Financial and Monetary Developments

Ripple Effects of the Houthi Terrorist Designation: Complexity and Uncertainty

The re-designation of the Houthis as a Specially Designated Global Terrorist group (SDGT) by the Biden administration, which took effect on February 16, has sparked a complex debate. The move follows a series of Houthi missile attacks on commercial vessels in the Red Sea and Bab al-Mandab Strait. The designation allows the US Treasury to impose sanctions on individuals and entities affiliated with the Houthis, potentially hindering their ability to fund activities deemed “terrorism” by the US. American citizens and companies are now prohibited from doing business with the Houthis unless they receive special permission. Even companies partially owned by the Houthis or related blacklisted groups are off-limits. Outside the US, the designation sends a strong message to other countries and organizations, potentially discouraging engagement for fear of violating US sanctions. Foreign businesses dealing with the Houthis could get into trouble, perhaps even landing on a similar blacklist. As a result, the new sanctions could limit the Houthis’ ability to access funds for essential supplies, equipment, and salaries for fighters, potentially impacting their military capabilities.

The SDGT designation is intended to balance pressure on the Houthis with the safeguarding of humanitarian access. Compared to the broader Foreign Terrorist Organization (FTO) designation, the SDGT is less comprehensive, potentially minimizing disruptions to humanitarian aid delivery. While aiming to pressure the Houthis and deter attacks on commercial shipping, the designation has raised concerns about its impact on aid delivery and the Yemeni economy. To mitigate these risks, the US Treasury’s Office of Foreign Assets Control (OFAC) issued five general licenses, authorizing specific transactions with the Houthis related to the provision of agricultural commodities, medicine, and medical devices (including replacement parts and components and software updates for medical devices); telecommunications, mail, and internet-based communications; personal remittances; refined petroleum products in Yemen; and port and airport operations essential to the Yemeni people.

Despite the targeted approach, concerns exist about unintended consequences to the Yemeni economy and humanitarian access. While the designation excludes direct sanctions on humanitarian actors, it could create a climate of fear and discourage engagement, inadvertently hindering aid delivery to millions in need. The Houthis control the most populous areas of Yemen, where 70 percent of the population is estimated to live. The designation, coupled with the ongoing conflict, could further cripple trade and investment, worsening the already dire economic situation and fueling further instability.

The designation has the potential to significantly impact Yemeni banks, compounding their isolation from the global financial system. Foreign correspondent banks (FCBs) are likely to ramp up de-risking measures and adopt stricter anti-money laundering (AML) compliance regulations, severing ties with Yemeni banks to avoid potential sanctions violations and reputational risk. This could further limit Yemeni banks’ ability to process international transactions. With limited access to FCBs and heightened compliance costs, the cost of financial transactions and trade financing could significantly increase for Yemeni banks. This could make importing essential commodities, like food and medicine, more difficult and expensive.

The full impact of the designation remains uncertain and hinges on several factors. It is not clear how the Houthis will react or adapt their operations. Varying interpretations and enforcement approaches by different countries and entities might significantly affect the impact on the Houthis and humanitarian access. The prospect of unintended consequences necessitates careful monitoring and continued diplomatic efforts. Yemeni banks should be provided with technical support to demonstrate robust AML compliance and mitigate exposure. Ensuring effective utilization of exemptions and continued dialogue with humanitarian actors is crucial to mitigate the designation’s negative impacts.

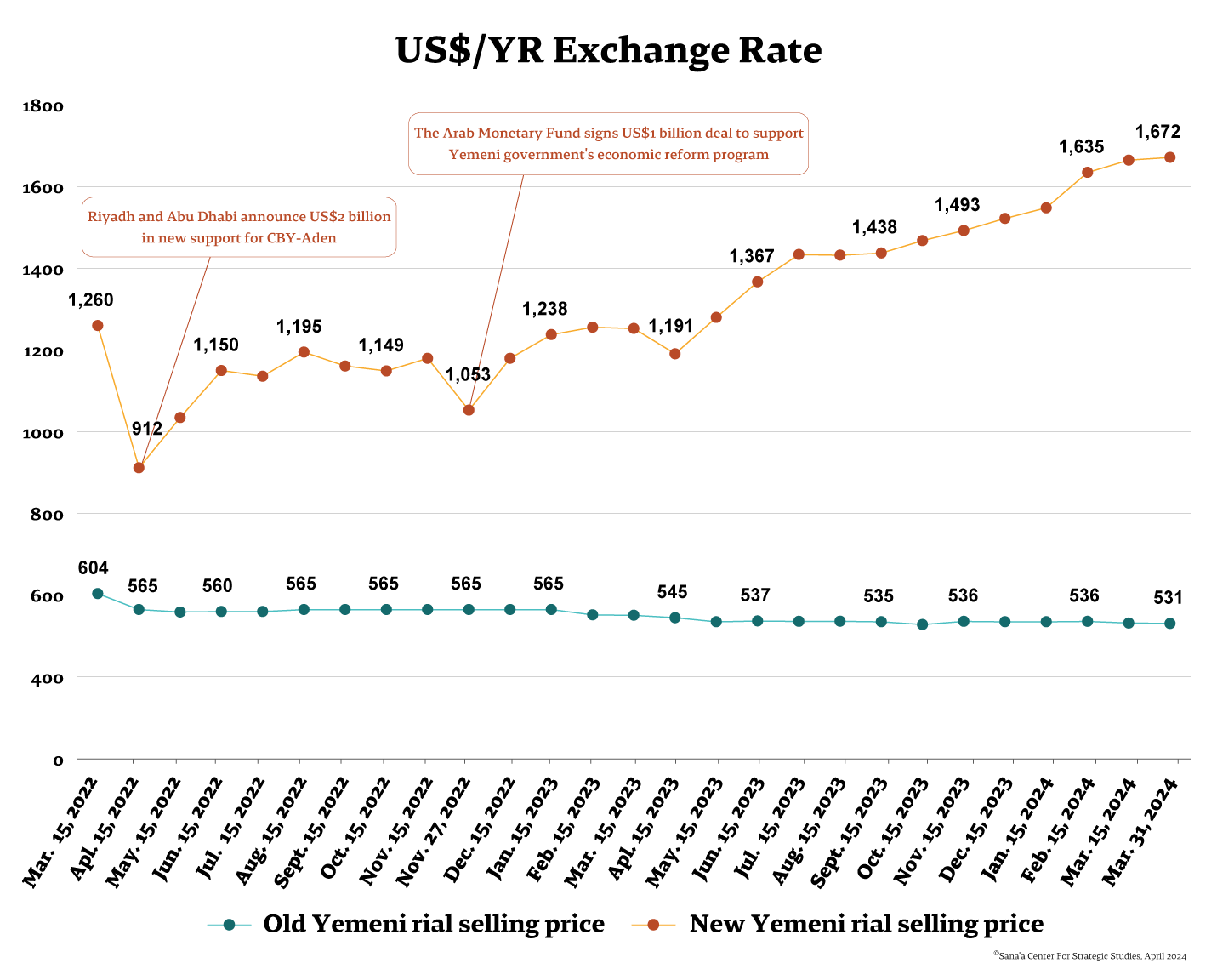

Saudi Support Bolsters Yemeni Rial After Steep Depreciation

In February, Saudi Arabia delivered a second tranche of a US$1.2 billion grant, amounting to US$250 million. Its release comes more than six months after the first tranche of US$267 million in August last year, aimed to prop up the Yemeni rial and support the government’s budget. The new funds helped replenish the CBY-Aden’s dwindling foreign currency reserves and allowed it to reintroduce regular FX auctions, intended to help finance the import of basic commodities, including foodstuffs.

Following the transfer, new rials initially appreciated by 2 percent, from YR1,665 to YR1,625 per US$1 by mid-February. This ended a period of instability and devaluation caused by depleted government coffers. In January alone, new rials had lost over 5 percent of their value depreciating from YR1,543 to YR1,626 by month’s end.

The Central Bank of Yemen in Aden (CBY-Aden) resumed foreign exchange (FX) auctions in late January. The first auctions attracted strong participation, with both the January 24 and February 15 auctions fully subscribed, with US$40 million and US$60 million on offer respectively. The initial appreciation of the rial proved temporary; the rial depreciated slightly over the second half of February, fluctuating between YR1,630 and YR1,685 per US$1. This reflected ongoing uncertainty about the government’s ability to address its widening fiscal deficit.

Despite some fluctuation, the rial entered a phase of relative stability in March, averaging around YR1,667 per US$1 as the Saudi injection took effect. However, concerns persist. The government’s heavy reliance on this singular source of support, coupled with its dwindling resources, threaten to rapidly deplete CBY-Aden’s foreign exchange reserves. The stability achieved through Saudi support is temporary, and Riyadh has been slow to release funds. Without additional support, the rial could see a renewed freefall to potentially record lows.

Since the beginning of the year, the CBY-Aden has held five FX auctions, with Yemeni banks purchasing US$178 million (78 percent) of the US$230 million on offer. At this point, the future of the Yemeni rial again hangs in the balance. The stability achieved through Saudi support is temporary, and Riyadh has been slow to release funds. Without additional support, the rial could see a renewed freefall to potentially record lows.

New Rules for Sana’a Money Exchanges

On February 19, the Sana’a-based Yemeni Money Exchange Association issued new regulations for money exchange outlets and companies in Houthi-controlled areas, purportedly aiming to ensure the transparency of their operations. The new rules strictly prohibit disclosing local or foreign currency balances to commercial clients during business hours. Further, money transfers and payouts must now match the currency used – dollar transfers must be paid out in dollars, not converted to rials at an internal rate, eliminating confusion for clients. For US dollar transfers, the disbursement rate must adhere to the “blue dollar” market rate, which typically reflects the actual market value. The association also reminded outlets to have sufficient cash on hand in both Yemeni rials and foreign currencies to ensure they can promptly fulfill all money transfer requests.

The association stated that money exchangers are fully responsible for complying with these new regulations and failure to do so could lead to penalties or other consequences. It claimed that the new regulations aim to create a more stable, transparent, and client-friendly environment, and that by adhering to these rules, exchanges can protect their reputations and better serve their commercial clients.

CBY-Sana’a Issues Directives to Combat Fraud and Regulate Exchange Companies

The Central Bank of Yemen in Sana’a (CBY-Sana’a) issued two resolutions on February 29 aimed to combat financial fraud, enhance financial security, and establish new licensing and operational requirements for the money exchange sector in Houthi-held areas.

Resolution No. (2), “Combating Fraud in Financial Institutions,” outlines procedures for identifying, preventing, and reporting fraud. It also defines responsibilities for combating fraud and establishes anti-fraud policies and customer-agent protections. Resolution No. (3), “Exchange Company Capital, Licensing, and Operations,” outlines the minimum capital requirements for money exchange outlets based on their classification. Operating companies licensed to provide money exchange services and operate a local money transfer network are required to maintain a minimum capital requirement of YR1.25 billion. Money exchange companies, which provide exchange services but are not permitted to operate a local money transfer network, have a minimum capital requirement of YR500 million. Money exchange shops have a YR10 million minimum capital requirement.

Regarding licensing and renewal fees, operating companies are required to pay YR5 million for their head office plus YR500,000 for every additional branch. Money exchange companies must pay YR2 million in fees for the main branch plus YR500,000 for each additional branch, while a money exchange shop is required to pay YR1 million. All companies are required to deposit a cash guarantee with the CBY-Sana’a to ensure compliance with regulations, with different amounts required for the different types of outlets.

Other notable articles of Resolution No. (3) include Article 4, which defines authorized activities for agents related to paying local transfers within the company’s network; Article 5, which establishes regulations for exchange operations, interaction with the CBY, company duties, and penalties for non-compliance; and Article 19, which outlines other penalties, including the withdrawal of licenses if they grant loans, credit balances, or overdrafts to their owners, agents, or regular customers.

The resolutions became effective upon their publication in the Official Gazette. Within 30 days of the regulations becoming law, money exchange providers were prohibited from opening any new accounts for individuals or recording credit transactions into their accounts. A carve-out was included for operating companies and money exchange companies opening pooled accounts to settle transactions and balances for commercial companies that have a legal commercial record.

A liquidity crisis in Yemen’s financial sector beginning in late 2016 triggered a massive migration of financial flows from the formal banking sector to the underregulated money exchange market. Ever since, companies providing exchange and money transfer services have opened accounts for individuals and granted loans and credit to their owners, agents, and customers, in violation of the law. The CBY-Sana’a previously sought to issue instructions preventing the opening of individual accounts, but these efforts failed. If the new resolutions are enforced, it will likely result in the closure of many exchange outlets and threaten the sector. Money exchange businesses have accumulated hundreds of billions Yemeni rials in their accounting systems and would likely be unable to repay balances to depositors, as the majority of money exchange and financial service providers have invested these funds in high-risk investment channels.

Ministry of Finance Issues Expenditure Control Measures

On February 20, the government-run Ministry of Finance took steps to ensure more responsible fiscal management through the issuance of Ministerial Circular No. (1) of 2024. The circular outlines the implementation of an expenditure control system for all departments, institutions, authorities, and executive offices under the central government’s purview.

The circular builds upon Cabinet Resolution No. (3) of 2024, which established the framework for monitoring government spending and commitments. This renewed focus on financial control aims to introduce greater efficiency and transparency in state finances and ensure that government spending aligns with the fiscal budget and is directed toward established priorities. All government entities are now required to submit comprehensive plans outlining their anticipated expenditures for the entire fiscal year. These must be updated on a quarterly basis to reflect any adjustments or changes in spending needs. Any modifications to these budgets must be promptly reported to the Ministry of Finance, accompanied by an amended plan for the remaining fiscal year. The circular also addresses various technical aspects related to the implementation of the expenditure control system, providing further guidance to government entities on adhering to procedures.

The circular seeks to address Yemen’s deepening fiscal crisis. Houthi drone attacks on oil export facilities in October and November 2023 eliminated the government’s primary source of revenue. Since early 2023, the Houthis have pressured commercial importers to redirect shipments from the port of Aden to Hudaydah, depriving the government of vital customs revenue.

Controversy Erupts Over Investigation into Central Bank Governor

On February 20, President of the Supreme Judicial Council (SJC) Mohsen Yahya Taleb issued a memorandum accusing Central Bank Governor Ahmed Ghaleb al-Maaqabi of hindering financial support for judicial authorities. The action followed an extraordinary meeting of the council, where they discussed obstacles in receiving allocated funds from the CBY-Aden, particularly those for the payment of salaries. The memorandum called for the governor to be referred to the Public Prosecutor for investigation and the imposition of a travel ban, granted on February 20. Al-Subaiha tribes, to which Al-Maaqabi belongs, moved to defend him, gathering outside his home in the Lahj town of Al-Khadra on February 23 and issuing a statement noting that all branches of government are suffering from delayed salary payments. By then the PLC had pressured the judges to retract their complaint, and the Office of the Attorney General confirmed the matter had been resolved.

The incident sparked significant controversy. Parliamentarian Ali Ashaal expressed concerns about the politicization of state institutions, urging authorities to address the issue. Legal experts echoed these concerns, highlighting the SJC’s lack of legal authority in this situation. They emphasized that the SJC cannot investigate non-judicial individuals, restrict travel, or refer individuals to the Public Prosecutor unless the crime falls under the judiciary’s jurisdiction. Taleb was only recently elected head of the judicial body and has close ties with PLC member Abdelrahman al-Maharrami. This has raised speculation that he is seeking favors for the Aden-based Al-Qutaibi Islamic Microfinance Bank, with which he is allegedly linked.

The CBY-Aden acts as the government’s treasury and implements its budget. It collects and distributes funds as dictated in the budget, covering expenses like salaries and operational costs. By law, it can refuse spending requests if the state lacks sufficient resources. This right has been increasingly exercised in light of the government’s ongoing fiscal crisis, raising questions about the governor’s decisions to withhold funds.

Clash of the Central Banks Disrupts Remittance Flows

Yemen’s already fragile financial system plunged deeper into crisis in February as the rival central banks, the CBY-Aden and CBY-Sana’a, locked horns in a battle for control of the remittance and money transfer sector. This sector is vital for millions of Yemenis who rely on money sent from abroad to survive the ongoing conflict.

The conflict erupted in mid-February when the CBY-Aden launched a new network, the Unified Network for Monetary Transfers (UNMONEY), aiming to boost transparency and control over financial flows. Through a circular, it mandated the use of UNMONEY by exchange companies in government-controlled areas, sparking controversy. The STC-affiliated Southern Money Changers Syndicate (SMCS), representing major exchange companies, accused the CBY-Aden of favoring Houthi interests and attempting to eliminate their resources.

The CBY-Sana’a retaliated in March, prohibiting all dealings with UNMONEY and imposing restrictions on remittance flows. On March 4, the Yemeni Money Exchange Association in Sana’a, acting under orders from the CBY- Sana’a, issued a circular prohibiting exchange houses and local money transfer networks from dealing with UNMONEY and banks not licensed by the CBY-Sana’a. It singled out in particular two companies, Al-Qutaibi Islamic Bank for Microfinance and Al-Busairi Bank for Microfinance, which both are headquartered in government-held areas and have emerged as major players in facilitating transfers inside Yemen. On March 13, the CBY-Sana’a issued a preemptive three-page circular to all banks and money exchange outlets prohibiting the receipt of remittances in anything but Saudi riyals, regardless of the original currency (typically US dollars or Yemeni rials). The circular also prohibited the disbursement of remittances (via Western Union, MoneyGram, and the like) through any agent of money exchange companies and banks outside the areas under the group’s control, or from branches not authorized by the CBY-Sana’a.

On March 19, the CBY-Aden responded in turn by blacklisting five Sana’a-based banks and their affiliated networks, further crippling transfers. The five banks were the Tadhamon Islamic Bank; the Yemen and Kuwait Bank; the Al-Amal Microfinance Bank; the Shamil Bank of Yemen and Bahrain; and the Al-Kuraimi Islamic Microfinance Bank. This was just the first in a series of punitive measures that continue to threaten the operations of the banking and money transfer systems.

This tit-for-tat escalation threatened to cripple the money transfer sector, disrupt remittance flows, and destabilize the Yemeni rial. A near-halt in transfers between government and Houthi-controlled areas was reported. Businesses faced difficulties with financial transactions, and citizens struggled to send money across the divided zones. The Houthi ban on dollar disbursements further worsened the situation, especially during Ramadan, when remittances typically rise. The Houthis, facing a severe liquidity crisis and reinstated US terrorist designation, have been tightening their grip on US dollars, including removing older bills from circulation and restricting newer ones. The ban on dollar transactions and their forced conversion to Saudi riyals is the latest chapter in a saga of financial warfare. In 2020, the Houthis wrought chaos by refusing to allow new Yemeni rials printed by the CBY-Aden to circulate in their areas and slapped massive fees (over 100 percent) on transfers from government-controlled areas.

In late March, a fragile truce was reached and de-escalation measures offered temporary relief. March 26, the Houthi-controlled CBY-Sana’a issued a new circular to reverse a ban on banks dealing with Al-Qutaibi and Al-Busairi exchange companies; in return, the CBY-Aden revoked its directive prohibiting transactions with the five Sana’a-based banks. The moves follow mediation efforts involving the Yemen Banks Association and banks affected by the recent measures; other media sources reported the involvement of unidentified international mediators.

However, this was a temporary reprieve. The underlying struggle for control of Yemen’s financial system and the lack of trust between the rival authorities pose significant challenges to finding a lasting solution. The conflict highlights the complexities of Yemen’s situation. The CBY-Aden seeks to regulate the money exchange market and stabilize the rial, while the Houthis see any such actions as a threat to their control.

Sana’a Introduces New Currency in Central Bank Face-off

On March 31, the Houthi-controlled CBY-Sana’a made a controversial decision to introduce a new metal coin to replace deteriorating 100 rial banknotes. The governor of the CBY-Sana’a claimed the move was simply intended to replace damaged banknotes and would not affect exchange rates. While he claimed the bank was operating with transparency and a commitment to stabilizing the economy, key details, including the number of replaced banknotes, remain unclear. The lack of information regarding the quantity of coins and their potential impact on existing liquidity raises concerns about inflation.

The internationally recognized government and the CBY-Aden have vehemently opposed the move. The CBY-Aden branded the coin “illegitimate” and “counterfeit” and has prohibited its circulation. It warned financial institutions and citizens against using the coins, arguing they would further disrupt trade, complicate inter-region transactions, and destabilize the existing exchange system. These accusations highlight the deepening rift between the two monetary institutions and raise serious concerns about the future of the Yemeni rial and the banking system.

The Houthi coin issuance, while purportedly only intended to replace a small percentage of damaged notes, carries a hidden threat. It could be the first step towards printing more such “replacement” currency at higher denominations, ultimately flooding the market with new money and eroding confidence in the rial. Uncontrolled expansion of the monetary base coupled with Houthi war financing could trigger hyperinflation in Houthi-controlled areas, further destabilizing the already fragile economy. The CBY-Aden’s own reckless resort to printing excessive amounts of new Yemeni rial banknotes to fund operations earlier in the war backfired spectacularly. The massive monetary expansion caused the currency to plummet in value, fueling a surge in food prices and ultimately destabilizing the economy. The Houthis’ ban on newly printed currency in January 2020 effectively created two monetary zones with distinct exchange rates. This ongoing monetary division significantly hinders the central banks’ ability to manage monetary policy and throws a wrench into any future plans for their reunification.

Central Bank in Aden Demands Banks Relocate

The CBY-Aden escalated the conflict further with its own resolution on April 2, demanding all Yemeni banks relocate their headquarters to Aden within 60 days. This move, ostensibly designed to maintain control over the banking sector and shield it from “illegal measures by Houthis,” who have been recast by the US as a Specially Designated Terror Group (SDGT), threatens to cripple the already struggling financial system. A stern warning accompanied the resolution: any bank failing to relocate within the designated timeframe will face legal repercussions under the Anti-Money Laundering and Terrorism Financing Law and its associated regulations. Failure to comply could result in punitive measures, including potential exclusion from the SWIFT network and international money transfer services like Western Union and MoneyGram. This would cripple the banking sector’s capacity for essential international financial transactions. The CBY-Aden may even threaten non-compliant banks with license revocation. The Houthis are almost certain to retaliate, potentially banning the relocation and implementing their own punitive measures against banks that choose to comply. Tit-for-tat measures could paralyze the banking sector, disrupting essential financial services like cross-border remittances and global trade financing.

In August 2021, the CBY-Aden published a statement on its official website stating that all commercial and Islamic banks licensed to operate in the country must expedite the relocation of their operation management centers to Aden, so it could carry out verification procedures and direct field inspections of their operations and ensure their commitment to fulfilling legal requirements. While this statement included threats of legal action against banks refusing to share operations data with the CBY-Aden, there were no penalties for banks failing to relocate.

The new demand is more serious. It comes in the form of a resolution, which from a legal perspective is much stronger, and includes threats of legal action against non-compliant banks. The circumstances are also different. The directive is in retaliation to the Houthis’ new coinage and their attempt to disrupt the CBY-Aden’s Unified Money Transfer Network. It also comes as the internationally recognized government is being suffocated financially after being deprived of its largest revenue source with the suspension of oil and gas exports. The CBY-Aden has cited military developments in the Red Sea and the Houthis’ recent redesignation as a terrorist group as justification for demanding relocation, saying it will protect banks from risking being associated with anti-money laundering and anti-terrorism financing measures.

Competition between Yemen’s divided central banks poses a grave threat to the nation’s already fragile economic stability. Without a unified monetary policy and a functioning banking system, the Yemeni people will continue to suffer the consequences of a deepening financial divide. Unless a peaceful resolution is reached, Yemen’s economy could face complete collapse. Urgent international intervention is crucial to de-escalate the situation and find a sustainable solution that prioritizes the well-being of the Yemeni people.

CBY-Aden Begins Transition to New Financial Transfer System

On March 7, the head of the government-run CBY-Aden, Ahmed Ghaleb al-Maaqabi, announced the launch of the first phase of a national system for financial transfers. The system will initially connect seven banks, with plans to expand and integrate all Yemeni banks in the coming months.

Al-Maaqabi emphasized that the switch to the new system aligns with the bank’s strategic plan to foster a comprehensive and advanced digital economy. The initiative aims to develop a robust payment infrastructure that empowers both the government and private sector to leverage financial technology for efficient and secure digital payments. If implemented, the system offers several potential benefits. All participating banks will be connected to a single hub, streamlining communication and data exchange. The system also promises to significantly expedite financial transfers, enhancing overall transaction speeds. Citizens will be able to withdraw cash from any ATM within the network, regardless of the issuing bank. It will also seamlessly integrate with Point-of-Sale (POS) terminals, facilitating faster in-store payments; electronic wallets will eventually be linked to the system as well.

But the launch of the system faces significant hurdles due to the ongoing political and economic divisions within the country. This fragmentation creates a lack of centralized authority, making it difficult to convince banks, a majority of which are headquartered in Sana’a, to participate in a system overseen solely by the CBY-Aden. The CBY-Sana’a could also pursue punitive measures to threaten banks and prevent their integration into the system. If not all banks participate, the system’s reach and effectiveness will be limited.

Building and maintaining the existing, outdated banking infrastructure already requires significant resources, access to which is increasingly scarce. Ultimately, a political solution to end the conflict and unify the administration of CBY will be necessary for creating a fully unified national financial system.

Fuel and Power Developments

Petromasila Resumes Gas Production in Sector 10, Boosting Electricity Supply

On February 11, the state-owned Petromasila Company announced the successful resumption of associated gas production and operations in Sector 10 in Hadramawt, following a comprehensive maintenance program for its gas processing and compression facilities. The program, carried out over the course of nearly a year, aimed to enhance efficiency and ensure sustainable production. The company said the maintenance was carried out in record time and involved 367 workers, including technical crews, supervisors and engineers, and contract workers.

Its successful completion allowed for the gradual restoration of associated gas production. The resumption of the supply has bolstered capacity at the gas-fired Wadi Hadramawt and Electricity Corporation power station by 75 megawatts, improving the supply of electricity to the region.

Aden Seeks Stable Fuel Supply with New Tenders Committee

On February 18, recently-appointed Prime Minister Ahmed Awadh bin Mubarak established a new Fuel Tenders Committee tasked with securing a stable fuel supply for power stations under ministerial decision No. 20 of 2024. The move comes in response to ongoing power outages that have plagued the interim capital of Aden. A prior tenders committee, frustrated by supply issues and alleged government inaction, resigned last June. It blamed the limited fuel supplies approved by the former prime minister and irregular payments from the Ministry of Finance and Central Bank, leading to depleted fuel stocks and crippling blackouts. Headed by the Ministry of Finance and comprising members of relevant ministries and authorities, the new committee is tasked with collaborating with these government bodies to determine the quantities of fuel required and to follow procedures outlined in the Yemeni Tenders Law to ensure fair and open tender processes.

Aden has grappled with frequent and prolonged power outages, impacting residents and businesses. Last summer, residents received as few as four hours of electricity per day due to a critical fuel shortage following the expiration of a Saudi fuel grant in April 2023. The Yemeni government spends heavily on fuel derivatives, yet struggles to collect electricity bills, leading to large debts. The recent release of the second tranche of a Saudi grant, worth 1 billion Saudi Riyals (nearly US$250 million), could provide temporary relief for fuel purchases and power station operation. While challenges persist, the new committee may offer a path to a more stable power supply. Success hinges on renewed foreign support, efficient execution, transparency, and addressing the underlying issues of fuel affordability and debt collection.

Emirati Fuel Arrives in Aden

On March 9, the tanker PS DREAM docked at the port of Aden, delivering approximately 42,000 tons of diesel fuel. This marked the third installment of a fuel grant provided by the UAE to enhance power generation capacity in Aden and other governorates under the control of the government during the holy month of Ramadan. In total, the Emirati grant comprises roughly 125,000 tons of diesel and 106,000 tons of fuel oil.

The UAE’s fuel grant arrives at a crucial time, aiming to improve electricity availability during Ramadan. Electricity demand typically surges during Ramadan due to longer nights and increased use of appliances for cooking and religious observances.

Power Cut in Marib after Plant Malfunction

Residents of Marib awoke to a frustrating blackout on March 18, after the gas-fired power plant in the city was abruptly taken offline for repair. The station, a vital piece of the region’s power grid, suffered a technical malfunction due to increased load. To prevent a catastrophic failure, emergency maintenance became necessary. The outage lasted roughly 10 hours, affecting approximately 2 million people.

The blackout underscores the precarious state of Marib’s electricity infrastructure. Before the war, the gas station supplied power to a vast swathe of governorates. However, the station’s operations were abruptly halted in March 2015 with the start of the conflict. It was shuttered for five years before resuming partial operations in May 2020, but full capacity remains elusive. Initial operations provided 55 megawatts of power, followed by a boost to 126 megawatts, though the plant’s full potential is some 340 megawatts. The current output is enough to meet the city’s needs, according to government pronouncements, but its reach is limited to Marib.

Other Economic Developments

Houthis Pay Public Sector Employees Half-Month’s Salary

The Sana’a-based Ministry of Finance issued orders for the Houthi-controlled CBY-Sana’a to pay public servants a half month’s salary, covering the second half of September 2018. The payment, which is currently being disbursed, coincides with Ramadan and is the first to civil servants working in Houthi-held areas since the beginning of the year. The last payment was made in September of last year, covering the first half of September 2018. Public servants in Houthi-controlled regions are now owed over five years of back pay.

Houthis Announce Mandatory Zakat

The Houthi-run Ministry of Civil Service and Zakat Authority in Sana’a issued a joint circular on March 16, setting the mandatory donation of almsgiving. This year’s mandatory charity donation is set at YR550 per person. The circular directs government entities in areas under Houthi control to deduct this amount from the next half-salary payment that is being disbursed to public servants, which will cover the first half of October 2018, before Eid al-Fitr. The fees are to be transferred directly to the Zakat Authority’s account.

Efforts to Reduce Marine Insurance Costs Stall

The internationally recognized government’s plan to lower marine insurance costs for ships entering its ports has run into trouble. Despite efforts to negotiate with international insurers, the government currently lacks the funds to proceed. The memorandum of understanding (MoU) that the government inked with the UNDP in August of last year requires a US$50 million deposit from Yemen, which remains unfulfilled.

In late December, the chairman of the Gulf of Aden Ports Corporation reported that shipping costs to government-controlled seaports had skyrocketed, with insurance fees spiking 200 percent due to the Houthi attacks on international shipping in the Red Sea and Bab al-Mandab Strait. The chairman emphasized that the war has inflicted heavy burdens on Yemen’s economy, with the private sector incurring US$400-500 million in insurance costs to incentivize ships to call at Yemeni ports. This alarming increase threatens vital trade, inflates prices for consumers, and adds to the burdens faced by the war-torn country. Maritime insecurity has forced a dramatic shift in trade, with 50-60 percent now bypassing the region for the safer but longer route around the Cape of Good Hope. Minister of Transport Abdelsalam Humaid acknowledged challenges, including recent regional developments and the Ukraine war, at a workshop organized by the Economic Association Foundation. Participants made a series of recommendations focused on upgrading infrastructure at the port of Aden, establishing a logistical area, and developing a national maritime security strategy.

The US has expressed concern over the economic consequences of the Houthis’ actions in the Red Sea, highlighting potential disruption to global trade and humanitarian consequences for Yemen. The current situation underscores the need to address financial limitations and broader security concerns to ensure safe and affordable maritime trade, vital for Yemen’s economy. In August of last year, Humaid reported a staggering 16-fold increase in insurance costs since the conflict began, which has led to trade diversions to regional ports like Jeddah and Salalah. In 2021, the UNDP estimated that insurance premiums exceeded US$200 million annually, raising transport costs and impacting Yemeni consumers through higher food prices, further exacerbating the already dire humanitarian situation.

While further initiatives are underway, overcoming obstacles like the unfulfilled MoU and addressing the root causes of the conflict are crucial for sustainable solutions and ensuring affordable access to essential goods.

Millions in Yemen Face Worsening Food Insecurity, UN Warns

A UN report published by the Food and Agriculture Organization (FAO) painted a grim picture of Yemen’s food security, warning that over 4.5 million people (45 percent) in government-controlled areas faced severe food insecurity (IPC Phase 3) between October 2023 and February 2024, a 12 percent increase from earlier forecasts. Over 1.3 million are in an emergency state (IPC Phase 4). This alarming rise is attributed to the worsening economic crisis, ongoing local conflict, reduced and irregular aid, and the devastation of Cyclone Tej. Other factors, including limited institutional capacity, weak infrastructure, and service gaps, further hinder humanitarian efforts and economic stability.

Aden Strike Intensifies as Southern Workforce Demands Action

Since early February, public services in Aden have been disrupted by a growing labor strike organized by the General Union of Southern Workers’ Syndicates (GUSWS) and the General Federation of Southern Workforce Unions (GFSWU).

The strike was initially launched on February 3 to protest unpaid salaries and dues. Following a consultative meeting on February 11, unions extended the strike and expanded its duration by two hours daily. The GUSWS blames the government’s failure to fulfill its financial obligations, citing hardships faced by employees struggling with rising living costs due to “catastrophic inflation” and “severe depreciation of the Yemeni rial,” which hit a record low of over YR1,660 per US$1.

Beyond immediate salary payments, the unions are demanding broader economic reforms. Participants called for legal action against the government for its failure to uphold its commitment to monthly salary payments, and a restructuring of salaries and wages to reflect the harsh economic realities.

The strike has significantly disrupted operations in government institutions, impacting essential services such as health, education, and electricity. This widespread disruption underscores the critical role these workers play in the functioning of Aden. The strike’s escalation reflects growing discontent among state employees, putting further pressure on the government to address grievances and find solutions to wider economic challenges in the areas under its control.

Saudi Arabia’s transfer of US$250 million to the CBY-Aden will likely help. The money is intended to support the payment of public sector salaries, operating expenses, and food security, part of a US$1.2 billion grant announced in August 2023. Economic and social turmoil have eroded public trust in the government, but the aid could strengthen its position and head off further unrest. The recent appointment of Prime Minister Ahmed Awadh bin Mubarak also carries hope for improved stability and progress on pressing issues.

Adding to the pressure, the General Federation of Southern Workforce Unions (GFSWU) announced a separate, comprehensive strike on March 3. This action follows a protest held in front of Ma’ashiq Palace on February 26 and signals a potential escalation of labor unrest across Aden and neighboring governorates. The strike is likely to disrupt essential services in government-controlled areas, including schools and government offices.

The GFSWU cited deteriorating living conditions, poor working conditions, and eroded salaries due to inflation as key reasons for the strike. They criticized the government for failing to fulfill previous commitments, including timely salary payments, bonuses, and implementing court rulings on public sector wages.

The GFSWU outlined eleven demands, including: immediate and regular salary payments at the end of each month; implementation of previous government decisions regarding salaries and benefits, including retroactive adjustments; a salary increase of YR100,000 and provision of health insurance for all public sector employees and workers; the resolution of issues faced by retirees; restarting operations at Aden’s refineries and restoring vessel traffic services in the port of Aden; and the repeal of Law No. 6 of 1995, which grants immunity to senior government officials, hindering efforts to hold corrupt individuals accountable.

The government has yet to publicly respond to the strike or the union’s demands, facing challenges due to limited resources and a fragmented governing structure. Notably, the Council of Trade Union Committees of the Aden Refineries Company announced it would not participate in the strike, urging its members to give the new prime minister a chance to address the crisis.

Yemen Faces Shortages of Essential Goods Amidst Red Sea Tensions

Minister of Trade and Industry Mohammed al-Ashwal recently sounded the alarm regarding the depletion of the country’s strategic stockpile of essential goods, including food and medical supplies. The minister attributed the decline to Houthi attacks on commercial vessels and the resulting disruption to maritime trade. The minister said Yemen’s current stockpile of essential goods, previously 3-5 months worth, is now depleting at an alarming rate. The situation threatens the daily lives of ordinary citizens who rely on these supplies. The minister also expressed concern about reduced support from international organizations, which have shifted their focus to other crises. The reduction in international aid underscores the complex global humanitarian landscape, where competing crises vie for limited resources.

Al-Ashwal also highlighted the growing importance of fishing, which now accounts for roughly 60 percent of exports in the wake of the Houthi attacks that crippled Yemen’s oil industry. He emphasized the potential environmental and economic consequences of an attack on an oil tanker in the Red Sea, which would pose a significant threat to the country’s fisheries and further hinder global trade.

The continued targeting of commercial vessels in the Red Sea, including those carrying essential goods, carries huge risks for the people of Yemen, who remain reliant on international aid.

Al-Makha Airport Poised for Takeoff

Al-Makha Airport has reportedly achieved operational readiness for commercial flights, both domestic and international, according to the airport director. This follows an inspection by a Civil Aviation Authority team, whose report was submitted to the Ministry of Transport for approval. The airport’s management now awaits the ministry’s final sign-off to officially reopen for air traffic.

Plans suggest flights will initially prioritize domestic connections, linking Al-Makha with Aden, Mukalla, Seyoun, and the Socotra archipelago. This could significantly improve travel options within Yemen, which have been hampered by the ongoing conflict. Following the establishment of domestic routes, the airport could expand to serve international destinations.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية