Long-waited financial support for the government finally materialized after it reached a dire fiscal situation in June and July. On August 1, Saudi Arabia announced it would support the internationally recognized government with a US$1.2 billion grant to finance the public budget and prop up the value of the Yemeni rial. Saudi Ambassador to Yemen Mohammed al-Jaber stated that the first batch of new funds would be released for use on August 2. The next day, the Central Bank of Yemen in Aden (CBY-Aden) announced that Saudi Arabia had deposited 1 billion Saudi Riyals (nearly US$267 million) into its account.

High-ranking government officials, including the CBY governor Ahmed Ghaleb and the Minister of Finance Salem bin Breik, said that funds from the new grant would be essential to compensate for the large reduction in public revenues following Houthi drone and missile attacks against infrastructure at oil ports in Shabwa and Hadramawt last fall, and to pay for vital expenditures, including public sector salaries and fuel for power stations in government-held areas. The support will also help the CBY-Aden to continue its holding of weekly foreign exchange auctions to finance the import of basic commodities and stabilize the rial.

Saudi Arabia has given substantial sums to the government in recent years. In April 2022, Riyadh and Abu Dhabi committed US$2 billion in financial support following the formation of the Presidential Leadership Council. Saudi Arabia stated it would provide US$1 billion through a deposit with the Arab Monetary Fund (AMF) to support economic reforms through 2025, and the UAE announced it would make available 1.1 billion dirhams (nearly US$300 million) to the CBY-Aden. In late February 2023, CBY-Aden head Ghaleb revealed that the government was struggling to utilize the funds, as Saudi Arabia had strengthened requirements for accessing them after earlier accusations of corruption. In 2021, the UN Panel of Experts accused the government of mismanagement of a 2018 Saudi deposit of US$2 billion for financing the import of basic food commodities. The lack of transparency created an environment conducive to embezzlement and mismanagement, though UN accusations against the CBY-Aden and Yemeni importers were ultimately withdrawn.

The new deposit appears to be completely new funds, unrelated to previous pledges. The support comes at a critical time for the government: Houthi drone attacks on oil export terminals halted hydrocarbon sales, denying the government access to what was by far its largest source of revenue. Its fiscal deficit was further compounded when Houthi authorities began pressuring commercial importers to redirect imports from Aden to Hudaydah in mid-January, costing the government 45-50 billion Yemeni rials per month in customs duties, roughly equivalent to salaries of military and security forces operating under their control. A ban on domestically produced cooking gas cylinders manufactured in Marib cut off another source of funds. By mid-summer, the government’s position had become critical, and it could no longer afford to keep the lights on. Rolling blackouts across the south fueled protests and political recrimination, and weekly FX auctions were postponed as the value of the rial plummeted.

CBY-Aden Liquidate Second Batch of IMF SDR Allocation

On June 17, the CBY-Aden announced that it was able to liquidate the second batch of International Monetary Fund (IMF) Special Drawing Rights and deposit the funds into the bank’s account with the US Federal Reserve in New York. According to the CBY-Aden, the support will be used for its weekly foreign currency auctions, which help finance the import of basic commodities. The bank noted the assistance of France, the International Monetary Fund (IMF), and the US Federal Bank in the process. The second batch is part of US$665 million in SDR support for Yemen that the IMF announced in August of 2021.

Riyadh Announces Massive Development Package for Hadramawt

The Saudi government announced a comprehensive development plan for Hadramawt on June 26, pledging hundreds of millions of dollars to the southeastern governorate, which has become a primary area of strategic competition between the kingdom and the United Arab Emirates. The funding, channeled via the Saudi Development and Reconstruction Program for Yemen (SDRPY), earmarks 1.2 billion Saudi riyals (US$320 million) for 20 projects in the health, education, transportation, and energy sectors. A ceremony laying out the foundations of several projects was attended by Presidential Leadership Council (PLC) chief Rashad al-Alimi, who visited Hadramawt for the first time since taking office in April 2022, along with Hadramawt Governor Mabkhout bin Madi and SDRPY official Hassan al-Attas. In the healthcare sector, the package includes the establishment and equipping of a hospital and cancer center at Hadramawt University, as well as equipment and fuel for Seyoun General Hospital. A gas separation and treatment facility is planned, along with a 100-megawatt power plant in Seyoun. The proposed projects also include the construction of new roads in Mukalla, the rehabilitation of the Al-Wadea border crossing with Saudi Arabia, and the rehabilitation of Shibam, a UNESCO World Heritage site. Another aspect of the plan focuses on enhancing water infrastructure in the governorate and support for the fisheries sector through the provision of motorized fishing boats.

Rial Plummets Before Rebounding After Saudi Grant Announced

The Yemeni rial (YR) experienced rapid fluctuation in government-controlled areas over most of the reporting period. The sale price of new rials depreciated by almost 12 percent, from YR1,316 per US$1 on June 1 to as low as YR1,474 on July 12. At its nadir, the price fluctuated almost hourly, and some money exchange outlets sold the US dollar at close to YR1,500. This was the third cycle of depreciation in the past three months: the currency dropped in the first half of May, falling 7 percent relative to the US dollar, and declined by almost 3 percent in the first half of June. From June 21-27, the new rial remained relatively stable, depreciating by one percent from YR1,360 to YR1,378 per US$1, coming after the CBY-Aden announced it was able to liquidate the second batch of the IMF Special Drawing Rights in mid-June and would use the new funds to continue the holding of weekly auctions. In the third week of July, new rials rebounded slightly, following rumors that new Saudi support could soon materialize. They rapidly regained value after US$1.2 billion in new Saudi support finally materialized, appreciating by 4 percent in the early days of August, from YR1,438 to YR1,383 per US$1. The appreciation ended a period of devaluation and instability as government coffers ran low. By contrast, old rials in Houthi-controlled areas remained stable, trading at between YR532-537 per US$1 on average over the reporting period.

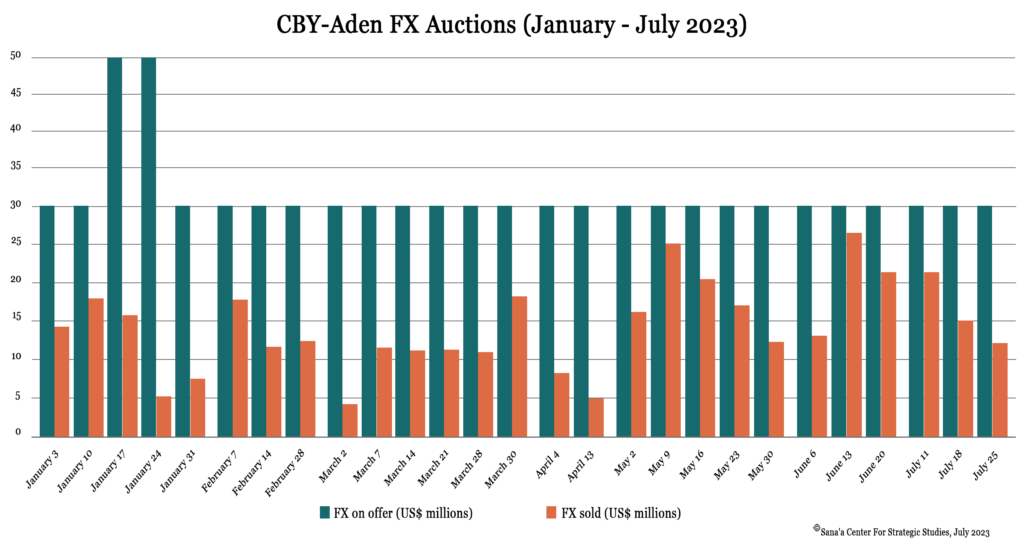

On August 1, the CBY-Aden announced it would postpone foreign currency auction no. 28 of 2023, due to continued improvement of the exchange rate driven by the announcement of new Saudi support. It said the delay came in response to requests from several banks, which wanted to wait until the rial rebounded further and its value stabilized. In June and July, the CBY-Aden announced the results of six FX auctions, valued at US$30 million each, which were 62 percent subscribed on average. Since the beginning of the year, 27 FX auctions have been held, with Yemeni banks purchasing US$391 million (46 percent) of the US$850 million on offer.

Blackouts Spur Protests Amid Recriminations

In June and July, power outages in the coastal city of Aden became longer and more frequent due to a lack of fuel, with nearly all residential neighborhoods of the city experiencing extended blackouts. The blackouts have been driven by a critical fuel shortage following the end of a Saudi fuel grant in April. The grant, valued at US$422 million, was announced in September 2022, and provided over 1.2 million metric tons of diesel to power more than 80 electricity stations. On July 5, Southern Transitional Council (STC)-affiliated Minister of Electricity and Energy Manea Bin Yammine told Saudi newspaper Okaz that the ministry was no longer able to provide fuel for power stations. He said the government typically spends US$75 million per month to purchase fuel for electricity generation, and blamed fragmented decision-making and ad hoc emergency interventions for the collapse in electricity generation. The government-owned Public Electricity Corporation has only been able to collect on a limited number of electricity bills, resulting in large debts.

On June 11, representatives of the government’s Fuel Tenders Committee announced their collective resignation. Appointed from the Ministry of Electricity and Energy, the Ministry of Oil and Minerals, and the Aden Refinery Company to oversee the purchase of fuel derivatives for power stations, the group accused the government of failing to develop sufficient solutions to address power outages in Aden and other areas under government control. In a two-page statement, the committee claimed that the current process for supplying power stations had made it difficult for it to function and impossible for it to apply Tenders Law No. (23) of 2007 and its executive bylaws. They alleged that the prime minister had only granted approval for the purchase of small quantities of fuel, between 3,000 to 10,000 tons, and that approval only comes after fuel stocks have been entirely depleted, in violation of the Tenders Law. The statement accused the Ministry of Finance and the Central Bank of Yemen (CBY-Aden) of not paying fuel suppliers on a regular basis and said they were several months in arrears. Fuel suppliers have subsequently been reluctant to submit offers; those that do take advantage of desperately depleted fuel stocks to inflate their prices. The committee said it had asked on several occasions for tenders to be issued quarterly, or as soon as fuel stocks were 50 percent depleted. The prime minister had already refused the committee’s repeated demands to underwrite Letters of Credit (LoCs) via the CBY-Aden, which might attract foreign bidders to supply fuel at lower prices and save huge sums for the state treasury.

In the second half of July, rolling blackouts in Aden grew longer, with households having access to electricity for only six of every 24 hours. The General Electricity Corporation in Aden announced on July 10 that several public and private power stations had stopped working due to the use of low-quality diesel fuel. The corporation indicated that the diesel had not been subjected to quality control checks and called for the immediate supply of new fuel. Media outlets reported that two years ago, the government signed a deal worth US$200,000 a month with the Saybolt Yemen company to monitor the quantity and quality of fuel supplies arriving at power stations, but the company has only a single office in Aden and limited capacity to perform its duties. Saybolt Yemen has no dedicated chemical laboratory or equipment for testing fuel derivatives. Instead, it sends samples to the Aden Refinery Company’s laboratory for analysis, and then issues results under its own name. It is unclear whether Saybolt Yemen is an independent entity or a subsidiary of Saybolt International, a cargo survey company headquartered in the Netherlands. According to its website, Saybolt International acted as the third-party inspection agent on behalf of the Saudi Development and Reconstruction Program for Yemen (SDRPY), tasked with the monitoring and evaluation of Saudi fuel grants to the Yemen government. This included monitoring power stations’ daily consumption of fuel as well as the amount of energy produced across governorates under government control and sharing the data monthly with the Supervisory and Control Committee, a joint government-SDRPY body.

The prolonged power cuts deepened people’s suffering, restricted internal mobility, and hurt businesses. They also provoked widespread anger and protests against the internationally recognized government and the STC, who have been blamed for failing to address the deterioration of economic conditions and public services. Thousands of people marched in Aden to demand better living conditions and a reliable electricity supply. The police have used force to crack down on protestors and discourage further demonstrations. Protests also took place in Hadramawt, Abyan, and Lahj. Media sources reported that angry protesters in Lahj burned tires and blocked the main road to Aden. Protestors also blamed the government for failing to stop the rapid depreciation of the rial, which has driven up the price of foodstuffs, many of which are imported. The STC, which controls the interim capital of Aden, has accused the government of using electricity provision as a political tool to damage the group’s image among supporters. At the same time, the STC has challenged the government’s ability to make decisions. Continuing disagreements between the sides have impeded the provision of basic services.

STC Threatens Self-Administration in Response to Energy Crisis

In response to the energy crisis, local authorities in Aden staged a short-lived act of rebellion, threatening to cut off the CBY-Aden from local revenues. On June 12, Aden Governor Ahmed Lamlas directed local officials to stop depositing revenues collected by governmental bodies and public institutions, such as the port of Aden, into their respective treasury accounts at the central bank. Lamlas affirmed this decision in a June 17 speech addressed to the PLC, where he characterized the move as a humanitarian and moral duty following the government’s failure to fulfill its obligations toward Aden and its people. Lamlas said the decision was not political, but rather a rejection of the negative practices of the government and its use of the power outages as a political tool. He asserted that the local authorities in Aden have repeatedly demanded that the sector be shielded from political conflict, but that there are actors who still insist on using it to press political agendas.

On June 13, the STC threatened to relaunch self-administration in southern governorates, calling on governors to follow Lamlas’ example and refrain from depositing their revenues into state treasury accounts at the CBY-Aden. Several followed suit, including Shabwa Governor Awadh bin al-Wazir al-Awlaki, who temporarily halted the transportation of crude oil outside Shabwa on June 13, before walking back the decision two days later. The STC used the situation as an opportunity to attack Prime Minister Maeen Abdelmalek’s government and demand the formation of a new one. The group attempted to impose self-governance in governorates under its control in southern Yemen in April 2020 and has grown economically stronger in the interim.

Despite the fact that many southern trade unions and community entities welcomed the escalation by the STC and Lamlas, the situation cooled down after Prime Minister Maeen Abdelmalek’s office addressed the governor’s claims on June 18 with a detailed report of government spending on the electricity sector. The report alleged that over 60 percent of electricity was used by Adeni citizens, and the cost of powering the governorate for only eight hours was nearly US$1.8 million. On June 20, following a PLC directive to ensure the continuous supply of fuel derivatives needed to operate power stations, Lamlas stepped back and directed local authorities to renew revenue streams back into the CBY-Aden.

Aden Court Rules Truck Tolls Illegal

The Administrative Court in Aden issued a verdict on June 20, declaring tolls imposed by the General Authority for Regulating Land Transport Affairs (GARLTA) on truck drivers to be illegal. The ruling, which followed a lawsuit filed by the Syndicate Committee of Drivers and Owners of Heavy Transport Trucks against GARLTA, noted that tolls collected between 2012 and 2023 violated resolutions issued by the prime minister.

During the court session, the lawyer representing the Heavy Transport Syndicate in Aden presented evidence alleging that GARLTA had collected YR48.2 billion in taxes during this period. Only YR2.4 billion (approximately 5 percent) of this amount was deemed legal, while the remaining YR45 billion was identified as illegal tolls forcibly collected from truck drivers at the Aden Free Zone, the Rabat checkpoint in Aden, and the Silat Bilah checkpoint in Lahj governorate.

The STC controls the administration and decision-making authority at the transport authority and has previously faced allegations of being involved in the collection of illegal taxes. In mid-April, GARLTA denied allegations made by the Heavy Transport Syndicate regarding the imposition of illegal taxes on trucks, responding to a memorandum directed to Aden Governor Ahmed Lamlas, which accused the transport authority of collecting YR100,000 from each truck driver at the entrance of Aden and failing to deposit the funds with the central bank.

On June 21, the acting head of the Land Transport Authority, Fares Shaafel, reportedly ordered a raid on the Heavy Transport Syndicate office at the Aden Free Zone in Al-Mansoura district. The raid came after Shaafel announced that the Land Transport Authority would assume control of the port, with approval of the PLC, STC, and governor’s office. In response to the raid, the Heavy Transport Syndicate announced a strike, saying they would not return to work until STC and government authorities intervene to remove Shaafel. On June 22, Anis al-Matari, the head of the Syndicate, sent a formal communication to Governor Lamlas, reporting the incident and requesting help, alleging Shaafel broke down the office’s doors with the help of Free Zone Security officers in the Al-Mansoura district, and was attempting to conceal evidence of illegal tolls imposed by the transport authority.

MPs Object to Sale of Aden Net

On July 18, 37 members of the government-aligned House of Representatives signed a letter directed to the head of the PLC, objecting to the sale of the state-run internet service (Aden Net) to the Emirati technology company NX Group. The MPs contended that the sale would be illegal and violate the constitution and existing laws, and called on PLC head Rashad al-Alimi to intervene and stop it. In the letter, MPs asserted that neither the cabinet nor the Ministry of Communications and Information Technology has the legal right to approve such a deal, which can only be authorized by the House of Representatives. It also stated that such agreements would negatively affect the national economy and the country’s security and sovereignty, and violate principles of transparency and fair competition.

The government issued decree No. 79 of 2022 at the end of December, granting NX Group the license to operate Aden Net, along with a number of exemptions and privileges. The ministry viewed the agreement as a partnership rather than a sale, and considered it necessary to improve telecommunications and internet services and reduce Houthi control over the sector. The partnership involves large international companies that had a major role in developing the sector in the region, according to an expansion plan studied by the ministry.

It is not clear how the deal was brokered, but media sources have reported that the ministry is intending to sell 70 percent of the assets of Aden Net, which provides 4G internet service in Aden and other governorates under the nominal control of the government. NX Group was established seven years ago and is based in Abu Dhabi, but has no previous projects as a mobile operator. Aden Net was established by the government in September 2018 to cover the deficit in internet service previously provided by the Yemen Net company, based in Sana’a, and to break the Houthi monopoly on the communications system.

Houthi-Controlled Port Receives First Cooking Gas

The Houth-affiliated Ministry of Transportation announced on July 6 that it had finished unloading a shipment of cooking gas at the port of Ras Issa in Al-Salif district in Hudaydah. The shipment of 14,825 metric tons of cooking gas was the first of its kind since the Houthi-run Red Sea Ports Corporation added a new berth for cooking gas, the construction of which began in February 2016.

The import of cooking gas into Ras Issa, a deepwater port able to receive large ships, comes following a Houthi ban on domestic gas cylinders produced at the Safer facility in Marib, which used to supply Houthi-held areas. Lost revenues from the ban amount to approximately YR7 billion a month, further compounding the government’s financial woes.

Houthis Announce Reductions in Fuel and Gas Prices

The Houthi-affiliated Yemeni Petroleum Company announced reductions in the prices of petrol and diesel fuel derivatives in areas under Houthi control starting June 16. An official spokesman for the company stated that after calculating the cost of fuel that had arrived at the port of Hudaydah, a 20-liter tank of gasoline would now be sold at YR9,000, down from YR9,500, while a 20-liter tank of diesel would be sold at YR9,000 instead of YR10,000.

In addition, on July 29 the Yemen Gas Company in Sana’a announced a reduction in the prices of cooking gas cylinders, effective the next day. A 20-liter cylinder would now be sold at YR5,500 through the company’s neighborhood agents, and at YR6,500 through gas stations to supply cars and commercial businesses. Prior to the cuts, a 20-liter cooking gas cylinder was sold at YR7,200, compared to YR5,000 for a domestically produced gas cylinder from Marib. The price of cooking gas increased following the Houthis’ decision to ban the sale of domestic gas cylinders in areas under their control at the end of May.

Sana’a Authorities Announce Reduction in Electricity Prices

On June 21, the Ministry of Electricity and Energy for Houthi authorities in Sana’a announced a reduction in the price of electricity sold to consumers. During a press conference, Minister of Electricity and Energy Mohammed al-Bukhaiti said that the General Electricity Corporation would now sell power to consumers at YR234 per kilowatt-hour, while private power generator owners would sell at YR248 per kilowatt-hour. The new prices were set to take effect on July 1. Al-Bukhaiti emphasized that the reduction was aligned with the fluctuating prices of diesel and mazut fuel derivatives, and threatened legal action against private generator operators who failed to abide by the set rates.

The price cut was the second since mid-April when the ministry reduced the kilowatt-hour price for electricity provided by the Houthi-run Public Electricity Corporation to YR270. Private power generator owners were required to sell at YR284. In May, the ministry launched a campaign to enforce the electricity tariff, which led to the closure of some commercial power stations, and the replacement of non-compliant power stations with services from the public utility.

Houthis Seize Chamber of Commerce, Close Dozens of Shops

On June 1, Houthi gunmen stormed the Chamber of Commerce and Industry (CCI) in Sana’a and overthrew its leadership. Houthi authority Minister of Industry and Trade Mohammed al-Mutahar appointed loyalist Ali al-Hadi as head of the chamber and Muhammad Salah as his deputy. The imposition of a new president is unprecedented, as the chambers’ members typically elect the body’s leaders. Neither man was a member of the leadership of the CCI Federation in Sana’a, nor had anything to do with the commercial private sector.

The move comes following a dispute over price ceilings set by Sana’a authorities in May. The body issued a rare statement condemning the price controls, saying they understood them to apply only during the fasting month of Ramadan, and risked causing financial losses by failing to take into account their full operational costs. The price reductions for selected foodstuffs that the ministry announced on May 23 range between 3 to 8 percent, covering commodities including wheat, rice, tea, yogurt, eggs, margarine, cooking oils, cheese, and legumes. Houthi authorities implemented regular field visits to local markets and have closed commercial centers, groceries, and sale outlets that fell afoul of the regulations.

In response, the General Federation of Chambers of Commerce and Industry issued a statement objecting to the measures, which it called illegitimate, and warned against their negative implications for the private sector. Officials in Aden also condemned the move, saying the ulterior motive was to install Houthi-affiliated figures and dominate lucrative businesses and commodities markets. In a tweet, government-affiliated Information Minister Muammar al-Eryani called the developments “a serious step” designed to “destroy the private sector and eliminate commercial houses.”

Starting on June 4, field teams appointed by the Ministry of Industry and Trade in Sana’a rigorously implemented a new monitoring campaign that resulted in the closure of dozens more shops and sales outlets in Sana’a and other cities. The ministry began the campaign following a one-week grace period for merchants to bring their prices in line with new price caps. The ministry claims its list was approved in coordination with major Yemeni producers and importers after a careful review of global prices and associated costs, including transportation.

Fraud Group Sentenced in Sana’a

On June 7, the Sana’a-based Public Funds Court convicted Belqis al-Haddad, owner of the Sultana Palace Group, sentencing her to ten years in prison for fraud. Sentences varied from one to ten years for 11 other women, among 82 who sold fictitious shares of the Sultana Palace Group, which deceived 110,000 people and took in an estimated YR66 billion from January 2016-July 15, 2020. Al-Haddad, the head of a company, was ordered to hand over about YR28 billion. The verdict also included the conviction of money exchangers accused of profiting from the scheme, who have had funds confiscated and been fined for their involvement. So far the court has only been able to recover an estimated YR7 billion.

In July 2021, Houthi authorities referred Al-Haddad to the Public Funds Court and the Anti-Corruption Court on charges of fraud and money laundering. The Sana’a-based Saba News Agency reported on June 9 that the number of victims of such schemes exceeds 300,000, most of whom are women. Fraudulent companies have convinced tens of thousands to sell their jewelry in order to buy fictitious shares.

Following the financial crisis in 2016, Yemen witnessed the emergence of many such fraudulent companies, which took advantage of economic conditions to steal large amounts of money from citizens. They present themselves as joint stock operations, but are neither legally registered nor have official offices. They operate as Ponzi schemes, depending on their representatives to market their shares. Older investors are paid from the investments of new ones, and the business continues with the aim of attracting as many new victims as possible.

Houthis Pay Half-Month’s Salary

On June 18, the Sana’a-based Ministry of Finance issued orders to disburse a half month’s salary to public servants in regions under Houthi control, covering the second half of August 2018. The payment came ahead of the Eid al-Adha religious festival marking the end of the Islamic Hijri year. Houthi authorities also distributed a half month’s salary when the holy month of Ramadan began, and another prior to the Eid al-Fitr holiday at its end. Since December 2022, civil servants working in Houthi-held areas have received only one and a half months’ salary, and are still owed nearly five years of back pay.

Sana’a Authorities Announce Boycott of Swedish Goods

Houthi authorities in Sana’a announced a boycott of Swedish goods effective July 8, in response to the burning of a Quran outside a mosque in Stockholm by an Iraqi-Christian immigrant on June 29. The decision also cancels the licenses of any Swedish organizations registered with the Houthi-affiliated Ministry of Industry and Trade. Given Yemen’s limited trade relations with Sweden, the decision is unlikely to have a significant impact.

WFP to Suspend Malnutrition Prevention Assistance

The United Nations World Food Programme (WFP) reported that it is preparing to fully suspend life-saving malnutrition assistance in Yemen as early as August, due to critical funding shortfalls. The move is expected to adversely affect the 2.4 million malnourished people originally targeted, who remain among the most vulnerable. Due to a severe funding deficit, the WFP has found it necessary to convert cash-based transfers to in-kind food distributions for more than 900,000 beneficiaries. It indicated that only 28 percent of the total US$1.05 billion it requested has been received, with contributions worth US$139 million confirmed in June from Australia, the European Union, Norway, the United States, and the Yemen Humanitarian Fund.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية