The government approved an agreement to establish a joint telecommunications company with an Emirati company to provide mobile phone and internet services in government-controlled areas on August 21, over opposition from several members of parliament. In a letter to Prime Minister Maeen Abdelmalek Saaed, 22 MPs in the government-aligned House of Representatives objected to the proposed sale of Aden Net to NX Digital Technology, a UAE-based technology company, characterizing it as a deliberate attempt to bypass parliament’s supervisory and legislative authority. The MPs called on the government to await the outcome of a report by a parliamentary fact-finding committee studying the deal. In a previous letter sent to PLC head Rashad al-Alimi in mid-July, the MPs said the proposed deal could only be approved by the House of Representatives, and that granting NX a license to operate Aden Net would negatively affect the country’s security and sovereignty, and violate principles of transparency and fair competition.

Critics accused the government and the Ministry of Communications of selling 70 percent of Aden Net’s assets to NX, which has no previous experience as a mobile operator. In December, the government issued decree No. 79 of 2022, granting a license to NX to operate in partnership with Aden Net, rather than selling an ownership stake, to improve telecommunications and internet services in government-held areas. Aden Net was established in September 2018 to replace internet services previously provided by the Sana’a-based Yemen Net telecommunications company and reduce Houthi authorities’ control over the sector.

Parliament Report Alleges Corruption in Public Institutions, Prime Minister Responds

The House of Representatives issued a report on August 25 documenting purported violations and corruption by several public institutions. Addressed to Prime Minister Saaed, the report alleged mismanagement and corruption in the electricity, energy, telecommunications, and financial sectors. The report is the outcome of a parliamentary fact-finding committee formed to investigate the legitimacy of the government’s decision to approve the sale of Aden Net to UAE-based technology company NX Digital Technology, among other accusations of corruption.

According to the report, the electricity ministry has suffered from widespread corruption and has become a black hole in the government’s budget, requiring massive funding without supplying even minimum levels of electricity. The report accused the government of failing to implement PLC Resolution No. (2) of 2022, which aimed to address power supply deficits in Aden and other regions under government control by raising capacity to 635 megawatts. Electricity generation capacity is less than half of the targeted amount; the deficit has increased further since power stations stopped operating in recent months due to lack of fuel, extending electricity cuts in Aden and other areas during the hot summer months.

The report said the government has spent an estimated US$100 million per month to purchase fuel derivatives for power stations. The budget allocated to electricity provision amounted to YR569 billion (approximately US$400 million) in 2022, not including funds allocated to the government-owned Public Electricity Corporation or funds available via a Saudi fuel grant. From November 2022 to April, the Saudi Development and Reconstruction Program for Yemen (SDRPY) supplied the government with over 1.2 million metric tons of diesel and mazut, valued at US$422 million, for power generation at more than 80 stations.

The report noted that the purchase of oil derivatives has been conducted outside the existing Tenders Law. It accused the Ministry of Oil and Minerals and the Yemen Petroleum Company of importing poor-quality fuel and allowing fuel derivatives shipments to enter government-held ports and markets without payment of the taxes and customs tariffs owed to the government. It also accused the oil minister of deliberately withholding data, information, and agreements signed by the ministry and its affiliate bodies.

In the telecommunications sector, the parliament report reiterated that the government violated the constitution and existing laws by approving the sale of 70 percent of Aden Net to the UAE-based NX Digital Technology Company on August 21. The cabinet refused to share copies of the agreement with the parliamentary fact-finding committee under the pretext that it should remain confidential, while critics argue that the deal would reveal corruption and a violation of the country’s sovereignty. The report demanded the government be held accountable for deliberate violations that harm national interests, waste public funds, and disregard the parliament’s supervisory role.

In the financial sector, the report criticized the government’s failure to mobilize revenues and deposit them into state treasury accounts in the Central Bank of Yemen (CBY-Aden). It also accused local authorities in some governorates of failing to cooperate with the central government to collect and deposit revenues in line with existing laws. The House of Representatives ordered the prime minister and the government to respond to the report within two weeks.

On September 5, Prime Minister Saeed denied the allegations of corruption and mismanagement at a press conference. The prime minister attacked the report of the fact-finding committee, calling the accusations malicious, and backed by influential individuals whose personal interests have suffered. He alleged that certain partisan individuals have attempted to obstruct the work of the government, and said that it has formed a committee headed by the minister of justice to respond to the allegations outlined in the report.

Saeed also defended his government’s performance, noting that it has continued to pay salaries and provide public services despite the suspension of oil exports, which accounted for 60 percent of total budget revenues before they ended last fall. In the first eight months of the year, the government’s expenditures amounted to YR1.3 trillion, while public revenues reached YR600 billion. Saeed said the recent Saudi US$1.2 billion pledge represented a lifeline for the government, despite its being conditional on a further set of reforms.

Since the beginning of the year, non-oil revenues have only declined by 5 percent, which Saeed attributed to reforms his government has implemented to reduce fiscal leakage and combat smuggling. The prime minister said the government has had to spend large amounts to provide electricity this year, allocating US$229 million for payments to the sector, not including accumulated arrears. The increase in electricity consumption in Aden and the government’s inability to complete strategic projects in this sector, such as a 120-megawatt solar power generation project, has compounded the problem. Saeed added that the government has allocated US$100 million to help governorates transition to renewable energy.

In the telecommunications sector, the prime minister acknowledged the government’s failures but said the challenges could be overcome. He detailed irregularities in the granting of licenses in the sector under former president Abdo Rabbu Mansour Hadi, who purportedly granted mobile service operator Y-telecom an exceptional license to provide fourth-generation telecommunications services and to use the state’s telecommunications infrastructure without paying fees to the government. As of writing, the company has neither paid license fees owed to the government nor operated mobile services. On the contrary, the company has called on the government to refund US$149 million, which it said it paid to the then-government in Sana’a for obtaining the license when it was established in 2006.

The government would need some US$3 billion of investment in the telecommunications sector to keep pace with regional standards, such as those in the Horn of Africa, and to be able to offer a minimum level of telecommunication services. Addressing the controversial sale of Aden Net, Saeed said that it is in the country’s interest to attract foreign investment and that the Emirati company will invest US$700 million in the telecommunications sector. This joint investment will grant the government a 30 percent share of the envisioned company assets. The prime minister said the government needs to develop telecommunications infrastructure, and that it would have been better for the House of Representatives to await its response on the matter, instead of rushing to issue a report. He stated that the government had spent a full year negotiating with the Emirati company, the negotiations took place publicly, and their outcomes were submitted to the PLC, the highest state authority.

Several high-ranking public officials and MPs have since criticized Saeed’s fiery attack on the parliament and the committee report, stating that his speech did not refute the allegations of corruption committed by his government across multiple sectors.

Saudi Arabia Announces US$1.2 Billion in New Financial Support

Long-waited financial support for the government finally materialized after it reached a dire fiscal situation in June and July. On August 1, Saudi Arabia announced it would support the internationally recognized government with a US$1.2 billion grant to finance the public budget and prop up the value of the Yemeni rial. Saudi Ambassador to Yemen Mohammed al-Jaber stated that the first batch of new funds would be released for use on August 2. The next day, CBY-Aden announced that Saudi Arabia had deposited 1 billion Saudi Riyals (nearly US$267 million) into its account.

High-ranking government officials, including the CBY governor Ahmed Ghaleb and the Minister of Finance Salem bin Breik, said that funds from the new grant would be essential to compensate for the large reduction in public revenues following Houthi drone and missile attacks against infrastructure at oil ports in Shabwa and Hadramawt last fall, and to pay for vital expenditures, including public sector salaries and fuel for power stations in government-held areas. The support will also help the CBY-Aden to continue its holding of weekly foreign exchange auctions to finance the import of basic commodities and stabilize the rial.

Saudi Arabia has given substantial sums to the government in recent years. In April 2022, Riyadh and Abu Dhabi committed US$2 billion in financial support following the formation of the Presidential Leadership Council. Saudi Arabia stated it would provide US$1 billion through a deposit with the Arab Monetary Fund (AMF) to support economic reforms through 2025, and the UAE announced it would make available 1.1 billion dirhams (nearly US$300 million) to the CBY-Aden. In late February 2023, CBY-Aden head Ghaleb revealed that the government was struggling to utilize the funds, as Saudi Arabia had strengthened requirements for accessing them after earlier accusations of corruption. In 2021, the UN Panel of Experts accused the government of mismanagement of a 2018 Saudi deposit of US$2 billion for financing the import of basic food commodities. The lack of transparency created an environment conducive to embezzlement and mismanagement, though UN accusations against the CBY-Aden and Yemeni importers were ultimately withdrawn.

The new deposit appears to be completely new funds, unrelated to previous pledges. The support comes at a critical time for the government: Houthi drone attacks on oil export terminals halted hydrocarbon sales, denying the government access to what was by far its largest source of revenue. Its fiscal deficit was further compounded when Houthi authorities began pressuring commercial importers to redirect imports from Aden to Hudaydah in mid-January, costing the government 45-50 billion Yemeni rials per month in customs duties, roughly equivalent to salaries of military and security forces operating under their control. A ban on domestically produced cooking gas cylinders manufactured in Marib cut off another source of funds. By mid-summer, the government’s position had become critical, and it could no longer afford to keep the lights on. Rolling blackouts across the south fueled protests and political recrimination, and weekly FX auctions were postponed as the value of the rial plummeted.

Government Unveils Plan to Pay Public Salaries via Yemeni Banks

The government-affiliated Ministry of Finance in Aden issued Circular No. (6) of 2023 to prepare for paying public servant salaries through qualified Yemeni banks. The banks nominated by the CBY-Aden to disburse payments for central and local government employees are the National Bank of Yemen, the Cooperative and Agricultural Credit Bank (CAC Bank), Al-Kuraimi Bank for Islamic Microfinance, Tadhamon International Islamic Bank, Shamil Bank of Yemen and Bahrain, Al-Qutibi Bank for Islamic Microfinance, and the Aden Microfinance Bank. The Ministry of Finance later expanded the list of approved banks to disburse salaries to include Yemen Kuwait Bank, Bin Doul Bank for Microfinance, Hadramawt Commercial Bank, Al-Basiri Microfinance Bank, Saba Islamic Bank, and Al-Inma Bank for Islamic Microfinance.

According to the circular, banks would be selected to distribute payments based on their location and capacity to provide government employees with high-quality financial services. The circular prohibits banks from conducting transactions with money exchangers to facilitate salary payments. It also mandates that government institutions provide the Ministry of Finance with an electronic copy of their payrolls to verify that employees whose names appear are working for the public entity in question. The requirements must be met by the end of the month or August salary payments will be frozen by the ministry.

Several public sector employee unions registered their objection to the proposal. On August 20, the General Syndicates for Teaching and Educational Professions in southern governorates issued a statement demanding a retraction of the decision, saying that collecting salaries from select commercial banks would force teachers to stand in long lines. Another union, the Coordination Council of Unions and Civil Society, called on the Ministry of Finance to continue disbursing salaries through money exchange companies rather than commercial banks.

The ministry says the decision will benefit government workers and the economy at large and that it was taken to combat financial and administrative corruption in government institutions and comply with requirements set by foreign donors, including Saudi Arabia and the United Arab Emirates. It confirmed the existence of irregularities in the salary lists of civilian, military, and security personnel, which required action to mitigate manipulation of the government’s fiscal resources. The ministry has cited several other benefits of paying salaries through formal banking channels. The plan will allow employees to withdraw salaries from any ATM or bank branch rather than having to distribute salaries in cash and in person, which protects against theft. Salary payments via banks would be documented in official records, allowing for easier tracking of payments and review of cases in the event of errors or payment issues. Government employees would also be able to benefit from additional banking services, such as personal loans and credit cards.

Rial Stablizes in Govt-Held Areas

After several months of repeated depreciation, the value of new rials stabilized in August, following the arrival of the first tranche (nearly US$267 million) of a US$1.2 billion Saudi grant to support the government’s budget early in the month. New rials traded at YR1,438 per US$1 at the end of July before appreciating to YR1,389 per US$1 on August 6. Their value would decline gradually throughout the rest of the month, trading at YR1,471 per US$1 on August 28 before appreciating slightly to YR 1,463 per US$1 as of September 3.

In Houthi-controlled areas, old rials remained stable, trading around YR535 per US$1 during the month.

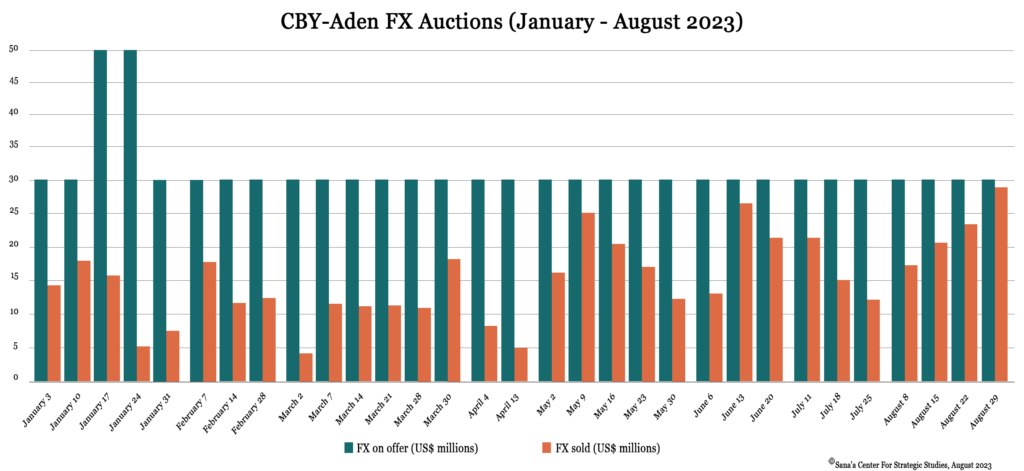

The CBY-Aden held four FX auctions during the month of August. The weekly auctions, which channel hard currency to Yemeni banks to support the import of essential commodities, had been postponed from July 25 to August 8. The central bank’s reserves were running dangerously low before the arrival of new Saudi support at the beginning of the month, and the CBY-Aden said several banks later requested a delay until the rial rebounded further and its value stabilized. The last auction of the month, held on August 29, was subscribed by 97 percent, the highest level of 2023. Since the beginning of the year, 31 FX auctions have been held, with Yemeni banks purchasing US$483 million (50 percent) of the US$970 million on offer.

Power Stations Shut Down in Aden

The General Electricity Corporation in Aden announced on August 20 that 80 percent of public and private-owned power stations had been forced to halt electricity generation due to a lack of fuel. All residential neighborhoods of the city are experiencing extended blackouts, with electricity provision declining from six to less than four hours a day. Aden experiences regular power outages, which intensify during the hot summer months when demand for energy increases, deepening the suffering of residents and restricting internal mobility. Their exacerbation has fueled widespread discontent.

The General Electricity Corporation said the government has failed to respond to repeated appeals to supply fuel. Power stations in Abyan and Lahj have been forced to cut electricity, with the General Electricity Corporation in Abyan stating that the governorate is experiencing a complete power outage due to the lack of fuel. Protests over the situation took place in Aden, Abyan, and Lahj. Angry demonstrators blocked roads and burned tires in several neighborhoods of Aden and cities in Lahj. On August 22, the General Electricity Corporation announced that 13,000 metric tons of fuel had arrived at the port of Aden, enough to supply the city’s power stations for approximately two weeks.

Aden and other governorates under government control have witnessed increasing electricity cuts since the expiration of a Saudi fuel grant in April. In November 2022, the SDRPY began supplying the government with over 1.2 million metric tons of diesel and mazut, valued at US$422 million. A new US$1.2 billion Saudi grant was announced in early August to address the government’s budget shortfalls, including the purchase of fuel to operate power stations, which is estimated to cost the government US$75-100 million per month.

Houthi Authorities Refer Power Stations to Judiciary

The Sana’a-based Ministry of Electricity and Energy announced on August 23 that it had referred 18 private power stations to the public prosecutor for violating new electricity tariffs aimed at regulating electricity prices in Houthi-controlled territory. The ministry announced reductions in electricity tariffs on June 21: the Houthi-controlled General Electricity Corporation would sell power to consumers at YR234 per kilowatt-hour, while private generator owners were mandated to sell electricity at YR248 per kilowatt-hour, effective July 1. The price cut was the second since mid-April, when the ministry reduced the kilowatt-hour price for electricity provided by the General Electricity Corporation and private generator owners to YR270 and YR284, respectively.

The tariff reduction came in response to declines in the price of diesel and mazut fuel derivatives used to fuel power stations. A series of campaigns to enforce the electricity tariff have been launched in recent months, leading to the closure of several commercial power stations and the replacement of non-compliant power stations with service from the public utility.

CBY-Aden Governor Details Govt’s Economic Situation

The head of the government-run CBY-Aden, Ahmed Ghaleb, detailed the government’s current financial state and recent challenges it has faced in an interview with local media. Topics covered in the interview included volatility in the value of new rials in recent months, the utilization of foreign financial support, and controversy surrounding the government’s plan to raise the customs exchange rate. Ghaleb acknowledged that the government is running a large fiscal deficit, with total revenues amounting to less than 40 percent of the public sector payroll. He also noted that the cost to purchase fuel to provide electricity in government-held areas exceeds US$95 million per month.

There are few options available to increase government revenues in the short term. The CBY-Aden is facing difficulties repaying debts, which complicates efforts to obtain external loans or assistance, except for funds channeled from the World Bank and the International Monetary Fund (IMF). Ghaleb said the CBY-Aden has approximately US$110 million available in the form of IMF Special Drawing Rights (SDRs), but there are currently no plans to tap this revenue source, as the government prefers to replenish its foreign currency by resuming oil and gas exports.

On the issue of the planned customs exchange rate hike announced in January, which has garnered public opposition and led to moves by Houthi authorities to entice importers to redirect shipping to Houthi-held ports, Ghaleb confirmed that the government was pressured by foreign donors to raise the rate as a requirement for obtaining external grants and deposits. He argued that the prevailing customs exchange rate, which is below the exchange rate for new rials in the parallel market, is improper policy, as it deprives the government of 50 percent of custom tariffs it could collect, and favors commercial importers over consumers. This is due to the fact that commercial traders tend to price their goods at YR1500 relative to the US dollar, plus a safety margin, to counter fluctuations driven by higher uncertainty in the commodity market.

Government and UN Agree Plan to Reduce Shipping Insurance Costs

The government inked a memorandum of understanding (MoU) with the United Nations Development Programme (UNDP) aimed at reducing maritime shipping insurance costs for ships entering government-controlled seaports. Signed on August 13 by Minister of Transport Abdelsalam Humaid and UNDP Regional Director for Arab States Abdullah al-Dardari, the MoU lays out a plan to deposit US$50 million with the Insurance Protection Club in London. A final agreement is expected to be signed in September.

According to Humaid, the cost of shipping insurance for vessels heading to Yemeni ports has increased 16-fold since the onset of the conflict, which has led to the redirection of commercial shipping to other seaports in the region, including Jeddah in Saudi Arabia, Salalah in Oman, and the port of Djibouti. In 2021, the UNDP estimated shipping insurance premiums exceeded more than US$200 million annually. Increased insurance costs have raised transport and logistics costs across supply chains in Yemen. Costs levied on international suppliers and importers are ultimately absorbed by Yemenis, who pay higher prices for imported food commodities.

Houthis Increase Tariffs on Goods From Govt-Controlled Areas

On August 6, the Houthi-affiliated Ministry of Finance increased taxes and customs fees on goods entering Houthi-controlled territory from government-held areas. According to the decree, the new tax will be set at 100 percent of the total customs value of all imports, up from the 50 percent tax currently collected at Houthi-controlled border crossings. The increase took effect on August 8 and will affect all traders importing goods through government-held territory.

The move comes as part of an ongoing struggle between Houthi authorities and the government over customs revenue, with the former pressuring importers to redirect shipments to the port of Hudaydah. The new fees will complicate the movement of goods across zones of control and ultimately lead to increases in commodity prices. The Houthis have moved to collect such tariffs before. In 2018, when the government reduced customs tariffs by 30 percent on imports, the Houthi authorities acted to erase the reduction by collecting the 30 percent difference. In March 2021, the Houthi authorities increased customs fees from 30 to 50 percent on commercial imports from government-held areas.