Houthi authorities banned the sale of domestic gas cylinders from Safer in Marib during the last week of May. The heavily populated regions in the north will now be exclusively supplied with imported cooking gas through the Houthi-controlled port of Hudaydah. The decision will further economically undermine the government, already deprived of its main source of revenue following Houthi drone attacks on oil export terminals. This has been compounded by a Houthi campaign to redirect commercial ships from Aden to Hudaydah in order to gain control of customs revenue previously collected by the government.

The government could lose close to YR7 billion a month from the new ban. It is estimated that more than 100,000 gas cylinders from Safer are sold each day in areas controlled by the Houthi movement. The decision to import cooking gas from abroad will increase its price by around 40 percent. An imported 20-liter cooking gas cylinder is currently sold at YR7,000, compared to YR5,000 for one produced in Marib.

Power Outages Hit Aden

The interim capital Aden experienced long-lasting power outages during May. In the beginning of the month, generators in many neighborhoods gradually ceased operations before completely shutting down toward the end of the month due to a lack of available diesel fuel. On May 8, the government-owned General Electricity Corporation in Aden warned that the governorate’s five power plants may also be forced to cease providing electricity, and called on the government to intervene to secure enough fuel to continue operating. The power stations have already been forced to reduce generation to specific hours.

The General Electricity Corporation in Aden repeated its warning of power outages on May 14. Starting on May 22, the corporation shut down several diesel-fueled power stations, capable of generating more than 80 megawatts of electricity, which resulted in a near-total power outage. Most neighborhoods in Aden experience at least 10 hours without power each day, with outages worsening during the hot summer months as demand for electricity increases. The blackouts have been driven by a critical shortage in fuel following the expiration of a Saudi grant in April. The Saudi Development and Reconstruction Program for Yemen had supplied the Yemeni government with over 1.2 million metric tons of diesel and mazut, valued at US$422 million, which had supplied more than 80 stations since November, as part of a deal between Saudi Arabia and the internationally recognized government. Fuel to run power plants costs the government close to US$1.2 billion a year, and it struggles to collect bills for the electricity generated. The government has requested new financial assistance from Saudi Arabia to address its widening fiscal deficit, but the Saudis are pushing for structural reforms in the energy sector before renewal of the grant, including improvements in collecting fees.

Aden suffers from frequent power outages, which worsen during the hot summer months as demand for electricity increases. Recurrent blackouts in government-controlled areas have provoked public anger against the internationally recognized government.

YICOM Employees Threaten Strike

Employees at Oil Block 4 in Shabwa planned to strike over unpaid wages and benefits and accused the administration of the Yemen Company for Investments in Oil and Minerals (YICOM) of discrimination against employees. On May 8, the director of YICOM called on employees at Oil Block 4 to postpone a planned strike. According to the director, YICOM has been forced to borrow to cover operational expenses after the government was forced to halt hydrocarbon exports following Houthi drone attacks on oil export terminals in October and November of 2022. He promised that the company was exploring solutions to resume paying wages as soon as possible. In a memorandum to the company’s management on May 4, the employees union in Shabwa called on YICOM to reduce its operating budget in order to afford salary and health insurance payments, which have been halted since September 2022, and threatened to launch a strike if their demands were not met within five days. YICOM announced in mid-January that it would cut operating expenses at its Aden office and at Oil Block 4, and reduce the number of active workers due to budget shortfalls. Crude oil from Block 4 in West Ayad is currently transported overland to power plants in Aden.

On May 18, the union issued a statement accusing the company of discrimination against some employees in paying wages and benefits. The union contends that the leadership of the company, which is based in Aden, has only disbursed salaries and cost-of-living allowances to select employees working at Oil Block 4 and at the Aden office, excluding most other workers.

Rials Lose Value

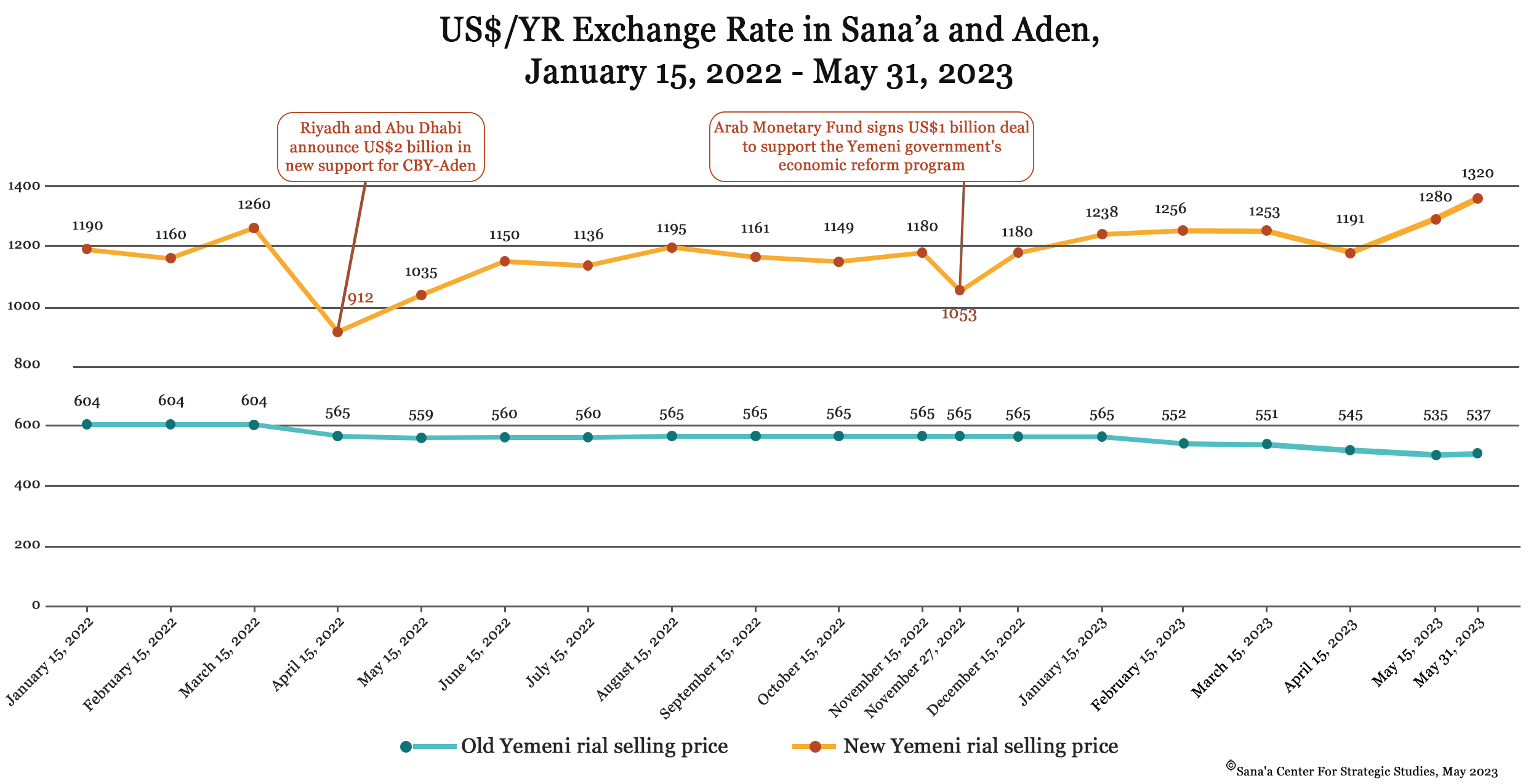

Both new and old rials areas fluctuated in value over the course of May. New rials experienced a precipitous decline in the first three weeks of the month, depreciating by nearly 7 percent, from YR1,228 per US$1 to YR1,320. Old rials in Houthi-controlled areas depreciated almost 2 percent, to YR540 per US$1 in the first week of the month, and were trading at YR537 by month’s end. Over the course of April, old rials had traded at between YR520-535 per US$1.

The drop in the rial’s value was expected after the Eid al-Fitr holiday, during which Yemeni workers abroad typically send increased remittances to their families. In particular, the depreciation of new rial notes was driven by the government’s critical shortage of foreign currency. The currency is now trading at its lowest value since late 2021, when Houthi forces were threatening to seize Marib and its oilfields.

Despite its dwindling foreign currency reserves, the Central Bank of Yemen in Aden (CBY-Aden) continued to hold its weekly auctions to intervene in the money market, in an attempt to contain recurrent bouts of depreciation in the new rial. On May 9, the CBY-Aden held its first currency auction since the Eid al-Fitr holiday to finance the import of essential commodities, which was 83 percent subscribed. On May 23, it announced its second auction WAS nearly 59 percent subscribed. The last auction of the month, on May 30, was nearly 42 percent subscribed. Since the beginning of the year, the central bank has held 21 FX auctions, with US$670 million on offer, of which only 42 percent (or US$279 million) has been purchased by Yemeni banks.

CBY-Aden Warns Public about Money Exchangers

On May 18, the government-affiliated CBY-Aden issued a statement warning the public against depositing money in accounts with money exchange companies, in reaction to false reports on social media claiming that exchangers were now allowed to accept deposits and distribute interest to customers. The central bank reiterated that money exchange companies are limited by law to buying and selling foreign currencies and conducting money transfers, and threatened punitive measures against violators.

Houthi-Run Central Bank Freezes Assets of Accused Fraudsters

On May 11, the Financial Information Unit of the Sana’a-based Central Bank of Yemen (CBY-Sana’a) issued a circular freezing the bank accounts of two dozen companies and individuals accused of involvement in Ponzi schemes, which defrauded thousands of Yemenis with promises of high returns on investment. Among those targeted with sanctions were the Sana’a-based Tihama Flavor company and its owner Fathiya al-Mahweti, who refused to let hundreds of shareholders withdraw their money prior to declaring bankruptcy in October. On March 1, residents in Sana’a’s Bani Matar district protested a Houthi military campaign to appropriate lands in the area for the construction of a housing development led by Tihama Flavor, which failed to purchase all of the lands on which it intended to build the housing. Fake financial companies have been on the rise as investors have shifted assets from the formal banking sector to less-regulated money exchange outlets.

PLC Chief Authorizes Settlement of Southerners’ Employment Claims

On May 15, PLC chief Rashad al-Alimi signed presidential decrees authorizing the payment of outstanding wages to nearly 53,000 civil, security, and military employees who were dismissed from their jobs in southern governorates after the civil war of 1994. Based on the decision of a committee formed in 2013 to address the reparations, the decrees rehired and promoted some employees, referred others to retirement, and settled all outstanding wage claims. Addressing grievances associated with southerners’ loss of employment after 1994 has been one of the main priorities of the Southern Movement (Hirak). Some observers viewed the decrees as an attempt by Al-Alimi to boost his standing among southerners in the face of efforts by STC leader Aiderous al-Zubaidi to consolidate control in the south. It is unclear how or when the wages will actually be paid, given the government’s dire financial situation.

Chinese Firm Cancels Deal with Houthis for Oil Exploration

Chinese energy firm Anton Oilfield Services Group (Antonoil) announced on May 23 that it was nullifying a deal with the Houthi-run government in Sana’a to develop oil fields “due to a lack of sufficient understanding of the relevant information previously.”

The Dubai branch of the group and a representative of the Chinese government signed a memorandum of understanding (MoU) with the Houthi-affiliated Ministry of Oil and Minerals on May 17 to invest in oil exploration in the country, according to the Sana’a-based Saba news agency. Yemen’s hydrocarbon infrastructure is based in three governorates – Marib, Hadramawt, and Shabwa – that are all under the control of the internationally recognized government. Hydrocarbon exports have been halted since the end of last year following Houthi attacks on oil port infrastructure in southern Yemen, which have cut off the government’s main source of revenue. The MoU signed between Houthi authorities and Antonoil likely aimed to conduct oil exploration and develop infrastructure in Al-Jawf, which borders Saudi Arabia and is divided between Houthi and government control.

Maintenance of Yemen Mobile Network Temporarily Ceases in Aden

On May 15, the Aden-based Public Telecommunications Corporation issued a directive blocking any maintenance, modernization, or development of telecommunications infrastructure by Yemen Mobile, the country’s largest mobile network operator. This will likely lead to decreased mobile and internet coverage. Yemen Mobile is the only telecommunications company operating nationwide after the government suspended the mobile services of Yemeni-Omani Company “YOU” (previously MTN) in June 2022 over delinquent tax payments.

Houthis Announce New Price Caps on Food

On May 23, the Sana’a-based Ministry of Industry and Trade announced new price caps on basic food commodities, with reductions ranging between 3 to 8 percent. The new controls will apply at commercial shops and retail stores operating in areas under Houthi control. The cost of a 50-kilogram sack of wheat grain was reduced from YR14,200 to YR13,700, and wheat flour from YR15,900 to YR14,700. The list also included reductions on other food commodities, including rice, tea, yogurt, eggs, margarine, cooking oils, cheese, and legumes. The ministry stated that the list is the fourth of its kind, set following an updated review of food prices in line with international prices and transportation costs. During the course of May, Houthi authorities carried out regular field visits to shut down commercial centers, groceries, and sale outlets caught violating the price controls.

The move was met with opposition from an industry group, who questioned its legality. On May 25, the Sana’a-based General Federation of Chambers of Commerce and Industry accused the Houthis of illegally shutting down companies without court orders and imposing fines without legal justification. It stated that imposing price caps violates Yemeni law, the constitution, and the free market system. The federation demanded an adjustment to keep pace with the increase in the prices of raw materials in global markets, especially in light of the Russian invasion of Ukraine. It further complained that Houthi authorities were arbitrarily stopping trucks at customs outlets for days or even weeks, causing heavy losses, and had raised fees on containers.

The new controls had been accepted by the private sector after a request from the ministry for their application during Ramadan, but the ministry has reneged on its promise to remove them.

Houthis Shutter Generator Operators

The Houthi-affiliated Ministry of Electricity and Energy announced it was shutting down private generator operators violating its newly-enforced electricity tariffs and took parallel measures to replace services through the government-owned Public Electricity Corporation (PEC). On May 24, the Houthis closed the private generator operator Beit Mayad, along with dozens of others in Sana’a. The ministry indicated that it would restore electricity to 6,000 houses through the PEC.

In mid-April, the ministry responded to lower diesel and mazut prices by cutting the price for electricity provided by the PEC to YR270 per kilowatt-hour, while owners of private generators were required to sell at YR284. The ministry claimed that 246 of 408 privately owned generators operating in areas under Houthi control had adhered to the new prices, including 140 of 177 in Sana’a. Since then, judicial bodies have fined non-compliant operators with fines amounting to hundreds of millions of Yemeni rials.

Concurrently, Houthi authorities have pushed for a plan to rehabilitate three power stations owned by the PEC in an attempt to increase production and dominate supply in areas under their control. The diesel-powered generators would be converted to mazut, which could reduce fuel costs by up to YR13 million a day and make electricity supplied by the PEC more competitive.

In March, the Sana’a-based Parliament approved Resolution No. (33) regulating the activity of generator owners, nominally to enhance service and competition and set environmental requirements. But the decree has complicated licensing, limited operators’ ability to collect fees, and allowed Houthi-aligned actors to dominate the market.

The shutdowns have provoked widespread anger. Owners have complained that the new price caps are too low. Consumers have experienced blackouts following the closure of several private generators. Some have accused the Houthis of taking a systematic approach, replacing private operators with ones loyal to the group as part of a broader strategy to dominate lucrative parts of the economy.

Motorcycle Imports Banned in Socotra

On May 24, the Governor of the Socotra Archipelago issued Circular No. 10, banning the import of motorcycles and spare parts to the islands. The law is intended to limit traffic and fatal motorcycle accidents, and threatens violators with confiscation of their vehicles and parts.

Houthi Authorities Approve Plan to Rehabilitate Hudaydah’s Ports

On May 7, the Sana’a-based Council of Ministers approved a plan by the Yemeni Red Sea Ports Corporation to rehabilitate Hudaydah’s ports and bolster their capacity. The plan, presented by Houthi-affiliated Minister of Transport Abdelwahhab al-Durra, requested additional equipment for the ports of Hudaydah, Ras Isaa, and Saleef, including marine pontoons and gantry cranes, as well as the implementation of new procedures to handle increased shipping traffic.

STC Forces Impose Illegal Tolls at Aden Checkpoint

On May 7, truck drivers complained that STC-affiliated Security Belt forces at the Al-Rabat checkpoint at the northern entrance to Aden had impounded a number of trucks and detained their drivers for refusing to pay additional illegal tolls at the checkpoint. The head of the Heavy Transport Syndicate, Anis al-Matari, issued a statement warning that such tolls threaten to destroy the commercial sector in Aden and may push merchants to reroute their shipments to the Houthi-controlled port of Hudaydah.