Rial Depreciates in Govt-Held Areas

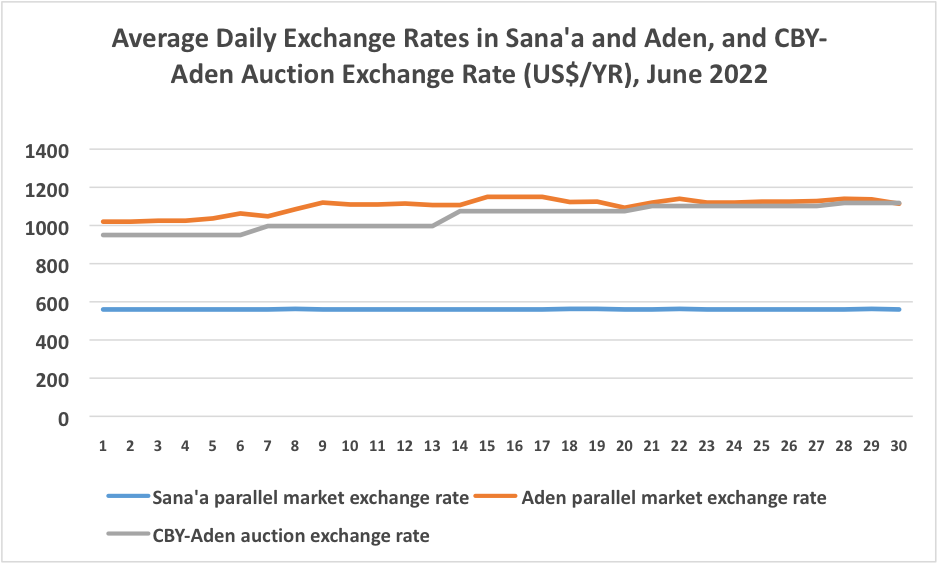

New Yemeni rial banknotes witnessed cyclic volatility over the course of June, depreciating by 10 percent relative to the United States dollar. Printed since 2017 and circulating in government-controlled areas, new rials lost almost 13 percent of their value in the first half of the month alone, falling from YR1,020 per US$1 to a low of YR1,150 on June 15, later rebounding slightly to close the month at YR1,114 per US$1. The recovery followed Presidential Leadership Council (PLC) head Rashad al-Alimi’s June 30 visit to Saudi Arabia, which saw Riyadh commit a further US$400 million in financial support to development projects and another US$200 million in oil derivative grants (see, ‘New Saudi Financial Support Announced’).

In comparison, the price of “old” Yemeni currency notes – printed prior to 2017 and circulating mainly in Houthi-controlled territory – was stable throughout June, trading within a narrow band around YR560 per US$1. The exchange rate for old rials has remained mostly stable since January 2020, when the Houthi authorities banned new rials from circulating in areas the group controls, in large part due to the fixed supply of old rial banknotes and the Houthi authorities’ strict enforcement of a fixed exchange rate regime. By contrast, the Yemeni government pursued an expansionary monetary policy for most of the past five years in order to cover budget expenses, with the increasing supply of new rials helping to foment exchange rate instability.

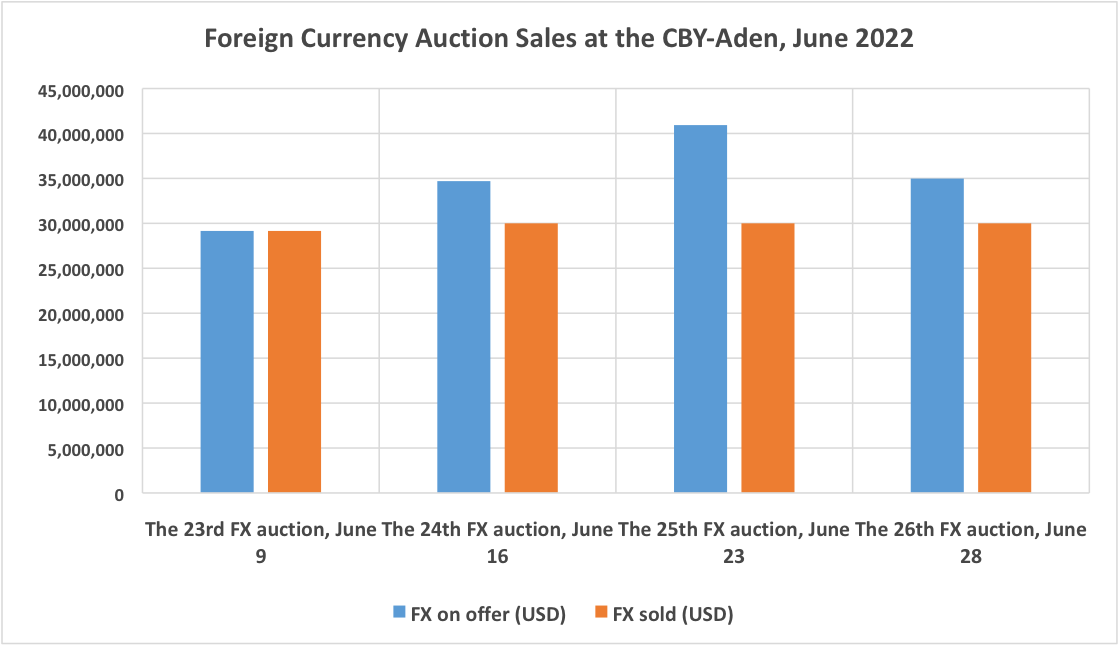

Over the course of June, the CBY-Aden held four foreign currency auctions, one each week, putting on offer a total of US$140 million for Yemeni banks to purchase. Roughly US$119 million, or 85 percent of the foreign currency made available, was sold, up from 72 percent the previous month.

The exchange rate offered by the CBY-Aden is a key determinant for banks to decide whether to participate in hard currency auctions trading. The four foreign currency auctions in June – there have now been 26 this year – sold hard currency above prevailing market exchange rates, at preferential rates of 12, 7, 2 and 7 percent, respectively. Notably, the first auction in June, which offered a 12 percent premium, was fully subscribed, while the third, which offered only a 2 percent premium, was the worst-performing of the month. While such premiums are designed to attract Yemeni banks, volatile cycles of rial depreciation decreased the incentive to bid.

An International Monetary Fund (IMF) statement released on June 7 concluded that the foreign exchange auctions introduced by the CBY-Aden have been an effective policy for allocating foreign currency resources and financing critical imports. However, the IMF indicated that banks’ participation has been inconsistent due to restrictions on the use of foreign currency, and that these should be lifted.

Under the implementation mechanism used by the CBY-Aden, the central bank first confirms that the foreign currency a commercial bank purchases will be allocated to serve customer demand – namely that of commercial traders looking to import goods – before it releases the funds.

New Saudi Financial Support Announced

On June 30, PLC President Rashad al-Alimi and other council members visited Saudi Arabia and met with Saudi Vice Minister of Defense Prince Khalid bin Salman. There, Salman announced that the Saudi Development and Reconstruction Program for Yemen (SDRPY) would provide the Yemeni government with US$400 million to support 17 development projects in six vital sectors: energy, transportation, education, water, health and infrastructure as well as additional US$200 million in oil derivative grants.

Since the formation of the PLC in April 2022, Saudi Arabia and UAE have announced numerous large-scale contributions, including US$2 billion to shore up the CBY-Aden’s dwindling foreign currency reserves and stabilize the rial; US$900 million to finance oil derivatives (diesel and mazut) for power stations; US$300 million for humanitarian relief; and the recent US$400 million to support development projects. However, financing packages to support the CBY-Aden and fuel for power stations have yet to materialize. The funds are apparently being held up because of unimplemented governance reforms Riyadh and Abu Dhabi have demanded in return for their release, which the CBY-Aden and Yemeni government have struggled to put in place (see below, ‘Saudi and Emirati Financial Support Facing Delays’).

Fuel Crisis Returns: Prices Soar in Govt-Controlled Areas

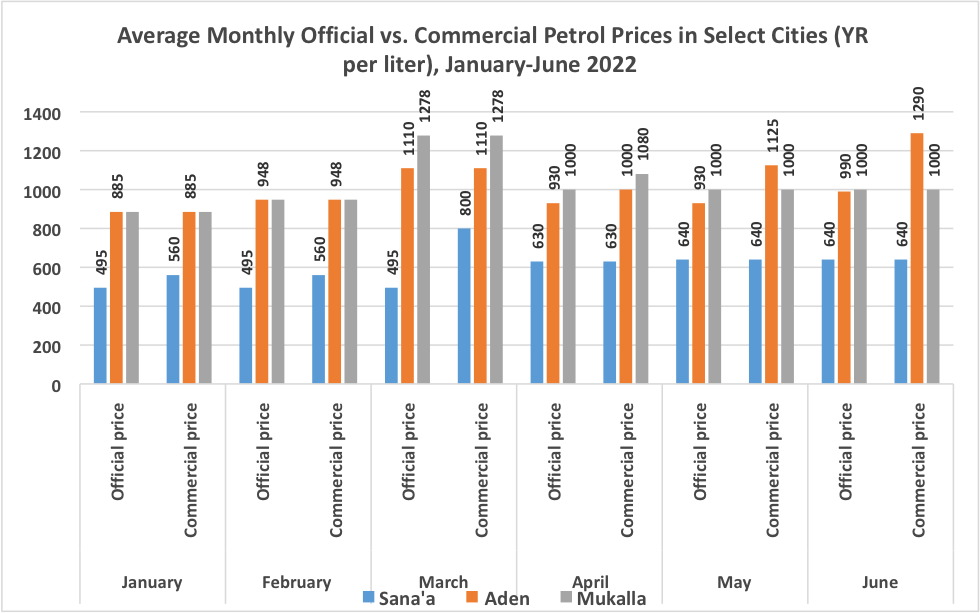

The interim capital of Aden and other cities under the nominal control of the government witnessed severe fuel shortages and price hikes in June, leading to social unrest and popular demonstrations. On June 4, the government-run Yemen Petroleum Company (YPC) announced a price increase of 6 percent, from YR930 to YR990 per liter of petrol at government-run stations (which usually sell at near cost). Two weeks later, commercial petrol stations increased their prices by 15 percent, from YR1125 to YR1290 per liter, following severe shortages and an increase in black-market trading. The black market in Aden has proliferated, as traders seek to profit from unmet demand, selling petrol at roughly YR1750 per liter. As a result, popular protests escalated in southern areas (see, Politics & Diplomacy: ‘PLC President Faces Aden Protests After Regional Tour’). Installed in April, the PLC has been criticized by residents as slow to deliver promised reforms, with the economic situation worsening in many southern regions of the country. Aden, among other areas, is suffering long power outages in the hottest season of the year.

On June 19, the YPC announced that it would continue to supply the local market with petrol at the subsidized price of YR990 per liter, 30 percent lower than the price offered at commercial petrol stations and lower than prevailing global prices. Even while the YPC subsidy is likely to be costly for the government, access to government stations has been limited due to long queues.

It should be noted that the price of petrol differed in areas under government control during June. Government-run stations in Marib continued to provide petrol at the highly subsidized price of YR190 per liter, though the supply was limited relative to the more expensive petrol sold at commercial fuel stations at YR1,100 per liter. In Mukalla, the capital of Hadramawt, the price remained stable at YR1,000 per liter at commercial stations, while in Taiz city it increased 28 percent, from YR1,050 to YR1,350.

Petrol prices in the south had remained relatively stable over the preceding two months, after the internationally recognized government announced a 16 percent reduction in the price, from YR1,110 to YR930 per liter in Aden. This followed the announcement of US$3 billion in consolidated Emirati and Saudi financial support to the government, which induced a considerable improvement in the exchange rate of the new Yemeni rial. During the first quarter of the year, escalation between the warring parties over the supply and sale of fuel throughout the country resulted in nationwide fuel shortages and price hikes (see, The Yemen Review, January & February 2022, for more details on the fuel crisis).

On 25 June, the General Coordination Council to the Yemeni Oil Company Unions (GCCYOCU) issued a statement detailing the reasons for the rise in prices. According to the council, price hikes have been driven by several factors: the depreciation of the rial; recent “economic changes in the world” related to the Russian invasion of Ukraine; liberalization of local fuel markets; the disruption of work between the Aden Refinery Company (ARC), the YPC and the CBY-Aden; and the entry of new private suppliers into the poorly regulated oil derivatives market.

Saudi and Emirati Financial Support Facing Delays

Currency volatility in government-controlled regions has been a major driver of soaring prices, with the currency experiencing significant downward pressure as more than US$3 billion in Saudi and Emirati financial support, promised to the government with the formation of the PLC in April 2022, remains largely undelivered.

The extension of the Saudi grant has been subject to a set of reforms that the SDRPY has mandated to maximize its benefit, which include increasing the collection rate of electricity service bills, improving maintenance for power plants, reducing power waste and satisfying effective governance and control measures for managing the distribution, transportation and consumption of oil derivatives. Over the course of June, no Saudi oil derivatives were received to help operate electric power plants. Since August 2018, oil derivatives provided by Saudi Arabia have played an essential role in alleviating fiscal burdens on the state, slowing the depletion of the CBY-Aden’s foreign currency reserves and helping to stabilize the rial.

The last batch of Saudi fuel arrived in Aden at the end of April, the conclusion of a year-long agreement signed between the government and the SDRPY in April 2021, under which the government was eligible to receive oil derivatives valued at US$422 million and totaling 1,260,850 metric tons to operate more than 80 power stations. Since 2018, Saudi Arabia has provided grants for oil derivatives worth US$602 million, but these are not always received. The government had received only 61 percent of the pledged US$422 million by the time the grant period ended in April.

Source: Saudi Development and Reconstruction Program for Yemen (SDRPY)

Based on Article No. 2 of the agreement signed between the Yemeni government Ministry of Electricity and Energy and the Saudi SDRPY, oil derivatives to operate power plants shall be provided at the prices prevailing on the domestic Saudi market, rather than international prices, with the difference covered by the Saudi fuel grant. According to the Saudi Press Agency, the quantities of diesel and mazut under the Saudi oil derivatives grant were, on average, 77 and 94 percent lower, respectively.

On June 20, Prime Minister Maeen Abdelmalek Saeed held a meeting in Aden with representatives of the ministries of finance, oil and minerals, and other relevant government authorities, to facilitate the resumption of the Saudi grant. The meeting centered on terms in the agreement between the Yemeni government and the SDRPY related to governance controls. Ten days later, Saudi Arabia pledged US$400 million to support development projects in 17 sectors and another US$200 million in oil derivatives grants.

On March 29 in a televised interview, Electricity and Energy Minister Anwar Kalashat had warned of severe electricity shortages due to the expiration of the Saudi grant and the government’s limited capacity to afford fuel on international markets. On June 28, a group of government leaders – including officials from the ministries of planning and international cooperation, and electricity and energy – met with a World Bank delegation in Aden to discuss the challenges associated with power generation and sustainable solutions for electricity and energy in Yemen, including the feasibility of gas power stations. Kalashat told the delegation that one of the largest challenges in the sector has been the large deficit in power generation, which reached almost 50 percent in June, as well as the amount of funding the Yemeni government would need to allocate every month to produce electricity, estimated at up to US$100 million in the absence of the Saudi fuel grant.

In mid-February, the Ministry of Electricity and Energy released a statement outlining governance and management deficiencies that have prevented the effective utilization of previous Saudi fuel grants and reduced the chances of obtaining further support. According to the ministry, one of the obstacles has been a lack of commitment from certain governorates, which have been late to deposit their financial obligations into a joint account created under the grant agreement. By the end of January, the government-owned Public Electricity Corporation and its branches accumulated YR9.71 billion in debt, and a month later had paid off only 45 percent of what it owed.

According to a report released by the Yemeni Ministry of Electricity and Energy and the Saudi SDRPY in May 2021, the ministry has faced difficulties collecting electricity tariffs. The highest collection rate was in Aden at 49 percent, followed by Shabwa governorate at 38 percent, while the lowest collection rate was in Lahj and Al-Dhalea collectively at only 30 percent.

Battle Over Control of Telecom Companies

On June 27, the Yemeni-Omani Company “YOU” (previously MTN) announced the cession of its mobile network service in the interim capital of Aden “for reasons beyond its control” and said it sought to resume service as soon as possible. YOU offices and mobile services in other government-controlled areas, including Abyan, Lehj, Al Dhalea and Marib faced partial closures and suspension, but gradually returned online three days later. The suspension of services in Aden accompanies YOU’s launch of 4G mobile phone technology, and an intense dispute between the fragmented branches of the Ministry of Telecommunication and Information Technology in Sana’a and Aden over the right to regulate mobile phone services.

Aden-based judicial authorities said on June 28 that the government’s suspension of YOU mobile services was a justified response to the company’s failure to pay overdue taxes. On April 24, the Public Funds Prosecution in Aden had released a judicial order imposing a precautionary seizure of the company for failing to pay YR24.24 billion in taxes for the years 2015, 2016 and 2017. In response, YOU filed a lawsuit against the government over the closure of its branches in Aden, asking for the cancelation of the judicial order and demanding compensation. It is unclear how the cases will play out and whether the company will resume operations in Aden. According to a credible source in the telecommunications sector, there have been ongoing negotiation efforts led by Omani shareholders and government officials to settle the dispute.

In November 2021, South African multinational telecommunications company MTN Group announced its exit from Yemen. It subsequently transferred 82.8 percent of its equity in MTN Yemen and its reported 4.7 million subscribers to Emerald International Investment LLC, which has faced accusations of being a Houthi front company facilitated by Omanis. At the time, the internationally recognized government rejected MTN’s decision, stating that it violated the company’s contractual obligations, and that the government was still owed overdue taxes and licensing fees.

The escalating dispute has left thousands of subscribers disconnected, and there has been widespread public panic as the service suspension disrupted businesses, personal communications and access to emergency services.

CBY-Aden Refutes STC Accusation of Planned Return to Sana’a

On June 12, the Aden branch of the Central Bank in Yemen (CBY) issued a statement denying STC claims that it was planning to relocate to Sana’a. The CBY-Aden release stated that: “The Central Bank of Yemen is surprised by the campaigns and statements issued by official entities, accusing the bank’s leadership and some of its officials of conspiring to transfer the bank to Sana’a. Such misleading information aims at poisoning the relationship between the bank and those entities…”

Houthis Look to Develop Stock Market with Iranian Expertise

On June 21, the head of the Securities and Exchange Organization of Iran, Majid Eshghi, and the governor of the Houthi-run CBY-Sana’a, Hashim Ismail, signed a memorandum of understanding for developing Yemen’s stock market infrastructure with Iranian expertise. Notably, the MoU appears to act counter to UN efforts to de-escalate the economic war by fomenting fresh fragmentation in the country’s financial markets.

Other Economic Developments in Brief:

- June 12: The King Salman Humanitarian Aid and Relief Center announced that Saudi Arabia would provide US$10 million to confront the existing threat from the FSO Safer oil tanker anchored in the Red Sea coast of the coast of Hudaydah (for details see, ‘“Every day that goes by is another day that we take a risk that this vessel will break up” – A Q&A with David Gressly about the FSO Safer’).

- June 22: The Yemeni government’s Minister of Planning and International Cooperation, Waed Badeb, warned that the country’s wheat stocks are almost depleted, in large part due to knock-on effects from the Russian invasion of Ukraine.

- June 29: S&P Global Commodity Insights published an article stating that the Austrian company OMV is looking to exit its oil and natural gas investments in Shabwa governorate. In the face of security challenges, the company plans to begin divestment and reduce its production activities.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية