On April 7, Saudi Arabia and the UAE announced US$1 billion each in new financial support for the Central Bank of Yemen in Aden, with Riyadh pledging a further US$1 billion to support development projects and fund fuel imports in government-held areas. The announcement was among the outcomes of the Riyadh consultations, and reaction in the Yemeni currency market was immediate and dramatic.

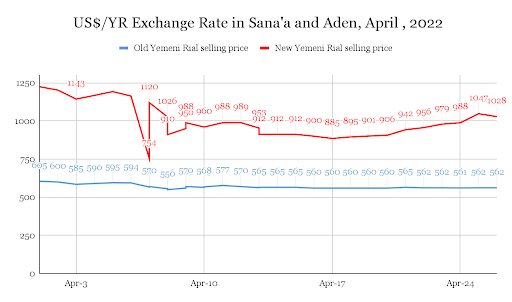

In Aden, where ‘new’ rials — issued by the CBY-Aden since 2017 — are predominately in circulation, wild swings in the exchange rate followed the announcement. Within the first day, the currency regained as much as 40 percent in value relative to the United States dollar before rapidly shedding much of these gains. Anecdotal evidence suggests that currency speculation magnified this volatility, with many exchange outlets setting their sell price for foreign currency far higher than their buy price and often refusing to sell foreign currency at all during this period – a strong indication that they expected the rial’s value to drop again, which would allow them to profit from arbitrage. This extreme volatility subsided somewhat in the days following. In Aden, the rial began April valued at close to YR1250 per US$1, but strengthened to YR885 by April 17, before losing ground again and closing the month trading around YR1,000 per US$1

In Sana’a, where the Houthi authorities have enforced a strict ban on the circulation of new rials and heavily regulated the exchange rate for ‘old’ rials, the currency volatility was far less pronounced. However, that the exchange rate shifted at all was significant, as old rials have been trading in a narrow band around YR600 per US$1 since November 2019. In the day following the Saudi and Emirati announcement, old rials gained as much as 16 percent before retreating slightly, and by mid-month the exchange rate had stabilized in a narrow band between YR560 and YR565 per US$1.

Saudi financial support for the CBY-Aden in 2018, totaling more than $2.2 billion, similarly led to exchange rate recovery and stability and had broad impacts across the economy in terms of lowering commodity prices, which in turn had broadly positive implications for Yemen’s dire humanitarian situation. The CBY-Aden had expended most of this support by early 2020, following which the rial’s value in government-controlled areas entered a period of steady decline interspersed with periods of high volatility, which adversely affected not just the humanitarian situation, but political and social stability.

The rial’s rising value in April reflected that currency traders anticipate that the CBY-Aden will shortly regain the ability to make large interventions in the foreign currency market, which would ease downward pressure on the value of the rial. Notably, however, the relatively small currency auctions the CBY-Aden held for commercial banks on April 5, 12 and 18, using the Refinitiv platform, were heavily undersubscribed, with the central bank selling roughly 21 percent of the US$60 million on offer. Banks’ reluctance to buy foreign currency in April was likely due to the large exchange rate fluctuations. For instance, during the latter two auctions, the announced price for a dollar, YR950, was close to or higher than the price in the parallel market.

Saudi and Emirati financial support comes as the international relief effort for Yemen is facing a massive funding shortfall for 2022 – it was less than 40 percent funded at the time of the announcement – which has led to widespread cuts in food and aid deliveries.

Truce Eases Fuel Supply Crisis, Retail Prices Increase

UN Special Envoy for Yemen Hans Grundberg’s announcement of a two-month truce on April 2 contained terms for allowing 18 fuel ships to dock and offload at the Houthi-held port of Hudaydah. Houthi authorities had blamed the Yemeni government policy of redirecting fuel shipments through government-held ports for a fuel crisis that had persisted since January. Following the announcement, fuel became widely available again at official gas stations, with the Yemeni government confirming seven fuel ships offloaded at Hudaydah in April.

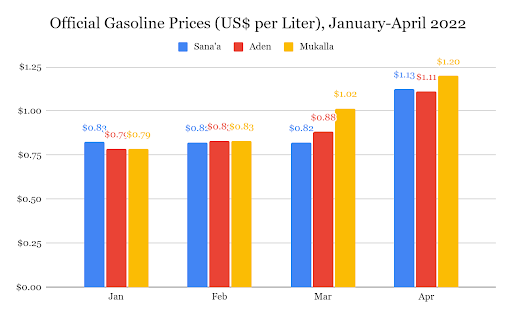

Despite the increased fuel supply, Houthi authorities in Sana’a upped the official price of gasoline 27.3 percent on April 10, from YR495 to YR630 per liter, while the same quantity on the black market was selling for YR850 (all prices in old rials). Similarly, the Houthi-run Ministry of Electricity raised commercial rates roughly 28 percent on April 9, from YR300 to YR420 per kilowatt-hour. At a press conference announcing the price increase, executive manager of the Houthi-controlled Yemen Petroleum Company (YPC) in Sana’a, Ammar al-Adhrai, justified the move as reflecting the “actual cost” of the fuel. However, given that the rial appreciated roughly 7 percent in April, the effective price increase and commensurate revenue for the Houthi authorities was slightly higher.

By contrast, authorities in areas under the nominal control of the internationally recognized government moved to decrease the price of gasoline in April. The YPC in Aden announced a 16 percent drop, from YR1,110 to YR930, while in Hadramawt authorities decreased prices almost 15.5 percent, from YR1,278 to YR1,000 per liter (all prices in new rials). Both attributed the moves as being in response to April’s exchange rate improvement, though the price changes were not completely in line with the rial’s changing value. When measured in US dollars, however, consumers in government held areas were paying roughly 5 percent more for gasoline at the end of April than they were at the beginning.

Shortages of Diesel and Cooking Gas Continue in Houthi Controlled-Areas

Despite the YPC in Sana’a announcing the end of the fuel crisis in April, shortages of diesel and cooking gas continued at official outlets. Both were generally more available on the black market, but at a significant markup. Officially, the price of diesel stood at YR870 per liter in April, though those seeking to actually purchase it paid between YR1,000 and YR1,200 on the black market (all prices in old rials). The price per cylinder of cooking gas on the black market decreased in April, however, to YR13,000 from YR20,000 per cylinder in March.

By contrast, in both Aden and Hadramawt authorities decreased the official price roughly 13 percent, from YR1,150 to YR1,000 per liter (prices in new rials).

Yemeni Government Announces New Budget

The Yemeni government approved the public budget for 2022 in the latter half of April. Total estimated public spending in the budget is YR3.65 trillion and estimated revenues stand at YR3.24 trillion, entailing an estimated budget deficit of YR410 billion. Importantly, the budget’s revenue estimates assume the government will resume large-scale oil and gas exports this year, which is far from certain.

Other Economic Developments in Brief:

- April 7: The International Organization for Migration (IOM) stated that in March 2022 it had recorded 7,344 Yemeni expatriates returning from Saudi Arabia without travel documents and 263 returning with travel documents. In total, the IOM recorded some 18,000 returnees from Saudi Arabia in the first three months of 2022.

- April 19: The CBY-Aden Governor Ahmed Ghaleb and central bank senior staff met with representatives from the International Monetary Fund and the World Bank. According to a CBY-Aden press release, topics discussed at the meeting included Yemen’s general economic situation, the impact of the Russian invasion of Ukraine on commodity and fuel prices, technical support for the CBY-Aden to optimize its use of the recent Saudi and Emirati financial support and structural reforms and steps to achieve and maintain financial stability.

- April 19: The head of the Presidential Leadership Council (PLC) Rashad al-Alimi confirmed the council’s commitment to addressing key economic issues, such as salary payments for public service, stabilizing the national currency and optimizing public revenue collection.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية