Overview

Houthi drone attacks on Nushayma and Al-Dabba oil terminals in the latter half of October paralyzed oil exports and threatened to undermine government finances. Although its effects were not felt in October, prolonged loss of oil revenue would cut the government off from by far its largest source of revenue, which would have widespread knock-on effects, including eroding the ability of the Central Bank of Yemen in Aden (CBY-Aden) to continue financing basic commodity imports, support the value of new rials and keep inflation subdued.

Representatives from the government-aligned Central Bank of Yemen in Aden (CBY-Aden) met with officials from the International Monetary Fund (IMF) and the US Federal Reserve in early October, with IMF officials praising recent CBY-Aden policies to stabilize the rial and predicting reduced inflation in late 2022. In Houthi-held areas, the Central Bank of Yemen in Sana’a (CBY-Sana’a) and other agencies continued efforts to digitize commerce and payment systems, as Houthi restrictions on rials printed by the CBY-Aden after 2017 have resulted in fewer and fewer circulating banknotes.

Despite the truce’s expiration on October 2, fuel ships reportedly continued to visit the Houthi-held port of Hudaydah. In government-controlled Aden, fuel shortages emerged in the first half of October, resulting in increased prices and electricity outages throughout the month. Although its effects were not apparent in October, the first shipment of the new Saudi fuel grant arrived October 26 in the city.

Houthis’ Oil Port Attacks Threaten Government Finances

The Houthi attacks at the port of Rudum in Shabwa governorate and the port of Shihr in Hadramawt aimed to pressure the government as UN mediation continues, including talks to address the four-years-worth of salary arrears owed to public employees in Houthi-controlled areas. Houthi demands have expanded to include the payment of salaries of military and security personnel in areas the group controls, however the government has refused to acquiesce. In 2014, before the Houthis took over Sana’a and much of northern Yemen, the salaries of military and security personnel constituted almost half of all salaries on the government payroll, with salaries overall making up roughly a third of total government spending. Were the Yemeni government to agree to pay all state salaries nationwide, it would quickly drain government finances while propelling a jump in economic activity in Houthi-controlled areas, which would allow the group to raise more revenue for itself through the ability to extract more taxes and levies.

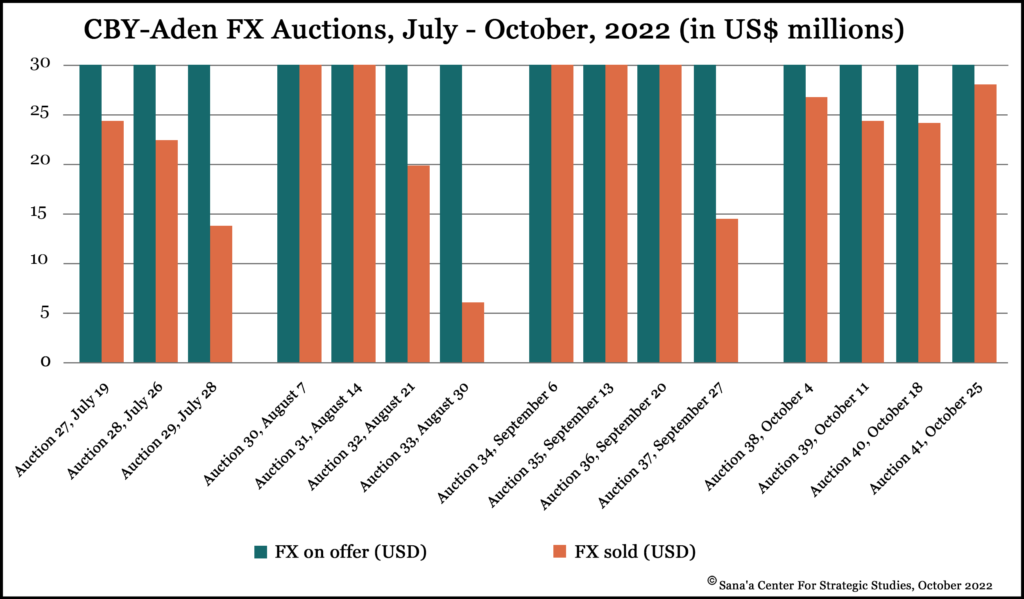

Until the drone attacks, the government had been on track to continue the remarkable recovery of oil export revenue in recent years. Between 2020 and 2021, the value of Yemen’s oil exports rose from US$710.5 million to US$1.418 billion. The CBY-Aden reported in August that in the first six months of the year, oil revenues increased 34 percent over the same period of 2021, from US$551.7 million to US$739.3 million, mainly driven by higher global fuel prices. A continued Houthi threat to the government’s oil export infrastructure could prevent the latter from being able to bring its oil to market. Without its largest source of revenue, the government would struggle to meet its critical spending needs, such as the provision of public services and the payment of civil servant salaries. A loss of oil revenue would threaten the CBY-Aden’s ability to continue holding its weekly foreign currency auctions, which in turn would put downward pressure on the value of new rial banknotes, invite renewed exchange rate instability, spur inflation, and lead to a further deterioration of the humanitarian situation.

CBY-Aden Meets with Int’l Officials, Houthi Scam Company Goes Under

On October 6, following a series of meetings with representatives from the CBY-Aden, the IMF estimated that the Yemeni economy would grow 2 percent this year and 3.2 percent in 2023, but noted that the evolving conflict and availability of external donor financing could influence these projections. In a statement, the IMF called for various reforms, including liberalizing the exchange rate for customs revenues, reassessing electricity subsidies, and improving transparency and accountability in the management of financial resources. The statement noted several positive developments, among them that the government has implemented a credible foreign exchange auction platform mechanism, eliminated the administratively set exchange rate for the public budget, and reduced its budget deficit. Looking ahead, the IMF said further exchange rate stability and the recent decline in international food prices are expected to lower inflation by the end of the year.

On October 14, CBY-Aden Governor Ahmed Ghaleb met with a delegation from the United States Federal Reserve. The talks, which occurred in Washington, DC, during the annual IMF–World Bank meetings, focused on technical assistance provided by the US central banking system to CBY-Aden and a potential expansion of support in the future. Current Federal Reserve support in banking services and human resource training aims to help the CBY-Aden keep pace with developments in modern banking and strengthen its capacity to carry out monetary functions and effectively serve the Yemeni banking sector. Other topics of conversation included expanding Federal Reserve support for the CBY-Aden in facilitating US dollar transfers between Yemeni banks and their correspondent accounts outside the country, and Yemen’s compliance with anti-money laundering and counter-terrorism financing statutes.

On October 20, local media reported that the company Thama Flavor, reportedly owned by Fathiya al-Mahweti, was refusing to allow investors to withdraw their assets as it prepared to declare bankruptcy. The company had reportedly amassed some YR150 billion in capital by offering investors returns of as much as 25 percent on real estate deals the company was involved in. Scam companies have been on the rise recently in Houthi-controlled areas. This has been facilitated by the mass migration of money from formal to informal networks during the conflict, where the lack of official regulation and oversight has allowed predatory behavior to flourish. The last large-scale investor scam to become public in Houthi-controlled areas involved Al-Sultana Palace, registered to a Bilqis al-Haddad. The Sana’a-based Public Funds Prosecution accused the company of defrauding some 100 investors of more than YR62 billion before announcing bankruptcy in 2020.

Rial Remains Stable, Houthi Authorities Push Currency Digitization

The exchange rate of new Yemeni rial banknotes remained relatively stable in government-held areas during the month of October, with the currency depreciating with slight fluctuations from YR1,125 per US$ at the beginning of the month to YR1,152 at the end of the month, a change of less than 3 percent. The CBY-Aden continued to support the value of new rials through its weekly foreign currency auctions to Yemeni banks to finance basic commodity imports. In Houthi-controlled areas, old rial banknotes remained stable trading within a narrow band around YR560 per US$1 throughout the month.

In response to the increasing shortage of cash liquidity in Houthi-controlled areas, the authorities there have been undertaking a broad campaign to digitize commerce and aggressively move public finance management away from the use of cash. On October 29, the CBY-Sana’a launched its first four-day national conference for financial technology (Fintech), with the participation of government bodies, the private sector, the banking sector, financial and technology institutions, and industry experts. The conference delved into the current state of Fintech in Yemen, and future prospects and challenges, with the aim of developing a national strategic framework to improve technological infrastructure, build the national payment system, develop regulatory frameworks, and regulate e-commerce. The event followed another conference, held October 10-12, that Houthi authorities launched under the banner of “Promoting Financial Inclusion,” at which they pushed for a national strategic plan for the digital transformation of commerce. According to a senior official at the Sana’a-based Ministry of Finance, the ministry has been taking aggressive measures to digitalize the public financial management system. The official stated that currently most government dues, including customs fees from commercial traders, are collected through e-cash transfers. Another government official said that the Houthi authorities had developed a digital payment system for the fuel derivatives market. Through this system, the CBY-Sana’a granted authorization to more than 30 money exchange companies to manage and collect funds from fuel traders and distributors and deposit these amounts digitally with the Sana’a-based Yemeni Petroleum Company’s (YPC) account at the CBY-Sana’a. According to the official, between YR3 billion and YR4 billion is deposited daily in the YPC account to purchase fuel derivatives.

Yemen is still overwhelmingly a cash-based economy, but since 2020 there has been an increasingly critical shortage of physical banknotes circulating in Houthi-controlled areas. This is a result of the Houthi authorities banning the circulation of ‘new’ rial banknotes, issued by the CBY-Aden since 2017, while bills issued prior to 2016 have been increasingly rendered unusable through normal wear and tear. In 2020, Houthi authorities altered the legal framework for the provision of e-money and digital financial services, allowing for minimally regulated financial service providers such as money exchange companies, traders, and non-financial institutions to obtain a license for the delivery of e-rial services. In 2021, Houthi authorities further expanded the digital currency system by granting licenses to financial institutions to establish e-wallets and participate in payment systems with interoperability among banks and other financial service providers. In late 2021 and early 2022, the Sana’a-based Ministry of Finance began to enforce a gradual migration to an e-payment system for disbursing public salaries and receiving government dues.

Fuel Shortages Drive Extended Electricity Outages in Aden

On October 4, a fuel crisis erupted in Aden with both government and commercial fuel stations shuttering because of a lack of petrol and diesel. While a new shipment of petrol arrived at the port of Aden on October 5, due to the time it took to offload and distribute the fuel, shortages in the market continued for several days, with petrol prices increasing from YR1,350 to YR1,750 per liter and the price of diesel rising from YR1,800 to YR2,500 per liter. On October 7, the General Electricity Corporation of Aden announced the diesel shortage had forced it to cut electricity production at several power stations, with regular blackouts continuing through mid-to-late October. The government’s import bill for diesel to run power stations is roughly US$90 million per month, but due to a lack of revenue and foreign currency reserves the government has racked up significant debts with commercial fuel traders, who have become increasingly reluctant to supply diesel on credit.

On October 26, the Saudi Press Agency announced that the kingdom’s first fuel delivery under the renewed Saudi fuel grant program had arrived at the port of Aden, which could potentially help address the city’s electricity outages. The fuel delivery amounted to 45,000 metric tons of diesel and 30,000 metric tons of mazut, worth US$30 million, and was intended to support the operations of more than 70 power plants in government-held areas. On September 29, the Saudi Development and Reconstruction Program for Yemen (SDRPY) and the Yemeni Ministry of Electricity and Energy signed a new fuel grant agreement for 250,000 metric tons of fuel derivatives, worth $200 million, to help the latter keep the lights on in government-held areas.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية