Fuel Crisis Erupts Nationwide

In January and February, a fuel crisis erupted in both Houthi- and government-controlled areas of Yemen. In Houthi-controlled areas, the crisis emerged in mid-January, intensified thereafter and continues at the time of writing. Thousands of cars line up, sometimes for days, in front of the few commercial gas stations that remain open, while on the black market, where fuel remains plentiful, sellers jack up prices. By the end of February, the price of a 20-liter tank of gasoline reached YR40,000 on the black market, more than four times the price at commercial fuel stations, set at YR9,500. The price of a 20-liter tank of cooking gas increased to YR20,000 on the black market in Houthi-controlled areas, almost four times higher than the official price and twice the average black market price in 2021. In response, massive demonstrations, permitted by Houthi authorities, took place in Sana’a and other Houthi-controlled cities.. Houthi authorities have criticized the Saudi-led coalition for the prevailing fuel shortage crisis, decrying the blockade that has kept fuel shipments from entering the port city of Hudaydah, and condemning the silence of the international community, particularly the United Nations.

Though the internationally recognized government has imposed restrictive measures regulating the import of fuel into Houthi-controlled areas, the shortages are partly due to manipulation and illegal exploitation by the Houthi movement, aimed at increasing international pressure on the government and coalition to lift their naval and air blockade. Media sources have leaked images showing hundreds of fuel trucks in long queues in the deserts of Al-Jawf governorate, prevented from entering Sana’a governorate by the Houthis. When interviewed by local media, Houthi officials claimed that convoys from government-held territory contain fuel that is of poor quality and fails to comply with safety guidelines.

In addition, electricity stations in Houthi-controlled areas introduced two separate price hikes in January. Private electricity dealers raised prices from YR300 to YR350 per kilowatt, and later to YR460 in response to fuel shortages.

The crisis comes amid a new phase of escalation between the warring parties over the supply and sale of fuel throughout the country. In late December, the internationally recognized government issued Ministerial Decree No. (30) for 2021, which limits the distribution, marketing and sale of oil derivatives to the government-run Yemen Petroleum Company (YPC). The decree’s second article stipulates that the YPC will purchase oil derivatives from qualified and approved companies and traders to cover the needs of the local market; the third article establishes an implementation mechanism, under which the YPC will coordinate with the Central Bank in Aden, the Aden Refinery Company (ARC) and the Technical Office of the Supreme Economic Council to shore up foreign currency reserves to secure the import of fuel derivatives.

Following the establishment of the new mechanism, the interim capital of Aden and other cities under the nominal control of the government witnessed a severe fuel shortage and price hikes. The crisis was partly attributed to an ongoing strike at the Aden Refinery Company Syndicate. On January 6, the ARC Syndicate released a statement and organized a comprehensive work stoppage in Aden, protesting the decree granting the YPC full authorization to regulate imports and distribution, and seeking to restore the refinery’s role as the established authority for regulating fuel imports and distribution. The Syndicate also demanded the payment of overdue financial allowances and the cancellation of a government decision to appoint a new Executive Director.

The strike was suspended on January 27 before resuming in early March, causing a near complete closure of fuel stations in Aden and other southern governorates. Workers at the ARC have threatened to escalate the strike until their demands are met. As a result of the government’s inability to replenish depleted fuel reserves, the black market in Aden has proliferated, with a 20-liter tank of gasoline selling at YR40,000, equivalent to approximately US$36. Between January and February, the Aden Oil Company issued a number of circulars raising the price of fuel derivatives. In mid-January, it set the price of a 20-liter tank of gasoline at YR17,700, up from YR13,200, attributing the move to the increase in global fuel prices and depreciation of the rial . A month later, the company increased the price to YR18,960, or YR948 per one liter.

The internationally recognized government, through Ministerial Decree No. (49) of 2019, had previously named the Aden Refinery Company the sole entity authorized to import and distribute fuel derivatives across the country. The ARC operated in cooperation with the government-led Economic Committee, which handled import and application documents to ensure compliance. At the time, the YPC rejected the decree, considering it a violation of laws regulating its mandate and the mandate of the ARC, which stipulate that the former has the prerogative to market oil, while the latter is responsible for the refinement and import of fuel derivatives.

The fuel crisis has had knock-on effects across the country, disrupting electricity supplies, halting water pumps and stranding people in critical need of medical care. The provision of basic services has been adversely impacted as hospitals, highly dependent on electricity-fueled generators, cannot run at full capacity. Households have been financially strained, many obtain water via costly pumps and trucks, whose prices have now risen. Public transportation has been largely unavailable and its cost has skyrocketed, driving up the prices of vegetables and locally produced crops and making mobility highly challenging, impeding many households’ ability to earn income.

Russian Invasion of Ukraine Impacts Yemen: Wheat, Fuel and Aid

On February 24, Russian forces invaded Ukraine. Western countries responded with the most extensive economic sanctions in modern history against Moscow and a massive multifaceted campaign in support of Kyiv. Widespread disruptions to global financial networks and supply chains have ensued. In Yemen, the likely immediate impacts relate to the price of wheat and fuel. A significant redirection of international aid away from Yemen also appears likely.

Russia and Ukraine are the world’s top and fifth largest wheat exporters, respectively, accounting for 17.6 percent and 8 percent of global exports. Global wheat prices, which had already increased more than 50 percent in the six months preceding the invasion, surged almost 34 percent between February 24 and March 7, before receding slightly in the days following.

Wheat is Yemen’s single largest food import, with wheat grain and flour accounting for nearly 70 percent of the country’s total food imports. From late December 2021 to the end of February 2022, Ukraine was Yemen’s largest source of imported wheat, accounting for roughly 40 percent, or slightly more than 755,000 metric tons, during that period. While Yemeni importers will likely be able to source wheat from new suppliers relatively quickly, the rapid increase in cost will have major implications for living standards and the humanitarian situation, especially within the context of the Yemeni rial’s dramatic depreciation.

The surge in global fuel prices will increase the transportation costs of most goods, impacting commodity prices in Yemen across the board. Oil rose more than 40 percent in the six months preceding the Russian invasion and jumped almost another 30 percent between February 24 and March 8. While the government will benefit from its crude oil exports being priced higher, any gains will be dwarfed by the increased cost of fuel imports. In September 2021, CBY-Aden estimated fuel imports and oil exports for 2021 at US$2.69 billion and US$1.26 billion, respectively. Increased demand for US dollars to purchase these imports will put further downward pressure on the value of the Yemeni rial.

Aid for Yemen, which dropped substantially during the COVID-19 pandemic as donor countries redirected resources to address related financial pressures, is expected to decrease further in light of the massive western effort to support Ukraine. Various donors are already in the process of redrawing their aid budgets. The Yemen Humanitarian Response Plan was only 58 percent funded in 2021. In an address to the UN Security Council on February 15, UN humanitarian chief Martin Griffiths said millions face a “death sentence” if funding levels are not restored. Noting that nearly two thirds of UN programs had been dramatically scaled back or closed, he added: “We have never before contemplated giving millions of hungry people no food at all.”

UN Says Govt, Houthis, ‘Agreed in Principle’ to Resolve FSO Safer Crisis

On February 5, UN Resident and Humanitarian Coordinator for Yemen David Gressly announced that following “constructive meetings” with senior officials from the government and Houthi authorities, the parties had “agreed in principle” on how to address the catastrophic environmental threat posed by the FSO Safer. The decrepit, 45-year-old single-hulled oil tanker moored off Hudaydah governorate with more than one million barrels of oil aboard has received almost no maintenance in more than seven years. Without a functioning ventilation system, explosive gasses have been building in the holding tanks. The UN-coordinated proposal would see the oil transferred to another ship. However, the Houthis have established a pattern over the last few years of agreeing in principle to UN plans to address the ship, only to renege on their commitment. According to Gressly, “We need to translate the good will being shown by all interlocutors into action as soon as possible.”

Paris Club Suspends Yemen’s Debt Payments

In mid-January, the Paris Club of creditor countries announced it had extended its suspension of Yemen’s debt, meaning the country would not be liable for debt servicing payments that had been due at the end of 2021. As of 2020, Yemen owed US$1.68 billion to members of the Paris Club. The announcement stated that the Yemeni government had “committed to devote the resources freed by this initiative to increase spending in order to mitigate the health, economic and social impact of the COVID-19 crisis,” and to seek debt relief from other international creditors.

Hadramawt Oil Production: Governor Halts Exports, Canadian Company Pauses Operations

On January 25, Hadramawt Governor Faraj al-Bahsani announced that he was threatening to halt oil exports from the governorate. The two-page memorandum Al-Bahsani directed to the prime minister, Maeen Abdelmalek Saeed, included a number of popular demands, including raising Hadramawt’s share of oil sales from 20% to 30%; promptly implementing a 100-mega power plant project; completing maintenance of Al-Rayyan power station; and approving the recruitment and financial allocation for an additional 10,000 soldiers to the Second Military Zone as well as payment of its past-due salaries. Al-Bahsani has repeatedly used pressure tactics during his years-long dispute with the government over the distribution of oil revenues.

On January 30, Reuters reported that Canada’s Calvalley petroleum company had suspended operations in Hadramawt governorate due to deteriorating security conditions. Calvalley notified staff and contractors on January 17 of the suspension of operations in block 9, “citing production and transportation disruption since Dec. 14 from checkpoints outside the company’s gate and road blocks.” For several months, protestors in Hadramawt have held demonstrations over deteriorating economic conditions. In early January, in neighboring Shabwa governorate, reports emerged of multiple explosions along pipelines leading to the Al-Nushayma export terminal.

Further Depreciation of the Yemeni Rial in Govt-Held Areas

The new Yemeni rial notes witnessed historic depreciation over the course of 2021, losing close to two-thirds of its value and falling to YR1,726 to the dollar. President Hadi responded in late December by replacing the board of governors at the Central Bank of Yemen in Aden, in an attempt to regain the trust of foreign backers and halt the devaluation of the rial. The previous management was accused by the UN Panel of Experts of colluding to embezzle nearly half a billion dollars from a US$2 billion Saudi deposit. The rial began recovering in the last month of 2021, rebounding to YR781 to the dollar by December 27.

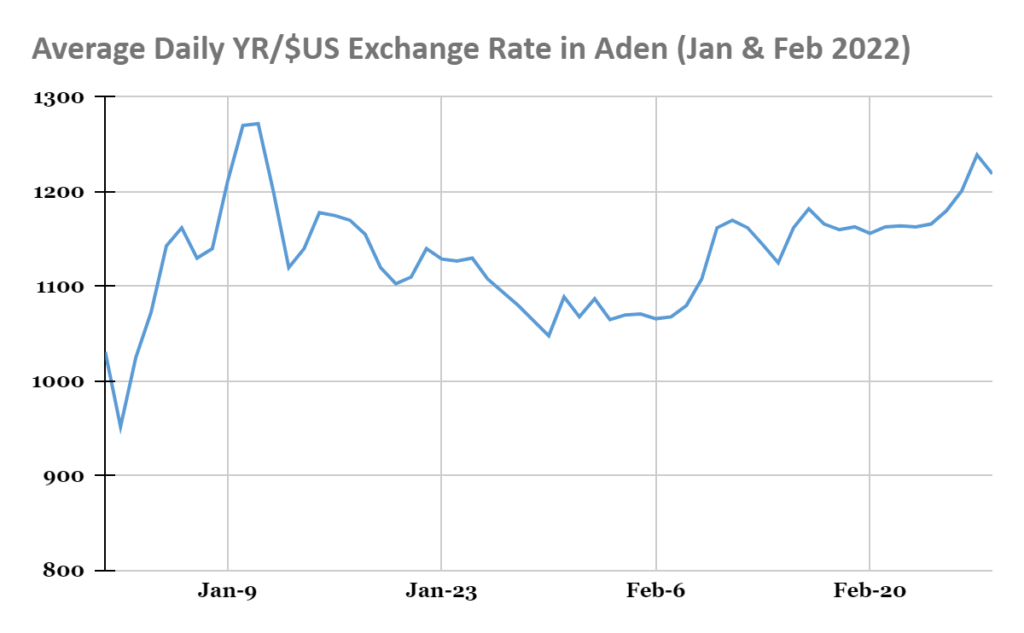

The late year stabilization of the rial’s value was fleeting. By January 2, it was trading at roughly YR1,210 to the dollar in Aden’s parallel exchange market. In response, the CBY-Aden continues to intervene through foreign exchange auction trading, but the impact so far has been negligible. The rial has depreciated steadily, to YR1,2oo per dollar on February 27, after minor appreciation in late January and early February. In contrast, old Yemeni rial banknotes have maintained their value in Houthi-controlled areas, trading between YR604 – YR600 to the dollar during January and February.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية