Financial and Monetary Developments

Yemen’s Central Banks Clash

The ongoing economic conflict in Yemen escalated to include a fierce struggle between its bifurcated central bank for control over the nation’s fractured monetary system and financial institutions.

On June 26, the Central Bank of Yemen in Aden (CBY-Aden) issued a new directive, effectively banning banks and exchange outlets from working with unlicensed electronic payment companies. This move specifically targeted 12 e-wallet companies, which were deemed to be facilitating electronic payments and transfers without the necessary authorization. This appeared to be a part of a strategy to increase pressure on the Houthis by limiting alternatives to the deteriorating banknotes in use in areas under the group’s control and to prevent inflating the cash base in Yemen’s currently fragmented regulatory environment.

In addition to the battle over electronic payments, the two central banks also engaged in a dispute over money transfers. In June 2024, the CBY-Aden suspended the operation of local money transfer networks, forcing banks and exchange houses to transition to its Unified Money Transfer Network (UNMONEY). The central bank mandated that all local money transfers be conducted through UNMONEY and implemented stringent regulations on financial transfers. This move was met with strong opposition from the Central Bank of Yemen in Sana’a (CBY-Sana’a), which condemned it as a violation of earlier de-escalation measures agreed upon by the two central banks. The Houthi-controlled Money Changers Syndicate wasted no time retaliating to the decree, announcing the suspension of dealings with exchange networks under the CBY-Aden’s control.

The CBY-Aden gave network operators 15 days to finalize any pending transactions and provide information on unreceived Hawala transfers. Banks were given until the end of July to bring their networks into compliance and threatened with punitive measures for non-compliance, including fines and the suspension or withdrawal of licenses. Effective June 26, this drastic move forced the closure of all local financial transfer networks operated by banks and exchange businesses. In a swift series of actions, the CBY-Aden issued Resolution No. (31) on July 10 and Resolution No. (32) on July 11, suspending the operations of a total of eleven exchange companies after violations were reportedly uncovered during field investigations.

On July 3, tensions escalated further when the CBY-Aden revoked the licenses of six major banks headquartered in Houthi-controlled Sana’a: the Tadhamon International Islamic Bank, Yemen Kuwait Bank, Yemen and Bahrain Shamil Bank, Al-Amal Microfinance Bank, Al-Kuraimi Islamic Microfinance Bank, and the International Bank of Yemen. While a temporary reprieve allowed branches in government-held areas to continue limited operations, the complete severing of ties with their Sana’a headquarters would have effectively cut these banks off from the global financial system, including the critical SWIFT infrastructure. SWIFT facilitates a large proportion of international trade, and the decision promised serious ramifications for a country so heavily reliant on imports, including nearly 90 percent of basic commodities. The move was cast as a punitive measure against banks that had defied a relocation order issued in April. By forcing Sana’a-based banks to choose between isolation and relocation, the CBY-Aden sought to wrest control of Yemen’s financial system and cripple the Houthi economy.

The bank sanctions escalated the dispute into a high-stakes power struggle. UN Special Envoy for Yemen, Hans Grundberg, expressed deep concern about the potential consequences of the CBY-Aden’s actions. In a letter addressed to the chairman of Yemen’s Presidential Leadership Council (PLC), Rashad al-Alimi, Grundberg warned that the bank’s decision could lead to a military escalation and urged a postponement of the license revocations until the end of August to allow for negotiations. The government expressed a willingness to negotiate and resolve broader economic issues, including resuming oil exports and unifying the national currency, but this was contingent on the Houthis’ commitment to do their part in refraining from unilateral monetary policy and divisive actions. However, the Houthis rejected the UN’s call for dialogue on the economic crisis, with Houthi Deputy Foreign Minister Hussein al-Ezzi bluntly refusing to engage in talks and stating that negotiations would be strictly confined to implementing the pre-agreed Saudi roadmap for peace. Houthi leader Abdelmalek al Houthi further escalated tensions by threatening renewed military action in response to the CBY-Aden’s order. To exert further pressure on the government, the Houthis orchestrated a series of actions targeting the sanctioned banks, including forcing the closure of banks’ branches in government-controlled areas like Marib and Taiz.

On July 14, the CBY-Aden condemned the Houthis’ actions as arbitrary and in violation of banking laws and regulations, accusing them of using coercion and blackmail to force bank closures and freeze operations. Protests in government-controlled cities like Taiz, Marib, and Al-Khawkhah erupted in support of the CBY-Aden, demanding a firm stance against Houthi-controlled banks.

Saudi Pressure Forces Climbdown

The war between the rival central banks continued to unfold throughout July, with both sides deepening their control over Yemen’s fractured financial system. Under immense pressure from Saudi Arabia, the internationally recognized government and CBY-Aden were forced to roll back months of efforts aimed at consolidating control over Yemen’s financial sector and economically isolating Houthi-controlled areas. An agreement, announced by the UN Special Envoy Grundberg on July 23 and heavily influenced by Saudi Arabia, focused on de-escalation related to Yemeni banks and the national airline, Yemenia Airways.

The deal includes four main points. Both the Houthis and the government agreed to reverse recent measures taken related to banks, including the CBY-Aden’s revocation of the licenses of six entities based in Sana’a, and to avoid similar escalations in the future. Yemenia flights from Sana’a to Jordan will resume with increased frequency, while new routes to Cairo and India will operate “as needed.” Joint meetings between government and Houthi officials will be held to discuss administrative, technical, and financial challenges faced by the airline. And finally, broader discussions will be held on economic and humanitarian issues based on the Saudi roadmap.

Still, the path to a real economic truce is riddled with political landmines. The Saudi intervention has caused significant internal strife. On July 17, CBY-Aden Governor Ahmed Ghaleb tendered his resignation in a strong show of defiance, citing the bank’s efforts to stabilize the Yemeni rial and regain international trust. Days earlier, Ghaleb’s deputy, Mansour Rajeh, also tendered his resignation. However, the PLC rejected Ghaleb’s resignation and expressed support for his economic and banking reforms. Nonetheless, the damage was done. Saudi interference undermined the CBY-Aden’s credibility in the global financial system after it was forced to rescind its decision to disconnect the six banks from SWIFT. The financial landscape remains deeply fragmented. The Houthis likely view the CBY-Aden’s weakened position as an opportunity and may exploit the situation to expand money printing, which would exacerbate the division of the rial. Finally, the UN’s optimism about the Houthi commitment to concessions and talks is questionable, given the group’s history.

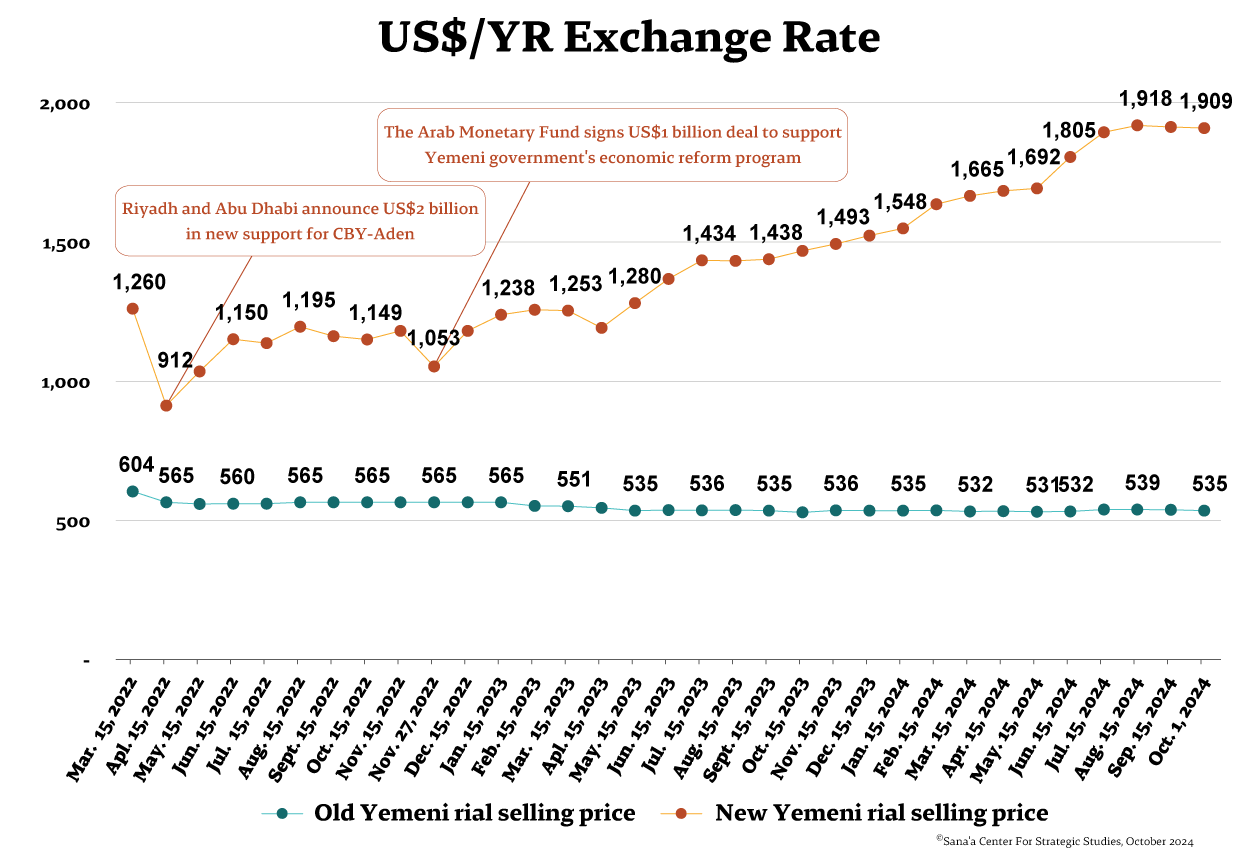

Rial Hits Record Lows Despite Saudi Aid

The Yemeni rial continued its downward spiral throughout the summer of 2024, reaching record lows despite ongoing efforts to stabilize the currency. The central bank’s struggles to maintain foreign reserves, coupled with the delayed arrival of Saudi aid, contributed significantly to the rial’s depreciation.

In late June, the new Yemeni rial hit a record low of YR1,834 per US$1, despite the arrival of Saudi funding on June 13. A third tranche of Saudi Arabia’s US$1.2 billion aid package, provided approximately US$300 million. Despite this injection, the funds were slow to arrive, and the government continued to face immense pressure on its budget following the suspension of oil revenues.

The CBY-Aden responded by resuming FX auctions, which had been on hold since late May. On July 11, the ninth auction of the year, with US$30 million on offer, was fully subscribed, but a subsequent auction on July 24 only managed a 57 percent subscription rate, falling short of expectations. The declining participation is a direct consequence of the restrictions imposed by the Houthi-controlled CBY-Sana’a.

The aftermath of the central bank crisis has seen Houthi authorities impose pressure on Sana’a-based banks to withdraw from the SWIFT system, hampering the CBY-Aden’s ability to monitor import financing transactions. This meant that banks operating in government-controlled areas were the only participants in the auctions, limiting the scope of intervention and leaving the rial vulnerable to further decline. Despite the resumption of foreign exchange auctions and the receipt of additional Saudi aid, the CBY-Aden’s foreign reserves remained critically low.

As the summer progressed, the new rial’s value continued to decline, reaching a new low of YR1,917 per US$1 on July 23. This followed a nearly 4 percent loss in value in July. Over the course of August and early September, the new rial experienced a brief period of stability, fluctuating around YR1,910 per US$1. By mid-September, it had slightly recovered to YR1,891 per US$1 following the arrival of further Saudi support, amounting to YR300 million to cover the cost of the public sector salary bill in areas under the control of the internationally recognized government.

However, the overall trend remained negative, and the currency has lost nearly 24 percent of its value since the beginning of the year. The CBY-Aden’s reliance on Saudi support and the limited foreign reserves available to the government pose significant challenges to the Yemeni economy. In Houthi-controlled areas, old rials remained relatively stable over the reporting period. Old rials experienced a slight decline in value, trading at an average of YR539 per US$1 at the beginning of July compared to YR532 on June 25, as a severe shortage of US dollars continued to affect Houthi-controlled areas.

Central Bank Auctions Debt to Stave off Fiscal Crisis

The CBY-Aden attempted to address the devaluation of the rial through auctions for treasury bills and government bonds. On June 26, CBY-Aden announced an auction for treasury bills with a maturity period of one year and a discount rate of 18 percent, as well as an auction for longer-term government bonds. These measures were intended to absorb excess money supply to help finance the budget deficit and public expenditures. Although this strategy could assist the CBY-Aden in managing the persistent decline of the rial, success depends on how much the bank could raise through these auctions. High interest rates on bills and bonds, however, risked adding a new burden to the public budget amid dwindling revenues.

In September 2024, CBY-Aden launched another bid to stave off financial collapse with short- and long-term debt auctions. Scheduled for September 18, these auctions represented an attempt to plug the gaping hole in Yemen’s fiscal deficit, which has been exacerbated by stalled Saudi financial support and a deteriorating economy. The CBY-Aden offered short-term treasury bills with a one-year maturity and long-term government bonds with a three-year term, each with initial issuance values of YR5 billion (subject to increase) and annual interest rates of 18 and 20 percent, respectively. Interest would be paid semi-annually. The minimum bid was set at YR50 million, submitted electronically via the Refinitiv platform or by email. However, no results were announced, potentially indicating a weak subscription appetite that CBY-Aden preferred not to publicize.

The government is struggling to manage unpaid public sector salaries, electricity shortages, and a critical fiscal gap that has been worsened by delayed Saudi support. The bond auctions are intended to raise new funds in light of these challenges. However, the high interest rates and liquidity issues faced by commercial banks further complicate the situation, raising questions about the ability of these measures to support financial stability and the continuity of essential public services.

International Bank of Yemen on Brink of Collapse

Adding to the crisis, the International Bank of Yemen, the country’s largest financial institution, was reportedly teetering on the edge of a financial abyss. Rumors of its impending bankruptcy gripped the nation in early September, echoing the catastrophic collapse of Lebanon’s banking system. The specter of such a disaster sent shockwaves through Yemen’s fragile financial sector.

In a desperate attempt to quell panic, the bank issued a statement on September 7 denying bankruptcy rumors and attributing its current woes to a liquidity crisis. The bank stated that it is working with the Central Bank of Yemen—referring to the Houthi-controlled CBY-Sana’a—to address the issue and expects to resolve the crisis by the end of the year. Despite these assurances, the International Bank of Yemen has undertaken cost-cutting measures, including reducing its workforce, to manage its financial strain.

The bank’s troubles are a stark reflection of the broader instability plaguing the financial sector. The country’s bifurcated banking system, divided across zones of control, creates dangerous secondary and tertiary effects. Financial instability in one segment can quickly spread to another, jeopardizing the entire economy. Yemen’s financial woes are compounded by the ongoing conflict, dependence on Saudi aid, and an embattled government. The threat of a banking crisis adds another layer of complexity to an already dire situation, with potentially catastrophic consequences for both the political and economic landscape.

Fuel and Power Developments

UAE-Funded Solar Power Plant Ushers in New Era for Aden

On July 15, government Prime Minister Ahmed Awad bin Mubarak inaugurated a 120-megawatt solar power plant gifted by the United Arab Emirates. The new facility, located in Aden, marks a pivotal moment in Yemen’s transition to renewable energy.

The project, a collaboration between the Ministry of Electricity and Energy and the Abu Dhabi Future Energy Company, is the largest of its kind in Yemen. Spanning 1.6 million square meters and comprising 43,766 bases and 211,584 solar panels, the plant was constructed by over 2,000 engineers, technicians, and workers over 1.3 million man-hours. Beyond its immediate benefits of reducing electricity costs and cutting fuel consumption during daylight hours, the solar power plant is expected to have an important environmental impact by significantly lowering carbon emissions.

Bin Mubarak emphasized the project’s role as a catalyst for broader renewable energy development across Yemen, highlighting another successful solar initiative in Al-Makha and expressing the government’s commitment to expanding clean energy solutions to Shabwa, Hadramawt, Al-Mahra, and other governorates. The plant’s design incorporates the potential for expansion to a capacity of 600 megawatts, with existing transmission lines already in place to accommodate future growth. This landmark project signifies a partial departure from the government’s heavy reliance on fossil fuels, which consume a large portion of its fiscal budget.

Oil and Banks: Yemen’s High-Stakes Battle

On July 27, PLC chief Rashad al-Alimi visited the oil-rich governorate of Hadramawt, where reports had emerged that the government hopes to resume oil and gas exports from the region. The reports were of a potential deal between the government and the Houthis: oil for banking concessions. The Houthis would purportedly allow the government to resume crucial oil exports in exchange for a rollback of the CBY-Aden’s decision to revoke the licenses of six major Yemeni banks. However, following the government’s capitulation to Saudi pressure, the central bank’s measures are already being undone. The supposed agreement reportedly outlined a revenue-sharing model, with the government receiving the entirety of oil revenues for six months, with possible extension, while Saudi Arabia would disburse salaries to public sector employees in Houthi-controlled areas, equivalent to half of oil export revenues.

On July 29, the Houthis swiftly announced their rejection of the proposed agreement, insisting on the full disbursement of salaries before oil exports resumed. This unwavering stance, coupled with continued threats to target oil facilities, underscores the situation’s fragility and the challenges of achieving a durable truce. In a statement, the Houthi-affiliated Supreme Economic Committee called the reported agreement a mere rumor. The Houthis reissued a stark warning to domestic and international oil companies, threatening severe military consequences for any attempt to export Yemen’s oil and gas reserves.

The payment of public sector salaries in Houthi-controlled areas and the resumption of Yemen’s oil and gas exports from government-controlled areas are two critical issues in the current economic situation and in various proposed frameworks to de-escalate and end the war. However, the Saudis are unlikely to pay the wages of Houthi forces while the group is still embroiled in the Red Sea, and the group has insisted on this as a precondition for any deal allowing the resumption of hydrocarbon exports, which it characterizes as a form of foreign exploitation.

Hadramawt’s Electricity Crisis: A Complex Standoff

The ongoing electricity crisis in Hadramawt has escalated tensions between local authorities, the Yemen Petroleum Company (YPC), and the Hadramawt Tribal Alliance (HTA). The crisis, characterized by severe power outages and disruptions in fuel supply, has sparked widespread protests and unrest in the region.

During August, residents of Mukalla and other coastal cities in Hadramawt were enduring a severe electricity crisis, receiving only two hours of power for every three hours of blackout. The government attempted to ameliorate the situation, and on August 21, the Hadramawt Coastal branch of the Yemen General Electricity Corporation (YGEC) announced that it had received 1.7 million liters of diesel from the Yemen Petroleum Company (YPC) and 1.1 million liters from PetroMasila as part of a grant directed by Hadramawt Governor Mabkhout bin Madi. These shipments, while promising, are unlikely to lead to long-term improvements—nearly half a million liters of diesel are required each day to fuel the region’s power plants.

The assistance has also not been enough to head off a price increase. On August 25, the YPC office in Hadramawt announced a significant increase in diesel prices, stating that it would import fuel to meet local demand after the temporary shutdown of a PetroMasila diesel distillation unit due to “force majeure.” Diesel prices will increase 29 percent, from the subsidized price of YR1,200 per liter to YR1,550 per liter, which the company says is the cost price.

The electricity crisis has become a focal point of contention among local authorities, the YPC, and the HTA. The YGEC has blamed a shortage of diesel for the disruptions, which it says are caused in part by the tribal alliance erecting checkpoints to prevent fuel from reaching power stations. The alliance vehemently denied the allegations and accused local authorities, the YPC, and YGEC of responsibility. In response to PetroMasila’s statement that it had been “forced” to suspend fuel shipments last week (a reference to tribal checkpoints erected on the orders of HTA leader Amr bin Habrish), the group announced that it had investigated the matter and found that PetroMasila “deliberately” prevented trucks from offloading fuel. The group claims it has consistently supported the uninterrupted supply of electricity and facilitated the passage of diesel tankers. It further alleges that the YPC has intentionally created a fuel shortage to shift blame onto the alliance.

The tribal alliance continues to wrestle for control of the electricity sector, and held an August 21 meeting with political, civil, and union leaders from Coastal Region districts, purportedly to better understand the needs of residents and how to best direct public services. The group has insisted on a fixed diesel price of YR700 per liter for citizens and demanded that the governorate receive a substantial share of revenues from local oil and gas to fund essential services.

Other groups, such as the STC and the Hadramawt Parliamentary Bloc, led by Saleh bin Salem al-Amri, have used the crisis to voice their concerns and sway support. On August 23, the bloc met in Mukalla to discuss the ongoing situation, according to local sources. As with many groups in Hadramawt’s hotly contested political scene, the meeting appears to have been largely performative, with the only result being a lofty statement encouraging the two sides to show “solidarity, compassion, and compromise” and to “strengthen the Hadrami social fabric.” The bloc also called on the electricity and petroleum companies to ensure regular delivery of fuel without providing recommendations on how to do so.

The standoff between the government and the alliance intensified after PLC chairman Rashad al-Alimi visited the governorate in late July. While Al-Alimi announced plans to construct two 50-megawatt power stations to alleviate the power shortage, this is a long-term solution that offers no immediate respite to the needs of the population. Al-Alimi’s trip was accompanied by rumors that the government planned to resume the export of local oil and gas and share the revenues with the Houthis as part of a political settlement. On August 20, Al-Alimi called for the establishment of a committee to investigate the needs of the Hadrami people. The move was met with harsh criticism, not only from other PLC members but also local residents, who took to the streets in Mukalla to protest deteriorating conditions and ongoing fuel shortages amid the dispute between the PLC and Amr Bin Habrish.

Electricity shortages are common in government-controlled areas and have sparked annual protests in Aden during Yemen’s hot summer months. Electricity is highly subsidized through a convoluted purchase scheme, and operational costs are exacerbated by the limited collection of utility bills.

Deteriorating Economy and Increasing Food Insecurity

World Bank Paints Grim Picture of Yemen’s Economy

The World Bank’s latest Yemen Economic Monitor, released in late June, delivered a stark warning: Yemen’s economy is on a downward spiral, strangled by the ongoing conflict and worsening regional tensions. The report paints a picture of a nation in freefall, with poverty gripping the majority of its citizens and basic needs unmet. Yemen’s GDP is projected to contract by a further 1 percent in 2024, following consecutive years of decline. This translates to a staggering 54 percent drop in real GDP per capita since 2015, which has plunged millions into poverty. Food insecurity now affects half of the population, with youth mortality rates on the rise.

The report also noted that the internationally recognized government faces a dire fiscal situation. Oil revenue has plummeted, and import redirection toward Houthi-controlled ports has decimated customs revenue. These combined factors have led to a 30 percent drop in fiscal revenues in 2023, forcing the government to implement further cuts to essential services and jeopardizing long-term growth.

The government’s current account deficit has widened to 19.3 percent of GDP, reflecting the crippling impact of the oil export blockade on trade. While some foreign reserves remain due to international support, the government’s resumption of monetary financing has fueled inflationary pressures. The cost of essential goods has skyrocketed, with many families spending 60 percent of their income on food alone.

The report warns that continued fiscal pressures and economic fragmentation between Houthi- and government-controlled threaten to deepen the divide and derail any potential recovery. The redirection of imports has disproportionately impacted the government-held territory, further straining its economic situation. Regional conflict, particularly the Houthi attacks in the Red Sea, further disrupts trade and international shipping, driving up costs and hindering economic activity.

Israeli Air Raid on Hudaydah Threatens Humanitarian Situation

On July 20, Israeli airstrikes on the Houthi-controlled port of Hudaydah targeted fuel reserves, destroying over 30 tanks. This significant loss of storage capacity (around 100,000 tons) threatens a fuel crisis in Houthi-controlled areas, causing shortages and price hikes, as well as increased transportation costs. The air raids also damaged two of the port’s ten cranes, which will cause delays in unloading essential goods. Disruptions in the delivery of food, medicine, and other vital supplies threaten to exacerbate existing shortages and cause price inflation, placing further strain on the fragile humanitarian situation.

Yemeni seaports handle 90 percent of the country’s imports. Hudaydah, whose infrastructure was painstakingly rebuilt and bolstered by the UN, international donors, and the global community, serves as a lifeline for the majority of the population. According to UNOCHA, over 80 percent of the country’s humanitarian aid, essential goods, and fuel—upon which 28 million Yemenis depend—flows through Hudaydah. Houthi attacks against commercial shipping have already driven up insurance and transportation costs in the Red Sea. Meanwhile, the port of Aden, under the internationally recognized government’s control, may lack the capacity to handle additional imports. Ongoing management disputes within the government further complicate matters. The Houthi group has also threatened retaliation against government-controlled airports and ports, which might further cripple the country’s import capacity. With limited fuel stocks and potential disruptions to port operations, delivering aid and ensuring food security will become even more challenging.

Poultry Prices Double in Houthi-Controlled Areas

In early August, Houthi authorities’ stranglehold on the poultry industry triggered a price surge of over 100 percent on chickens sold in Sana’a and other territories under the group’s control. The profiteering has sparked public fury as residents grapple with an already dire economic situation.

The Houthis’ monopoly on poultry imports, coupled with exorbitant taxes, has created a lucrative scheme enriching a select cabal within the group. Hundreds of chicken shops have been forced to close, leaving consumers at the mercy of predatory restaurants, which have drastically reduced their offerings. The shops that remain open are rationing their stock, selling less than half the quantities once offered. Larger chickens have vanished, replaced by smaller, less desirable birds. Consumers report prices doubling overnight.

Manufactured scarcity has exacerbated the crisis. The Houthi-affiliated Ministry of Agriculture banned imported frozen chicken last year. Enacted in the guise of supporting local farmers, the ban has facilitated authorities’ monopolization of the market. Rather than fostering domestic production, the Houthis have imposed crippling taxes and restrictions. Egg production and feed materials have also been hit with exorbitant levies. A new tax introduced in 2020—YR35,000 for every 1,000 tons of imported corn, fodder, and soybeans entering the Houthi-controlled port of Al-Salif—represented a six-fold increase over existing tariffs. The entire poultry industry, a vital sector supporting 300,000 jobs, is now under siege. Official figures reveal a production shortfall of 39 percent, with an annual output of 160,000 tons against a national demand of 290,000 tons.

The revenue that the Houthis can mobilize from the industry is difficult to assess. Media sources have reported that they have been siphoning off billions of Yemeni rials for some time. With daily consumption estimated at two million chickens in Sana’a city, excess profits from the capital alone could reach a staggering YR600 million per day or YR18 billion per month. Considering the reach of Houthi control, the total amount extracted from the industry is likely several times higher.

WFP to Resume Food Distribution in Houthi-Controlled Areas

In mid-August, the World Food Programme (WFP) announced its intention to tentatively resume food assistance in Houthi-controlled territories after a six-month hiatus. However, the resumption comes with significant caveats. While the WFP has plans to distribute food to one million people in August, the target areas and details of distribution remain unclear.

The decision to restart aid follows a pilot program launched in April, and the WFP has emphasized that it will conduct a gradual scale-up of assistance. The cautious return will prioritize short-term relief measures. The WFP has selected 23 districts deemed most vulnerable, but negotiations on further steps are still ongoing, delaying the expansion of aid. Information on rations and distribution frequency for both the initial phase and subsequent operations remains unavailable. One-off food distributions will provide a temporary respite but are insufficient to address the long-term food security challenges facing millions of Yemenis.

The Integrated Food Security Phase Classification (IPC) Technical Working Group in Yemen has reported that acute malnutrition is rapidly increasing, with the West Coast experiencing “extremely critical” levels for the first time. The rapid increase in acute malnutrition is attributed to the combined effects of disease outbreaks, such as cholera and measles, severe food insecurity, lack of access to safe drinking water and sanitation, and economic decline. Lisa Doughten, Director of the Financing and Partnerships Division at the United Nations Office for the Coordination of Humanitarian Affairs (OCHA), addressed the UN Security Council (UNSC) on the issue, noting the lack of funding to address cholera outbreaks and food insecurity.

The WFP paints a grim picture of the humanitarian and food security crisis. As of July 2024, a staggering 62 percent of Yemeni households reported inadequate food consumption, an all-time high during the conflict. The crisis has affected both government-held (64 percent) and Houthi-controlled areas(61 percent). Severe food deprivation has peaked at 36 percent across the country.

The assessment attributes this food security emergency to deteriorating economic conditions, delays in food aid, and limited livelihood opportunities. The onset of the lean season from July to October, when there is less agricultural activity, was expected to worsen the situation further in all 117 districts in the government-controlled area. The severe floods that ravaged Yemeni communities in late July and August have further compounded the challenges faced by vulnerable populations, particularly in Hudaydah, Hajjah, Al-Jawf, Al-Mahweet, Taiz, and Hadramawt.

The Yemeni rial’s dramatic depreciation in government-held areas, driven by low foreign reserves and suspended crude oil exports, has exacerbated the crisis. While the rial’s value has remained relatively stable in Houthi-controlled areas, the overall impact on food prices has been severe.

Fuel prices have also skyrocketed in government-held regions, with petrol and diesel costs increasing by 22 percent and 26 percent, respectively, since the start of the year. This surge, fueled by currency depreciation and rising global oil prices, has pushed the cost of the minimum food basket to an all-time high, up 13 percent since January and 18 percent year-on-year.

The assessment notes that fuel imports through Red Sea ports increased by 24 percent from January to July 2024 year-on-year, while imports through southern ports declined by 27 percent during the same period. The July 20 Israeli airstrikes on the port of Hudaydah destroyed 33 oil storage tankers and nearly 800,000 liters of WFP-owned fuel, but overall, food imports through Yemeni seaports increased by 15 percent compared to the same period in 2023.

Houthis Raise Taxes on Imported Textiles

In early September, Houthi authorities imposed a staggering 100 percent tax increase on imported clothing and textiles. This measure came as part of a broader campaign by the group to extract maximum revenue from the Yemeni populace ahead of public celebrations for the birthday of the Prophet Mohammed.

The Houthi-aligned Ministry of Finance instructed customs and tax authorities to significantly hike duties on a range of imported goods, including essential items like clothing, shoes, and bags. The cost of these exorbitant levies was compounded by mandatory financial contributions for the religious festivities. Merchants in Sana’a reported a progressive escalation in taxes: initially set at YR5 million per truckload, the tax had risen to YR30 million by early September. By contrast, the internationally recognized government imposes a tax of YR1 million per truckload.

This financial strain placed on traders and businesses operating in Houthi-held territory is exacerbated by double taxation on shipments that have already been taxed by the government before entering northern Yemen. The Houthis have justified the increases as a measure to support domestic production, but given the absence of local factories capable of making such goods, this rationale has been met with skepticism. Rather, the tax is part of a broader Houthi strategy of economic appropriation and centralization, which has included the closure and confiscation of hundreds of companies, factories, and commercial establishments. The Houthis have further committed to this policy following the formation of a new government in Sana’a in August, which has made increasing financial revenues a priority.

Wheat Imports Plummet

In mid-September, the latest United Nations Market & Trade Bulletin highlighted intensifying economic strains on Yemen, with wheat imports through the Houthi-controlled port of Hudaydah dropping by 54 percent following attacks on Red Sea shipping and an Israeli strike. The disruption has drastically affected food supply chains in Houthi-controlled areas.

Despite a 12 percent rise in wheat imports through other key ports, including Aden, the reduction in Hudaydah’s intake poses a serious threat to Yemen’s overall food security, especially as the conflict continues to disrupt supply lines. The report notes that food commodities remain available in most markets, but the drop in imports through Hudaydah—Yemen’s primary entry point for grain—has sparked concern about future shortages.

Red Sea Attacks Drive Up Insurance Costs

Military action in the Red Sea has sharply driven up the cost of insuring ships passing through the waterway, with premiums more than doubling since early September. The surge follows renewed Houthi attacks on commercial vessels in the late summer months, which have heightened fears of further strikes and pushed some insurers to halt coverage altogether.

Additional war risk premiums, charged for vessels transiting high-risk zones, have jumped from 0.7 percent to as high as 2 percent of a ship’s value, as reported by industry experts. The unpredictability of Houthi attacks is causing insurers to become increasingly cautious, with many smaller underwriters pulling out of Red Sea coverage entirely.

David Smith, head of Hull and Marine Liabilities at McGill and Partners, noted this is the first time some underwriters are outright refusing coverage for the region. The August 21 attack on the Sounion tanker highlights the risks; the Houthis ultimately allowed the tanker to be towed away following concerns over an environmental catastrophe, but attacks on nearby ships continued, driving up insurance costs for the salvage operation.

The rise in insurance costs adds another layer of complexity to a region already burdened by geopolitical tensions, trade disruptions, and supply chain vulnerabilities. Without a resolution or de-escalation in sight, shipping through the Red Sea is likely to remain an expensive and hazardous endeavor.

Other Developments

Yemen’s Ongoing Transparency Crisis

In mid-September, the latest US Financial Transparency Report, published by the Bureau of Economic and Business Affairs, underscored the government’s failure to meet basic standards of financial transparency, noting the absence of key budget documents, including executive and end-of-year reports. This lack of clarity has deepened doubts over the management of state resources.

A critical issue raised in the report is the government’s failure to disclose its debt obligations, particularly those related to state-owned enterprises (SOEs), many of which operate in areas beyond government control. This opacity prevents the international community and donors from accurately assessing Yemen’s financial situation, raising concerns over mismanagement and unsanctioned agreements with external parties.

Equally troubling is the government’s lack of transparency in managing off-budget accounts, particularly in sectors like defense and intelligence, which remain beyond civilian or parliamentary oversight. Hidden financial flows in these areas create opportunities for corruption and further erode public trust. There is no detailed information on how funds are allocated to executive offices, including the presidency, exacerbating concerns over unchecked spending. Natural resource extraction suffers from weak regulation and unclear guidelines for awarding contracts or licenses. The failure to establish transparent procedures heightens the risks of corruption and mismanagement.

The report also emphasized the lack of independence and irregular operation of Yemen’s Supreme Audit Institution, which prevents it from holding the government accountable. Yemen’s failure to ensure transparency is a major obstacle to reform. Addressing these issues is critical not only for restoring public trust but also for securing international support and ensuring more effective use of the country’s limited resources.

Yemenia Airways Caught in the Crossfire

Yemen’s aviation sector continues to be a casualty of the ongoing conflict, with Yemenia Airways caught in a bitter tug-of-war between the Houthis and the internationally recognized government. On June 26, the Houthis seized three Airbus 320s, bringing the total number of seized planes to four. The group confiscated a large-capacity Airbus 330 a month earlier and is effectively grounding the planes at Sana’a Airport. Yemenia Airways, frustrated by the Houthis’ freezing of US$100 million in company funds, had suspended withdrawals from its Sana’a accounts and stopped issuing tickets in Houthi-controlled areas. The Houthis retaliated by requiring passengers to purchase tickets exclusively through channels they control and seizing the three airplanes. The seizures came after the airline transported Yemeni pilgrims returning from Hajj in Jeddah. Thousands of pilgrims were stranded in Saudi Arabia, unable to return home due to the crippled air service.

The government-aligned Ministry of Transport has urged travel agencies under Houthi control to relocate to government-held territories, further fracturing the already fragile airline industry and complicating travel for Yemenis. The Houthis claim the Saudi-led coalition lacks sincerity in reopening Sana’a airport, offering only limited flights to Amman. They have rejected a proposal for the resumption of Sana’a-Amman flights facilitated by the internationally recognized government, viewing it as a way to circumvent a full airport opening. The Houthis claim they have submitted flight schedules for various destinations, highlighting their desire for a comprehensive reopening.

On July 6, the Sana’a office of Yemenia Airways announced that it would not recognize management operating outside Sana’a. The statement also included unsupported allegations of corruption against Yemenia’s Aden office. The politicization of air travel by both sides leaves ordinary Yemenis stranded, hinders access to medical care and essential goods, and disrupts family reunification.

Starlink Launches in Yemen Amidst Opposition and Challenges

Starlink satellite internet has officially launched in Yemen, offering a much-needed alternative to the country’s unreliable and costly existing telecom services. The government has embraced Starlink as a transformative solution for internet access, particularly in areas it controls that have been severely affected by the ongoing conflict and the Houthi monopoly over telecommunications infrastructure.

Launching the Starlink satellite internet went through multiple phases. In early August, the government approved the Starlink licensing contract to provide affordable and high-speed internet access to Yemenis in areas under its control. In early September, the government-run Saba News network announced the start of the pilot phase of Starlink satellite internet services in government-held areas. Ahead of its launch, a joint technical team from Yemen’s General Telecommunications Corporation and Starlink has been tasked with testing the quality of the new high-speed satellite internet service.

On September 18, businessman and investor Elon Musk announced that the Starlink satellite internet is now officially available in Yemen. The government-run Public Telecommunications Corporation confirmed the launch, which could be a significant step towards reliable, high-speed internet in government-controlled areas.

To make the service more accessible, the government has authorized local distributors to provide Starlink devices and support services. It has established a mandatory registration process for all Starlink devices, including those acquired through unofficial channels, with users encouraged to comply with new regulations. Distributors are expected to offer subscription plans that account for the economic hardships many Yemenis face, aiming to broaden access to the service.

However, the Houthis have vehemently opposed its deployment and warned against its use through their affiliated telecommunications ministry, citing concerns about surveillance and foreign interference, and threatened to block the service in areas under their control: “We warn all citizens against dealing with Starlink, which provides satellite internet services, as its services are illegal.” The launch of Starlink could undermine the Houthi government’s control over the telecommunications sector and its ability to monitor internet traffic. The Houthis have used telecommunications infrastructure to gather intelligence, spy on government officials, and target them militarily. Starlink will operate beyond Houthi regulation capabilities, despite a statement by Houthi Supreme Political Council member Mohammed al-Bukhaiti that “the conflict could extend to outer space.” Al-Bukhaiti also cited a US embassy tweet welcoming the service as evidence that it should be considered a hostile step in the standoff in the Red Sea.

By centralizing revenues from internet services in Sana’a, the Houthis had also secured a lucrative source of income. The Houthis currently receive the lion’s share of an estimated YR120 billion (US$480 million) in annual telecom revenues, but face losing some of that if there is a big uptake for faster, more reliable, and more secure service through Starlink. The cost of internet and calls will be lower than through the government-run Aden Net, which could make it more viable for the government, companies, and international institutions. One option for the Houthi authorities would be to stop the sale and use of satellite dishes, which are needed to access the system.

Yemen is the first country in the Middle East to adopt Starlink’s satellite internet system, and given the dire state of internet services from Aden Net and the Houthi-run Yemen Net, which rely on aging undersea cables, most Yemenis will likely welcome this development. The launch of Starlink has the potential to revolutionize many sectors in Yemen, including education, healthcare, and the economy. However, the long-term success of the service will depend on the political and logistical challenges posed by the ongoing conflict.

اقرأ المحتوى باللغة العربية

اقرأ المحتوى باللغة العربية