Economic developments in September centered on the fuel crisis in Houthi-held areas and the continued delay of the Saudi-Emirati economic support package to the government. In early September, Houthi authorities initiated an emergency plan in areas under their control amid reportedly severe fuel shortages. Houthi authorities accused the coalition of being behind the shortage, citing a backup of fuel ships outside the port of Hudaydah, while the government accused the Houthis of manufacturing the crisis by preventing fuel merchants from submitting agreed-upon import documentation. The fuel crisis was ultimately averted in mid-September when the government allowed eight fuel ships into Hudaydah.

Although new Yemeni rials remained relatively stable in government-held areas through most of September, the threat of renewed exchange rate instability persisted, with Riyadh and Abu Dhabi continuing to withhold promised financial support for the Central Bank of Yemen in Aden (CBY-Aden). At the end of September, Saudi Arabia and the Yemeni government reached an agreement to provide the latter with a new oil derivatives grant, worth US$200 million, to support power plant operations in areas of Yemen under the government’s control.

Renewed Fuel Crisis Claimed in Houthi-Held Areas

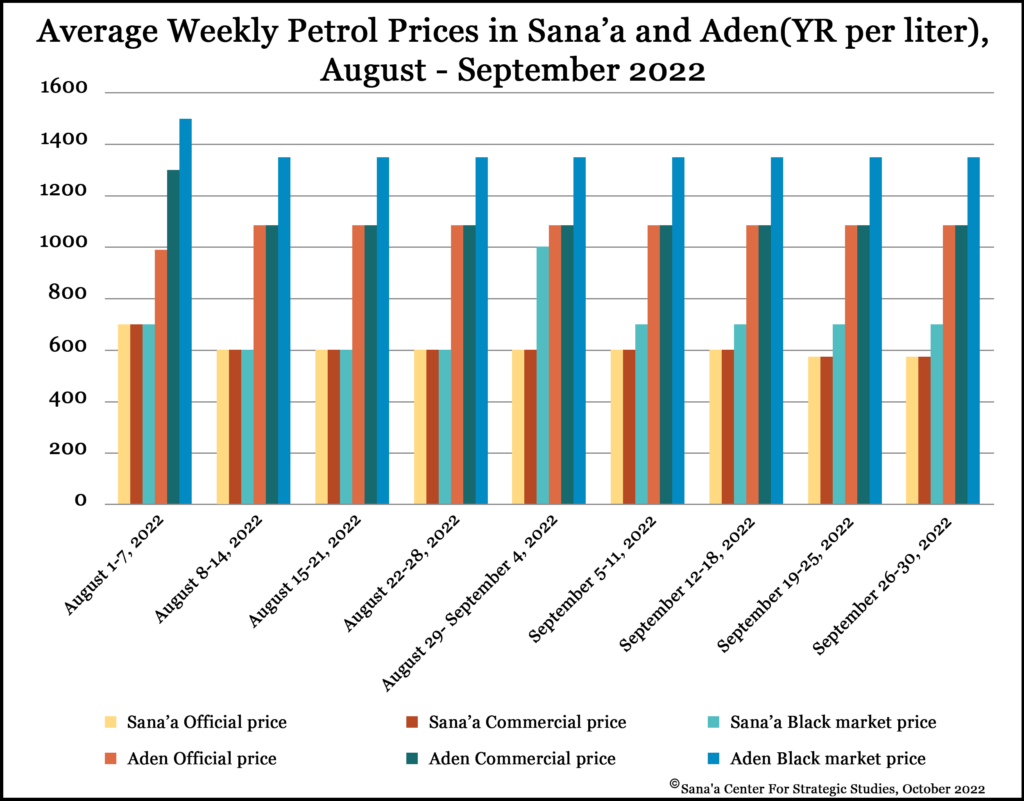

A fuel crisis developed in Houthi-held areas in September. On September 4, the Yemen Petroleum Company in Sana’a announced the adoption of an emergency plan for distributing oil derivatives after severe shortages resulted in most state and commercial fuel stations closing their doors. Due to the reduced supply, the black market initially exploded: the price of one liter of petrol increased by 67 percent, from YR600 to YR1000 per liter, while the price of diesel increased by 16 percent, from YR690 to YR800. Under the emergency plan, 17 fuel stations would operate to meet local demands, six of which would be located in Sana’a and its suburbs. The plan would limit the fuel a driver could purchase to 40 liters, with an automated system installed to ensure compliance.

On September 2, the YPC accused the coalition of causing shortages by preventing tankers from offloading at the port of Hudaydah. In response, the government accused Houthi authorities of having prevented fuel merchants in areas under their control from submitting proper documentation to the UN-facilitated Hudaydah import process since early August, causing the backup. From September 10-11, the government permitted eight fuel ships to enter Hudaydah port, reportedly outside of the established procedures, after which Houthi authorities rescinded their emergency fuel distribution plan.

New Saudi Fuel Grant Announced

On September 29, Saudi Arabia and the Yemeni government reached an agreement to provide the latter with a new oil derivatives grant, worth US$200 million, to support power plant operations in areas under the government’s control. The agreement, between the Ministry of Electricity and Energy and the Saudi Development and Reconstruction Program for Yemen (SDRPY), is for a total of 250,000 metric tons of fuel derivatives. The announcement of the agreement stated the SDRPY has already implemented procedures for the first delivery of US$30 million worth of fuel to operate more than 70 power plants.

The new grant is essentially a continuation of a previous year-long agreement, signed in April 2021, which allocated US$422 million to the government to support the purchase of some 1.26 million metric tons of fuel derivatives at the price prevailing in the Saudi domestic market. This was intended to help operate more than 80 power stations in Yemen. However, the government was only able to utilize 61 percent of these funds by the time the grant period ended in April 2022. The SDRPY subsequently suspended the fuel derivatives grant, claiming that poor governance, mismanagement, and corruption were preventing its effective utilization, and that governorate authorities benefiting from the grant were failing to meet their financial obligations to pay for the electricity they received.

Currency

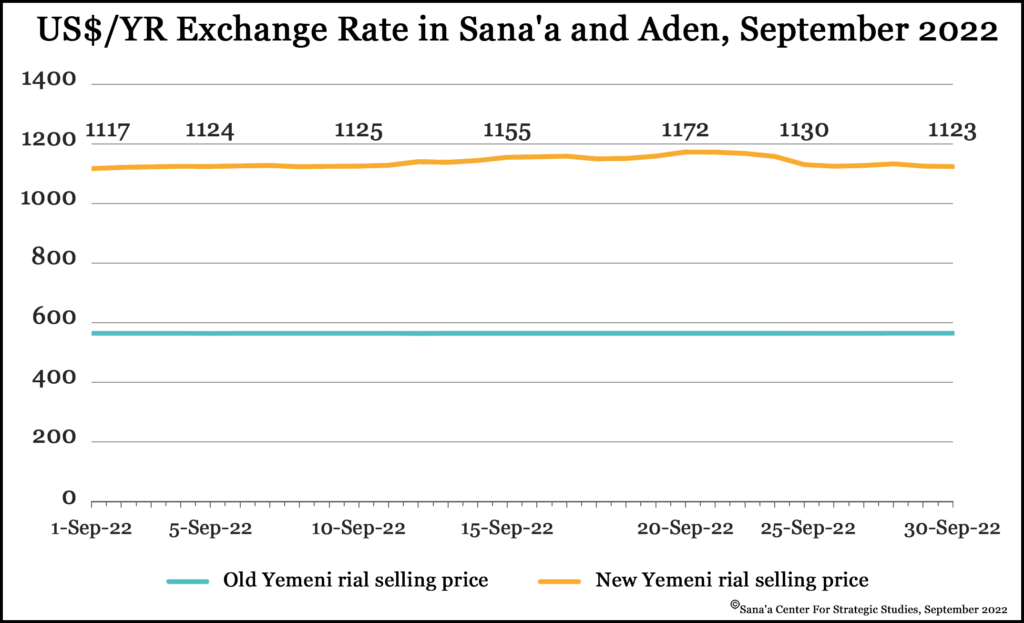

The exchange rate of new Yemeni rial banknotes remained relatively stable in government-held areas through most of September. Between September 1 and September 27, the new rial experienced slight fluctuations and depreciated by 2.3 percent, from YR1,114 at the end of August to YR1,140 on September 27. In Houthi-controlled areas, old rial banknotes remained stable, trading within a narrow band around YR560 per US$1.

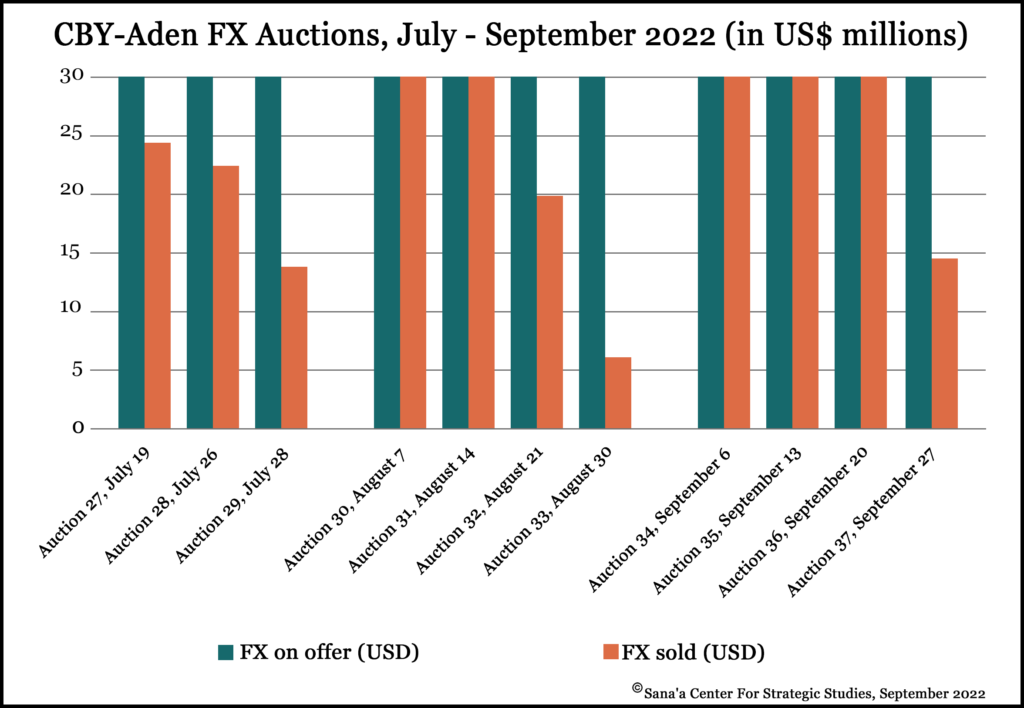

However, the threat of renewed exchange rate instability persisted, with Riyadh and Abu Dhabi continuing to withhold promised financial support to the CBY-Aden. Since early April, the UAE and Saudi Arabia have requested governance and institutional reforms as prerequisites for the delivery of US$2 billion in financial support to replenish the CBY-Aden’s foreign currency (FX) reserves. Abu Dhabi has reportedly agreed in principle to deposit its share of the support, US$1 billion, into a CBY-Aden account in the UAE, while Riyadh is insisting that its share be deposited into the Arab Fund for Economic and Social Development, with the CBY-Aden required to meet as-yet undisclosed terms in order to access the funds. With the FX reserves it has remaining, the CBY-Aden continued FX auctions for commercial banks, the sales from which are earmarked to finance basic commodity imports.

On September 14, the government announced that it had agreed to pay US$30 million in debt installments owed to the Arab Fund for Economic and Social Development. A cabinet committee, headed by the minister for Planning and International Cooperation, is seeking to negotiate with external creditors about the possibility of forgiving, reducing, or rescheduling Yemen’s foreign debt, given the country’s poor financial situation. Between October 2-5, a government delegation composed of representatives from the CBY-Aden, the Ministry of Finance, and the Ministry of Planning and International Cooperation, and headed by CBY-Aden governor Ahmed Ahmed Ghaleb, met with IMF officials at the fund’s mission in Amman. Meetings covered government fiscal and monetary policies, prevailing economic conditions and challenges, and reforms to improve macroeconomic stability. The International Monetary Fund (IMF) and the government reportedly reached an agreement to release financial support that was allocated to the government last year. In August 2021, the IMF announced the equivalent of US$650 million in financial support for the government in the form of IMF-maintained units of account known as Special Drawing Rights (SDRs), but to date the CBY-Aden has been unable to access the funds. The agreement will allow for half of these funds to be released. If they do materialize, it would provide a substantial boost to the CBY-Aden’s FX reserves and almost certainly strengthen the exchange rate for new rial banknotes.

The CBY-Aden held four foreign currency auctions in September for banks to bid. The first three auctions, the 34th, 35th, and 36th of 2022, each had US$30 million on offer and were fully subscribed. The September 27 auction saw less than half the FX on offer sold. With dwindling FX reserves, the CBY-Aden has largely financed these auctions through receipts from the government’s limited hydrocarbon exports, as well as irregular Saudi support for government military and security salaries. While Riyadh has committed roughly 300 million Saudi riyals a month (almost US$80 million) for these salaries, the expected payments are occasionally canceled or delayed, putting increased pressure on the CBY-Aden’s FX stocks.

Houthis Draft Law Seeks to Ban Usury

In response to directives from Houthi leader Abdulmalek al-Houthi to Islamicize Yemen’s economy, on September 5 the Sana’a-based Council of Ministers approved a draft law banning “usurious transactions.” The first article of the law prohibits all forms of interest payments, whether in civil or commercial transactions. This includes interest payments associated with treasury bills and government bonds, which are illegal debt instruments under certain Islamic regulations. The council referred the draft law to the Houthi-aligned Higher Economic Committee for study, with final approval required from the House of Representatives. According to media sources, following its initial announcement, the Council of Ministers withdrew its original draft and re-submitted another on September 17, with an explanatory memorandum stipulating that the law must pass, given that the prohibition of usury is a divine edict.

In the runup to the announcement, the Yemen Banks Association (YBA) sent a private letter to the governor of the CBY-Sana’a on August 17, questioning the Islamic jurisprudence upon which the law was based and warning against massive financial fallout should it be enacted. The YBA also noted that the implementation of similar laws in Libya, Iran, Pakistan, and Sudan had been postponed once authorities realized that banning banks from charging interest brought significant challenges. The YBA said that canceling all previous interest dues – including those which the government owes to banks on public debt instruments and which banks owe to customers on their deposits – would cause financial losses across the board, and set off an economic calamity equivalent to the suspension of civil servant salaries.

Telecommunications

On September 24, the Sana’a-based Public Telecommunications Corporation (PTC), also Known as Yemeni Telecom, officially announced the launch of the “Yemen 4G” wireless internet service. The new system supposedly uses fourth-generation mobile telecommunications networks to allow data transmission of up to 100 megabytes per second. According to the announcement, the service will initially cover 11 governorates under Houthi control. It is expected to generate substantial revenue for Houthi authorities, given that it would reportedly cover many areas where there is currently little or no internet service.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية