Prime Minister Maeen Abdelmalek Saaed denied allegations of corruption against his government made in a parliamentary report during a press conference on September 4. The alleged violations include mismanagement and corruption amounting to YR2.8 trillion (approximately US$1.9 billion) across the electricity, energy, telecommunications, and financial sectors.

Saaed attacked the report of a parliament fact-finding committee, calling the accusations malicious and backed by influential individuals whose personal interests have suffered. He alleged that certain partisan individuals have attempted to obstruct the work of the government, and said that it has formed a committee headed by the minister of justice to respond to allegations outlined in the report. The prime minister defended his government’s performance, noting that it has continued to pay salaries and provide public services despite the suspension of oil exports, which accounted for 60 percent of the total budget revenues before they ended last fall. In the first eight months of the year, the government’s expenditures amounted to YR1.3 trillion, while public revenues reached YR600 billion. The deficit is currently about 40-50 percent due to the halt of oil exports. Saeed also said the US$1.2 billion Saudi grant announced in August represented a lifeline for the government, despite its being conditional on a further set of reforms. Since the beginning of the year, non-oil revenues have only declined by 5 percent, which Saeed attributed to reforms his government has implemented to reduce fiscal leakage and combat smuggling.

The government has had to spend large amounts to provide electricity this year, allocating US$229 million for payments to the sector, not including accumulated arrears. The increase in electricity consumption in Aden and the government’s inability to complete strategic projects in this sector, such as a 120-megawatt solar power generation project, have compounded the problem. Saeed added that the government has allocated US$100 million to assist governorates under its control to transition to renewable energy. The parliamentary committee’s report detailed accusations relating to price discrepancies for oil derivatives. Saeed said that influential individuals lost money when imported fuel derivatives became subject to customs taxes after 2018. When the government adopted a decree to regulate the import of fuel derivatives, it collected an estimated YR19 billion in taxes, which increased to YR137 billion in 2020.

In the telecommunications sector, the prime minister acknowledged the government’s failures but said the challenges could be overcome. He detailed irregularities in the granting of licenses in the sector under former president Abdo Rabbu Mansour Hadi, who purportedly granted mobile service operator Y-telecom an exceptional license to provide fourth-generation telecommunications services and to use the state’s telecommunications infrastructure without paying fees to the government. As of writing, the company has neither paid license fees owed to the government nor operated mobile services. Instead, the company has called on the government to refund US$149 million, which it said it paid to the then-government in Sana’a for obtaining a license when it was established in 2006.

The government would need some US$3 billion of investment in the telecommunications sector to keep pace with regional standards, such as those in the Horn of Africa, and to be able to offer a minimum level of telecommunication services. Addressing the controversial sale of Aden Net to the UAE-based company NX Digital Technology, Saeed said that it is in the country’s interest to attract foreign investment and that the Emirati company will invest US$700 million in the telecommunications sector. This joint investment will grant the government a 30 percent share of the envisioned company assets. The prime minister said the government needs to develop telecommunications infrastructure, and that it would have been better for the House of Representatives to await its response on the matter, instead of rushing to issue a report. He stated that the government had spent a full year negotiating with the Emirati company, the negotiations took place publicly, and their outcomes were submitted to the PLC, the highest state authority. Several high-ranking public officials and MPs have since criticized Saeed’s fiery attack on the parliament and the committee report, stating that his speech did not refute the allegations of corruption committed by his government across multiple sectors.

Increase in Commercial Activity at Hudaydah Ports

The Houthi-aligned head of the Yemeni Red Sea Ports Corporation, Mohammed Abu Bakr bin Ishaq, reported on September 12 that commercial activity has increased 52 percent at Hudaydah’s ports (Hudaydah Ras Issa, and Al-Salif), with the number of shipments received up 75 percent in 2023 compared to the same period last year. The announcement was made during a visit by high-ranking Houthi officials, including Prime Minister of the National Salvation Government Abdelaziz Saleh bin Habtoor, Minister of Transport Abdelwahab al-Durrah, and Hudaydah Governor Mohammed Ayyash Qahim.

Al-Durrah criticized a memorandum of understanding (MoU) signed between the United Nations Development Programme and the Aden-based Ministry of Transport to reduce maritime insurance costs for ships entering government-controlled ports, saying it was biased against Houthi authorities. Under the MoU, signed in mid-August, the government would deposit US$50 million with the Insurance Protection Club in London.

Al-Durrah also complained about the clearance requirements of the United Nations Verification and Inspection Mechanism for Yemen (UNVIM), which he claimed caused long delays for vessels docking in Hudaydah. He said this had resulted in large fines for commercial traders, with costs passed on to citizens. But barriers on shipping have been significantly eased following progress in the ongoing Saudi-Houthi talks. Ishaq said in an interview in early March that the UNVIM had agreed to allow more types of goods to Houthi-controlled ports and expand its operating hours to clear additional ships for entry. He also claimed that vessels were no longer subject to a secondary inspection by the Saudi-led coalition and could proceed directly from Djibouti following UNVIM approval.

In its August report, the World Food Programme (WFP) noted there has been a steady flow of fuel shipments into Hudaydah since the truce was enacted in April 2022. From January to July 2023, the combined volume of fuel imported through the northern ports of Hudaydah and Al-Salif increased 81 percent compared to the corresponding period last year. United Kingdom Maritime Trade Operations (UKMTO) reported that “it has been made aware of an entity impersonating the UNVIM directing that merchant vessels in the vicinity of Aden anchorage divert to Hudaydah port.” It continued, “Vessels in the vicinity are advised to exercise caution and report any suspicious activity to UKMTO.”

Truck Drivers Call for Strike in Protest of Houthi Restrictions

On October 9, dozens of truck drivers at the Houthi-controlled Red Sea ports of Hudaydah called for a comprehensive strike in protest of new traffic restrictions. Police in Sana’a have forced truck drivers to use longer, alternative routes between Sana’a and Hudaydah, which were not built for heavy trucks. Earlier this month, Houthi authorities enforced the use of an alternate route from Sana’a to Al-Mahwit for trucks bound for Hudaydah, and the use of the Hudaydah-Dhamar route for heavy trucks traveling from Hudaydah to Sana’a. Houthi authorities also announced that trucks will only be allowed to travel between 4 p.m. and midnight.

The restrictions were purportedly implemented with the purpose of ensuring citizens’ safety and promoting traffic security. The widely-held belief among truck drivers is that they are aimed at gaining control over transport from Hudaydah’s seaports and monopolizing it under companies controlled by Houthi authorities.

New Rials Drop Precipitously in October

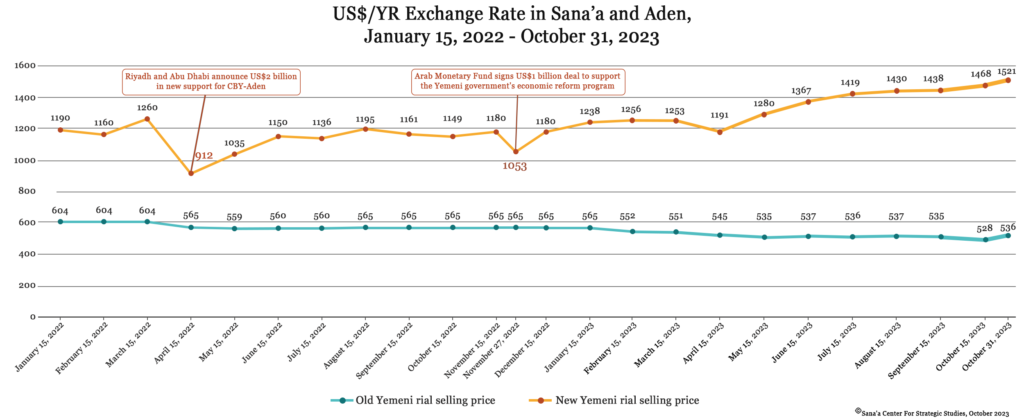

New rials in government-held areas depreciated by 5 percent in October, reaching lows not witnessed since late 2021, as the government contends with falling revenues and limited foreign currency reserves. This was preceded by smaller drops in value, as new rials depreciated by 3 percent from YR1,425 to YR1,471 per US$1, from the end of August to early September. The rial rebounded slightly to YR1,432 on September 17 before slightly depreciating to YR1,455 per US$1 toward the end of the month. By the end of October, new rials had dropped to YR1,521 per US$1.

Old rials in Houthi-controlled areas experienced slight fluctuations over the reporting period. They remained relatively stable over the course of September, trading at YR535 per US$1 on average, slightly appreciated to YR527 by mid-October, and were trading at YR536 by month’s end.

The precipitous decline of new rials coincided with the depletion of the Central Bank of Yemen’s (CBY-Aden) foreign currency reserves, which has been compounded by the government’s widening fiscal shortfall. Oil exports, previously the primary source of revenue, have been halted since late last year following Houthi missile and drone attacks on southern oil ports. Government customs revenues have decreased markedly this year as commercial shipping has been diverted to the Houthi-controlled ports of Hudaydah following the lifting of coalition restrictions. A US$1.2 billion Saudi grant was announced in early August to finance the public budget and prop up the value of the Yemeni rial, but Riyadh has only released 1 billion Saudi riyals (roughly US$267 million) as the first tranche.

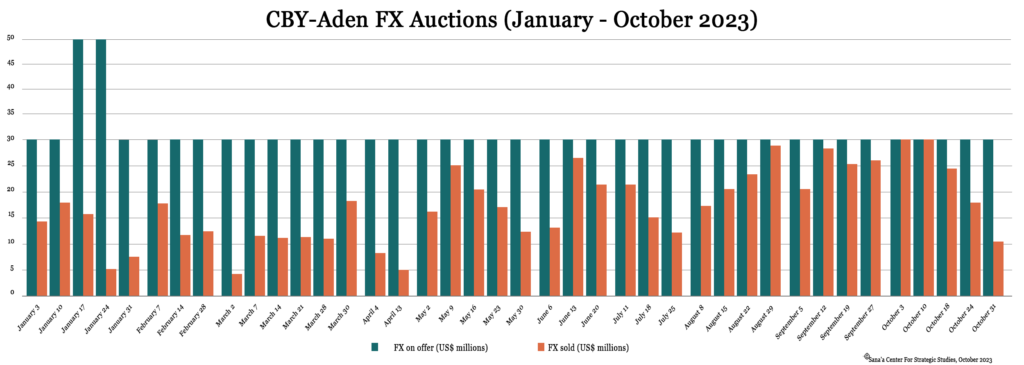

The first tranche is now exhausted, and the delay in the delivery of a new tranche is limiting the CBY-Aden’s capacity to continue holding foreign exchange auctions to finance the importing of basic commodities and utilize its equivalent amount of new rials currency to help the government meet vital spending needs, including the payment of public sector salaries and subsidizing the purchase of fuel derivatives for electricity generation. Since the delivery of the first installment of the Saudi grant, the CBY-Aden has held 14 FX auctions, selling US$321 million from its limited foreign currency reserves to Yemeni banks to help finance the import of basic commodities and lessen downward pressure on the Yemeni rial. Since the beginning of the current year, 41 FX auctions have been held, with Yemeni banks purchasing US$712 million (56.1 percent) of the US$1.27 billion on offer.

The CBY-Aden ceased holding of new foreign currency auctions near the end of October, indicating that its FX reserves are likely perilously low. Absent new support, the rial is expected to depreciate further in the coming months.

Government Workers Protest Salary Payments through Banks

Thousands of public sector employees working in multiple government departments continued to demand that the Ministry of Finance repeal its decision to transfer public payroll data and payment disbursement to the banking system. At the beginning of September, teachers staged protests, while Ministry of Culture employees hired lawyers to oppose the decision.

The Medical Professions Syndicate announced the start of a partial strike beginning September 11, and a full strike on September 20, in protest of the ministry’s decision. The General Federation of Southern Trade Unions also called on the government to immediately reverse the move, threatening to declare a general strike and paralyze the system. It said it held the government responsible for the deterioration of humanitarian and socioeconomic conditions and demanded a 100 percent increase in salaries and an end to the deterioration of public services.

There have been a series of strikes and vocal objections by employees across the public sector, who are concerned they will not be able to withdraw their salaries via the banking system. But the government has remained firm: On September 12, the Ministry of Finance issued Circular No. 13 of 2023 to add two banks, the Yemen Commercial Bank (YCB) and the International Bank of Yemen (IBY), to the list of those nominated to pay public sector salaries.

CBY-Aden Holds its First Auction of Government Bonds

On September 11, the government-controlled Central Bank of Yemen (CBY-Aden) announced the first auction of the year for local public debt instruments, namely government bonds of one-year maturity, through the American Refintiv electronic platform. It indicated that the total initial value of the bonds to be auctioned is set at YR20 billion and is subject to increase. The nominal value of each bond was set at YR1 million, while the minimum bids for each participant were set at YR100 million and its multiples. The participants are able to claim interest after six months and when the bond matures, with the annual interest rate set at 18 percent.

On September 19, the CBY-Aden announced the results of Auction No. 1-2023. Only YR5.7 billion (or 28.5 percent) of the bonds on offer were sold, at an average return of 17.7 percent. There were only three participants, who submitted eight bids for the auctioned bonds.

CBY-Aden Joins Arab Regional Payment System

The CBY-Aden announced on September 14 that it had completed the necessary requirements and successfully joined the Arab Regional Payment System (BUNA). The CBY-Aden is the seventh Arab central bank to join the platform. Membership in BUNA will act as an important international interface for the CBY-Aden and Yemeni banking sector at large to conduct cross-border transactions and increase opportunities for economic and financial integration in the Arab region.

The platform is affiliated with the Regional Corporation for Clearing and Settlement of Arab Payments and fully owned by the Arab Monetary Fund, and has been in operation since December 2020. Based in the United Arab Emirates (UAE), it is a centralized cross-border payment system that was launched to enable financial institutions and central banks to send and receive payments in Arab and international currencies safely and effectively.

CBY-Aden Announces Tender for Audit

The CBY-Aden announced a public tender for the auditing of its accounts and financial data for the years 2021, 2022, and 2023. According to the late-September announcement, qualified and interested auditing firms are required to submit their technical and financial proposals to the CBY-Aden before November 2. The firm will be required to provide annual audits of the CBY-Aden’s accounts in accordance with Article no. 56 of CBY Law No. 14 of 2000. The tender announcement noted that in order to be considered, firms must be internationally classified or recognized, maintain a good reputation and standing, and have a valid license. The CBY’s financial statements went unaudited for five years following its relocation from Sana’a to the interim capital of Aden in late 2016. In mid-June, the CBY-Aden’s Board of Directors approved the bank’s financial statements for the years 2016-2020, audited by Baker Tilly International. The government and CBY were under significant pressure to audit the accounts following the publication of the United Nations Panel of Experts 2020 report, which accused the government of money laundering and corruption. The report claimed that the CBY-Aden had misused a US$2 billion Saudi deposit intended to fund the import of essential commodities, allowing commercial traders to reap large windfalls. The UN panel subsequently withdrew the accusations in March 2021.

CBY-Aden Participates in IMF and World Bank Annual Meetings

CBY-Aden Governor Ahmed Ghaleb and Finance Minister Salim bin Breik participated in the annual International Monetary Fund (IMF) and World Bank meetings of Middle Eastern and North African finance ministers and central bank governors in Marrakesh, Morocco, which concluded on October 15.

During the meetings, Ghaleb discussed Yemen’s dire humanitarian situation, exacerbated by Houthi attacks on oil infrastructure last year that halted oil exports and denied the government one of its main sources of revenue. He also emphasized the importance of the IMF’s funding for Yemen’s humanitarian needs but noted that the country has found it difficult to obtain and make use of international financing due to strict terms for utilization that do not take into account realities on the ground. Ghaleb called for the IMF to reconsider requirements for financial sustainability, the sustainability of public debt, and the repaying of external debt in conflict-affected countries, especially for programs designed to address disasters and countries experiencing abnormal conditions.

World Bank Approves Grant for Yemen

On September 22, the World Bank approved a US$150 million grant for the Yemen Emergency Human Capital Project (YEHCP). The grant, funded through the World Bank’s International Development Association (IDA), is the second phase of funding for the YECHP, which was launched in June 2021 and aims to provide essential health, nutrition, and water and sanitation services to Yemen’s population. The project aims to buttress the government’s institutional capacity and will focus specifically on improving basic service coverage and quality, and resilience against disease outbreaks. The World Bank noted that the project has already served 8.4 million Yemeni beneficiaries. Since 2016, the IDA has provided Yemen with US$3.9 billion in grants.

Government Failure to Utilize Wheat Grant Sparks Debate

Controversy broke out over a grant for 40,000 tons of wheat announced by Poland at a donor conference in February 2023. The Yemeni government was notified of the grant that same month but did not take the necessary measures to receive it before it expired in September. The government and WFP were accused of corruption estimated at US$20 million.

Yemeni government bodies traded accusations over the failure. In an early October memorandum signed by the Minister of Trade and Industry Mohammed al-Ashwal directed to Prime Minister Maeen Abdelmalek Saeed, the minister said that the Polish government’s withdrawal of the grant was due to the failure of the government to arrange the transportation of the wheat. According to the memorandum, the Ministry of Trade and Industry received a directive from the prime minister to coordinate with the Yemeni ambassador to Poland and search for a way to transport the wheat shipment from grain silos at the Polish port of Gdansk. It also includes an implicit accusation that the Ministry of Planning and International Cooperation did not fulfill its responsibilities to facilitate the delivery.

The Ministry of Trade and Industry said it had signed a contract with Al-Massi Food Company to transport the 40,000-ton shipment in exchange for 50 percent of the wheat. However, in another memorandum, dated September 11, Minister of Planning and International Cooperation Waed Badib explained that his ministry received a directive from the prime minister to take responsibility for the delivery only after he had rejected the contract signed by the Ministry of Trade and Industry. Badib said that he had communicated with a representative of the WFP in Yemen to transport the shipment and that the WFP apologized to the ministry for its inability to afford the expense of transporting the grain, which it estimated at US$20 million. But several media outlets reported that economic experts estimated the market price of shipment to be only US$14 million, and transportation costs less than US$2 million, fueling speculation of attempted corruption.

The case has sparked widespread debate and criticism regarding the mismanagement of aid funds and the failure to optimize their utilization. Some accused the government and prime minister of behaving irresponsibly, as the country continues to face massive food insecurity and one of the world’s largest humanitarian crises. According to humanitarian organizations, a staggering 21.6 million Yemeni people require some form of assistance, and 80 percent of the country struggles to put food on the table and access basic services.

Aden Power Stations Warns of Blackouts

On October 23, the government-owned General Electricity Corporation (GEC) in Aden warned that the governorate’s power plants may be forced to completely cease providing electricity due to a lack of fuel. According to the GEC, 70 percent of diesel-powered stations were already out of service, and the PetroMasila station, which runs on mazut, was completely shut down. It called on the government to provide urgently needed fuel for the power plants to avoid a complete blackout in the interim capital. On October 22, the GEC branch in Lahj announced that two electricity plants in the governorate – the Bir Nasser and Al-Ahram stations – had been forced to cut their supply. Aden, Lahj, and neighboring Abyan governorate have witnessed regular popular protests over the past two months, as residents demand a solution to the chronic electricity shortages.

Aden and other governorates under government control began experiencing extended blackouts following the expiration of a Saudi fuel grant in April. In November 2022, the Saudi Development and Reconstruction Program for Yemen (SDRPY) began supplying the government with over 1.2 million metric tons of diesel and mazut, valued at US$422 million, for electricity generation at more than 80 power stations. A new US$1.2 billion Saudi grant was announced in early August to address the government’s budget shortfalls, including the purchase of fuel to operate power stations, which is estimated to cost US$75- 100 million per month. The GEC confirmed the arrival of 13,000 metric tons of fuel at the port of Aden on August 22, but no further fuel shipments have been announced. In early October, Prime Minister Saeed stated that the electricity crisis would be resolved soon, as electricity demand declines significantly in the winter compared to the hot summer months.

STC Blames Government for Electricity Crisis, Accuses CBY-Aden of Mismanagement

On October 26, the STC blamed the internationally recognized government for the ongoing electricity crisis in Aden and other southern governorates. During the monthly meeting of the STC Presidium, led by Ali al-Kathiri, the acting head of the Presidium and Chairman of the Southern National Assembly, the party accused the government and Prime Minister of delaying solutions to the electricity crisis and failing to provide sufficient fuel for operating power stations. It called on the Presidential Leadership Council (PLC) to intervene, particularly with regard to the refusal of the Central Bank of Yemen in Aden to finance the purchasing of fuel shipments.

The Presidium also criticized the CBY-Aden for its inability to regulate cash circulating in the market and for failing to mandate that Yemeni banks transfer their headquarters from Sana’a to Aden. An STC economic committee submitted a brief with a number of recommendations aimed at addressing challenges related to the banking sector.

On October 28, the STC-affiliated Southern Money Exchangers Association (SMEA) published a statement accusing the CBY-Aden of using the Southern Money Changers Syndicate (SMCS) to cover up corruption. The SMEA, established in August as a rival to the SMCS, said certain money exchangers had improperly benefited from the bouts of instability in the value of the Yemeni rial to enrich themselves at the expense of citizens. Surprisingly, the statement praised the management of the Central Bank of Yemen in Sana’a for its efforts in curbing currency speculation compared to the CBY-Aden, which it accused of lacking “strong and honest management.” The SMEA proposed recommendations that it claimed would allow CBY-Aden to maintain exchange rates and economic stability, such as continuing foreign currency auctions, with the goal of eventually restoring the value of new rials to YR750 per US$1.

Temporarily Suspended Flights from Sana’a Resume

Yemenia Airways announced the resumption of flights from Sana’a International Airport to Amman, Jordan, starting October 17. Yemenia suspended commercial flights to the Jordanian capital, the only current route out of Sana’a, in early October, due to a dispute with Houthi authorities over access to more than US$80 million in airline funds held in Sana’a-based banks since March, which has severely curtailed its ability to operate flights. The government-run Ministry of Transport said that although Houthi authorities continue to block Yemenia’s access to funds, the decision to resume flights stemmed from humanitarian concerns over Yemenis’ ability to travel abroad for medical treatment.

Following the freeze, Yemenia’s Aden branch stopped selling tickets for flights from Sana’a International Airport, and divisions deepened between the airline’s respective branches. At the time, Houthi authorities responded by suspending flights for international organizations for a week and limiting their operation to only one day a week. There have been disputes over the utilization of revenues mobilized by the sales of airline tickets. Ticket sales in Houthi-controlled areas represent nearly 70 percent of total ticket revenues in the country, given that the majority of the Yemen population live in Houthi-controlled regions. Yemenia proposed that Houthi authorities take 70 percent of the funds accumulated in Sana’a, with the remainder going to the internationally recognized government. Yemenia alleged that the Houthis had initially agreed to the proposal but later rejected it.

The Houthi-affiliated Ministry of Transport has denied that any funds had been frozen and accused Yemenia of creating a malicious pretext to prevent Yemeni medical patients and citizens from traveling abroad. Houthi authorities threatened to take escalatory measures against the airline and have already prevented a Yemenia flight from taking off to another destination in a bid to compel the company. Houthi-aligned Deputy Foreign Minister Hussein Al-Ezzi commented on the freezing of Yemenia’s funds, admitting that some restrictions had been implemented: “We have only ceased the withdrawal of large sums in order to prevent corruption and to ensure and establish honest, disciplined, and transparent behavior for the benefit of the company.” He warned that authorities in Sana’a would escalate the situation should they be pressured to choose between permitting corruption and depriving Yemenis of travel abroad.

The halting of the six weekly flights has deprived thousands of Yemeni passengers from traveling to Amman, and from there to the rest of the world. The Sana’a International Airport was reopened in April 2022 as part of a UN-brokered ceasefire.

New Aircraft Joins Yemenia Fleet

Yemenia Airways welcomed its newest Airbus A320 aircraft, named “Kingdom of Himyar,” to its fleet at the Aden International Airport on October 8. The following day it made its first flight, from Aden to Cairo. The A320 is a short-to-medium-haul aircraft, with a maximum capacity of 150 passengers. It is the fifth Airbus plane currently owned by Yemenia, and the sixth aircraft to join its fleet. The plane was acquired as part of an August deal to purchase two A320s signed with Spain’s Vueling Airlines Company in Dubai. According to Yemenia, the second aircraft, named “Kingdom of Saba,” will arrive sometime in the next month. Before purchase, the two aircraft were subject to technical examinations in Lithuania. The first plane was then transported to Dubai at the end of August. The purchase is part of an ambitious expansion plan embarked on by Yemen’s national carrier to increase routes and operate more international passenger flights. However, its expansion strategy coincides with deepening disputes over its operation and finances.

Zenith Energy Terminates its Acquisition of OMV

Dutch-owned Zenith Energy announced the termination of a Share Purchase Agreement (SPA) it held with Austrian-owned OMV Yemen on September 4, due to the conditions required for completion of the SPA not being satisfied. On January 3, Zenith Energy announced its acquisition of 100 percent of the outstanding share capital of OMV (Yemen Block-S2) Exploration GmbH, OMV Jardan Block 3 Upstream GmbH, and OMV Block 70 Upstream GmbH (collectively ‘OMV Yemen.’) As per the terms of the SPA, OMV has refunded Zenith its deposit of US$4,323,800, along with the accrued interest. Additionally, the share purchase agreement between Zenith Energy and Hingbo Industries Company Limited, which was involved in the sale of a 51 percent interest in Zenith Energy Netherlands, has also been terminated following the end of the SPA with OMV Yemen.

Following Zenith Energy’s withdrawal from the above-mentioned agreement to purchase OMV’s oil field rights, OMV announced on September 5 plans to lay off around 200 employees at Block S2 in the Al-Uqlah area of Armaa district, beginning next year. Company officials cited financial difficulties and a cessation of oil exports as the reasoning behind the layoffs.

Separately, Employees at Block 4 in Shabwa issued a statement on September 12 announcing the start of a comprehensive strike over the nonpayment of wages and benefits by the Yemen Investment Company for Oil and Minerals (YICOM) for July and August. The employees said they had been demanding payment of their delayed salaries for more than two months, but the company’s management had not responded, forcing them to go on strike. Employees called for a strike and the halt of operations in all oil fields and terminal sites of Block 4 from September 11, and threatened to take further escalatory measures if their demands were not met.

In early May, the Employees Union of YICOM in Shabwa issued a memorandum calling on management to reduce its operating budget in order to provide salary and health insurance payments, and threatened to strike. In response, the director of the company called on employees to postpone a planned strike and promised to explore solutions to resume payments as soon as possible. He explained that the company had suffered from a drop in revenues and had to borrow to cover operational expenses after the government was forced to halt hydrocarbon exports following Houthi drone attacks against oil export terminals in October and November 2022. YICOM announced in mid-January that it would cut operating expenses at its Aden office and at Block 4 in Shabwa and reduce the number of active workers due to budget shortfalls. Crude oil from Block 4 in the Eyad area in Shabwa’s northern Jardan district is currently transported overland to power plants in Aden.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية