On August 23, the Yemeni government’s Minister of Industry and Trade Mohammed al-Ashwal stated that Yemen has stocks of wheat sufficient to cover approximately four months of consumption during a meeting with the Chamber of Commerce and commercial traders and importers in Aden. Al-Ashwal said that Yemen was establishing supply lines to import wheat from several countries, including Romania and France, and noted ongoing discussions to import wheat from Russia and Ukraine via Turkey. A document allegedly leaked from the Ministry of Trade and Industry on August 12 showed that Yemen had secured access to 176,000 tons of wheat, sufficient to address domestic needs for two and a half months, comprising 70,000 tons in current stocks plus 106,000 tons to be imported in August and September.

On August 30, the World Food Programme (WFP) announced that a WFP-chartered cargo ship carrying 37,000 metric tons wheat grain had departed a Ukrainian port bound for Yemen. The shipment will be milled into flour in Turkey before moving on, part of a July 22 agreement between Moscow and Kyiv, co-signed with the United Nations and Ankara, to resume grain shipments disrupted by the Russian invasion of Ukraine. Last year, Yemen imported 45 percent of its wheat from the two countries. The August 30 shipment is the second WFP food aid delivery to leave Ukraine since the Russian invasion in February.

In its Yemen Food Security Update for August, the WFP reported that food access for Yemenis remained highly constrained. The cost of the minimum food basket rose by 74 percent and 38 percent in government- and Houthi-controlled areas, respectively, over the past 12 months. Due to funding shortages, WFP has been forced to reduce its food rations for the fourth distribution cycle of 2022.

Government, UN, Seek to Reduce Import Costs

On August 4, the government’s minister of transportation, minister of planning and international cooperation, and central bank governor held a meeting with the resident representative of the United Nations Development Program to discuss ways to reduce the cost of insurance for commercial ships entering Yemeni ports. A statement following the meeting said that the cost of marine insurance has increased roughly 16-fold compared to the pre-conflict period, as Yemen’s ports have been classified as “high risk.” The meeting floated the idea of a mechanism by which the government would make an insurance deposit with the London P&I Club, a multinational insurance conglomerate, with the aim of reducing insurance fees for commercial ships entering Yemeni ports. Reduced insurance costs would lower import costs for traders – savings which could then be passed on to consumers.

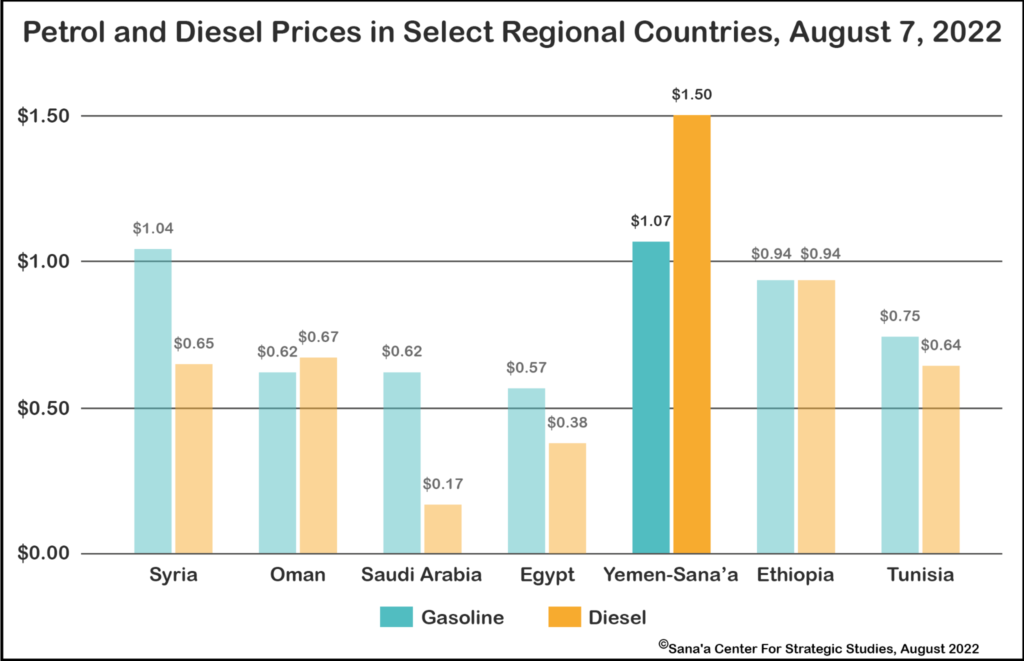

Petrol Prices and Diesel Shortages Ease in Houthi-Held Areas

On August 6, in response to declining global fuel prices, the Yemen Petroleum Company (YPC) in Sana’a reduced the official price of petrol by 14 percent, from YR700 to YR600 per liter, and the price of diesel by 8 percent, from YR750 to YR690 per liter. However, fuel prices in Houthi-controlled areas are still among the highest in the region, particularly with regard to diesel. This likely indicates that Houthi levies and taxes associated with fuel imports and sales are highly profitable for the group.

Following the renewal of the truce in early August, the diesel shortage in Houthi-controlled regions eased somewhat. Houthi authorities, however, continued to blame the Saudi-led coalition for creating supply bottlenecks by preventing tanker vessels from offloading at the port of Hudaydah.

As the Sana’a Center Economic Unit previously noted, diesel vessels that have reached Houthi-held territory during the truce period have likely carried sufficient diesel to meet normal market demand. Market shortages are thus likely due to the YPC-Sana’a intentionally limiting the supply of diesel at official fuel stations, possibly to build up strategic reserves for Houthi military operations, which has in turn caused recurrent shortages and wide divergences in prices at official, commercial, and black-market fuel stations.

Expected Rial Appreciation Dampens Bank Appetite for FX

The exchange rate of both new and old Yemeni rial banknotes remained relatively stable in government- and Houthi-held areas for the month of August, with some appreciation in government-held areas following PLC head Alimi’s visit to UAE and Saudi Arabia. At the beginning of the month, the government’s new rial banknotes were trading at an average of YR1166 per US$1. They appreciated by 5 percent over the month, closing at YR1110 per US$1. In comparison, old rial banknotes in Houthi-controlled areas traded within a narrow band around YR560 throughout the month.

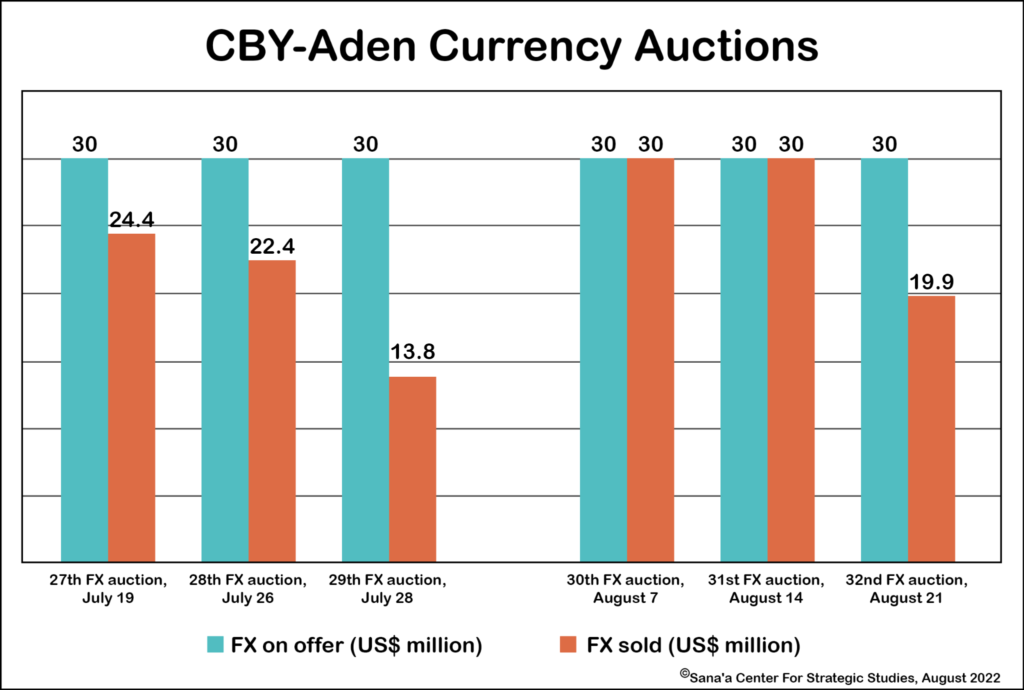

During the course of August, the CBY-Aden held four foreign currency auctions, at which it offered up a total of US$120 million for commercial banks to purchase. Each auction saw US$30 million up for sale, with the first two, on August 7 and 14 respectively, fully subscribed. However, commercial bank engagement then declined: the auction on August 21 was only 66 percent subscribed, and the one on August 30, the 33rd of 2022, was the worst performing of the year, with only 20 percent of the foreign currency on offer sold. The expectation of renewed rial appreciation appeared to be a significant factor disincentivizing banks from participating, as it would reduce the marginal currency premium banks earn between the preferential exchange rate offered at the auctions and the parallel market exchange rate. As of the end of June, the CBY-Aden had allocated US$537 million through the Refinitiv platform-based foreign currency auctions to fund basic commodity imports.

PLC chief Rashad al-Alimi traveled to UAE on August 15, and then on to Saudi Arabia on August 20. His meetings focused partly on accelerating the handover of a US$3 billion economic support package – US$2 billion in CBY-Aden support, and $US1 billion for development projects – promised after the formation of the PLC in April. CBY-Aden Governor Ahmed Bin Ghaleb accompanied Alimi on the trip. According to an August 20 report by Saudi TV channel Al-Hadath, Bin Ghaleb said a Saudi-Emirati deposit would be delivered to CBY-Aden “in the coming days,” noting that financial support would help the government stabilize the rial and create a conducive environment for deeper reform. However, as of August 31, the promised financial support had not materialized. The stability of the currency continues to be at risk due to the CBY-Aden’s dwindling access to FX reserves. Riyadh and Abu Dhabi have demanded governance reforms before they will release the promised support to the government-controlled central bank.

Government Reports Revenue Growth in First Half of 2022

The CBY-Aden’s Economic and Monetary Developments Report, released in August and covering the first half of 2022, indicated that the government’s public budget recorded improvements in its fiscal position. While the report contained several errors, the Sana’a Center Economic Unit was able to verify the following figures:

- Hydrocarbon revenues increased by 34 percent, to US$739.3 million in the first half of 2022 from US$551.7 million over the same period last year. The increase was mainly driven by the rise in global fuel prices, but also by the government adopting a policy of evaluating the public budget based on its hard currency revenues.

- Non-hydrocarbon revenues (tax and customs) increased by 238 percent, from YR114 billion to YR386 billion, over the same period. The report indicated that public expenditures increased to YR1,102 billion from YR638 billion, which can also be attributed to the government’s revised calculations. Recurrent expenditures represented 99.4 percent of the total public expenditures in the first half of 2022, of which 33 percent were public salary payments.

The clashes in oil-rich Shabwa and the possibility they could spread to the other oil-rich governorates of Marib and Hadramawt in early-to-mid August raised concerns about a potential suspension of oil and gas production and its effects on public revenues. Although the effects of the clashes appeared to be contained, local media reported clashes at least temporarily affected oil production in the S2 field in the Al-Aqla area of Shabwa’s Jardan district. If a larger suspension of oil and gas production were to take place, it would have severe consequences for government revenues, given that oil exports, while substantially below pre-conflict levels, are by far its largest domestic source of revenue.

STC President Becomes Head of Government Resource and Revenue Committee

On 14 August, PLC head Rashad al-Alimi announced the formation of the Supreme Committee for Financial Resources and Revenue Development. The committee is to be headed by PLC member and STC president Aidarous al-Zubaidi. Al-Zubaidi’s appointment received widespread public criticism, as it was seen as further empowering the secessionist group in areas technically under the government’s control, where high levels of public revenue leakage are already rampant. According to Al-Alimi, the newly formed committee would have full purview over public resources and is charged with developing plans to increase the state’s capacity to collect revenues. On July 31, the PLC announced its intention to form two other high-level committees, one for central and local revenues, and another for development and reconstruction projects.

CBY-Aden Seeks Consolidation in the Money Exchange Industry

On August 4, the CBY-Aden issued Resolution No. (58) of 2022, amending several articles of Resolution No. (14) of 2021 regarding the regulation of money exchange outlets. The amendments aimed to tighten licensing requirements for money exchange businesses and limit the number active in the market by increasing their minimum capital requirements, financial guarantees, and annual licensing fees. According to the decree, money exchange companies must now hold YR1 billion as a minimum capital requirement, and another YR500 million in cash guarantees with the CBY-Aden to ensure legal compliance, plus pay YR20 million in annual licensing fees. In addition, for each branch in excess of nine, money exchange companies must pay another YR100 million – YR50 million in capital requirements and YR50 million in cash guarantees. Money exchange shops – defined as single owner, single outlet enterprises – must now hold YR500 million as a minimum capital requirement and another YR150 million as a cash guarantee to be deposited into the CBY-Aden. Hawala agents, which are legally licensed to operate in remote areas only, are subject to YR100 million and YR20 million in minimum capital and cash guarantee requirements, respectively. The resolution gave money exchange companies and shops until 2025 to fulfill the requirements.

The measures are aimed at curbing the proliferation of small exchange shops and promoting consolidation within the industry, which should theoretically help the CBY-Aden reduce currency speculation. Yemen has suffered a liquidity crisis since 2016, which has initiated a massive migration of financial flows from commercial banks to money exchange operators, spurring their enormous proliferation. This, in turn, has had an outsize impact on exchange rate volatility, particularly in government-controlled areas. While the decree is ostensibly a positive step to rein in rampant currency speculation, it conflicts with Houthi industry regulations and, given that most exchange companies operate nationwide, could cause further conflicts in the monitoring and regulation of the market. It is also highly doubtful, given the CBY-Aden’s limited capacity to monitor the industry, that the regulations will be effectively implemented or enforced.

On August 10, the Aden Exchange Society, representing money exchange companies operating in the city, issued a statement asking the CBY-Aden to reconsider the resolution. The statement said that the new decree would put a great financial burden on the money exchange sector, deepen the country’s already poor economic and humanitarian crises, and negatively affect financial stability and the rial exchange rate.

CBY-Sana’a Ups Capital and Ownership Criteria for Microfinance Banks

On August 21, the Houthi-controlled Central Bank of Yemen in Sana’a (CBY-Sana’a) issued two resolutions aimed to regulate microfinance banks. Resolution No. 2 of 2022 increased the minimum capital requirements for microfinance banks operating in the country from YR500 million to YR5 billion. Microfinance banks have five years to meet the new capital requirements. Within one year, microfinance banks must hold no less than YR2.6 billion, and then allocate at least 25 percent per year over the next four years to satisfy the new requirements. Microfinance institutions also have the freedom to meet the requirements utilizing their accumulated reserves. The second decree, Resolution No. 3 of 2022, amended Resolution No. 12 of 2010 regarding the executive bylaws of Microfinance Bank Law No. 15 of 2009, setting more stringent requirements for partners and owners of money exchange establishments to become shareholders in microfinance banks. The decree states that money exchangers must liquidate their established money exchange businesses and give up licenses granted by the central bank in order to be eligible.

The CBY-Sana’a’s new requirements followed similar regulations announced by the CBY-Aden in March, increasing capital requirements for commercial and Islamic banks to YR45 billion, and microfinance banks to YR5 billion, within the next five years. The introduction of regulations to raise capital requirements for financial institutions has been driven by several factors. The capital currently held by financial institutions and mandated by pre-conflict legal frameworks has substantially diminished in real value given the dramatic depreciation of the Yemeni rial since the war began. Commercial traders, businessmen, and money exchangers have increasingly competed for licenses to become microfinance banks, which would allow them to accept deposits and grant financial loans. By law, money exchangers are not allowed to take deposits or provide credit loans, however, money exchange outlets have assumed many of the functions legally reserved for banks since the start of the conflict, becoming the dominant source of cash liquidity to the market.

Government, Houthis Wrestle Over Telecommunications Sector

On August 14, PLC member Aidarous al-Zubaidi, following a meeting with Director General of the Public Telecommunications Corporation Wael Tarmoom, affirmed the need to relocate national telecommunications hubs to Aden. Al-Zubaidi said Houthi authorities continue to control the telecommunications sector and utilize its revenues to finance their military efforts. Zubaidi is head of the STC, which dominates security in the interim capital. The government began intensifying measures to assert authority over the telecommunications sector in April, when its Public Funds Prosecution office in Aden ordered the Yemeni-Omani company YOU (formerly MTN) to pay YR24.24 billion in arrears for the years 2015, 2016, and 2017. After the company failed to comply, the government closed its operations in Aden in late June, with the suspension remaining in place as of this writing. In the past month, the government also demanded access to the control center of the Yemen Mobile Company, the country’s largest mobile network operator, claiming it aimed to prevent Houthi forces from using the network for military purposes.

On August 16, the Syndicate Committee of the Public Telecommunications Corporation (PTC) in Sana’a released a statement accusing the Houthi-run finance and civil service ministries of violating laws and undermining its financial and administrative independence, and threatened to strike in response. The two Houthi-controlled ministries have been attempting to regulate how the PTC can spend its budget and administer telecommunications operations. Established laws and regulations grant the PTC full financial, administrative, and organizational independence. It is not subject to the Ministry of Finance’s authority to control expenses and revenues for public ministries and institutions, nor the Ministry of Civil Service’s purview over human resource capacities within government entities. According to the Syndicate’s statement, the actions taken by the finance and civil service ministries in Sana’a could result in catastrophic consequences, including lost revenues and the potential suspension of telecommunications and internet services to commercial and financial businesses, health facilities, and the public at large. The Syndicate warned that it would take all necessary measures to defend the telecommunications sector and its employees, including announcing a complete and immediate strike.

Houthi Authorities Increase School Fees

In Houthi-held areas, on August 18 the Houthi Zakat Authority implemented a new measure to increase the cost for families to send their children to private schools. According to an allegedly leaked document issued by the Zakat Authority in Dhamar governorate, each student attending a private school will now be required to pay YR1,000. The Houthi Zakat Authority has targeted a wide spectrum of resources and income channels in the public and private sectors in order to extract funding from citizens, inflating the costs of necessities and essential services.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية