Houthi Red Sea Attacks Increase Shipping Costs

The seizure of an Israeli-linked ship by Houthi forces in the Red Sea and repeated attacks on commercial shipping threaten to pile additional pressure on Yemen’s economy by raising the costs of imports. Shipping to Yemen already incurs increased transport and logistics costs due to its designation as a “high risk” area. According to a 2021 UNDP assessment, war premiums, covering the potential loss or damage to vessels, resulted in insurance costs for shipping to the port of Aden port to be 15 times the regular rate. These additional insurance costs, totaling more than US$20 million per year, are ultimately borne by Yemeni consumers. While the full economic ramifications on shipping to Yemen following the Houthi seizure of the Galaxy Leader vessel and other attacks are not yet clear, analysts say the incident will lead to an increase in war premiums. The high risk area has now been widened to reflect the growing scope of the attacks and Houthi capabilities. Insurance costs had doubled by mid-December, and are likely to rise further. One local businessman claimed his freight rates had already gone up by 50 percent. The ramifications are intensified by Yemen’s reliance on imported food – more than 80 percent is shipped in from abroad, mostly through the ports of Hudaydah. While the campaign has had a deleterious effect, Israel imports far more via the Mediterranean.

Purported Government-UAE Oil Sale Under Scrutiny

The revelation of a government plan to sell oil to an Emirati company at a significant discount has sparked outrage, with critics slamming the potential deal as a waste of the country’s natural resources, while the government has defended the move as necessary to generate much-needed revenue. A leaked document from the Prime Minister’s office from June revealed that the Ministry of Oil and Minerals negotiated a deal with Emirati company EMO to purchase 3.5 million barrels of crude oil from existing reserves in Hadramawt and Shabwa at a 35 percent discount, and another 14.5 million barrels of future oil production at a 30 percent discount. In exchange, EMO would provide petroleum derivatives to operate power stations in areas under government control.

The leaked document outlined the rationale for the deal, saying the government was in a critical economic situation, which limited its ability to carry out its basic mandate, provide minimum levels of public services, or regularly pay public sector salaries. Oil exports, the government’s primary source of revenue, have been halted since Houthi drone and missile attacks on oil export terminals in October and November 2022. News of the potential deal sparked widespread criticism, with critics focusing on the secret nature of the agreement and the discounted prices. Media outlets said that the deal to sell 18 million barrels of crude oil would garner US$1.1 billion, while at the global price the value of the oil exceeds US$1.6 billion.

The deal also reportedly bypassed the usual approval processes, avoiding scrutiny from governmental or legislative bodies. Prime Minister Maeen Abdelmalek Saeed has been called on to clarify how the sale was negotiated outside existing mechanisms for transparency and accountability. The deputy speaker of the government’s House of Representatives has demanded a copy of the Supreme Committee for Oil Marketing’s decision regarding the Emirati offer and the agreement signed with the exporting company. Further fueling the controversy, the sale of future oil production has never been carried out in Yemen before, and critics say the move could jeopardize the country’s future economic sovereignty.

UAE Sends Emergency Fuel Shipment to Aden

An emergency fuel shipment from the UAE arrived in Aden on November 7 to power electricity stations in the interim capital, which has been experiencing regular blackouts for several months due to a lack of fuel. Emirati Ambassador to Yemen Mohammed Hamad al-Zaabi announced the fuel delivery following a meeting with PLC chief Rashad al-Alimi in Aden. The government-owned General Electricity Corporation (GEC) has issued several statements since late October warning that power stations in the city might be forced to completely shut down if no new fuel became available. According to the GEC, fuel supplies fell to as low as 4,000 metric tons on October 28, an amount sufficient to sustain operations for only four days in Aden, Abyan, Lahj, and Al-Dhalea governorates. During the electricity crisis in Aden, which has continued since the summer, the GEC has repeatedly called on the government to intervene and expedite the provision of fuel to power stations. A separate statement, issued on November 2, appealed to security forces protesting in Zinjibar district in Abyan to allow the passage of tanker trucks bringing crude oil from Shabwa to supply the Petromasila power station in Aden.

The Emirati delivery is the latest effort by Abu Dhabi to support the electricity sector in government-controlled areas. In late 2022, the Ministry of Electricity and Energy and Masdar, a renewable energy company also known as Abu Dhabi Future Energy, signed an agreement to build a solar power station in Aden. Intended to generate 120 megawatts per hour, the project would also include the construction of transmission lines and conversion stations to transmit and distribute electricity to Aden’s various neighborhoods. At the time, Prime Minister Maeen Abdelmalek Saeed said that the project should be completed by June 2023. Media outlets have recently indicated that construction of the power station is in its final stages, without clarifying when it will become operational. When complete, the project should help alleviate some of the government’s dependence on imported fuel to operate power stations in Aden.

Aden and other governorates under government control began experiencing extended blackouts following the expiration of a Saudi fuel grant in April. In November 2022, the Saudi Development and Reconstruction Program for Yemen (SDRPY) began supplying the government with over 1.2 million metric tons of diesel and mazut, valued at US$422 million, for electricity generation at more than 80 power stations. A new US$1.2 billion Saudi grant was announced in early August 2023 to address the government’s budget shortfalls, including the purchase of fuel to operate power stations, which is estimated to cost US$75-100 million per month. The GEC confirmed the arrival of 13,000 metric tons of fuel at the port of Aden on August 22, but no further Saudi shipments have been announced. Regular protests in Aden and other governorates have criticized the government for failing to develop solutions to address the chronic electricity crisis.

Judiciary to Investigate Corruption in Aden’s Electricity Sector

On November 5, Attorney General Judge Fawzi Ali Saif referred a complaint submitted against the government over corruption in the electricity sector in Aden to the Central Organization for Control and Accounting. The complaint was filed by the Preparatory Committee for the National Movement for Correction and Construction, a recently established STC-affiliated civic organization, and urged the Attorney General to initiate an impartial and transparent inquiry into issues within Aden’s electricity sector. Despite the government allocating approximately US$3 million per day to purchase fuel supplies to operate power plants across the south, blackouts remain persistent, provoking regular demonstrations by angry residents.

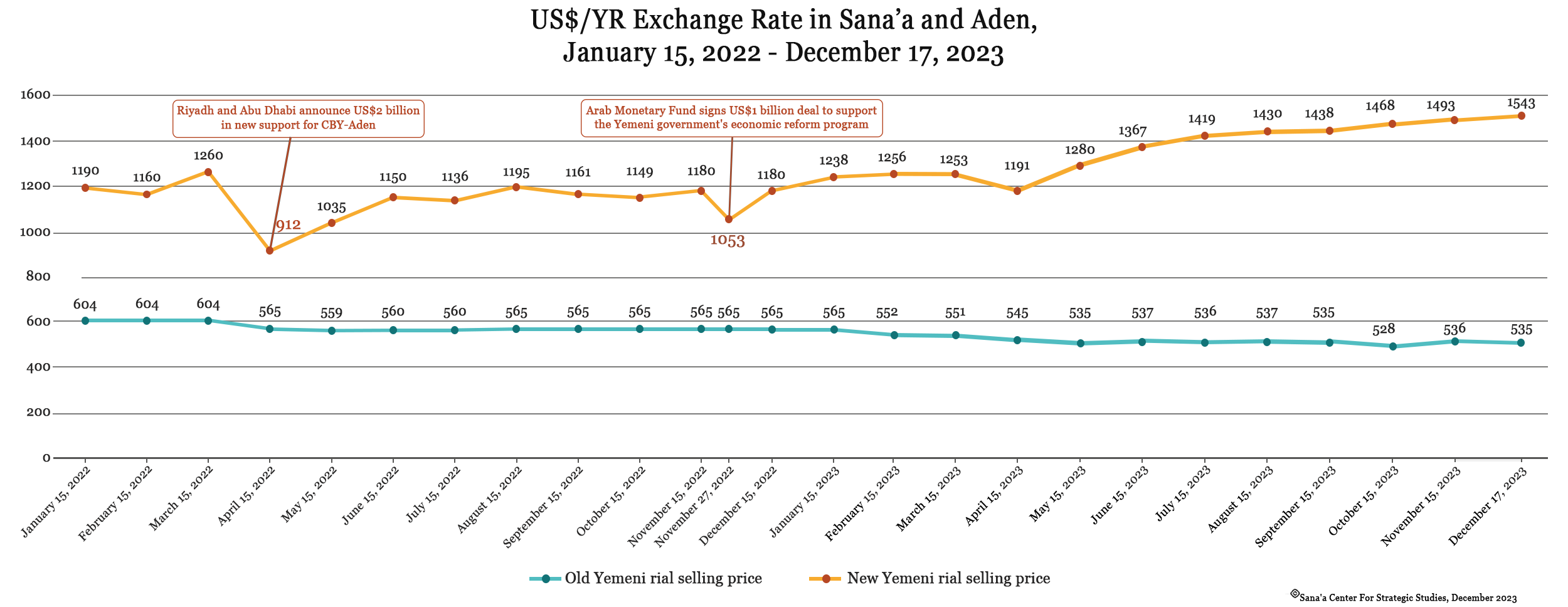

New Rials Continue to Lose Value

New rials in government-controlled areas continued to fall in value over the course of November and early December. They depreciated by over 1 percent, from YR1,521 in late October to YR1,542 per US$1 as of November 12. They regained value toward the end of the following week, reaching YR1,505 per US$1 as of November 19, before entering a new wave of devaluation, closing the month at YR1,533 per US$1. The fluctuation follows a period of steep depreciation in October, where the currency lost more than 5 percent of its value, reaching lows not witnessed since late 2021. The trend has continued in December, with new rials trading at YR1,543 per US$1 as of December 17. The currency, which was trading at Y$1,544 per US$1 on December 10, tumbled briefly to YR1,553 per US$1 during the middle of the week before recovering days later.

The devaluation of new rials was sparked after the government-run Central Bank of Yemen (CBY-Aden) depleted its foreign currency reserves toward the end of October, forcing it to suspend the weekly foreign currency auctions that helped finance the import of essential commodities and stabilize the value of the rial. A US$1.2 billion Saudi grant was announced in August to finance the public budget and prop up the value of the Yemeni rial, but Riyadh has only released 1 billion Saudi riyals (roughly US$267 million) as the first tranche. Since the delivery of the first installment of the Saudi grant, the CBY-Aden has held 14 FX auctions, selling US$321 million from its limited foreign currency reserves to Yemeni banks to help finance the import of basic commodities and lessen downward pressure on the Yemeni rial. This has now been exhausted, and the delay in the delivery of new funds to replenish the CBY-Aden’s foreign exchange reserves is expected to drive up further depreciation in the new rials and trigger food price inflation.

Old rials in Houthi-controlled areas have remained stable, trading at YR535 per US$1 on average over the reporting period.

WFP and Houthis Reach Agreement to Restart Food Aid

In mid-December, a UN employee based in Sana’a and a Western diplomat told the Sana’a Center that the World Food Programme (WFP) had reached an agreement with Houthi authorities to restart General Food Distribution in areas under the group’s control. The deal, which has not been announced publicly, was reportedly agreed with the Houthi-run Supreme Council for the Administration and Coordination of Humanitarian Affairs and International Cooperation (SCMCHA) and will see aid directed to the most vulnerable families. The WFP will be given responsibility for identifying beneficiaries, and Houthi authorities have pledged to refrain from intervening in the allocation of food aid.

Even with an immediate agreement, the WFP noted that it could take up to four months to resume food assistance due to supply chain disruptions and given that food stocks in Houthi-controlled areas have been almost completely depleted. WFP food aid to government-controlled areas continues to the most vulnerable families, in line with adjustments made in August 2022.

On December 5, the WFP had announced the suspension of General Food Distributions in Houthi-controlled areas. The organization said the move was driven by limited funding and the absence of an agreement with Houthi authorities on a smaller program that would target the neediest families. The “difficult decision,” made in consultation with donors, came after nearly a year of unsuccessful negotiations with Houthi authorities to reduce the number of beneficiaries from 9.5 million to 6.5 million. Despite the very real negative ramifications of a cut of food aid in Houthi-held areas, intransigence on the part of Houthi authorities did not come as a surprise. Previous arrangements granted the Houthis near complete control over aid entering areas under their control. The group was able to divert food aid to loyalists to curry political favor, recruit troops to the frontlines, or sell it on the black market at exorbitant prices.

Dozens of NGOs criticized the decision, saying it would impact up to 9.5 million people across northern Yemen, and the nuance of the negotiations was mostly lost on social media. After the WFP’s announcement, pro-Houthi news outlets, politicians, and activists sought to frame the move as an act of US imperialism aimed at punishing the Houthis, and Yemenis as a whole, for standing against the Israeli military campaign in Gaza.

SCMCHA also sought to frame WFP’s decision as a collective punishment of Yemenis in response to their solidarity with the Palestinian people amid the ongoing Israeli military assault on Gaza. On December 11, the Houth-affiliated Secretary-General of SCMCHA, Ibrahim al-Hamli, met with the director of the United Nations Office for the Coordination of Humanitarian Affairs (OCHA), Markus Werne, to discuss the recent termination of World Food Programme (WFP) aid in Houthi-controlled territories. In the meeting, Al-Hamli accused the UN of politicizing aid – which he said constituted a crime against humanity – while Werne responded that he was working with WFP officials to continue aid despite financial challenges.

While Government’s Fiscal Crisis Deepens, Uncertainty Surrounds Public Revenues in Hadramawt

The internationally recognized government continues to contend with a stifling fiscal crisis, amid the cessation of oil exports following Houthi drone attacks on southern oil ports in late 2022 and a delay in the receipt of pledged Saudi financial support. Government customs revenues have also decreased markedly this year as commercial shipping has been increasingly diverted to the Houthi-controlled ports of Hudaydah following the lifting of coalition restrictions. Planned maintenance at the Marib refinery at Safer, which began on November 28 and is scheduled to take place over 25 days, has deprived the government of yet another source of revenue. Approximately 7,000-8,000 barrels of crude were refined daily at the plant and sold on the local market, with a portion of proceeds going to government coffers.

The PLC has yet to officially respond to Hadramawt Governor Mabkhout bin Madi’s decision in late November to cease depositing Hadrami-generated public revenues to government-run Central Bank of Yemen (CBY-Aden) accounts. According to Bin Madi, the move came as a response to the failure of the government and Ministry of Finance to provide the local authority in Hadramawt with the funds allocated in the public budget to meet pressing service provision needs and other essential spending priorities. The local authority also accused the government of manipulating Hadramawt’s share of oil sales revenues; an agreement was reached in 2019 for the governorate to receive 20 percent of revenues generated from hydrocarbon production in Hadramawt. Similar arrangements were also reached with Marib and Shabwa.

Bin Madi held a meeting with leaders from the Nahad tribe in Mukalla on December 5, during which Saleh bin Ali bin Thabit, the tribe’s leader, expressed support for the decision to withhold oil revenues from the central government. However, the leader of the Second Hadrami Uprising, Hassan al-Jabri, chaired an emergency meeting of the group on December 8 and announced that it would escalate efforts to oppose Bin Madi’s move and called on Saudi-led coalition forces to support them “against conspiracies” in the governorate. Defense Minister Mohsen al-Daeri expressed sympathy with the governor’s position, which aligns with the PLC policy of empowering local government, but said it had come as a surprise. “It’s up to the central government to deal with the issue,” he said during a December 8 meeting with the governor. International stakeholders have also weighed in. European Union ambassadors stressed the importance of depositing all public revenues regularly into CBY-Aden during a meeting with CBY-Aden Governor Ahmed Ghaleb on November 28, while British Ambassador Abda Sharif discussed the issue with Bin Madi during a meeting on December 6.

From a practical standpoint, the move only puts limited pressure on the Yemeni government – despite its dire financial situation – given that oil exports from Hadramawt, previously a major source of revenue, have been halted since November 2022 following Houthi attacks on oil export terminals. The government, which is currently struggling to cover the public sector salary bill and other essential spending needs, could be thrown an economic lifeline soon.

While a US$1.2 billion Saudi grant was announced in August to finance the government budget, Riyadh has only released 1 billion Saudi riyals (roughly US$267 million) as the first tranche. A senior government official told the Sana’a Center that Saudi Arabia may be planning to hold off on the release of the second tranche until the resumption of salary payments to public sector employees in Houthi-controlled areas, which is still a subject of negotiations between Riyadh and the Houthis, though these appear to have stalled. The government is unlikely to be able to pay the public sector wage bill in government-held areas after December, absent new financial support. Government sources have said that Saudi Arabia is expected to release the second tranche of its grant in January to rescue the government from imminent fiscal collapse and replenish its depleted coffers.

US Treasury Sanctions Houthi Financing Network

On December 7, the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) sanctioned 13 individuals and entities accused of providing the Houthi group with tens of millions of dollars worth of foreign currency generated from the sale and shipment of Iranian commodities by the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF). The sanctions targeted exchange houses and companies in multiple jurisdictions, including Yemen, Lebanon, and Turkey, as part of a network operated by Sa’id al-Jamal, a “Houthi and IRGC-QF financial facilitator” who was previously sanctioned in June 2021. The network allegedly served as a major conduit for Iran to send money to Yemen.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية