Fuel Price Hikes in Houthi-Controlled Areas

On July 3, the Sana’a-based Yemen Petroleum Company (YPC) increased the official price of petrol by 9 percent, from YR640 t0 YR700 per liter, in areas under the control of Houthi authorities. Since last June, Houthi-controlled cities have suffered from continuing shortages of diesel, leading to wide divergences in prices at official, commercial and black-market fuel stations. In the last week of July, commercial and black-market prices were approximately 17 and 33 percent higher, respectively, than the official price. Between June 2021 and July this year, the YPC in Sanaa has increased the price of fuels three times. During this period, the price of petrol increased 137 percent, from YR295 per liter to YR700 per liter, while the price of one liter of diesel increased by 197 percent, from YR295 to YR875.

There were no official price hikes by the government-run YPC-Aden in July, however limited institutional capacity to regulate or finance fuel imports continued to sustain a relative fuel shortage and high black market prices in many southern cities. In June, the YPC-Aden increased the official price of petrol by 6 percent, from YR930 to YR990 per liter, with commercial fuel stations subsequently raising their prices 15 percent, from YR1125 to 1290YR per liter. Unmet demand in July allowed the black market to sustain prices of YR1500 per liter in both Aden and Taiz. In Marib, where the official fuel price is set at the highly-subsidized rate of YR175 per liter – though it is generally unavailable at this price – the black market was selling petrol for YR800 per liter.

On July 4, the YPC in Sana’a released a statement saying that price hikes in Houthi-controlled areas reflect increases in global crude prices and transportation costs, which it said had doubled. Less than a week later, on July 9, an official spokesman for the YPC-Aden said that in addition to these price shocks, the government has not been able to allocate sufficient hard currency stocks to import fuel, which costs some US$600 million annually, in the light of delayed Saudi and Emirati financial support. He added that the recent truce with the Houthis, an agreement which allowed larger quantities of fuel derivatives to be imported through the Houthi-held port of Hudaydah, had contributed to fuel shortages in government-held regions. The spokesman stated that the truce had spurred an exodus of businessmen and traders from government-held ports to Hudaydah, where they have been offered better incentives by Houthi authorities.

The fuel derivatives market has been highly lucrative for warring parties, in particular Houthi authorities and their affiliated business networks, who often manipulate the supply through official channels to generate higher returns on the black market.

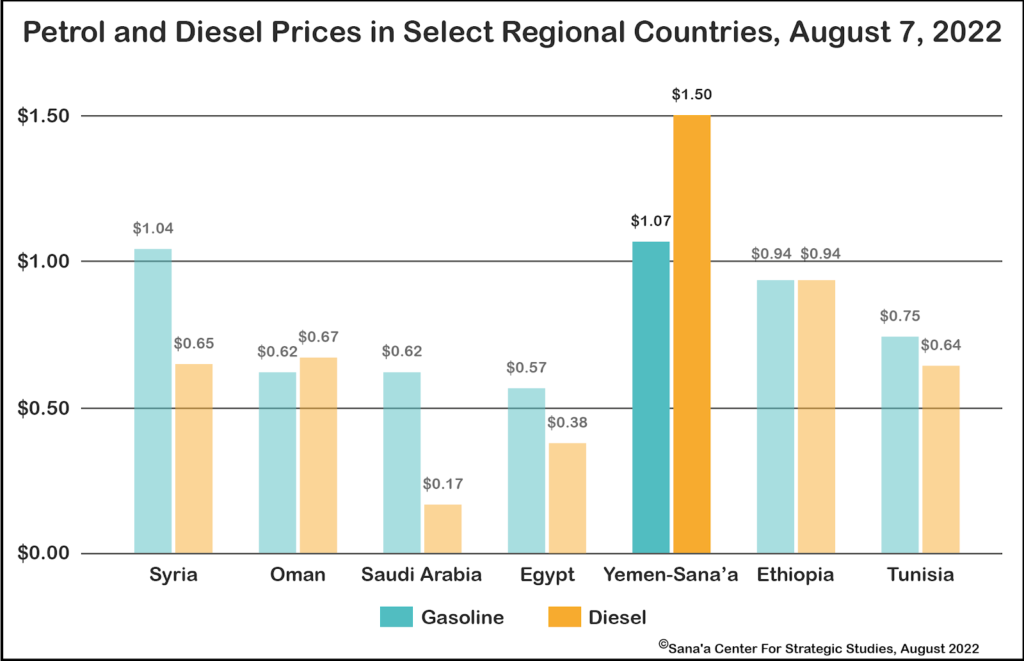

In the first week of August, the YPC-Sana’a announced that it was responding to declining global fuel prices by reducing the official price of petrol by 14 percent, from YR700 to YR600 per liter, and the price of diesel by 8 percent, from YR750 to YR690 per liter. Comparatively, however, fuel prices in Houthi-controlled areas are among the highest in the region, particularly in regard to diesel. This likely indicates that Houthi levies and taxes associated with fuel imports and sales are highly profitable for the group.

Houthis Blame Saudis for Diesel Crisis, Evidence Suggests Otherwise

In July, the Houthi-run YPC released several statements accusing the Saudi-led coalition of seizing fuel ships and causing a supply bottleneck in oil derivatives, in particular diesel. At the beginning of July, the YPC-Sana’a issued a statement saying the coalition had blocked the passage of two fuel vessels originating from the UAE and carrying a total 57,735 tons of diesel, for four days off the coast of Jizan, Saudi Arabia. A second statement, on July 29, accused the coalition of holding five ships loaded with almost 150,000 tons of oil and diesel off of Jizan, blocking them from heading to Hudaydah. According to the last statement, the ships were seized for “varying periods” that “amounted to 17 days,” despite having successfully completed the examination and audit procedures of the United Nations Verification and Inspection Mechanism (UNVIM). The following day, a YPC spokesman announced that three of the ships – the Viviana, Sea Adore, and PSS Energy – which together carried some 87,000 tons of fuel, had been released and had arrived at Hudaydah.

Since last June, Houthi-controlled cities have suffered recurrent shortages of diesel, leading to wide divergences in prices at official, commercial, and black-market fuel stations. For most of July, the official price of diesel was YR750 per liter, but availability was limited. As noted above, at the end of July, diesel sold on the commercial and black markets was being priced roughly 17 and 33 percent above, respectively, the official price.

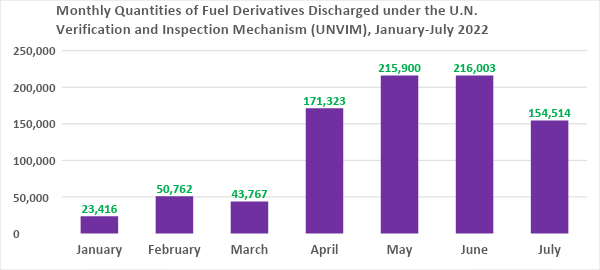

It is plausible that Houthi authorities have intentionally limited the supply of diesel to the market to build up their own strategic reserves. The truce allowed for 36 fuel ships to offload at the Houthi-held port of Hudaydah between early April and the end of July. In a statement, the YPC-Sana’a disclosed that only 80 percent of the fuel had actually been offloaded, though the ships likely carried sufficient diesel to address market demand.

Indeed, the UNVIM Operational Analysis report indicated in July 2022 that 154,514 tons of fuel derivatives was discharged in Hudaydah, an increase of 247 percent relative to the 2021 monthly average (44,589 tons) and a 17 percent increase compared to the monthly average since May 2016 (131,792 tons). In addition, the UNVIM reported that fuel vessels in July 2022 spent an average time of 10 days in the Coalition Holding Area (CHA) off the coast of Saudi Arabia, compared to 60 days on average in July 2021, and to an average of 73.3 days last year.

The YPC has regulated the supply of diesel sold at official fuel stations by restricting access to a limited number of public institutions and Houthi affiliates. Commercial businesses, including electricity generator owners and the majority of the public, can only buy diesel at commercial stations or on the black market. On July 30, the Houthi-aligned Minister of Electricity and Energy and the Executive Director of the YPC signed an agreement to regulate the demands of public and privately owned electricity stations and determine their diesel requirements. It is unclear whether this mechanism will apply to the fuel aboard the vessels cleared for offloading at Hudaydah at the end of July.

Currency Watch

New Rials Depreciate, Old Rials Remain Stable

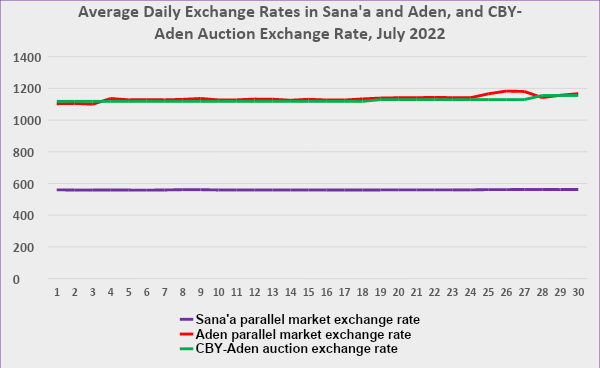

The Yemeni rial (YR) exchange rate in government-controlled areas recorded a cumulative 6 percent depreciation relative to the United States dollar (US$) between the beginning and end of July, falling in value from YR1,103 per US$1 on July 1 to YR1,169 on July 31. In the first three days of the month alone, new rial banknotes – those issued by the CBY-Aden since 2017 – fell 3 percent, depreciating from YR1,103 to YR1,136 on July 4. The currency rebounded slightly and then remained relatively stable at YR1,140 per US$1 until July 24. In fluctuations over the last week of July, the rial fell as low as YR1,183 on July 26, before ending the month at YR1169 per US$1.

One of the primary drivers of exchange rate instability in government-controlled areas was the CBY-Aden’s reduced intervention in the foreign exchange market. In July, the CBY-Aden held three foreign currency auctions, at which Yemeni commercial banks purchased only about half the funds they had at the four auctions in June (see below).

Currency stability is an increasing risk due to the CBY-Aden’s dwindling foreign currency reserves and with Riyadh and Abu Dhabi demanding governance reforms before releasing US$2 billion in promised support to the government-controlled central bank.

In Houthi-controlled areas, the exchange rate for old rial banknotes – printed prior to 2017 – remained stable, trading within a narrow band around YR560 per US$1.

Commercial Banks Sour on FX Auctions

Over the course of July the CBY-Aden held three foreign currency auctions, at which a total of US$90 million was made available for Yemeni banks to purchase. Of this, only 67 percent (US$60.6 million) was sold. The auction at the end of July, the 29th of 2022, was the worst-performing of the year, with only 46 percent of the available foreign currency sold, down from 75 and 81 percent, respectively, in the two auctions preceding it.

The total amount of foreign currency sold in July was just 51 percent of that sold in June, when 85 percent of the US$140 million on offer was purchased. Commercial banks’ declining appetite to participate likely relates to the marginal premiums offered on the currency for sale and continuing exchange rate volatility, which together raise the potential for banks to take losses on the currency they buy. When the 28th auction was announced it carried a 2 percent premium above the market rate, but due to rial appreciation between the announcement and the day of the auction, purchasing banks took a 1 percent loss relative to the prevailing market exchange rate. Should the Saudi and Emirati support come through, the rial would likely appreciate significantly, giving banks further incentive to hold on to their rials.

At the end of July, the CBY-Aden announced that through the 28 currency auctions it had this year, it had disbursed a total amount of US$473.5 million to commercial banks to finance the importing of basic commodities.

Government Seeks to Monitor Country’s Largest Mobile Network

Speaking confidentially to the Sana’a Center, an engineer working in the telecommunications sector reported that the government has recently asked Yemen Mobile Company, the biggest mobile network operator in the country, to provide it access to the mobile network and allow it to monitor mobile services in areas under government control as part of a larger effort to prevent the Houthi authorities from utilizing mobile networks to identify military targets. The rival branches of Yemen’s fragmented telecommunications ministry have regularly fought over the ability to regulate and collect fees from the sector. Another recent escalation came in June when the government’s branch of the Ministry of Telecommunications and Information Technology suspended the mobile network services of the Yemeni-Omani Company “YOU” (previously MTN) in Aden, accusing it of being delinquent on tax payments.

Delegation Negotiates Wheat Imports with Indian Government

On 21 July, media reported that Yemeni government officials and representatives from the country’s private sector had started negotiations with the Indian government to facilitate wheat imports. In May, India banned wheat exports due to surging domestic prices but subsequently exempted Yemen from the export ban. An Indian official said in July that her country had exported more than 250,000 tons of wheat to Yemen in the past three months. Abu Bakr Baabid, Vice President of the General Federation of Yemeni Chambers of Commerce and Industry, confirmed that the wheat had been purchased, but said delivery had been blocked at the Indian port of departure. In 2021, Russia and Ukraine together provided Yemen with 42 percent of its wheat exports, but following Moscow’s invasion of its neighbor in February 2022 – and the ensuing disruption in exports due to the blockade of Ukrainian ports and sanctions on Russia – Yemen has been forced to resource its grain imports elsewhere.

Retailers Keep Commodity Prices High Despite Falling Costs

The Yemeni Association for Consumer Protection (YACP) in Sana’a issued a statement on July 19 demanding that the Ministry of Industry and Trade compel traders to reduce retail prices on food commodities in line with recent declines in global market prices. The YACP stated that the global price decline ranged between 20-25 percent, and the ministry should compel reductions on retail prices for goods arriving in Yemen for the rest of July, August and September.

The Yemeni rial has appreciated in value country-wide since the government-Houthi truce was announced in April, which also precipitated increased deliveries of food and fuel to the country. According to the WFP, during the first half of 2022 total fuel imports through Hudaydah ports increased 137 percent compared to the previous year, while total food imports were 17 percent higher relative to the same period in 2021. Since May there has also been a decline in global food prices. These factors, however, have not translated into lower retail prices for Yemeni consumers, with weak commodity market regulation allowing traders to pocket the cost savings themselves.

On July 24, the Sana’a-based Ministry of Industry and Trade issued a decision to reduce and control the price of grilled chicken (defined as weighing 900-1,000 grams), which would force vendors to reduce the price per chicken from YR2,500 to YR2,000. As of this writing, however, the decision had not been implemented.

Government Signs Agreement to Develop Energy Sector

On July 5, the government, represented by its Minister of Electricity and Energy, Anwar Kalashat, and Minister of Oil and Minerals, Abdul Salam Baaboud, signed an agreement with Siemens Energy in Germany to develop Yemen’s electricity and energy sector. The agreement is a road map for developing sustainable power solutions and aims to build gas-fueled power plants and to diversify using renewable energy sources. The agreement also includes the installation of new transmission lines for the national electricity network, connecting Yemeni governorates and developing, rehabilitating, and providing maintenance for existing power stations.

Yemen’s already weak public electricity production became critically deficient during the conflict, as infrastructure was directly and indirectly targeted by the warring parties and the responsible state institutions fragmented. As a result, profiteers have spurred the growth of a black-market economy to fill the vacuum. The supply of electricity from Marib’s two gas-powered stations, with a capacity of 360 and 400 megawatts respectively, has been disrupted, amplifying shortages nationwide.

On July 18, Al-Araby Al-Jadeed newspaper reported that Yemen currently spends an estimated US$1.2 billion annually on importing fuel derivatives to produce only one gigawatt of electricity, addressing just 7 percent of the country’s actual energy needs, estimated at 14 gigawatts.

Given deteriorating economic conditions and the ongoing conflict, Yemen will continue to suffer from severe power shortages in the short and medium term. Sustainable solutions for power would require greater security and stability, and huge investments in the reconstruction and rehabilitation of the country’s damaged and outdated electricity infrastructure.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية