yemeni government-controlled central bank headquarters in Aden in January 2018 saw the currency rebound. The rial ended the month averaging YR454 per US$1 in parallel market trading.

By July it was trading at a monthly average of YR497 per US$1, a relatively manageable 9.5 percent loss in value over seven months. Over the next three months, however, the Yemeni currency entered its longest period of rapid, accelerating decline of the conflict, hitting an all-time low of more than YR800 per US$1 in early October. Over this period, UN agencies and humanitarian organizations voiced increasingly urgent warnings that Yemen was descending into widespread famine as basic commodity prices soared and millions more Yemenis lost the ability to afford food (see ‘A Deepening Food Security Crisis’). A short, two-day survey of 10 retailers of basic food commodities across Sana’a governorate conducted by the Sana’a Center at the end of August found that prices had already increased significantly by that point, relative to two months previous, with rice increasing 37 percent, vegetable oil 26 percent, wheat grain 25 percent, wheat flour 17 percent, and sugar 11 percent.

Sources: CBY, WFP, and Sanaa Center Economic Unit

The collapse of the currency in 2018 was the result of multiple factors building over the course of the war. These included the general economic collapse in the country, the cessation of oil exports – previously the country’s largest source of foreign currency – and a resultant shortage of foreign currency in the local market, and increased domestic currency supply through the printing of new rial banknotes to cover government spending. In addition, monetary policy and financial regulation in Yemen has, since September 2016, been divided between the Yemeni government-controlled Central Bank of Yemen (CBY) in Aden and the Houthi-controlled CBY in Sana’a. This has allowed speculative market factors to bring increasing volatility to bear on the exchange rate; in particular, unregulated fuel importers’ demand for foreign currency is widely seen as the primary factor behind the YR’s accelerated slide in value between July and October 2018. Weak regulatory enforcement over money exchange outlets also contributed to the rial’s instability in the second half of 2018.

Yemen’s currency recovered somewhat toward the end of 2018. In December, the rial was trading between YR480 to YR530 per US$1, similar to the range it had traded in prior to the collapse that began in July. On December 31, the rial was trading at roughly YR525 per US$1 in Sana’a and YR530 per US$1 in Aden. Central to the currency’s recovery were Saudi foreign currency deposits at the Aden-based CBY, as well as fuel grants from Riyadh to areas nominally controlled by the Yemeni government. The Yemeni government-appointed Economic Committee, in collaboration with the Aden-based CBY, used the Saudi backing to finance imports and implement currency stabilization measures in November and December. As December ended, prices for basic commodities had decreased by an average of 21 percent (relative to October) and fuel prices had dropped between 18-35 percent (relative to November) depending on the governorate.

On current trajectories, the Sana’a Center Economic Unit forecasts that the rial will remain relatively stable within a fluctuation range of 20 percent throughout the first half of 2019. This projection is based on the fact that the Aden-based central bank had, as of January 1, 2019, foreign currency reserves of US$2.7 billion on hand, a sufficient amount to finance imports and protect the value of the rial over the next six months.

Of continuing concern as 2019 begins, however, are the disparate monetary policies between northern and southern areas of the country, and the warring parties’ demonstrated willingness to try and leverage fiscal and economic mechanisms to gain advantage over their rivals. This will continue to threaten the sustainability of any recovery in the currency or economy generally.

Food and Fuel Price Spikes Slow to Recede

Toward the end of 2018, and with the value of the rial improving, both the internationally recognized Yemeni government and the Houthi authorities issued lists stipulating maximum prices for various commodities, in an effort to contain the growing threat of famine, and threatened to crack down on violators. But in the absence of proper government oversight and effective regulatory bodies, many traders did not lower prices to levels proportional to the rial’s recovery. The Sana’a Center learned at the end of November that many retailers in Sana’a were still selling commodities as if they had been purchased at October’s record low exchange rate of YR800 per US$1.

In December, the Sana’a Center Economic Unit conducted a survey in the cities of Sana’a and Aden on average retail prices for basic commodities. The survey revealed that on average prices for sugar, wheat flour, wheat grain and vegetable oil in Sana’a and Aden decreased in December by 21 percent relative to October.

Sources: WFP and Sanaa Center Economic Unit surveys for 2018

December also witnessed a drop in the price of fuel derivatives in both Houthi- and government-controlled areas. Compared to prices in November, the prices for one liter of petrol and diesel in December were reduced on average almost 23 percent and 18 percent, respectively, in areas controlled by the armed Houthi movement. Reductions in fuel prices ranged between 20 percent and 35 percent in the government-affiliated governorates of Hadramawt and Aden (see graph below for details).

Factors Destabilizing the Yemeni Rial

Unregulated Fuel Importers and Unlicensed Money Exchangers

A Yemeni Banking Association survey, published on October 11, 2018, found a consensus opinion among Yemen’s top bankers that the primary instigator of the rial’s depreciation was fuel importers’ increased demand for foreign currency. Between mid-August and the end of September 2018, there was a relatively sustained spike in global oil prices, with the benchmark West Texas Intermediate crude rising roughly 13 percent from some US$65 per barrel to US$73.25. During this period, the Sana’a Center Economic Unit assessment is that fuel importers in Yemen, anticipating further oil price rises, began buying US$ out of the local market with which to place new rush orders.

Beginning in mid-September, Yemen then became gripped by fuel shortages, with licensed fueling stations closing en masse in many areas and black market traders stepping up to sell fuel at significant markups from the regulated prices. A Sana’a Center Economic Unit survey covering all Yemeni governorates found price increases of available petrol averaged 130 percent across the country for the last two weeks of September relative to average August prices. Available evidence indicated that fuel traders acted as a cartel in collectively halting fuel sales to official retail outlets in September. The subsequent shortage allowed traders to sell to the black market for significantly more profit, offsetting the anticipated increases in import costs due to rising global oil prices and anticipated profit losses due to the depreciating local currency.

Sources: WFP and Sanaa Center Economic Unit surveys for 2018

Unlicensed money exchangers, which have proliferated over the course of the conflict, have abetted the fuel importers’ currency trading and international financial transactions outside the formal economy, while also acting as currency destabilizers in their own right. The general collapse of state regulation during the conflict, and in particular that which followed the schism of the CBY in 2016, allowed an estimated 800 unlicensed money exchangers to enter the market between 2015-2017, according to a confidential banking sector market study made available to the Sana’a Center. The migration of financial flows to the informal economy has also been spurred by a prolonged liquidity crisis in the commercial banking sector, as well as Yemen’s designation as “high risk,” which prevented the country’s commercial banks from being able to carry out international transactions.

Often, networks of unlicensed Yemeni money exchangers have been affiliated with larger, licensed and more established firms. While overall, unlicensed firms have handled far less volume than the top 10 largest licensed firms, the former’s attempts to capture market share through aggressive pricing has had oversized influence on the rial exchange rate. Several campaigns to crack down on unlicensed exchangers both by the Yemeni government and the Houthi authorities had little impact in 2018, with many simply reopening shortly after being closed down.

Increased Money Supply

With the general economic collapse and secession of hydrocarbon exports that accompanied the conflict, public revenues also plummeted. This has forced the Yemeni government to radically reduce spending on all budget items except public sector salaries. Public spending, however, has still been greater than revenues since 2015. Indeed, the total public salary bill has increased substantially in areas under Yemeni government control, where the government has enlisted new security and military personnel and doubled salary disbursements to incentivize new recruits.

In response, the Government of Yemen has at various times ordered the central bank to print new rial banknotes to cover expenses. According to the World Bank, the total money supply in Yemen grew 53 percent in 2018. This enlarging of the domestic money supply, in an environment of declining economic activity and scarce foreign currency, has in turn placed downward pressure on the value of the rial on the exchange market. The injection of new banknotes into the economy in August almost certainly played a role in the subsequent rapid devaluation of the rial, and contributed to the dramatic increase in currency circulation outside commercial banks, as the World Bank has noted. It estimated that currency circulation outside the formal banking sector grew more than 100 percent between 2014 and 2017, from YR810.9 billion in 2014 to YR1.67 trillion by the end of 2017.

During the recent currency collapse the Yemeni government also promised to increase spending, adding more speculative pressure on the YR. In August, demonstrations began in Aden with protesters demanding the government address soaring prices. The protests continued into September, spreading to Hadramawt, Lahj, Abyan and al-Dhalea governorates. In Aden, protesters blocked roads with burning tires and barriers, while retail stores and service outlets closed as part of a civil disobedience campaign. In an attempt to quell the dissent, the Yemeni government announced in September that it would raise civil servant salaries by 30 percent. Protests also occurred in Houthi-controlled areas, including Sana’a, though Houthi security forces quickly quashed them.

Decreasing Remittances

According to the CBY’s 2014 annual report, money sent back home from Yemenis working abroad – primarily in Saudi Arabia – accounted for roughly 30 percent of foreign currency inflows prior to the war. According to World Bank estimates, remittance inflows from expat workers remained relatively constant through 2017, and with the sharp decline in energy exports, became the country’s largest source of foreign currency.

In recent years, however, Riyadh has intensified its efforts to restrict foreign access to its labor market as part of a so-called “Saudization” of the economy, part of a larger reform program referred to as Vision 2030. In early February 2018, the Saudi Ministry of Labor and Social Development issued another in an ongoing series of nationalization decrees. Effective September 2018, and to be implemented between then and January 2019, the decree aimed to ban foreign workers from 12 types of employment. The Saudi government also increased the costs of visas and work permits for expats.

In early 2018, reports emerged about Saudi authorities undertaking large-scale deportations of Yemeni workers without legal status. Riyadh announced that it had arrested hundreds of thousands of foreign workers lacking the necessary permits and was beginning deportation proceedings. The cumulative impact of Saudi nationalization policies on Yemeni expatriate laborers in the kingdom was unclear as of this writing. However, it is highly likely their number has decreased, with an accompanying reduction in remittances. Furthermore, preliminary Sana’a Center research regarding expats in the Saudi labor market suggests that as many as 70 percent of Yemeni workers could lose their current jobs by 2020 if the Saudization policies continue to be implemented. This would have dire impacts for families and communities in Yemen that depend on these remittances for income, as well as for the country at large in the loss of foreign currency flows into the local market.

Stabilizing Influences on the Yemeni Currency and Economy

More Than US$2 Billion in Saudi Deposits and Fuel Grants

On January 17, 2018, Saudi Arabia announced it would deposit US$2 billion at the CBY in Aden to support Yemen’s domestic currency. The immediate stabilizing effect this had against market speculation began to weaken, however, after prolonged negotiations between Saudi and Yemeni officials regarding the deployment of the funds. A mechanism was finally agreed upon in July by which to finance basic commodity imports, however the process for traders to apply was generally regarded as too cumbersome and the wait time for approval excessive. The central bank’s first batch of letters of credit, issued on July 31, amounted to just US$20.4 million; it is common market understanding in Yemen that interventions below US$100 million do not noticeably impact the money supply. The market thus began to lose faith in the impact of the Saudi deposit, putting downward pressure on the rial and contributing to its slide through the summer and into the fall.

In October, after the Yemeni rial reached record lows in value, several measures were instituted to help spur a moderate recovery. First, the Saudi government announced a US$200 million grant to the Aden-based CBY at the beginning of the month. The central bank in Aden then approved US$170 million out of the US$2 billion Saudi deposit to finance the importation of basic foodstuffs later in the month. Finally, an appreciation in the rial followed the arrival of a Saudi oil tanker to Aden carrying US$60 million in fuel. This was the first delivery of a planned monthly fuel grant by Riyadh, the intent of which was to support power generation in areas controlled by the Yemeni government and decrease fuel importers’ demand for foreign currency. Also lessening fuel importers’ demands on the currency market was the downward trend in global oil prices since October.

On November 3, the central bank announced it was finalizing a third round of basic import financing worth US$170 million, while Riyadh delivered the second US$60 million in fuel grants the same month. These supports, in combination with other steps taken by the Aden-based central bank, contributed to a significant recovery of the Yemeni currency toward the end of 2018. On December 8, Aden-based CBY Governor Mohammad Zammam announced that a total of US$356 million had been withdrawn from the US$2 billion Saudi deposit to fund imports. The Aden-based central bank’s total foreign currency reserves thus stood at US$2.7 billion as the year ended.

Limited Gains in Oil Exports

Just prior to the current conflict, oil exports accounted for 65 percent of foreign currency entering Yemen, according to the CBY’s 2014 annual report. These exports halted completely in 2015, with the Saudi-led military coalition intervention, al-Qaeda in the Arabian Peninsula (AQAP) occupying export terminals along the southern coast, and Houthi forces seizing control of export terminals on the western coast. In 2016, after UAE-backed forces expelled AQAP from the city of Mukalla and its environs, limited but regular exports resumed out of Hadramawt governorate. Yemen’s PetroMasila has handled production in Hadramawt, with exports being made to the Anglo-Swiss company Glencore.

In October 2018, Aden-based CBY Governor Mohammed Zammam stated that revenues from PetroMasila’s facilities were estimated at US$150 million every two months. According to this statement, the net revenue to the Yemeni government was $50 million, which was being deposited at the Aden-based CBY, while $50 million was allocated to cover power generation in Aden and neighboring governorates, $30 million went to PetroMasila’s operational budget, and $20 million to the Hadramawt local authority.