Currency Crisis

Sana’a Introduces New Currency in Central Bank Face-off

Yemen’s already fractured financial system faces a dangerous escalation as its rival central banks engage in a high-stakes power struggle, threatening a full-blown currency war. On March 31, the Houthi-controlled Central Bank in Sana’a (CBY-Sana’a) made a controversial decision to introduce a new coin to replace deteriorating 100 rial banknotes. The governor of the CBY-Sana’a claimed the move was simply intended to replace damaged banknotes and would not affect exchange rates. While he claimed the bank was operating transparently and committed to stabilizing the economy, key details, including the number of replaced banknotes, remain unclear. The lack of information regarding the quantity of coins and their potential impact on existing liquidity raises concerns about inflation. There is concern that their rollout could later be followed by a massive introduction of new rial banknotes, threatening the Central Bank in Aden’s (CBY-Aden) monetary mandate as the sole printer of the national rial currency.

The internationally recognized government and CBY-Aden have vehemently opposed the move. The CBY-Aden branded the coin “illegitimate” and “counterfeit” and has prohibited its circulation. It warned financial institutions and citizens against using the coins, arguing they would further disrupt trade, complicate inter-region transactions, and destabilize the existing exchange system. These accusations highlight the deepening rift between the two monetary institutions and raise serious concerns about the future of the Yemeni rial and the banking system.

The Houthi coin issuance, while purportedly only intended to replace a small percentage of damaged notes, carries a hidden threat. It could be the first step towards printing more such “replacement” currency at higher denominations, ultimately flooding the market with new money and eroding confidence in the rial. Uncontrolled monetary base expansion coupled with Houthi war financing could trigger hyperinflation in Houthi-controlled areas, further destabilizing the already fragile economy. The CBY-Aden’s own reckless resort to printing excessive amounts of new Yemeni rial banknotes to fund operations earlier in the war backfired spectacularly. The massive monetary expansion caused the currency to plummet in value, fueling a surge in food prices and ultimately destabilizing the economy. The Houthis’ ban on the newly printed currency in January 2020 effectively created two monetary zones with distinct exchange rates. This ongoing monetary division significantly hinders the central banks’ ability to manage monetary policy and throws a wrench into any future plans for their reunification.

The dispute over the new 100 rial coin issued by Houthi authorities worsened following an ultimatum issued by the government-affiliated CBY-Aden on April 2, giving Yemeni banks in Sana’a 60 days to move their headquarters to Aden or be subject to anti-money laundering and terrorism laws. The government has toughened its position, saying that for the order to be rescinded, the Sana’a authorities should not only withdraw the coins but vow to lift the blockade of oil and gas exports, which have decimated government revenues and contributed to the steep depreciation of the rial in government-held areas.

A UN-mediated attempt to get the Aden and Sana’a central bank governors together in the same room to resolve the currency crisis failed, with Aden insisting on a clear agenda in advance. There is a conspicuous absence of pressure from Saudi Arabia or the United States – both busy discussing their security deal – to resolve the issue, which offers them a chance to see the Houthis sweat a little under pressure.

International Outrage Over New Houthi Currency

The Houthis’ new coinage ignited a firestorm of international condemnation. The US, EU, UK, and France erupted in a chorus of outrage on April 4, blasting the Houthis’ issuance of a “counterfeit” 100 rial coin as a deliberate attempt to shatter the country’s fragile financial stability, deepen existing divisions, and derail the already precarious peace process.

The US Embassy in Yemen condemned the Houthis, which the US has already listed as a Specially Designated Global Terrorist group, for issuing counterfeit currency and urged them to prevent it from entering circulation. It warned that such unilateral action threatens to further divide the economy, undermine the integrity of the banking sector, and jeopardize Yemen’s commitment to global regulations to fight terrorism financing. The European Union delegation to Yemen echoed these concerns, highlighting the devastating consequences for the financial sector and Yemen’s compliance with international financial regulations. They declared that such actions “undermine the path to peace and prosperity for Yemenis.” The British Embassy in Yemen minced no words, calling the Houthi action “a deliberate attempt to destabilize the banking system and exacerbate divisions within the already crippled Yemeni economy.” They warned that “further fragmentation will only worsen the plight of ordinary Yemenis.” France joined the chorus of condemnation, calling the Houthi move “an illegal and unilateral decision by an unrecognized entity.” They emphasized that “this action deepens the country’s divisions at a time when unity, particularly around the currency, is paramount for the Yemeni people.” All four reaffirmed their unwavering support for the government-affiliated CBY-Aden and its critical role in maintaining financial stability. They urged the Houthis to abandon “reckless behavior” and engage constructively in UN-led peace efforts, particularly on crucial economic issues. The international community, previously hesitant to take a strong stance, seems to be shifting its approach. But by issuing new currency, the Houthis may have trapped themselves. The move reinforces doubts about their commitment to peace, painting a picture of a group prioritizing escalation over stability.

The West’s stance provoked angry reactions from the Houthis. The Houthi-run CBY-Sana’a branded the statements from the American and British embassies as “blatant and illegal interference” and a continuation of the “US-Saudi economic war” against Yemen. This escalation in rhetoric highlights the deepening rift between the Houthis and the international community. In an interview, CBY-Aden head Ahmed Ghaleb described the Houthis’ minting of new coins as “crossing a red line,” highlighting the potential for hyperinflation in Houthi-controlled areas. This, coupled with the existing currency divide, could pave the way for a disastrous dual currency system, crippling 70 percent of the Yemeni economy and isolating millions.

Liquidity Crisis Grips Sana’a as Depositors Protest

A wave of panic swept through Sana’a as a liquidity crisis threatened to engulf the city’s banking sector. The crisis, simmering for years, reached a boiling point on May 12, sparking protests and raising fears of a banking collapse mirroring Lebanon’s recent financial meltdown.

Dozens of depositors, their anxieties mounting, staged a protest in front of the International Bank of Yemen (IBY). This act of defiance, a difficult feat in Houthi-controlled Sana’a, where public demonstrations are heavily suppressed, was a stark indicator of the desperation gripping the city. Protestors demanded access to their frozen savings and the resumption of monthly cash disbursements of even small amounts of interest earned on non-cash deposits. Previously, the IBY had been one of few banks offering such limited relief, disbursing decreasing payments before stopping entirely in March.

The liquidity crisis stems from a confluence of factors. Sana’a’s banks are plagued by a severe shortage of Yemeni rials, and Houthi authorities have exacerbated the issue by forcing the recirculation of damaged banknotes. Compounding the problem is the Houthis’ Anti-Usury Transactions Law, issued in March of last year to prohibit banks from paying interest on savings, crippling a key source of income for depositors and banks alike.

The cash shortage left ATMs in Sana’a devoid of Yemeni rials, forcing customers to queue at bank branches in a desperate attempt to access their money. This created an atmosphere of panic, leading some banks to resort to offering withdrawals in Saudi riyals, a desperate measure that underscores the collapse of the local currency. Adding fuel to the fire was the deafening silence from the Houthi authorities and a lack of concrete steps to address the crisis.

The crisis in Sana’a threatens to have a devastating impact on the already fragile economy. Without access to their savings and with businesses struggling to operate, residents face an uncertain future. The lack of decisive action from parties to the conflict to address the liquidity crisis only serves to deepen public anxiety and raise the specter of a financial meltdown.

CBY-Aden’s Currency Reform Sparks Fresh Crisis

On May 30, the CBY-Aden mandated that all citizens, businesses, and financial institutions exchange pre-2016 Yemeni rials within 60 days. It set two options for surrendering older currency. Those without CBY-Aden accounts (e.g., citizens, businesses, and other non-financial institutions) must deposit their old rials at commercial and Islamic banks operating in government-held areas. Financial institutions with CBY-Aden accounts must deposit all pre-2016 rials at the central bank’s headquarters or at its branches in government-held areas.

The move was part of a tit-for-tat battle between the central banks over the nation’s fragmented monetary system. Part of the regulatory contest centers around the management of the Yemeni rial, now effectively divided into two currencies with vastly different values.

The CBY-Aden is attempting to assert its dominance over the monetary system by guaranteeing a one-to-one exchange for its new notes. While it claims sole authority due to its internationally recognized status, this is undermined by the harsh realities of Yemen’s dual currency system, now firmly entrenched across the divided zones of control. The Houthis banned post-2016 currency at the end of 2019 in an attempt to assert control over monetary policy and spiraling inflation. At the time, the CBY-Aden was printing vast quantities of notes to pay soldiers and public sector employees. The result has been two-fold: divergent exchange rates, with new rials worth less than a third of the older, physically degraded notes, and the concentration of an estimated 90 percent of old rials in Houthi territory as the good money drove out the bad.

This distribution reveals the likely true motivation – the unification of the currency at a lower value. New rials are currently trading at less than YR1,800 per US$1 and continue to fall, while old rials have maintained a steady value of near YR532 per US$1. Bills exchanged at a one-to-one rate would lose two-thirds of their present value.

The CBY-Aden warned that failure to comply will result in unspecified consequences. The central bank’s legal justifications for the order are tenuous. While its officials have cited Article 126, this article prescribes a two-year window for currency replacement, not a mere 60 days. The extended timeframe reflects the logistical complexity of withdrawing old notes and issuing new ones. However, the central bank’s claim that pre-2016 notes – designed with an estimated 18-month lifespan – have been “completely destroyed” is evident in the condition of still circulating bills.

For its part, the CBY-Sana’a responded by announcing a rival compensation scheme for holders of old rials in government-controlled areas and gave details of its mechanism for absorbing pre-2016 rials currently circulating in government-held territory. Starting June 8, the Al-Rahida Customs Control Center in Taiz and the Afar Customs Control Center in Al-Bayda would operate as “compensation points,” with other locations to be announced at a later date. Houthi authorities will reportedly exchange old rials for new rials at the market rate as determined by the CBY-Sana’a. Amounts of YR3 million or less can be readily exchanged; amounts exceeding YR3 million require prior approval, and customers must fill out a disclosure form as stipulated in Articles 23 and 24 of the Anti-Money Laundering and Counter-Terrosim Financing Law.

It is unclear exactly what terms the Houthis will offer, but they will likely be closer to the prevailing market rate, with new rials currently worth roughly a third of the old bills. The Houthi scheme will thus be more attractive to holders of old rials in government areas, though around 90 percent of the older bills already circulate in the Houthi-controlled north.

While they are offering them in exchange, Houthi officials still referred to new rials as “illegal.” The initiative was likely intended to counter the government’s scheme, reassert the status of old rials, and continue the bifurcation of the currency. The acquisition of additional old rials could also help the Houthis as they attempt to manage an ongoing liquidity crisis driven partly by the physical degradation of notes.

On June 21, CBY-Aden issued new regulations to regulate the flow of hard currency between government-controlled and Houthi-held areas. The directive banned travelers from transporting foreign currency into areas controlled by the Houthis and capped the amounts of new rials permitted to leave or enter government-controlled areas at YR200,000. It also prohibited the transport of old rials into Houthi-held areas, requiring them to be exchanged in government-controlled areas for new rials at a one-to-one rate.

The reopening of roads between government- and Houthi-held areas in Marib and Taiz complicates efforts to enforce restrictions on the leakage of hard currency. In Taiz, where the road between Taiz city and Hawban industrial area was reopened on June 13 for the first time since 2015, the Islah-affiliated Taiz Military Axis ordered military and security forces to carry out the CBY-Aden’s orders at all security checkpoints leading to Houthi-controlled territories.

Battle Over Banks Escalates

Central Bank in Aden Demands Banks Relocate

The CBY-Aden issued a resolution on April 2, demanding all Yemeni banks relocate their headquarters to Aden within 60 days. The move, ostensibly designed to maintain control over the banking sector and shield it from “illegal measures by Houthis,” who have been recast by the US as a Specially Designated Global Terror group (SDGT), threatens to cripple the already struggling financial system. A stern warning accompanied the resolution: any bank failing to relocate within the designated timeframe would face legal repercussions under the Anti-Money Laundering and Terrorism Financing Law and its associated regulations. Failure to comply would result in punitive measures, including potential exclusion from the SWIFT network and international money transfer services like Western Union and MoneyGram. This could cripple the banking sector’s capacity for essential international financial transactions.

The directive has some precedent. In August 2021, the CBY-Aden published a statement on its official website stating that all commercial and Islamic banks licensed to operate in the country must expedite the relocation of their operations management centers in Aden so it could carry out verification procedures and direct field inspections of their operations and ensure their commitment to fulfilling legal requirements. While this statement included threats of legal action against banks refusing to share operations data with the CBY-Aden, there were no penalties for banks failing to relocate.

The new demand by the CBY-Aden is more serious. It comes in the form of a resolution, which, from a legal perspective, is much stronger and includes threats of legal action against non-compliant banks. The circumstances are also different. The directive came in retaliation to the Houthis’ new coinage and their attempt to disrupt the CBY-Aden’s new Unified Money Transfer Network. The CBY-Aden also cited military developments in the Red Sea and the Houthis’ recent redesignation as a terrorist group as justification for demanding relocation, saying it will protect banks from risking being associated with anti-money laundering and anti-terrorism financing measures.

Sana’a-Based Banks Association Denounces Relocation Order

The Sana’a-based Yemeni Banks Association (YBA) fiercely criticized the CBY-Aden’s demand that all Yemeni banks relocate their headquarters to Aden, labeling it as a reckless risk to Yemen’s financial sector and economy. YBA President Mahmoud Naji blasted the move as “arbitrary” and said it was fueled by political pressure. He argued that banks strategically choose their locations based on market forces, specifically supply and demand, and this made Sana’a the clear choice. The majority of Yemeni commercial and industrial companies are based in the city and surrounding governorates – the lifeblood of the economy and the primary customers of banks. He also pointed to the absence of any legal mandate dictating where banks must be headquartered, arguing that current banking laws empower shareholders to determine the location of their respective headquarters.

The CBY-Aden’s relocation decree even ignited criticism from financial experts who typically support the government, such as Mohammed Halboub, Chairman of the Yemeni National Bank based in Aden, who highlighted several major roadblocks that could derail the plan. He noted that Houthi authorities could block the transfer of vital IT infrastructure, the backbone of banks’ operations. Even if this hurdle is overcome, significant technical challenges will remain. Setting up new data centers in Aden would be a complex and expensive undertaking. Compelling bank staff to relocate is another major obstacle. Low morale and financial constraints, exacerbated by recent Houthi policies that have crippled bank revenues in Sana’a, make employee buy-in highly unlikely. The most fundamental obstacle, however, lies in the impossibility of physically relocating the banking market itself. Clients cannot be uprooted and forced to move their business to Aden. Halboub cited a potential option of last resort, the “Venezuelan model,” where banks operate electronically despite geographical separation. However, the success of such an approach hinges on the consent of both the Yemeni public and the international community – both highly doubtful prospects. Halboub ultimately warned against continuing with any attempts at forceful relocation, saying it would be akin to “killing” the Yemeni banking system.

While the CBY-Aden’s demand that banks relocate is intended to cripple Houthi control over finances and safeguard the CBY-Aden’s own legitimacy, it presents a significant challenge for the internationally recognized government. Implementing the decision is fraught with risk. Banks with a majority of their business in Houthi-controlled areas will face threats, intimidation, and even asset seizure if they comply. Past measures have been reversed, including a ban on five banks, suggesting pressure on the government to back down. Continuing to succumb to such pressure would severely weaken the government’s position and erode public confidence in the CBY-Aden – a clear victory for the Houthis.

Central Bank Conflict Escalates to Remittance System

On May 23, CBY-Aden issued a new resolution to tighten regulations on foreign transfers processed through international remittance companies. The CBY-Aden’s resolution mandates that foreign transfers flow exclusively through qualified banks and money exchange companies it approves. Institutions must be authorized to partner with international remittance services like Western Union and MoneyGram. Qualified institutions offering remittance services must operate through their main branches, and any sub-agents must register with the CBY-Aden for approval. Recipients must receive transfers in the currency sent, with conversion only occurring at the beneficiary’s request and prevailing market rates.

This action directly counters the Houthis’ restrictions on international remittances. In March 2024, the CBY-Sana’a issued a decree forcing all transfers to be disbursed in Saudi riyals, regardless of the original currency. This move, fueled by a desperate need for US dollars, also prohibited the disbursement of remittances through agents that had not received authorization from the Houthis, which has caused significant hardship for Yemenis relying on overseas remittances.

The CBY-Aden’s resolution continues its push to regulate the country’s entire money transfer market by extending control over remittance activities even in Houthi-held territories, potentially forcing local exchange companies to cease unauthorized operations. By mandating original currency delivery, the CBY-Aden directly challenges the Houthis’ attempt to control the flow of US dollars. Importantly, by emphasizing adherence to international banking standards, the CBY-Aden aims to solidify its position as the internationally recognized monetary authority overseeing Yemen’s financial system.

However, the CBY-Aden faces significant challenges in achieving this. The fractured financial landscape, with most Yemeni banks and exchange companies headquartered in Sana’a, makes enforcing nationwide compliance daunting. The lack of a centralized monetary authority reflects broader political and economic fragmentation, and securing commitments from Sana’a-based institutions may not be possible. The CBY-Sana’a could also retaliate with punitive measures to discourage financial institutions from cooperating with the resolution.

Banks Blacklisted as Financial Divide Deepens

The CBY-Aden blacklisted six Sana’a-based banks on May 30 after accusing them of failing to adhere to anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. The six banks were the Tadhamon Islamic Bank, the Yemen and Kuwait Bank, the Shamil Bank of Yemen and Bahrain, Al-Amal Microfinance Bank, Al-Kuraimi Islamic Microfinance Bank, and the International Bank of Yemen. The CBY-Aden assured depositors that the sanctioned banks would continue basic operations in government-controlled areas, but the situation has reached a breaking point as further retaliatory measures threaten to plunge the economy into chaos.

The Houthi-controlled CBY-Sana’a proactively responded to the blacklisting with a series of punitive measures to prohibit banks from any sort of cooperation with CBY-Aden. In late May, its Financial Information Unit issued a circular banning all banks under their control from sharing any information with CBY-Aden or the internationally recognized government. Any bank that breached the order was threatened with harsh legal consequences, including being charged with “communicating with the aggression” – a serious offense punishable by severe penalties. This move effectively severed financial communication between the two halves of the country.

On May 31, the CBY-Sana’a escalated further, banning 13 Aden-based banks from operating in Houthi territories, citing a lack of proper licenses. This claim appears spurious, as 11 of the banks held valid licenses issued by the CBY-Aden. The list of sanctioned institutions includes Al-Qutaibi Islamic Microfinance Bank, Al-Busairi Bank for Microfinance, the Aden Islamic Microfinance Bank, the Aden First Islamic Bank; the National Bank of Yemen – Aden, the Cooperative and Agricultural Credit Bank in Aden (CAC Bank-Aden), Al-Shumul Bank for Islamic Microfinance, Al-Salam Capital Bank for Islamic Microfinance, Tamkeen Microfinance Bank, the Alinma Bank for Islamic Microfinance, Al-Sharq Yemeni Bank for Islamic Microfinance, Hadramawt Commercial Bank, and the Bin Dowal Islamic Microfinance Bank.

The CBY-Aden’s new sanctions have triggered a domino effect. Major international banks like Al-Rajhi Bank in Saudi Arabia have moved to cut ties with the blacklisted Sana’a banks and asked their financial agents, including several Yemeni banks, to produce a no-objection certificate from the CBY-Aden giving permission to continue dealing with Yemeni financial institutions. MoneyGram, a leading remittance company, is also complying with the CBY-Aden’s regulations, limiting the flow of funds into Houthi-controlled areas. On May 28, the company issued an ultimatum to its Yemeni branches and agents: obtain a no-objection certificate from the CBY-Aden or risk being shut down. Many banks and financial agents are struggling to obtain the CBY-Aden’s authorization to handle international remittances coming into the country. This bureaucratic hurdle could potentially create a chokehold on money transfers, a vital lifeline for many Yemeni families.

Following the CBY-Aden blacklisting of six financial entities in Sana’a and its order to hand in all old banknotes within 60 days, the Ministry of Transportation instructed Yemenia Airways on June 6 to shift its revenues to its bank accounts in Aden or overseas. Similarly, the Ministry of Communications called on mobile phone companies to move their offices from Sana’a to Aden.

For the Houthis, the threat they face is no less than being completely cut out of the international financial system and facing a similar set of constraints imposed on Russia following its invasion of Ukraine. Using Russia’s alternative to the SWIFT transfer system could be one option for Sana’a, but it would hardly be a sufficient replacement. The most likely scenario is that the black market would flourish. Migrant workers would have no choice but to use it to move money, and client trust in banks operating in Houthi territories would plummet. The Houthi authorities would lose control over remittances and humanitarian aid, leading to a flow of cash into government areas. This would benefit the government, though it hardly makes up for their other complaints: the Houthis’ blockade of oil and gas exports, the group’s ban on domestically produced cooking gas cylinders, and Saudi Arabia’s tightening of purse strings.

The Houthis have their demands, too. They have signaled a readiness to make some concessions but want to tie a resolution to the frozen Saudi-Houthi peace deal and the roadmap that would follow. These include the payment of salaries to teachers, military personnel, and others in Houthi territories, a share in migrant remittances, which are currently under government control, and a role in external trade policy.

CBY-Aden Bans Unauthorized Electronic Payments, Money Transfer Platforms

On June 26, the CBY-Aden issued a new directive prohibiting banks and exchange outlets from dealing with electronic payments companies operating without licenses issued by the government-affiliated central bank, in accordance with the pre-war Circular No. 11 of 2014. Numerous such entities were established following a March 2020 directive by CBY-Sana’a, which permitted non-bank institutions such as money exchange companies, traders, and other non-financial institutions to offer e-rial services. The ban included 12 e-wallet companies, reasoning that such wallets also operate and prompt electronic payment services and transfers without being officially licensed by the CBY-Aden.

Since the central bank split in 2016, the CBY-Sana’a has worked to establish a minimally regulated, non-bank-led model for electronic payments, an initiative that its counterpart in Aden has opposed. The CBY-Aden’s new directive appears intended to increase pressure on the Houthis by limiting alternatives to the deteriorating banknotes in use in the north, thereby exacerbating attendant liquidity problems.

On the same day, the CBY-Aden also suspended the operation of local money transfer networks owned by banks, exchange houses, and other financial institutions, giving network operators 15 days to finalize unfinished transactions and hand over information about all unreceived Hawala transfers. Banks have been given until the end of July to bring their networks into compliance. Operators must then commit to using the CBY-Aden’s Unified Money Transfer Network (UNMONEY) for all local money transfers. The central bank first announced UNMONEY in February. The network is intended to improve transparency and control of money flows and drew immediate condemnation from authorities in Sana’a. The CBY-Aden has threatened various punitive measures for entities that do not comply, including fines and the suspension or withdrawal of licenses.

The directive runs contrary to earlier de-escalation measures the central banks had agreed to. The CBY-Sana’a had said it would lift its ban on exchange houses dealing with UNMONEY; in return, the CBY-Aden would revoke its directive prohibiting transactions with five Sana’a-based banks and other exchange companies. The measures could lead to further escalation of the conflict between the respective central banks and fuel further fragmentation and deterioration of the private sector. The restrictions could cripple the ability of private sector actors to operate across zones of control, further destabilizing the rial and exacerbating the economic recession.

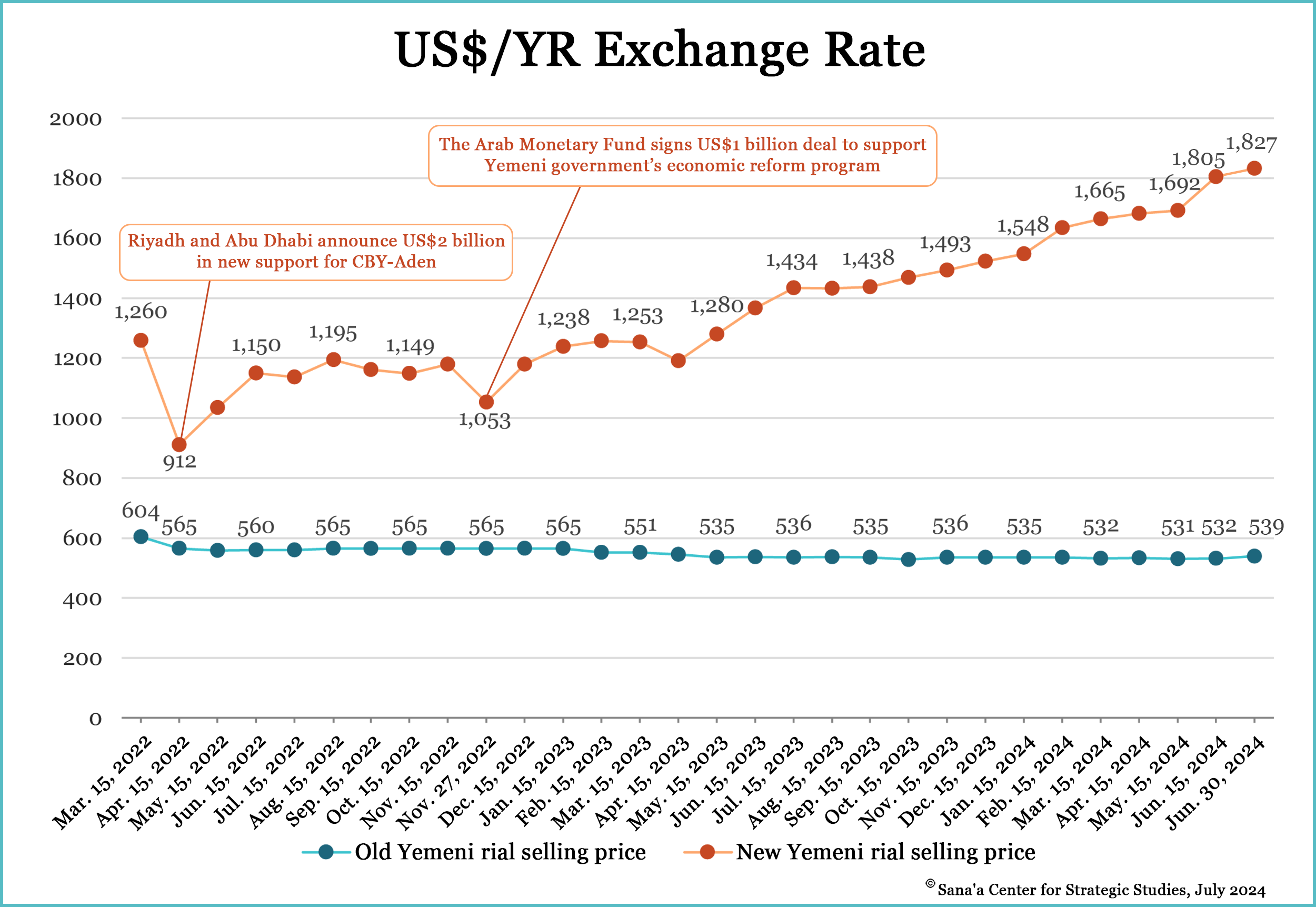

Rial Experiences Continued Volatility

New Yemeni rials experienced continued depreciation over the reporting period. The currency held steady over the course of April, trading between YR1,660 to YR1,680 per US$1 on average. Old rials, used in Houthi-controlled areas, also remained stable over this period, trading at an average of YR531 per US$1.

But the government has huge financial obligations compared with the limited resources it can currently mobilize, and it is running a large fiscal deficit as it struggles to pay public sector salaries. Only five FX auctions had been held in 2024 by the end of June, with Yemeni banks purchasing US$178 million (78 percent) of the US$230 million on offer. Inspired by the prospect of renewed support, the CBY-Aden briefly resumed foreign currency auctions after suspending them in late March. It held two currency auctions in May, each with US$30 million on offer, which were 89 and 73 percent subscribed, respectively.

On June 13, PLC chief Rashad al-Alimi confirmed the arrival of a new batch of funding from Saudi Arabia to support the internationally recognized government. Amounting to some US$300 million, the Saudi deposit was the third tranche of a US$1.2 billion aid package announced in August 2023 to support the government’s budget and prop up the value of the Yemeni rial. The sorely needed financial support came as the rial’s value dropped to record lows, depreciating 5 percent in May alone. Despite the arrival of the new Saudi funds, the rial declined a further 3.8 percent in June, hitting YR1,827 per US$1 as of June 30. This could be partly attributed to an increase in the money supply in the market after public servant salaries were disbursed ahead of the Eid al-Adha holiday on June 17.

Market uncertainty amid the escalation in economic warfare between the CBY-Aden and the Houthi-run CBY-Sana’a is undoubtedly another factor behind the rial’s decline. Still, the arrival of new Saudi funds amid the ongoing struggle for control over Yemen’s banking sector and money transfer systems could be interpreted in some quarters as tacit support by Riyadh for CBY-Aden’s recent escalatory measures.

Defying expectations, the CBY-Aden did not announce the resumption of its suspended foreign currency auctions in June, which might have partially stabilized the exchange rate. Instead, on June 26, the CBY-Aden announced an auction for treasury bills with a maturity period of one year and a discount rate of 18 percent. The Central Bank also announced an auction for longer-term government bonds. The bank is hoping to absorb some of the excess money supply to finance the budget deficit and help the government pay for public expenditures. Such monetary tools could help the CBY-Aden manage the persistent decline of the rial. However, success depends on how much the bank can raise in these auctions. The high interest rates offered on bills and bonds could instead add a new burden to the public budget in the absence of sustainable revenue.

Old rials in Houthi-controlled areas also slightly declined in value in June, trading at an average of YR539 per US$1 as of June 30. Although the CBY-Sana’a imposes a fixed exchange rate, the fluctuation can be attributed to a severe shortage of US dollars in Houthi-controlled areas.

Government Finances in Peril

Government Suffocates as Houthis Continue to Throttle Oil Exports

Prime Minister Ahmed Awad bin Mubarak painted a grim picture of government finances on April 9, revealing the brutal cost of Houthi attacks on Yemen’s oil infrastructure in late 2022. These assaults, targeting key export facilities, severed the government’s access to its primary source of revenue and foreign currency. Mubarak declared a staggering loss of 3 trillion Yemeni rials (approximately US$2 billion) in government revenue last year due to the complete halt of oil exports. This act marked the start of a relentless economic strangulation with devastating consequences for the Yemeni people.

In early August 2023, the government reported losses of US$1.5 billion as a result of the attacks. The Houthis’ demand to divert oil revenues toward public sector salaries, including those of military personnel in the areas they control, has removed any prospect of an agreement to restart exports. In an April interview, CBY-Aden head Ahmed Ghaleb said the Houthi stranglehold on oil exports has crippled the government, precipitating a staggering 70 percent decline in hard currency reserves and a 75 percent cut to government funding. The result has been a financial crisis, jeopardizing public employee salaries, electricity generation, and the stability of the Yemeni rial.

Aid Funding Falls Short

USAID Commits to Five-Year Aid Package

On April 21, the United States and Yemen agreed on a five-year assistance agreement. Signed by Minister of Planning and International Cooperation Waed Abdullah Batheeb and USAID Yemen Country Director Kimberlee Bell, the economic growth program aims to assist the stabilization of Yemen’s economy through improved monetary and fiscal policies and facilitating international trade. It also includes initiatives related to access to essential healthcare, improved nutrition for children and pregnant women, water and sanitation, improved service delivery, and education focused on literacy and numeracy skills in early grades. USAID has provided more than US$5.8 billion in humanitarian and development assistance to Yemen since 2015.

WFP Update Reveals Grim Realities

The World Food Programme’s (WFP) report covering March 2023 to March 2024 painted a stark picture of Yemen’s food security crisis, significantly exacerbated by ongoing political fragmentation. While the WFP continues to support 3.6 million people in government areas, albeit with reduced rations, their General Food Assistance (GFA) program has been suspended in Houthi-controlled areas since December. This has had a devastating impact, particularly in the northern Houthi-controlled governorate of Hajjah, where the share of households experiencing poor food consumption skyrocketed by 165 percent between November and February. Internally displaced persons (IDPs) are bearing the brunt of the cuts in assistance – the share of IDPs facing poor food consumption has surged since the program’s suspension, reaching 41 percent in February.

The cost of the minimum food basket (MFB) reached record highs in government-controlled areas between February and March. Compared to March 2023, MFB prices have increased by 12 percent. All government-controlled governorates saw price hikes, with the sharpest increases occurring in Marib and Abyan. Notably, MFB costs in Houthi-controlled areas are still 8 percent lower than March 2023 levels.

This price surge in government territories is driven by a combination of factors. The Yemeni rial depreciated by 25 percent against the US dollar year-on-year in government-controlled areas. This has led to unprecedented local food and fuel price inflation. The global increase in prices of essential commodities like sugar, vegetable oils, red beans, and wheat flour (up by 45, 36, 8, and 6 percent, respectively) further compounds Yemen’s food security woes.

The disparity in fuel prices highlights the stark economic divisions across zones of control. In government areas, petrol and diesel prices saw significant year-on-year increases of 26 and 17 percent, respectively. In contrast, aggregate fuel prices, which include cooking gas, remained unchanged in Houthi-controlled regions compared to March 2024. But this masks a year-on-year decrease of 4 percent and 18 percent for petrol and diesel, respectively. This is likely due to a combination of a stronger local currency and relaxed import restrictions on fuel through the Houthi-controlled ports of Hudaydah.

Despite recent tensions in the Red Sea, the overall volume of food imports remained relatively stable in the first quarter of 2024 and increased by 12 percent year-on-year. However, food imports via Red Sea ports declined by 14 percent compared to the last quarter of 2023, despite a 24 percent year-on-year rise. This drop can be attributed to limited storage capacity at the port, which has caused delays with ships unloading cargo. Food imports via the southern ports of Aden and Mukalla nearly tripled compared to last quarter but were still 17 percent lower than the first quarter of 2023. Despite these fluctuations, Yemen’s current reserve stocks of food are expected to last for the next two to three months.

The WFP report indicates that fuel imports have not been disrupted by the Red Sea crisis. Fuel imports through Red Sea ports increased by 6 percent compared to the last quarter of 2023 and by 29 percent year-on-year. This is likely due to incentives offered to traders by Houthi authorities in Sana’a, including covering demurrage costs and providing favorable customs rates. While fuel imports via southern ports also saw a 30 percent increase compared to last quarter, they have declined by 11 percent annually. Given the rising insurance costs for Yemeni ports, the situation requires close monitoring in the coming months.

Aid Organizations Issue Dire Warning

On the eve of the Sixth Senior Officials Meeting in Brussels, 190 humanitarian organizations, including UN agencies, issued a joint statement on May 6, warning of a looming humanitarian catastrophe unless drastically increased funding is secured.

On May 7, the Swedish government announced that European governments and the United States had pledged another US$791.69 million to address humanitarian crises in Yemen. However, the Norwegian Refugee Council criticized the announcement for “failing” to go far enough, as the pledged funding is still far below what is required this year for Yemen to reach its humanitarian needs.

With millions in desperate need, the situation is dire. Ahead of the Brussels meeting, a mere US$435 million of the 2024 Yemen Humanitarian Response Plan had been funded – a fraction of the US$2.7 billion required. Humanitarian organizations warned that “underfunding poses a crippling challenge,” translating to delays, cutbacks, and suspension of vital programs delivering food, healthcare, and other essential services.

The numbers paint a grim picture. Over 18.2 million Yemenis – more than half the population – require urgent assistance after enduring over nine years of war. Food shortages, disease outbreaks, and a crumbling infrastructure threaten their very survival. In 2023, 229 humanitarian actors, mostly local partners, provided life-saving support to an average of 8.4 million people a month.

Donors must urgently address the funding gap and prioritize sustained support for the 2024 Response Plan. This investment will not only save lives but also enhance Yemeni resilience and reduce dependence on aid in the long term.

IMF Mission Highlights Challenges and Reforms

On May 2, representatives of the internationally recognized government, including CBY-Aden Governor Ahmed Ghaleb and Minister of Finance Salem Bin Breik, concluded a five-day meeting with an IMF mission led by Joyce Wong in Jordan’s capital, Amman. Discussions centered on the latest economic and political developments, the future outlook, and progress on key reforms in Yemen. The findings paint a concerning picture, with ongoing conflict and a dormant oil sector creating a precarious future.

The halt in oil exports since Houthi attacks on key facilities in October 2022 continues to strangle Yemen’s economy. Growth is estimated to have shrunk by 2 percent in 2023, with inflation stubbornly high despite declining global food prices. The loss of oil exports, previously accounting for over half of government revenue, widened the fiscal deficit to an alarming 4.5 percent of GDP in 2023. This depletes reserves and weakens the exchange rate, further pressuring an already fragile economy.

The IMF warned that 2024 could see further deterioration due to heightened regional tensions. An escalation of the conflict in the Red Sea could disrupt trade and financial channels, potentially leading to a decline in external support, including critical humanitarian assistance. The mission emphasized the urgent need to accelerate fiscal reforms. Key areas include improving tax collection, prioritizing essential expenditures, and maintaining consistent and predictable foreign exchange auctions. Strengthening the CBY-Aden’s governance and data collection is crucial to enhancing transparency and accountability. The mission further highlighted the importance of a stable financial sector with robust compliance measures aligned with international Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) frameworks and national standards. This will facilitate trade and remittances, which are vital lifelines for the Yemeni people.

External financial support to Yemen remains essential for alleviating fiscal pressure, curbing reliance on money printing, and maintaining price stability. Active engagement with donors will remain crucial to addressing outstanding funding needs and ensuring consistent financial assistance.

Electricity Blackouts Plague Government Areas

Sabotage Plunges Marib into Darkness

Media sources reported that on May 6, the bombing of an electrical tower crippled the Marib power station, plunging the city into darkness. The attack came a mere five days after another act of sabotage, targeting a tower between the Safer oil facilities and the city of Marib, that also forced the power station to shut down. While engineers managed to swiftly repair the network and restart operations, the attack highlights the tenuous nature of Marib’s energy security.

The attacks coincided with a visit by PLC chief Rashad al-Alimi to the governorate, raising troubling questions about their motive. The repeated targeting of the Marib power station, coupled with ongoing clashes between government forces and tribal militants, not only plunges Marib into darkness but severs the international road linking the city to the Al-Abr region. This effectively halts the movement of fuel tankers from the Safer facilities, further exacerbating existing fuel shortages.

The Houthis have also issued statements saying they could take steps to prevent the domestic use of Marib crude oil: “Without any sense of shame or guilt, they seize Marib’s oil, while 90 percent of the people are completely deprived, as if it is the private property of [Marib Governor Sultan] Al-Aradah and the Islah party,” Houthi-affiliated Deputy Foreign Minister Hussein al-Ezzi wrote on X, opening a poll asking whether the Houthi authorities should take action to stop Marib oil production.

Aden Power Station Runs Out of Fuel

On May 1, the Aden General Electricity Corporation (GEC) announced the shutdown of the crucial PetroMasila power station due to depleted fuel supplies. A temporary reprieve came on May 3 with a meager supply of additional fuel, but the corporation warned it was a temporary and unsustainable solution. The 260-megawatt station has been operating at a fraction of its potential for over a year due to unbuilt transmission lines and other missing infrastructure.

The PetroMasila station, with a capacity of 260 megawatts, has been operating at a fraction of its potential for over a year. This was initially due to an incomplete transmission line and transfer station project. But even after its supposed completion months ago, the government’s failure to secure sufficient fuel has kept the station running at or below half capacity. Before the fuel shortage took it offline, it was generating a mere 50 megawatts.

The outage at PetroMasila is just one symptom of a larger crisis. The official spokesman for Aden Electricity, Nawar Abkar, previously confirmed the worsening situation in the city, saying an estimated 40 percent of Aden’s power stations were paralyzed by fuel shortages. Diesel stations lay dormant for more than two weeks, awaiting the arrival of a delayed fuel shipment.

The consequences of this inaction are borne by the residents of Aden. Homes and businesses are plunged into darkness, with only two hours of unreliable electricity during peak summer temperatures for every eight hours of blackout. As a result, dozens of citizens took to the streets to protest the lack of electricity, blocking the road leading to the Aden International Airport in Khormaksar district and setting fire to several cars, according to local security sources. After several days of 12-hour blackouts, the interim capital experienced a 20-hour blackout on May 13, with homes and businesses receiving only four hours of electricity. The drastic reduction in electricity provision provoked public anger, leading to protests.

Further exacerbating the issue are payment disputes between the internationally recognized government and the private energy companies that supply the fuel for power stations. The GEC is desperately trying to secure additional shipments, but negotiations have stalled due to the government’s financial woes. A crucial diesel shipment arrived at the port of Aden, but its owner refused to unload it until the government settled outstanding debts. In a memorandum made public on May 8, private companies, including Sapson Energy and Al-Ahram Energy, threatened to halt operations entirely if outstanding debts accumulated since 2021 were not settled by May 21. This could further complicate the fuel supply chain and throw the entire electricity grid into disarray.

The current crisis is not a recent development. Years of neglect and a lack of investment in Aden’s electricity infrastructure have contributed significantly to the current situation, and last summer saw similar protests as blackouts and living conditions became unbearable. The government has faced a barrage of criticism for its handling of the problem, and accusations of mismanagement and lack of transparency abound. The government claims to spend US$100 million a month on fuel and power plant rentals, but revenues from the heavily subsidized electricity sector barely reach US$5 million. With the recent depletion of a US$250 million Saudi aid package, the government is again facing criticism for its handling of resources. The wartime closure of the Aden Oil Refinery has forced the city to rely on imported fuel, a costly option further hampered by the government’s dwindling financial resources. The cessation of crude oil exports after Houthi attacks on oil terminals in late 2022 has deprived the government of the revenue needed to cover energy costs.

Critics point out that the government, heavily reliant on foreign aid, has failed to address the underlying causes of the crisis or otherwise improve living conditions for Yemeni citizens. Its apparent inaction, particularly during the scorching summer months, has pushed residents to the brink. Anger and frustration have boiled over into street protests, and residents have blocked roads and burned tires in a desperate attempt to force the government to act. However, much of the criticism remains online – residents have taken to social media to vent their frustration, and criticism of Southern Transitional Council (STC) and government officials has reached new levels. A slogan circulating among activists jokes that the STC doesn’t represent Adenis in summer, only in winter. Others have satirically lamented the days of former President Ali Abdullah Saleh, who at least provided services. Some have even advocated more extreme measures, urging citizens to besiege government headquarters to demand solutions. The STC, a key partner in the government that controls and administers much of Aden, has leveled harsh criticisms of its own, accusing the government of neglecting service provision in the south and minimizing its own responsibility.

Al-Alimi Unveils Strategy to Resolve Electricity Crisis

In a televised address on May 21, one the eve before the 34th anniversary of Yemeni unification, the head of the PLC, Rashad al-Alimi, outlined a comprehensive strategy to tackle the nation’s chronic electricity crisis. The plan combines immediate relief measures with a long-term vision for sustainable power generation. Immediate measures include securing consistent fuel supplies for existing power plants. This will increase generation capacity and enable a swifter response to service disruptions. In collaboration with the government and local authorities, the PLC has also been formulating a long-term plan over the past two years. This strategy, supported by the Saudi-led coalition, aims for permanent solutions to the country’s perennial electricity shortages.

Al-Alimi said improvements were imminent, including the securing of a sustainable fuel supply and the addition of 120 megawatts (MW) to the grid from a renewable energy plant in Aden next month, followed by 25 MW from Al-Makha in Taiz. A key pillar of the long-term strategy involves a significant investment in renewable energy sources. Plans include establishing a 56 MW renewable energy facility in Shabwa, with additional projects planned for Hadramawt, Taiz, and Hudaydah’s Al-Khawkhah and Hays districts, totaling 135 MW. The government is committed to increasing the capacity of the President Power Station in Aden to over 200 MW after network renovations, and Kuwait is funding a US$40 million project to restore and rehabilitate the Marib gas station, complemented by contributions from the local authorities.

The focus on both immediate relief and long-term infrastructure development is a promising sign. However, effective implementation will require overcoming challenges posed by the ongoing conflict and an inefficient distribution system.

Other Items

Govt Cracks Down on Pharmaceutical Imports

The internationally recognized government is taking a hard line on pharmaceutical imports that violate safety regulations. The Industry and Commerce Prosecution in Aden has issued a directive demanding the re-export of all pharmaceuticals shipped in non-compliant iron containers. The official memorandum, dated April 23, announced a proactive investigation into the use of unsuitable containers for pharmaceutical imports. To safeguard public health, authorities have mandated the re-exportation of these shipments to their origin countries. Pharmaceutical company owners have been notified of this requirement and face legal repercussions if they fail to comply within one week.

The directive reinforces a ban implemented by the Appeals Prosecution in Aden in late March. That decision prohibited the import of any medicines via containers that don’t meet the established specifications for safe pharmaceutical transport and storage. The circular, issued to all medicine importers, explicitly outlined the ban on “dry, unrefrigerated iron containers or any other method that does not conform to the requirements and conditions of storage and specifications required for the safe preservation of medicines.”

Investigation Halts Red Sea Cable Repairs, Threatening Global Internet Connectivity

On May 15, Bloomberg reported that a critical artery of the global internet passing through the Red Sea faces a unique challenge: repairs to a damaged subsea cable have stalled due to an investigation into the cable owner’s alleged ties to the Houthis. The situation, coupled with the Houthis’ history of disrupting maritime traffic, raises concerns about the vulnerability of internet infrastructure and potential disruptions for Europe and Asia.

The AAE-1, a 25,000-kilometer cable connecting Europe and Southeast Asia, is one of three cables that were damaged in the Red Sea. In February 2024, a Houthi missile attack sank the commercial ship Rubymar, whose anchor may have severed the three subsea cables (AAE-1, Seacom/TGN, EIG) as it foundered. The incident significantly impacted internet connectivity in the Middle East, and traffic was rerouted or directed to other Red Sea cables. The internationally recognized government is now investigating the AAE-1 consortium, which includes Yemen’s sole international carrier, TeleYemen, for links to the Houthi group. The investigation is preventing repair crews from accessing the cable, hindering restoration efforts for internet traffic between Europe and Asia.

Repairing internet cables in Yemen presents a complex legal and political landscape for international companies. Two permits are needed for any work to begin. The internationally recognized government retains the power to grant these permits and pursue legal action against companies operating without authorization. But the Houthis, who control territory near where the damaged cables lie, exert de facto authority. Securing their permission is necessary for safe and efficient repairs.

Over 90 percent of Europe-Asia internet capacity transits through the Red Sea, making it a critical chokepoint for telecoms. Disruptions in the region significantly impact countries like India, Kenya, and the UAE, which are heavily reliant on the cables for internet connectivity with Europe. The upcoming addition of new subsea cables, including the Blue-Raman, India-Europe-Xpress, and 2Africa, further underscore the Red Sea’s importance. The Bab al-Mandab Strait, a natural bottleneck between Africa and the Middle East, forces cables to pass near Yemeni waters off the coast of Houthi-controlled territories.

The Houthis control significant telecommunications infrastructure, including parts of TeleYemen, a member of the AAE-1 consortium. US-based NGO the Counter Extremism Project (CEP) has accused the Houthis of exploiting this control by monitoring and censoring internet traffic and profiteering from a growing user base. While the Houthis insist they have not targeted subsea cables, their attacks on commercial ships raise concerns about potential future disruptions.

The government’s investigation, while legitimate, is slowing down cable repairs and prolonging internet disruptions. Exploring alternative repair routes or collaborating with neutral third parties could be options if delays persist.

Aden Bakers Strike: Crippling Flour Costs Threaten Supply

Simmering tensions between Aden’s bakery owners and local authorities erupted into a full-blown crisis on May 24. The Professional Bakeries and Automated Bakeries Association, flexing its collective muscle, announced a two-pronged strike to protest the closure of bakeries in Buraiqa district for alleged pricing violations. The association announced a partial strike, followed by a complete, open-ended shutdown of all bakeries across Aden beginning the next day. In a scathing statement, the association condemned the “arbitrary measures” imposed on Buraiqa bakeries, highlighting the disconnect between government regulations and the realities on the ground.

Their core demand is official recognition of a new bread price – YR100 for a 60-gram loaf – reflecting the “increased costs of ingredients used in bread production.” Current bread prices remain unchanged since 2022 – despite ever-increasing costs of flour, yeast, oil, and other essential ingredients. Diesel fuel, rent, and labor costs have also skyrocketed, further squeezing profit margins. As such, the association’s statement emphasizes the bakery industry’s precarious situation, caught between surging ingredient prices and a weakening local currency.

The association warned against further “arbitrary actions” targeting other bakeries, hinting at an escalation of the strike if these measures continue. Its resolve has been bolstered by support from several automated bakery owners in Aden, who predict a complete shutdown and industry-wide bankruptcy unless price hikes are implemented. The statement also implored all relevant authorities to acknowledge the dire circumstances and formulate a sustainable solution. This solution, they emphasize, must safeguard the interests of both citizens and bakery owners. Ultimately, the strike is a stark reminder of the domino effects of economic instability. Without a swift and comprehensive solution that addresses the concerns of both producers and consumers, the dispute could further destabilize an already fragile situation in Aden.

Transport Ministry Chases Yemenia Revenues

On June 2, government Minister of Transport Abdelsalam Humaid issued a directive calling for the immediate transfer of Yemenia Airways revenues to the airline’s accounts in Aden or abroad. The move is purportedly aimed at removing the airline’s revenues from Houthi control and allowing the company to allocate resources to developing and modernizing its fleet. According to the directive, Houthi authorities in Sana’a have seized or frozen more than US$100 million belonging to the airline. The ministry also requested the immediate transfer of Yemenia’s other departments in Sana’a to the company’s Aden branch.

The ministry appears to be trying to tie the issue to the CBY-Aden’s recent suspension of six commercial banks for failing to relocate their headquarters to Aden. Yemenia offices and agencies currently handle transactions with these banks in governorates under Houthi control. The directive coincided with the brief suspension of some flights from Sana’a, as traffic was limited to pilgrims traveling to Saudi Arabia. Yemenia resumed flights on June 5, but with the requirement that flights only be booked through the company’s offices outside Sana’a.

Disputes over the airline’s revenues have occurred before. Last October, Yemenia suspended commercial flights due to a disagreement with Houthi authorities over access to more than US$80 million in airline funds held in Sana’a-based banks. Houthi officials retaliated by suspending flights designated for international organizations and then limiting their operation to once a week. Houthi Deputy Foreign Minister Hussein al-Ezzi admitted they had put restrictions on Yemenia withdrawing money: “We have only ceased the withdrawal of large sums in order to prevent corruption and to ensure and establish honest, disciplined, and transparent behavior for the benefit of the company.” At the time, the government-run Ministry of Transport said that although Houthi authorities were continuing to block Yemenia’s access to funds, flights would resume due to humanitarian concerns, and they restarted later that month. But Yemenia’s Aden offices stopped selling tickets for flights from Sana’a, and divisions deepened between the airline’s respective branches.

Ticket sales in Houthi-controlled areas represent nearly 70 percent of total ticket revenues, roughly reflecting the proportion of the Yemeni population living there. Yemenia had proposed that Houthi authorities take 70 percent of the funds accumulated in Sana’a, with the remainder going to the internationally recognized government, but Houthi authorities reportedly rejected the proposal.

Oil Workers Protest Layoffs

Employees of the Austrian oil and petrochemical group OMV protested the dismissal of 33 of their coworkers to the Ministry of Oil and Minerals. OMV announced the layoffs last September after a sale of its interests to Dutch-owned Zenith Energy fell through. Some 200 workers at the S2 block in the Al-Uqlah area of Armaa district in Shabwa now stand to lose their jobs. The 33 were the first batch of workers to be let go, and another 120 were transferred to leave without pay, with no guarantee of further employment. The employees have called on Minister of Oil Saeed al-Shamasi to intervene on their behalf. They say they blame the layoffs for the death of a coworker, who suffered a stress-induced heart attack, and are incensed that the firings were announced on May 1, International Workers Day.

Yemeni oil and gas exports have been suspended since the fall of 2022 when Houthi attacks on southern oil terminals and attendant tankers initiated a de facto blockade. Companies in affected industries have seen a total loss of revenue, as has the internationally recognized government. OMV has been in prolonged talks with the UAE’s state-owned Abu Dhabi National Oil Co. (ADNOC) to merge their chemicals units, but after a series of delays, no deal is expected before Austrian elections this fall.

Al-Makha Airport Takes Flight

In a welcome sign of progress amidst the ongoing conflict, the internationally recognized government announced the opening of Al-Makha Airport in Taiz governorate. This critical air hub on the southwest coast will now serve both arriving and departing flights. The announcement, made by the General Authority of Civil Aviation and Meteorology (GACM) in Aden, highlights the airport’s readiness following the successful completion of preparations. Operating as a Category G airport, Al-Mokha will operate during daylight hours starting April 5. The GACM extended an invitation to all airlines and international organizations operating in Yemen to leverage Al-Makha Airport’s capabilities. The airport boasts full technical and administrative preparedness, complete with an internationally recognized code (OYMK) designated by the International Civil Aviation Organization. The airport will have limited operational capacity for the time being due to a lack of electricity. PLC member and head of the National Resistance forces Tareq Saleh, who controls coastal Taiz, including Al-Makha, announced plans to open the airport in 2022 with Emirati assistance.

New US Sanctions Target Houthi Networks

On June 17, the US announced new sanctions targeting Houthi weapons smuggling and financial networks. The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated two individuals and five entities allegedly involved in procuring weapons for the Houthis.

One sanctioned individual, Ali Abdelwahab Mohammed al-Wazir, and his company are based in China, where the group has procured materials to manufacture advanced conventional weapons inside Yemen. Sanctions also targeted an Oman-based company and its operator, Muaadh Ahmed Mohammed al-Haifi. Both men are Hashemites, a segment of Yemeni society that claims descent from the Prophet Mohammed and includes the Al-Houthi family, and is estimated to make up 5-10 percent of Yemen’s population. The Houthis have taken several measures since their takeover of Sana’a in September 2014 that privilege Hashemites in politics, military and security, and the economy.

The most recently announced sanctions also targeted a UAE-based company, a Cameroon-flagged vessel, and its captain for facilitating the shipment and sale of commodities on behalf of the group. An earlier round of sanctions on June 10 designated individuals, entities, and vessels involved in the illicit transport of oil and other commodities as part of a network run by Houthi financial facilitator Said al-Jamal. Overall, the sanctions come as part of a concerted US effort since the beginning of the year to pressure the Houthis financially over their attacks against commercial vessels in the Red Sea and other strategic waterways. The Houthis were redesignated as a terrorist group by the Biden administration shortly after the US and UK began an air campaign targeting the groups’ military assets in Yemen in January. OFAC also announced sanctions that month targeting several Houthi military officials for their role in attacks against commercial shipping.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية