Government’s Financial Woes Deepen

Yemen is experiencing a severe economic downturn as it tries to navigate long-term fiscal challenges. A World Bank report on Fiscal Vulnerabilities in Low-Income Countries released in late November highlighted Yemen’s dire fiscal situation as among the worst in the world. The World Bank’s Yemen Monitor for Spring 2024 noted that the current crisis is caused by plummeting oil and customs revenues, which had long been the backbone of Yemen’s economy. The government has also forcefully cut down fiscal expenditures, limiting the provision of essential services and jeopardizing sustainable economic development and growth.

Despite attempts to address these challenges by centralizing financial control, the government’s fiscal health remains precarious. Many employees have received their salaries late. Limited Saudi support, tainted by political interference, has compromised the Yemeni government’s autonomy. In addition, the Houthi group’s’ grip over key lucrative markets, including imports of food and humanitarian goods, and their reckless engagement in regional military conflicts have further hindered economic recovery.

The government has engaged in diplomatic efforts with several international actors to secure further support. In discussions at the International Monetary Fund (IMF) and World Bank’s Annual Meetings in Washington in October, officials explored possible solutions to contain the escalating economic and humanitarian crisis. The meetings also emphasized the imperative of emergency support programs to address food insecurity and curb rampant inflation. However, as evidenced by the lack of significant progress on the issue during the most recent UN General Assembly, the international community has shown limited interest in addressing the economic crisis in Yemen.

In late November, the Central Bank of Yemen in Aden’s (CBY-Aden) board of directors warned of potential social unrest due to the dire economic situation and urged the PLC to take immediate action, as the government was unable to pay public sector salaries for the month of October. The Ministry of Finance, responsible for managing government finances, was forced to suspend salary disbursements due to a lack of liquidity within CBY-Aden treasuries.

Over the last two years, the CBY Aden’s contractionary monetary measures have proven unsuccessful. Furthermore, its secondary open market policy, including the issuance of noninflationary public debt instruments to offset the fiscal deficit, has failed due to deteriorating public confidence in these investments, both among Yemeni banks and the general public.

The economic crisis has significantly worsened throughout the year. Existing issues like the disruption of oil exports, the government’s primary revenue stream, and inconsistent and insufficient external aid, have contributed to and been compounded by dwindling foreign exchange reserves. The resulting severe inflation has led to an erosion in citizens’ purchasing power. Prime Minister Ahmed Awad bin Mubarak traveled to Riyadh in November in an effort to secure emergency financial support from Saudi Arabia.

Delays in salary payments and the government’s failure to provide basic public services have sparked protests in several regions. Unions have issued calls for general strikes to exert pressure on the government to fulfill its fiscal obligations. Public sector workers, particularly teachers, have struggled to meet their basic needs with the reduced purchasing capacity of their wages standing at below US$50 a month.

Accusations of corruption and illegal hard currency exports have further worn public trust. The ongoing economic downturn and lack of transparency in managing fiscal resources have contributed to the perception that senior government officials are maximizing their own interests at the expense of the needs and welfare of citizens. Persistent internal divisions within the PLC also threaten social cohesion in areas under the nominal control of the government and hamper collective action to address the ongoing crisis.

In early December, the government belatedly paid October salaries to members of security, military, and administrative units in governorates under its control. This followed widespread protests and general strikes in several governorates over rumors that it planned to disburse only half the wages. The Ministry of Finance confirmed its commitment to paying salaries in full in an attempt to curb growing public discontent, but the delay pushed many in government-held areas closer to poverty and famine.

Rial Plummets to Record Lows

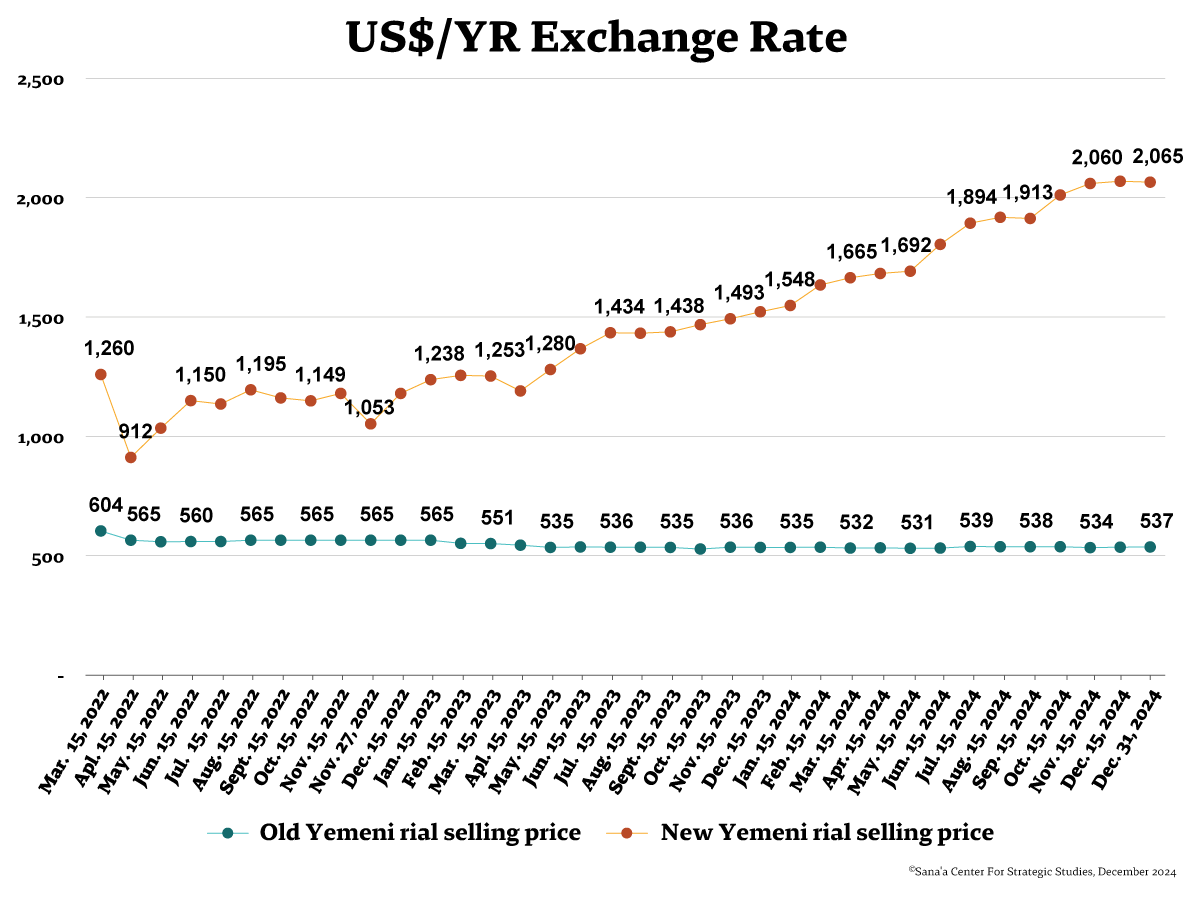

The new Yemeni rial continued its steep decline throughout late 2024 in government-controlled areas, aggravating Yemen’s already precarious economic and humanitarian situation. After a period of relative stability following the arrival of US$300 million in Saudi financial support in June, the new rial hit a record low and was trading at more than YR2,000 per US$1 by mid-October. The CBY-Aden’s attempts to stabilize the currency proved largely ineffective, with low foreign currency auction subscription rates and significant gaps between official and market exchange rates.[1] In contrast, old rials, which circulate in Houthi-controlled areas, remained relatively stable, hovering around YR535-YR539 per US$1.

Several compounding factors have contributed to the rial’s freefall. The CBY-Aden’s limited foreign reserves, due to the suspension of hydrocarbon exports and insufficient Saudi aid, have significantly weakened its ability to stabilize the currency. The bank’s weakened influence on financial governance has also allowed unlicensed money exchange outlets to engage in speculation and profit from rial fluctuations, further undermining the currency market.

The CBY-Aden announced two new debt auctions in late October, hoping to raise YR15 billion through the sale of one-year treasury bills at an 18 percent interest rate and three-year government bonds at 20 percent interest; both offered semi-annual interest payments. However, the bank’s struggles to stabilize the rial—despite foreign currency auctions and fiscal interventions—have deepened investor skepticism. Yemeni banks have had little incentive to participate, as they have been struggling with substantial frozen investments in public treasury bills dating back to late 2016. The CBY-Aden’s lack of transparency regarding the level of banks’ subscriptions to issued debt suggests significantly low demand.

The central bank’s abdication of its regulatory role in the face of escalating Red Sea tensions has also fueled mounting anxiety in the commercial and industrial sectors. Fearing disruptions to the supply of essential commodities, Yemeni traders have significantly increased their demand for hard currency to secure liquidity and stockpile imports, further draining the market. Meanwhile, Saudi Arabia has occasionally intervened in Yemen’s financial affairs, undermining the CBY-Aden’s ability to implement independent financial and monetary policies. Under Saudi pressure, the CBY-Aden was forced to reverse several key decisions aimed at isolating Houthi-controlled financial institutions. This weakened the central bank’s leverage, leaving it in a vulnerable position, unable to fully assert its authority over the fragmented banking sector.

Throughout November and December, the new rial remained near record lows, consistently above YR2,060 per US$1, marking an 8 percent decline since early October and a 33 percent drop since the start of 2024. A long-awaited US$500 million Saudi disbursement in late December, including a US$300 million deposit in the CBY-Aden and US$200 million for the government’s budget deficit, provided some respite but is unlikely to address the deep-seated economic issues.

The US$200 million represents the fourth and final tranche of a US$1.2 billion Saudi aid package announced in August 2023. Without a strategy to resume oil exports, ensure monetary policy independence, and implement sound fiscal policies, the rial’s freefall is likely to continue, pushing Yemen further into economic and humanitarian crisis.

Government Announces Economic Reform Plan

In mid-November, the government announced an ambitious economic reform plan to tackle immediate financial priorities and long-term structural challenges. Finance Minister Salem bin Breik held a ministerial meeting outlining the plan to strengthen fiscal management, tackle corruption, streamline the government’s handling of domestic resources, and establish a specialized committee, including representatives from key ministries and the CBY-Aden. The reform agenda also entails broader efforts to strengthen partnerships with the private sector.

One of the central goals is to address the financial instability caused by the Houthi blockade of oil exports, which accounted for a significant portion of the government’s revenue. The blockade, combined with limited support from international donors, has laid bare the need for a coordinated fiscal strategy to minimize future reliance on foreign aid and maximize the use of limited domestic resources. In November, a delegation of the European Union, the United Kingdom, and the World Bank visited Aden to explore pathways to support the government’s economic reforms, including securing the necessary funding to address the crisis and stabilize key sectors such as electricity.

The political divisions within the PLC and between various factions in the government continue to impede the implementation of economic reforms in government-controlled areas. The effectiveness of the new strategy will depend largely on the government’s ability to reconcile its internal divisions.

Climate Change Threatens Economic Recovery

In its Country Climate and Development Report released in November, the World Bank estimated that Yemen’s GDP could drop by as much as 3.9 percent by 2040 due to a worsening climate, causing declines in agricultural and fisheries production, labor productivity, and public health and infrastructure. In the most pessimistic scenarios, the organization warned that increased temperatures could worsen droughts and cause infrastructure damage, further destabilizing the economy.

The agriculture sector is already constrained by limited arable land and water shortages. Domestic agriculture currently accounts for about 15-20 percent of Yemen’s food needs. Although Yemen is self-sufficient in certain cereals, such as sorghum and millet, it is heavily dependent on wheat, rice, oil, sugar, and milk imports. Cultivable areas are limited, accounting for only 2-3 percent of Yemen’s land. More than 96 percent of agricultural land is threatened by desertification, which already affects nearly 90 percent of farming regions.

The report projected that fish stocks could decline by up to 23 percent between 2041 and 2050 due to rising sea temperatures and changes in marine ecosystems. The logistics and transport sectors also face threats, as the country’s rural population relies on unpaved dirt roads to access essential goods. The report projected that damage to transport infrastructure will jump by 45 percent by 2050 due to increased flooding and landslides.

Extreme weather events have already contributed to vast displacement, increased prevalence of waterborne diseases, and the loss of livestock and agricultural land, outcomes that are expected to continue. The report notes that “half of Yemenis, about 16.7 million people, are exposed to at least one climate hazard of either extreme heat, drought, or flooding, exacerbating the multidimensional elements of poverty, with strong regional concentrations.”

The World Bank advocated developing a regional response plan to adapt to the changing environment. Specifically, it recommended funneling investments toward water and food security, infrastructure development, including localized renewable energy, and human development, particularly the empowerment of women and youth. Sustainable practices and better resource management are vital for strategic investment in climate-sensitive sectors like agriculture and fisheries. However, Yemen accessing climate finance remains a significant challenge due to weak institutions and perceived investment risks.

Yemen’s Humanitarian Crisis Worsens

Yemen is mired in a catastrophic humanitarian crisis driven by economic collapse, recurrent violent conflict, climate shocks, and funding shortfalls. These converging crises have pushed millions of Yemeni citizens to the brink of starvation and created alarmingly severe food insecurity across many parts of the country. A report by the Famine Early Warning Systems Network (FEWS NET) warned that nearly 19 million people in Yemen could require urgent humanitarian assistance by February-March 2025. The report highlighted the devastating impact of the country’s deepening economic crisis, which has pushed millions into poverty and food insecurity.

In September, local authorities in Shabwa voiced their disapproval of the WFP’s decision to drop 8,076 cases from the aid program. Families appealed to the World Food Programme (WFP) to reinstate their names on the beneficiary list for its food security project. They have called for a thorough reevaluation of the beneficiaries through the WFP’s local partner, the Humanitarian Solidarity Association, and for holding them accountable for any adverse consequences. Residents complained that cutting down aid assistance would lead to an alarming increase in malnutrition, poverty, and disease among the most vulnerable populations, including the sick, displaced, widows, and orphans.

In early October, UNICEF announced the delivery of cash transfers to 1.43 million vulnerable families. Later in the month, Saudi Arabia gave US$25 million to the WFP for emergency food aid in Yemen, aiming to reach over 546,000 individuals and support community resilience. The WFP assessments indicated that 64 percent of Yemeni households were experiencing inadequate food consumption — the highest rate recorded during the conflict. This renewed crisis is driven by deteriorating economic conditions, delayed humanitarian aid, and limited livelihood opportunities, and compounded by severe flooding in recent months that has particularly affected vulnerable communities. Suspensions of food aid since December 2023 have left approximately 9.5 million people facing acute food insecurity.

By late November and early December, reports from the FAO and other UN agencies highlighted an increasingly grim picture. The Joint Monitoring Report projected that 17.1 million Yemeni citizens (about 49 percent of the population) will need food assistance in 2025. This projection includes 12.4 million in Houthi-controlled regions. Driven by currency depreciation, conflict, and economic instability, the report states that more than half of Yemenis suffered from inadequate food consumption in September 2024.

In government-controlled areas, rial devaluation, weak fiscal policies, and limited revenue streams have triggered a severe inflationary cycle. In Houthi-controlled areas, a severe currency shortage has exacerbated market dysfunction. While food prices in Houthi-controlled territory remain relatively stable due to a strictly applied fixed foreign exchange rate regime and price controls, households have limited access to regular income. By contrast, areas under the control of the government are experiencing significant spikes in food prices, particularly for staples such as wheat flour, rice, beans, and cooking oil. The cost of the Minimum Food Basket (MFB) in government areas has risen to YR130,364 (US$68), a 25 percent increase from the previous year. Even in areas under Houthi control, the average cost of an MFB rose by 2 percent from 2023 to YR46,247 (US$87). The resulting food insecurity has led 52 percent of Yemeni households to resort to extreme coping mechanisms, such as reducing meal portions, seeking out cheaper alternatives, begging, and selling personal belongings. Displacement, particularly in the governorates of Hudaydah, Marib, and Taiz, has compounded the crisis and added pressure on already fragile local economies with limited resources.

In government-controlled areas, a drop in fuel imports by 31 percent between August and October disrupted public services and led to electricity shortages and challenges in the logistics and transportation sectors. While fuel imports via Red Sea ports in Houthi-controlled areas have increased by 50 percent since September, food imports across Yemen decreased by 30 percent in the same timeframe. Diesel and petrol prices are significantly higher in government-controlled areas but remain relatively stable in other parts of the country. In November, diesel and petrol prices in government areas were 7-14 percent higher compared to the same month last year and up 29-31 percent over the three-year average. These increases were also driven by the rapid devaluation of the Yemeni rial, which depreciated by 26 percent over the course of 2024.

Yemen has been grappling with a critical shortage of funding for the country’s Humanitarian Response Plans. In early December, Yemen’s Permanent Representative to the UN urged the international community to secure funding for Yemen’s 2025 plan. The UN’s 2025 Humanitarian Response Plan includes a US$2.5 billion appeal to assist 10.5 million people in need. However, the 2024 plan was underfunded, with only 48.5 percent of the requested US$2.71 billion secured.

The Houthis have continued their aggressive campaign to detain UN and international agency staff, further exacerbating the humanitarian situation in Yemen. In a joint statement, representatives of Western nations and Yemen condemned these arbitrary detentions and emphasized that such actions hinder the delivery of essential aid to millions in need. In concert with Western donor countries, the UN announced it would curtail operations in Houthi-controlled areas, prioritizing only lifesaving and life-sustaining initiatives. This was followed by the Swedish government announcing its suspension of development aid to northern Yemen by the end of 2024 due to the Houthis’ continuing attacks on ships in the Red Sea and detention of UN staff. It also stated that it would phase out development assistance in government-held parts of the country by June 2025. The Swedish government said it had considered the ripple effects on humanitarian work in Yemen and did not rule out that the 80 million Swedish kronor (equivalent to US$7.3 million) in development aid could be transferred to humanitarian fields.

CBY-Aden Faces Scrutiny Over Billions of Dollars Sent Abroad

The CBY-Aden’s shipment of vast amounts of hard currency out of Yemen sparked widespread criticism in November. A document titled “A report to the attorney general regarding the central bank smuggling money in sacks through official outlets and under the signature of the governor,” was widely circulated on social media. The report claimed that the government and CBY-Aden had smuggled billions of dollars out of the country in 2023 and 2024.

Fadi Baoum, a member of the STC presidium, repeated the allegations in a now-deleted Facebook post alongside documents detailing the amounts withdrawn. According to the claims, approximately US$690 million in 2023 and 2.4 billion Saudi riyals in 2024 were exported through Aden International Airport. Fears that illegal transactions could further destabilize the currency and contribute to economic collapse led to calls for an immediate and transparent investigation.

The CBY-Aden, however, strongly condemned and denied accusations of illegal activities in an official statement issued on November 20. Describing the allegations as baseless and misleading, it stated that all transfers sanctioned by the bank are subject to strict legal procedures, including anti-money laundering and counterterrorism checks by its Information Collection Unit and Banking Supervision Sector. It specified that the amounts in question were legal transfers by licensed Yemeni banks necessary to finance the import of crucial goods like food and medicine. The statement further called into question the motivation for the claims, demanding accountability and prosecution.

CBY-Aden Announces Launch of IBAN System

On December 11, 2024, the CBY-Aden launched the International Bank Account Number (IBAN) system, an internationally agreed method of identifying bank accounts to facilitate cross-border transactions with a reduced risk of transcription errors. The CBY-Aden first initiated procedures to activate the system and discussed the plan with banks last April.

The CBY-Aden acknowledged the support of the United States Agency for International Development (USAID) in its efforts. The IBAN system is essential for connecting Yemen to the Arab financial system and enhancing its financial inclusion while ensuring compliance with international financial regulations. However, the Houthi group has banned banks in areas under its control from connecting to the system, further exacerbating the division of Yemen’s financial landscape and hindering efforts to modernize the banking sector and integrate it into global networks.

Aden Faces Energy Crisis Amid Fuel Shortages

Aden and neighboring governorates have been plagued with persistent power outages lasting up to 20 hours a day. The power crisis has disrupted the provision of essential services like water, healthcare, and waste management. The Aden Electricity Corporation has warned that without new fuel supplies, even the few operational power plants, such as the Al-Haswa and Al-Mansoura stations, are at risk of shutting down. Despite repeated calls from the electricity corporation and local authorities, the limited government response has left citizens frustrated and vulnerable.

While solar power projects, such as the UAE-funded solar plant in Aden, offer long-term hope, they can’t meet immediate energy demands. The 120-megawatt solar facility cannot cover growing demand, and its reliance on daytime power generation leaves the city vulnerable during off-peak hours. The energy crisis in Aden underscores broader governance failures and a lack of coordination between local authorities, energy companies, and fuel suppliers. As the situation worsens, the risk of social unrest grows, with the population increasingly dissatisfied with the government’s inability to provide reliable energy. Without swift, comprehensive action to secure fuel supplies and invest in energy infrastructure, Aden’s energy crisis will continue to fuel instability across government-controlled areas.

Elsewhere, the Yemen Gas Company has launched efforts to address another pressing energy issue: damaged gas cylinders. The company is replacing and refurbishing 160,000 gas cylinders across government-controlled governorates, including Aden. The initiative aims to ensure the safety of users by replacing 60,000 damaged cylinders and refitting 100,000 others with high-quality Italian valves. The campaign, which follows the completion of a training course for 17 technicians, is part of the company’s broader goal to enhance gas safety and supply.

Fuel Tanker Drivers Protest Illegal Levies

Truck drivers who haul domestically produced gas initiated an open sit-in at the Hassan checkpoint in Abyan governorate in October. The protesters complained about security checkpoints established along routes connecting Aden, Abyan, and Shabwa governorates that were reportedly collecting illegal tolls.

Al-Masdar Online reported that the drivers were coerced into paying large fees — YR40,000 per tanker — in “improvement taxes.” Such tolls persist despite directives issued by PLC member Abdelrahman al-Muharrami to curb the practice. The truckers state that they have been prevented from entering the interim capital, Aden, without complying with the demands for payment. The imposition of illegal tolls highlights the fragmented resource mobilization landscape in government-controlled areas. It also reflects a broader pattern of corruption and mismanagement that plagues local governance in Yemen.

Hadramawt Diesel Prices Cut

In late October, Hadramawt Governor Mabkhout bin Madi issued a decree reducing diesel prices in the governorate by 45 percent, from YR1,450 to YR800 per liter. PetroMasila, the state-owned oil company, said it would allocate 350,000 liters of diesel per day to meet the needs of the local market at the new subsidized price. In August, the Yemen Petroleum Company in Hadramawt announced an increase in diesel prices, citing the need to import fuel to meet local demand after the temporary shutdown of PetroMasila’s first diesel distillation unit due to “force majeure.” Diesel prices rose by over 29 percent, from YR1,200 to YR1,550 per liter.

The decision to lower prices followed widespread protests and escalating tensions between the government and local tribes over the transfer of Hadrami hydrocarbon production to other government-controlled areas. Several cities in Hadramawt have experienced protests fueled by near-total electricity blackouts and the plummeting currency. The demonstrations were led by the Hadramawt Tribal Alliance (HTA) and the Hadramawt Inclusive Conference, both led by tribal leader and deputy governor Amr bin Habrish.

Local authorities, PetroMasila, and the HTA have been locked in a blame game. While the government and PetroMasila attribute the electricity crisis to HTA-driven fuel shortages and technical issues, the tribal alliance has accused them of intentional manipulation and corruption. Tribal forces allied with the HTA have seized oilfields and set up roadblocks, preventing the transport of locally sourced oil and gas outside the governorate as a means of pressuring the government to address their demands, which include lower fuel prices and a larger share of oil revenues.

PetroMasila Opens New Refinery

On November 24, state-owned PetroMasila announced the successful opening of a new heavy fuel oil (mazut) refinery in Hadramawt. The news came amid the governorate’s ongoing electricity crisis and fuel shortages and as the government struggles to import sufficient quantities due to the continuing economic crisis and currency devaluation.

The company confirmed it was able to produce experimental quantities of mazut, which will be allocated to support power plants across the governorate under the supervision of local authorities. The CEO of the PetroMasila Company, Mohammed bin Sumait, said the aim was to provide the government with hard currency by locally refining fuel.

In a separate statement, the Hadramawt Valley Electricity Corporation noted that severe shortages of imported fuel and necessary maintenance on a main gas station turbine were also responsible for increased power outages in the governorate.

US Intensifies Pressure on Houthi and Hamas Financing Networks

In a coordinated approach, the US Treasury Department has issued a series of sanctions targeting both the Houthi war machine and Hamas’ financial networks. These actions come in parallel with the renewal of existing UN sanctions and Canada’s designation of the Houthis as a terrorist group and collectively aim to intensify international pressure.

In early October 2024, the Treasury Department launched a two-pronged sanctions campaign. The initial round targeted Houthi arms smuggling networks operating in Yemen, Iran, and Oman. The US decision to freeze the assets of implicated individuals and entities aims to disrupt the supply of weapons to the Houthis and degrade their military capabilities. While these sanctions may close certain supply routes, the group could likely find alternative means of acquiring weaponry and resources.

In mid-October, the Treasury Department imposed new sanctions on a network linked to Sa’id al-Jamal, a key financier for the Houthi group. These sanctions targeted eighteen companies, individuals, and vessels involved in transporting illicit oil, the proceeds from which are used to fund Houthi military operations. The sanctions highlight the Houthis’ dependency on Al-Jamal’s network to facilitate the sale of Iranian petroleum and reflect ongoing US efforts to counter Iranian support for the Houthis. Although the sanctions may temporarily hinder specific operations, again, the Houthis’ adaptability indicates that further measures will likely be necessary.

A second round of sanctions targeted Hamid al-Ahmar, a prominent Yemeni tribal figure and Islah-linked businessman, for allegedly channeling millions of dollars to Hamas’s military and governance activities in Gaza. The Treasury’s announcement accused Al-Ahmar of managing a portfolio of over US$500 million in assets as the head of the Jerusalem International Foundation, an organization purportedly involved in facilitating funding for Hamas’s military and governance activities in Gaza through a web of businesses and charitable organizations across various countries, including Turkey, Algeria, and Qatar.

Al-Ahmar has deep-rooted connections with various political factions, including the Islah party. This made him a key player in the political landscape even after he left Yemen following the Houthi military takeover of Sana’a. Notably, various Houthi leaders expressed support for Al-Ahmar and denounced the designation. Given the family’s legacy as paramount sheikhs of the Al-Hashid tribal confederation and established patronage networks, the designation could significantly affect Al-Ahmar’s political influence within Yemen, alienating some factions while consolidating support among others.

On November 13, the United Nations Security Council unanimously extended sanctions through Resolution 2758, renewing travel bans and asset freezes on Houthi-linked individuals and entities. These sanctions, first imposed in 2014, aim to pressure the Houthis into peace talks and limit their military capabilities. The resolution also extended the mandate of the UN Panel of Experts, which is tasked with monitoring the sanctions and reporting on the illicit transfer of weapons and materials used by designated individuals or groups in Yemen. While the US welcomed the UN’s decision, it expressed disappointment over a lack of additional measures, particularly those recommended by the Panel of Experts to address Houthi aggression in the Red Sea and weapons transfers to the group.

On November 14, the US Treasury Department imposed sanctions against 26 individuals and entities linked to the Al-Qatirji Company, which it accused of facilitating Iranian oil sales to Syria and the Houthis. Adding to the pressure, on December 2, the Canadian government designated the Houthi movement a terrorist entity. The Houthis were determined to have met the definition of a terrorist group under the Canadian criminal code, which prohibits terrorist financing, travel, and recruitment. The government cited the Houthi insurgency against the internationally recognized government and attacks on civilian and naval vessels in the Red Sea and other waterways, as well as their targeting of Israel.

Houthis Move on Tobacco and Other Economic Sectors

The Houthis continue to extend their control over Yemen’s most lucrative economic sectors. In early October, they brought the Kamaran Tobacco Company under their effective control. The state-controlled firm, manufacturer of the well-known Raidan brand, has remained in Sana’a throughout the war despite the Aden-based government being its majority owner.

British American Tobacco reportedly holds a 31 percent stake in the company, which opened a factory in a Jordanian free zone in 2019. Now, Houthi authorities have imposed a new general manager and appointed at least two other senior figures to the company. Kamaran Tobacco Company’s Aden branch denounced the changes as illegal.

Houthis Draft Law for Salary Payments

On December 1, the Houthi-affiliated Supreme Political Council issued a new draft law aimed at addressing public sector salary payments and the plight of small depositors in the banking sector. The day earlier, Mohammed Ali al-Houthi, a member of the Houthi Supreme Political Council, chaired a meeting to discuss austerity measures aimed at solving the Houthi government’s banking and salary payment crisis. Attendees included the speaker of the Houthi-affiliated House of Representatives, prime minister, and ministers of finance, economy, and industry. The law, referred to as “a temporary exceptional mechanism,” was ratified by the Sana’a-based House of Representatives on December 3. While ostensibly intended to address the economic hardships of hundreds of thousands of public sector employees working and living in Houthi-controlled areas, the potential impacts of the law and the underlying motives for the legislation raise serious concerns.

The new law contains four chapters detailing the funding sources for salaries, as well as a mechanism for disbursing payments. It states that some money will be drawn from independent special funds, most notably the Teacher’s Fund. The law also proposes mobilizing additional funds from independent institutions, which may include telecommunication companies and other revenue-generating government-owned entities. These institutions would be required to make extra fiscal contributions outside of regular taxes and zakat. The law stipulates that these fiscal contributions would not be considered loans and debts owed by the government. The Ministry of Finance may, however, consider repaying the contributions if the country receives future compensation, likely in a post-conflict scenario. Beyond concerns that the depletion of these resources could lead to a broader collapse of the entities involved, the benefit to recipients is also questionable. The draft grants the Houthi Minister of Finance, Abdeljabbar al-Jarmouzi, the prerogative to determine which funds to draw from and how much should be taken from any government, private, or mixed-ownership bank.

Chapter 3 of the law outlines a disbursement mechanism for salaries, with state employees divided into three categories. The first includes senior officials in institutions such as the House of Representatives, the Shura Council, the judiciary, and others who would receive full salaries. However, salaries in this category represent less than 5 percent of the total public salary wage bill in Houthi-controlled areas. The second category includes employees of public institutions that do not have sufficient revenue streams, who will be paid half a salary per month. The third category would receive half a salary every three months and includes employees of government entities that have revenues or operating expenses funded by the general government account, such as the tax authority and finance ministry.

According to the draft law, the disbursement will be linked to a unified salary statement, drafted by the Houthi authorities and approved by the civil service, according to which thousands of employees would not qualify for salary payments if they were considered “absent” from their work – many public sector employees have been forced to search for other job opportunities due to their reduced income. Bonuses and incentives will also be scrapped. Three anonymous members of the Houthi-run parliament stated that they were briefed on a mechanism that would pay half salaries every three months in exchange for a significant increase in taxes, customs, and fees for social service provisions such as healthcare.

Having drastically cut and delayed the payment of salaries of civil service employees for more than seven years and made their provision a cornerstone of their negotiations with Saudi Arabia, Houthi authorities face growing popular resentment in response to the economic recession in areas under their control.

- This was highlighted by the 12th auction of the year, with US$50 million on offer. The central bank only managed to sell US$25.247 million, well below its target. The significant gap between the official exchange rate of YR1,965 per US$1 at the time of auction and the current market rate, which has surged to over YR2,000 per US$1, indicated the significant volatility of the rial in the money market. The next auction in late October also managed to sell only US$18.446 million of the US$30 million offered at an exchange rate of YR2,007 per US$1, a concerning 62 percent coverage rate.