The government-held port of Aden received the commercial ship Blue Nile on April 8, without it being subject to inspection by the Saudi-led coalition at Jeddah, a first since the expansion of the conflict in 2015. The arrival followed a statement released by Aden Governor Ahmed Hamed Lamlas on April 4, encouraging shipping companies to operate direct routes to the port of Aden and announcing several deregulation measures, including the suspension of container fees and action against illegal levies. On April 6, the government-affiliated Ministry of Transport followed up with a statement confirming the eased import restrictions, and said it had informed local and international shippers of the new regulations, which include covering insurance fees for war-related risks, increasing the capacity of loading and offloading operations, and allowing the entry of all types of legal goods through government-held ports and border crossings. The same day, the deputy head of Yemen’s Chambers of Commerce in Aden, Abu Bakr Abeed, told Reuters that more than 500 types of goods were removed from a list of products previously banned by the Saudi-led coalition, including fertilizers and batteries. Under previous requirements, shipping companies seeking to import goods to government-held ports had to apply for permission from the Yemeni Ministry of Transportation at least a week prior to their intended arrival, and vessels had to undergo inspection by the Saudi-led coalition before being allowed to enter Yemeni territorial waters.

The eased import rules follow the relaxing of restrictions on commercial goods entering Houthi-held ports in March. The head of the Houthi-affiliated Yemen Red Sea Ports Corporation, Mohammed Abu Bakr Ishaq, said during an interview on March 7 that the United Nations Verification and Inspection Mechanism for Yemen (UNVIM) had agreed to allow more types of goods to enter Houthi-held ports and expand its operating hours to clear additional ships for entry. Ishaq also claimed that vessels were no longer subject to a secondary inspection by the Saudi-led coalition and could proceed directly from Djibouti to the port of Hudaydah following UNVIM approval. UNVIM, based in Djibouti, was established in 2015 to prevent arms shipments to Yemen, and previously only approved the entry of ships carrying specific goods to Houthi-held ports, including foodstuffs, fuel derivatives, and cooking oil. UNVIM clearance requirements often resulted in long delays in vessel docking.

The easing of restrictions comes amid ongoing Saudi-Houthi talks. Barriers on shipping to ports under the group’s control have been among the central points of negotiation. Restrictions on imports into Yemen, which imported up to 90 percent of its food before the conflict, have had devastating effects on the economy and contributed to the humanitarian crisis.

WFP Announces Arrival of Wheat Shipment

On April 17, the World Food Programme (WFP) announced the arrival of a ship carrying 30,000 metric tons of wheat to the western port of Hudaydah to support humanitarian aid in Yemen. The vessel, MV Negmar Cicek, sailed from the Ukrainian Black Sea Port of Chornomorsk in Odessa following the renewal of the Black Sea Grain initiative last month. Backed by the WFP, the shipment is jointly funded by the United States, France, and Spain, and will provide a 50-kg bag of wheat flour to nearly 4 million Yemeni citizens for one month. Enacted on March 18, the Black Sea Grain Initiative was launched with the aim of overcoming the global food crisis, in particular in countries that are facing high levels of food insecurity. USAID reported that prior to this shipment, WFP-chartered vessels had transported more than 511,000 tons of wheat through various Black Sea ports to support humanitarian operations in Yemen, Afghanistan, Ethiopia, Kenya, and Somalia as of March 23. WFP Country Director and Representative in Yemen Richard Ragan said the shipment came at the right time, especially in light of the funding constraints that the program is facing. The response is only 17 percent funded in Yemen over the coming six months. The WFP needs around 85,000 tons of wheat each month in Yemen, where donor support has so far kept famine at bay. Ragan indicated that continued assistance, along with the six-month truce, has helped to reduce the number of Yemeni people living in famine-like conditions from 161,000 to zero. However, there are still 6.1 million people living at emergency levels of food insecurity. According to Regan, continued donor support will allow the WFP to eventually transition from life-saving assistance to resilience and development work.

CBY-Sana’a Increases Capital Requirements for Money Exchanges

On April 30, the Central Bank of Yemen in Sana’a (CBY-Sana’a) issued Resolution No. (4) of 2023 to increase minimum capital and cash guarantee requirements for money exchange outlets. According to the decree, money exchange companies operating transfer networks will have their minimum capital requirement raised to YR1.25 billion. Those that do not operate networks will have theirs raised to YR500 million. The requirements also affect local shops. Money exchange shops operating in areas where financial services are available must now hold YR100 million, while those operating in areas where such services are not available (defined as at least seven kilometers from any licensed bank, exchange company, or exchange shop) must hold YR50 million. The decree stipulates that money exchange companies and shops must each deposit a cash guarantee with the CBY-Sana’a equivalent to 25 percent of their new capital requirement to ensure compliance. They have been given eight months to fulfill the new requirements. The CBY-Sana’a also issued a resolution regulating licensing, limiting the locations from which new outlets can operate. It suspends the provision of licenses to any new exchange companies, shops, or branches if there are three or more similar financial outlets within four kilometers. The resolution bans branches of exchange companies and shops from moving more than one kilometer away from their current location on the same license. It also states that licenses that have been suspended will not be renewed. This decree follows Resolution No. (58) of 2022, issued by the CBY-Aden in August last year, in an attempt to tighten requirements for money exchanges in order to improve oversight and limit currency speculation.

The CBY-Aden mandated that money exchange companies hold YR1 billion as a minimum capital requirement and deposit another YR500 million with the CBY-Aden as a cash guarantee to ensure legal compliance, and pay YR20 million as an annual licensing fee. Money exchange shops were required to hold YR500 million and deposit another YR150 million with CBY-Aden. Hawala agents, which are only legally licensed to operate in remote areas, were mandated to hold YR100 million and YR20 million in minimum capital and cash guarantee requirements respectively. The CBY-Aden gave exchange outlets until 2025 to fulfill the requirements.

Central Bank and Finance Ministry Issue Conflicting Orders on Salary Payments

The Ministry of Finance and the Central Bank of Yemen in Aden (CBY-Aden) issued conflicting orders for the payment of public sector salaries. On April 16, the finance minister directed the CBY-Aden to start paying April salaries to all civil, security, and military units on April 17, prior to the celebration of Eid al-Fitr. On the same day, a document signed by the deputy governor of local banking operations at CBY-Aden ordered branches to pay salaries following the holiday, during the last five days of April. Media sources indicated that executives at CBY-Aden rejected the Ministry of Finance’s directive due to the current fiscal position of the government and the need to finance rising expenditures, postponing payments until the ministry accumulates the necessary liquidity for their disbursement. By law, the CBY acts as the treasurer and implementer of the state budget, including the payment of salaries drawing on revenues deposited into its treasury.

The government is struggling to cover the cost of public sector salaries after losing oil revenues following Houthi drone attacks on infrastructure at ports in Shabwa and Hadramawt in October and November. Its fiscal deficit has been further compounded since mid-January, when Houthi authorities began pressuring commercial importers to redirect imports from Aden to the port of Hudaydah, which has resulted in the loss of customs revenues. Despite the CBY-Aden’s directive, bank branches, including those in Taiz and Hadramawt, took measures to begin implementing the finance ministry’s order before suspending payment procedures after receiving further orders from CBY headquarters in Aden. This reflects the weak level of coordination between the CBY-Aden headquarters and its branches, which still operate independently and are not fully subject to the authority and directives of the central bank.

Meanwhile, the Sana’a-based Ministry of Finance issued orders on April 9 for the Houthi-controlled Central Bank of Yemen in Sana’a (CBY-Sana’a) to pay public servants a half month’s salary, covering the first half of August 2018. This payment comes ahead of the Eid al-Fitr holiday marking the end of the holy month of Ramadan. Houthi authorities also distributed a half month’s salary ahead of the start of Ramadan, meaning civil servants working in Houthi-held areas have received one full month’s salary since December 2022. Public servants are still owed nearly five years of back pay.

Central Bank Warns Against Rejecting YR200 Notes

On April 19, the Central Bank of Yemen in Aden (CBY-Aden) issued a cautionary statement to businesses regarding the acceptance of older-design YR200 notes. The warning came after media outlets reported that some money exchange shops and commercial outlets have refused to accept the notes. The bank reiterated that all banknotes of the national currency in all denominations are considered legal in their full nominal values as means of payment, and stated that any violations would be monitored in order to take legal measures against the offending parties. The older design of the YR200 note was first issued by the CBY in 1996, but the notes have gradually disappeared from the money market and currently have the lowest circulation of any denomination by volume. Their relative rarity was compounded following the issuance of a YR250 note in 2009 and a new version of the YR200 note in August 2018, which came in a different size and color.

Fuel From Saudi Grant Arrives in Aden

On April 8, the fourth batch of a Saudi fuel grant, amounting to 30,000 metric tons of fuel derivatives, arrived at the port of Aden, according to the government-run Sabanet news agency. The grant is provided through the Saudi Development and Reconstruction Program for Yemen (SDRPY) to operate more than 70 power stations in government-controlled areas. Since November 2022, SDRPY has supplied the Yemeni government with approximately 150,000 tons of diesel and 100,000 tons of mazut.

LNG Tanks Arrive in Mukalla

On April 18, the government-run Sabanet news agency reported that four liquefied natural gas tanks with a total storage capacity of 400 tons had arrived at the port of Mukalla in Hadramawt. Executive Director General of the Yemeni Gas Company Mohsen Wahit said the tanks arrived by directive of the Ministry of Oil and Minerals in coordination with the local authority, and will help to modernize and expand the Brom facility, located in the Brom Mayfaa district in western Hadramawt. He said the new tanks will raise storage levels to help meet local demand and reduce bottlenecks in supply.

Currency

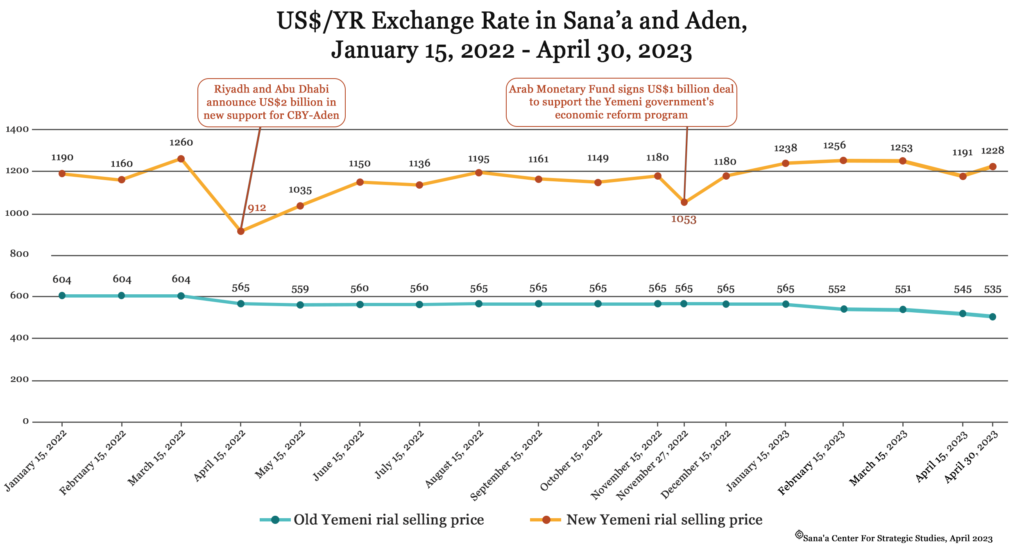

New rials in government-held areas experienced up and down fluctuations over the course of April. In the first half of April, new rials appreciated by over 4 percent, from YR1,251 to YR1,194 per US$1 amid positive market sentiment following reported progress in Oman-mediated talks between Saudi Arabia and the Houthi movement. In the second half, however, the new rials entered a relative cycle of devaluation, depreciating by almost 3 percent, from YR1,194 to YR1,228 per US$1. Old rials in Houthi-controlled areas appreciated almost 4 percent, from YR550 to YR530 during the month.

Migrant workers tend to increase remittances to relatives in Yemen when celebrating Eid al-Fitr, and in response, money exchangers often exploit the high levels of incoming remittances to purchase these hard currencies at undervalued prices — while refraining from selling them for Yemeni rials. This allows them to sell hard currency at a higher rate when the rial enters cycles of depreciation and inflows of remittances decline.

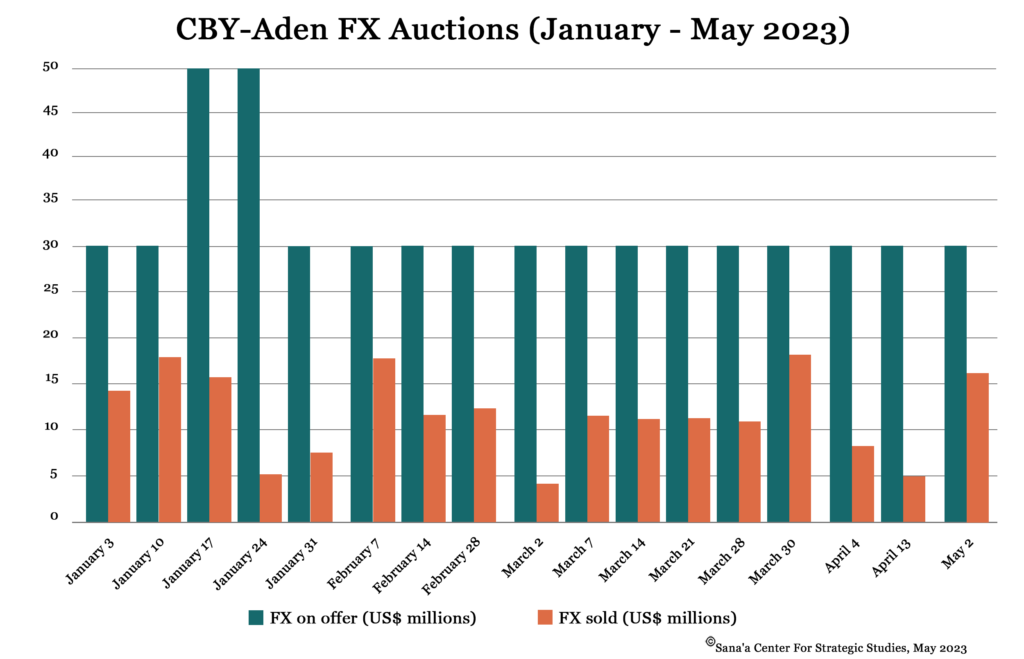

CBY-Aden temporarily suspended its weekly hard currency auctions, holding three auctions in April and the first two days of May, compared to six in March. The latest foreign currency auction, announced on May 2, was 55 percent subscribed. Since the beginning of the year, the CBY-Aden has held seventeen FX auctions, with a total of US$550 million on offer, but only 37 percent (or US$203 million) has been purchased by Yemeni banks. Subscription rates have been down this year as the CBY-Sana’a has sought to restrict banks’ participation and the exchange rates offered have been perceived as less favorable.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية